When visitors or employees affiliated with specific organizations plan a stay in Columbus, they have the opportunity to utilize the H3Gov form, a crucial document designed to streamline the process of claiming a hotel/motel excise tax exemption. This form, integral to both guests and hotels within the City of Columbus, serves as a certificate that, when properly completed and submitted at the time of registration, exempts qualifying guests from the city-imposed hotel/motel excise tax. It's essential for guests affiliated with government entities or businesses, as it stipulates that the lodging purchased by these individuals or groups must be directly funded by the entity’s own accounts to qualify for the exemption, explicitly excluding payments through indirect means such as per diem, entity advances, or personal funds expected to be reimbursed. Detailed within the form are sections for both the business or institution's authorization, including federal identification and contact details, as well as specifics about the hotel stay itself. Importantly, the form carries a caution for federal government employees, underscoring that rooms paid for with personal methods, awaiting government reimbursement, will not qualify for the exemption. This document provides a structured pathway for both the reporting and claiming of such exemptions, delineating responsibilities, and requirements clearly for all parties, and ensuring compliance with local tax regulations. The H3Gov form, therefore, not only facilitates an understanding of tax exemption eligibility for travelers but also streamlines the administrative process for hotels, encapsulating crucial information and guidelines for a smooth transaction.

| Question | Answer |

|---|---|

| Form Name | H 3Gov Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | ohio agriculture tax exempt form, ohio hotel tax exemption, ohio hotel guest tax exempt form, ohio hotel tax exempt form |

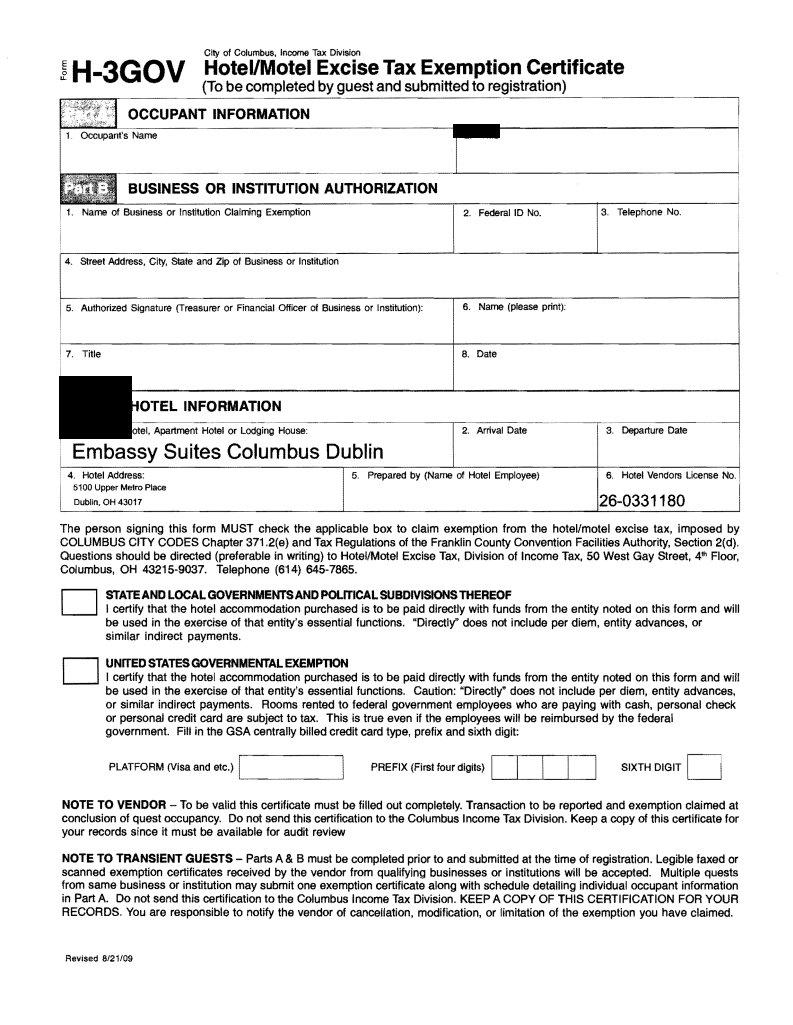

City of Columbus, Income Tax Division

セhMSgov@Hotel/Motel Excise Tax Exemption Certificate

(To be completed by guest and submitted to registration)

セセMZZZイMM] |

oMM]cMM]cMMMuM]MpaMMMnZMZZZtセin]f]oM]MZZrmation@ |

' |

' |

PARTA |

|

|

|

BUSINESS OR INSTITUTION AUTHORIZATION

|

2. |

Federal 10 No. |

3. Telephone No. |

4. Street Address, City, State and Zip of Business or Institution |

|

|

|

5. Authorized Signature (Treasurer or Financial Officer OF Business or Institution): |

6. |

Name (please print): |

|

i 7. Title |

8. |

Date |

|

HOTEL INFORMATION

- |

|

||

Name of Hotel, Apartment Hotel or Lodging House: |

2. Arrival Date |

3. |

Departure Date |

Embassy Suites Columbus Dublin |

|

|

|

4. Hotel Address: |

5. Prepared by (Name OF Hotel Employee) |

6. |

Hotel Vendors License NO.. |

5100 Upper Metro Place |

|

|

|

Dublin. OH 43017 |

|

||

The person Signing this form MUST check the applicable box to claim exemption from the hotel/motel excise tax, imposed by COLUMBUS CITY CODES Chapter 371.2(e) and Tax Regulations of the Franklin County Convention Facilities Authority, Section 2(d). Questions should be directed (preferable in writing) to Hotel/Motel Excise Tax, Division of Income Tax, 50 West Gay Street, 4111 Floor, Columbus, OH

D STATE AND LOCAL GOVERNMENTS AND POLITICAL SUBDIVISIONS THEREOF

I certify that the hotel accommodation purchased is to be paid directly with funds from the entity noted on this form and will be used in the exercise of that entity's essential functions. "Directly" does not include per diem, entity advances, or similar indirect payments.

D UNITED STATES GOVERNMENTAL EXEMPTION

I certify that the hotel accommodation purchased is to be paid directly with funds from the entity noted on this form and will be used in the exercise of that entity's essential functions. Caution: "Directly» does not include per diem, entity advances, or similar indirect payments. Rooms rented to federal government employees who are paying with cash, personal check or personal credit card are subject to tax. This is true even if the employees will be reimbursed by the federal government. Fill in the GSA centrally billed credit card type, prefix and sixth digit:

PLATFORM (Visa and etc.) |

PREFIX (First four digits} |

IL _ - ' |

SIXTH DIGIT |

|

|

NOTE TO VENDOR - To be valid this certificate must be filled out completely. Transaction to be reported and exemption claimed at conclusion of quest occupancy. Do not send this certification to the Columbus Income Tax Division. Keep a copy of this certificate for your records since it must be available for audit review

NOTE TO TRANSIENT GUESTS - Parts A & B must be completed prior to and submitted at the time of registration. Legible faxed or scanned exemption certificates received by the vendor from qualifying businesses or institutions will be accepted. Multiple quests from same business or institution may submit one exemption certificate along with schedule detailing individual occupant information in Part A. Do not send this certification to the Columbus Income Tax Division. KEEP A COPY OF THIS CERTIFICATION FOR YOUR RECORDS. You are responsible to notify the vendor of cancellation, modification, or limitation of the exemption you have claimed.

Revised 8/21/09