FIPS can be completed online very easily. Simply make use of FormsPal PDF editor to complete the job fast. The editor is consistently upgraded by our team, getting new awesome features and growing to be a lot more convenient. By taking several easy steps, you may begin your PDF journey:

Step 1: First of all, access the tool by clicking the "Get Form Button" above on this site.

Step 2: With the help of this online PDF file editor, it is easy to accomplish more than merely complete blank form fields. Edit away and make your docs appear sublime with custom text incorporated, or optimize the original input to perfection - all that comes with an ability to add any kind of photos and sign the PDF off.

Filling out this document generally requires care for details. Ensure that each and every field is filled in correctly.

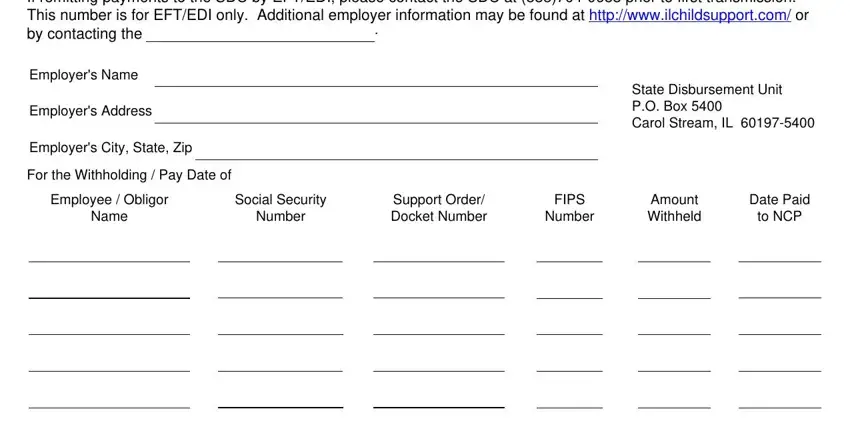

1. Start completing the FIPS with a selection of necessary blanks. Collect all of the necessary information and ensure there is nothing left out!

2. Just after this array of blank fields is completed, proceed to type in the suitable information in all these - Please print and enclose a copy, Total Withheld Income Submitted, httpwwwilchildsupportcom, HFS R IL, and Page of.

As to Total Withheld Income Submitted and Please print and enclose a copy, make sure you do everything correctly in this section. These two are surely the most important fields in the form.

Step 3: Make certain the information is correct and then click "Done" to finish the process. Get hold of your FIPS after you subscribe to a 7-day free trial. Easily gain access to the pdf within your personal account page, along with any edits and adjustments automatically preserved! FormsPal is dedicated to the confidentiality of all our users; we ensure that all personal information going through our tool is kept protected.