You may fill in application tax credit instantly in our PDF editor online. To have our editor on the forefront of efficiency, we strive to integrate user-driven features and enhancements on a regular basis. We are always pleased to get suggestions - assist us with revolutionizing PDF editing. Getting underway is simple! Everything you should do is stick to the next simple steps down below:

Step 1: Firstly, access the editor by clicking the "Get Form Button" in the top section of this webpage.

Step 2: As soon as you launch the tool, you'll see the form prepared to be filled in. Apart from filling out various fields, you might also do several other actions with the Document, particularly writing custom words, editing the initial textual content, inserting illustrations or photos, affixing your signature to the form, and much more.

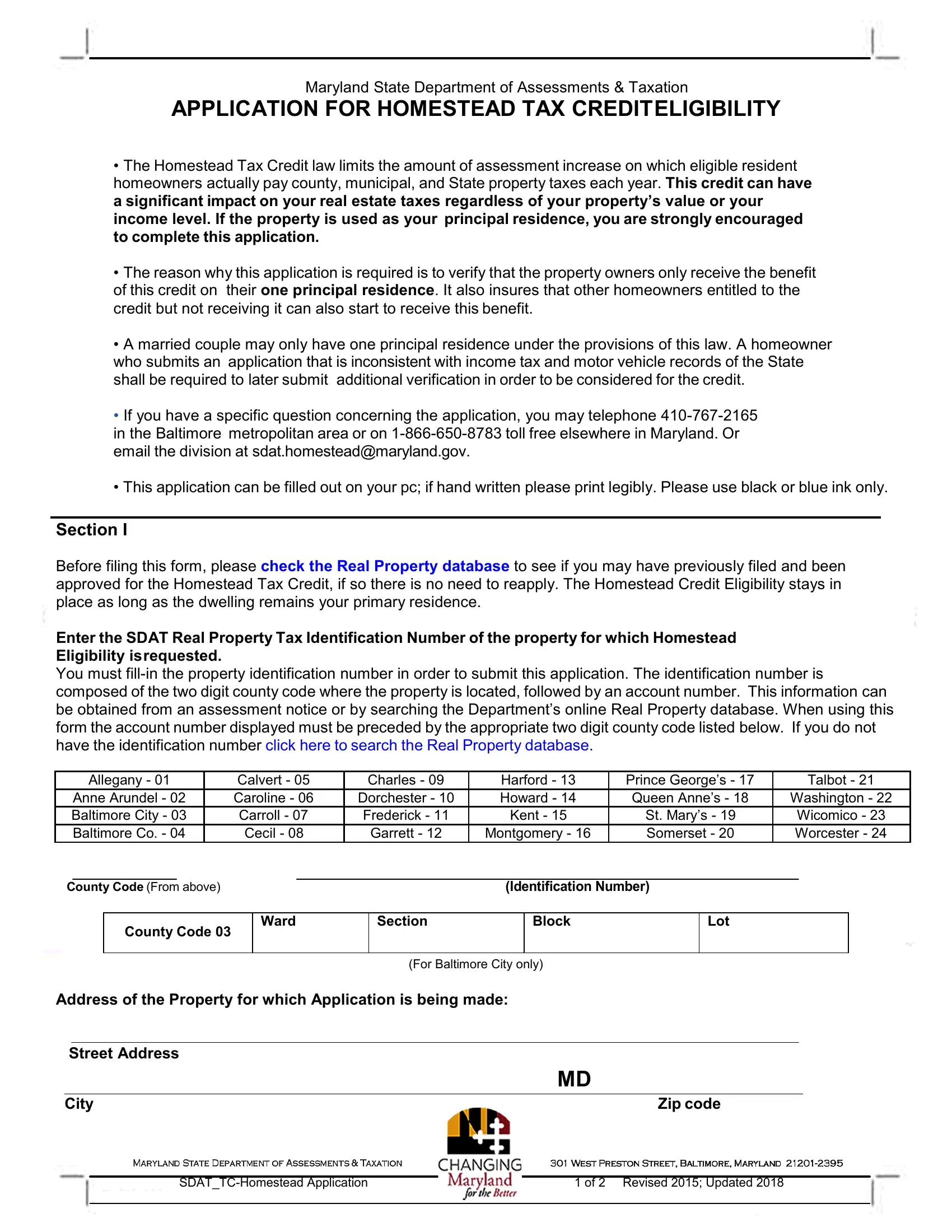

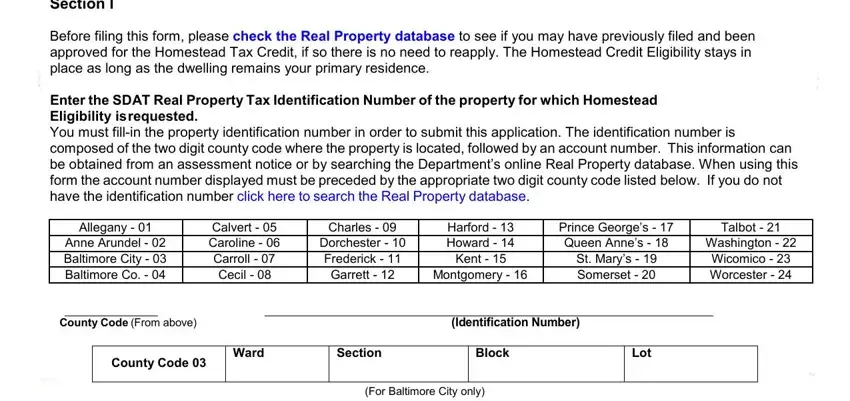

This PDF will need particular data to be filled out, hence you need to take your time to enter exactly what is required:

1. While completing the application tax credit, make certain to complete all necessary fields within the associated area. This will help to expedite the work, which allows your details to be processed without delay and accurately.

2. Your next stage is to submit all of the following blanks: Address of the Property for which, Street Address, City, Zip code, SDATTCHomestead Application, and of Revised Updated.

In terms of SDATTCHomestead Application and City, be certain that you do everything properly in this current part. Both these could be the key fields in this document.

3. In this specific part, have a look at Is the real property shown on, Is this real property address the, Is this real property address the, Yes No Not applicable No, Is this real property address the, Yes No Not applicable Not, Is any portion of the principal, All owners must complete the, Printed Name of Homeowner First, Social Security Number, Printed Name of Spouse or nd, Social Security Number, Printed Name of Homeowner First, and Social Security Number. Each one of these must be filled out with greatest precision.

4. You're ready to complete this next part! In this case you've got these Printed Name of Homeowner First, Social Security Number, Printed Name of Homeowner First, Social Security Number, In submitting this application I, Homeowners Signature, Spouse or CoOwners Signature, Date, Telephone Number Daytime, Mail completed application to, A person who willfully or with, PENALTIES FOR PERJURY, PRIVACY AND STATE DATA SECURITY, and The principal purpose for which blank fields to fill in.

Step 3: Prior to moving on, it's a good idea to ensure that all blank fields are filled out the proper way. As soon as you determine that it's fine, click on “Done." Right after creating afree trial account here, you'll be able to download application tax credit or email it directly. The document will also be readily accessible in your personal cabinet with all your adjustments. When using FormsPal, you can certainly complete forms without being concerned about database leaks or entries getting distributed. Our secure platform helps to ensure that your personal information is kept safely.