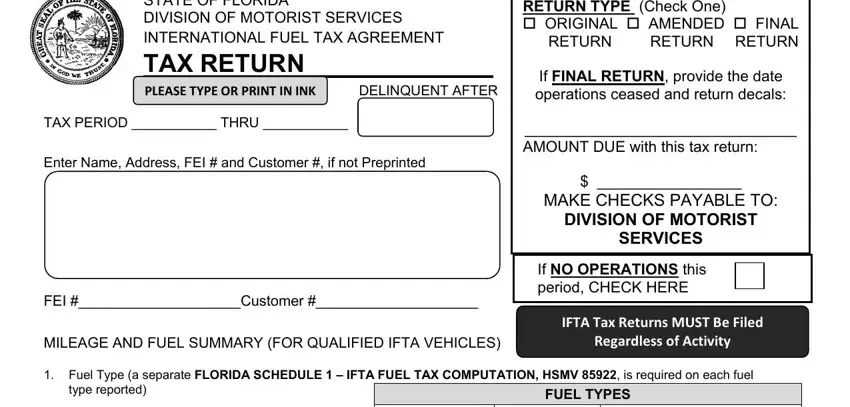

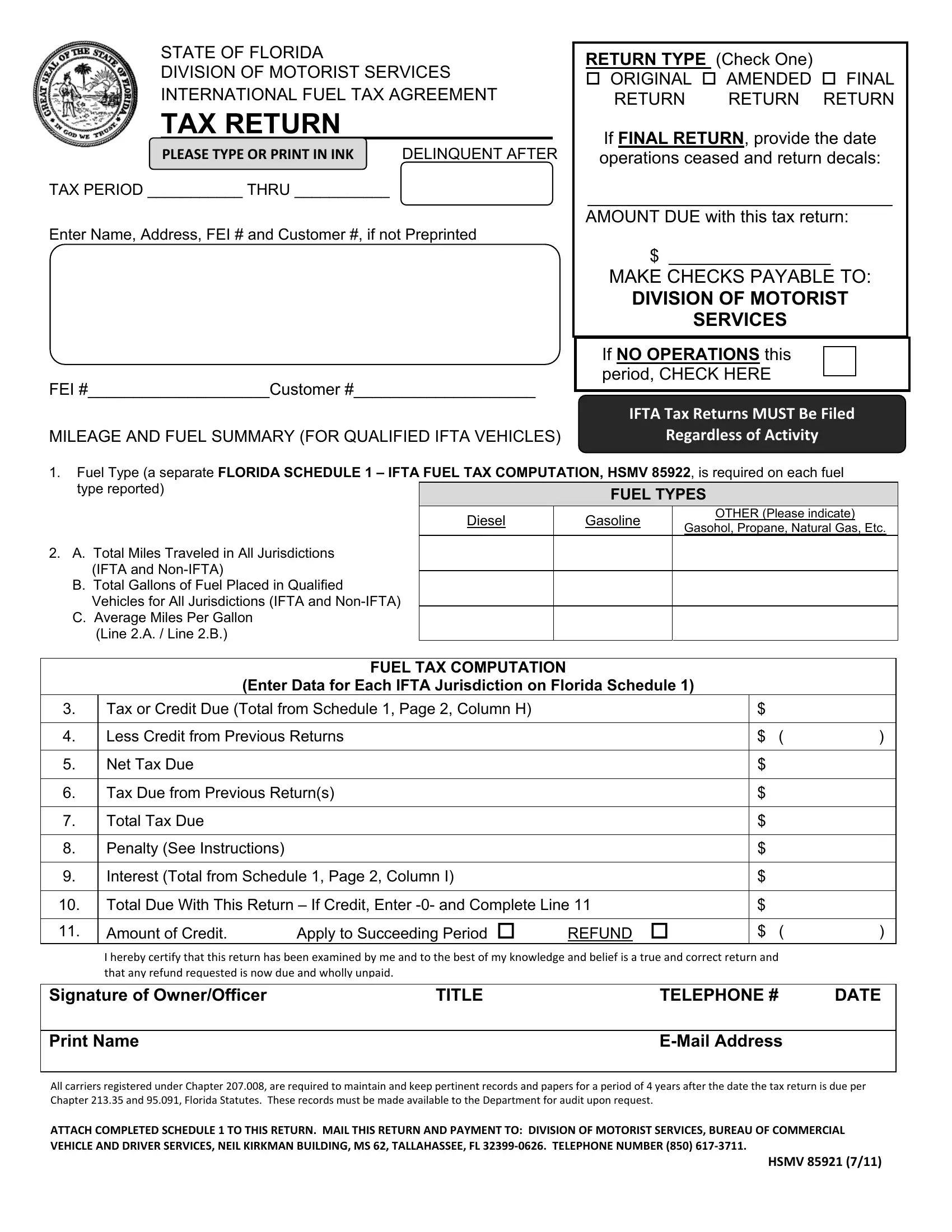

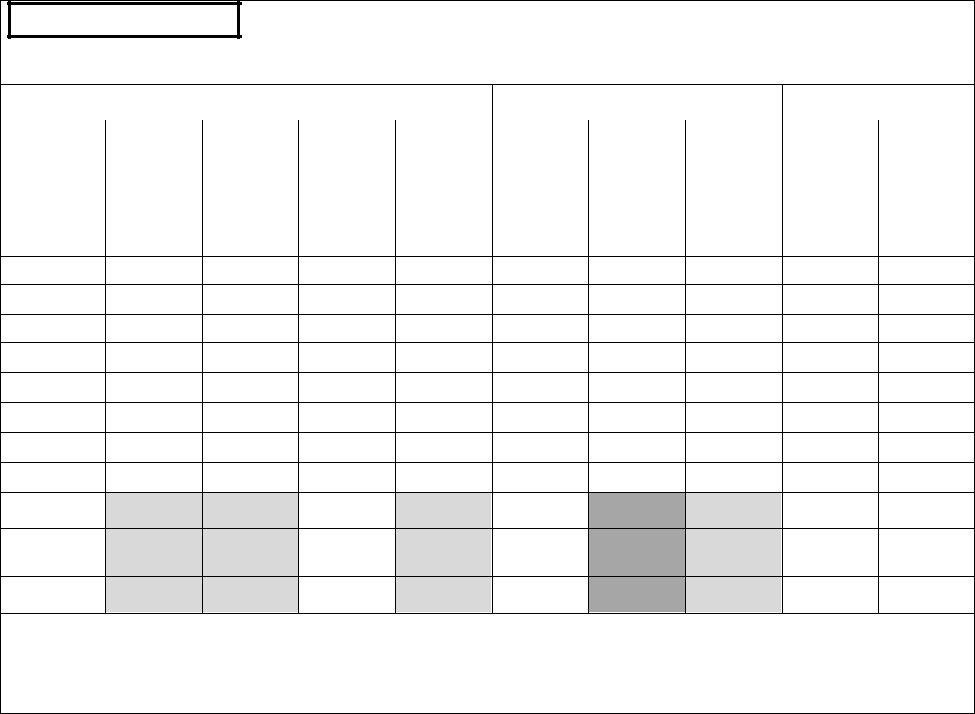

STATE OF FLORIDA

DIVISION OF MOTORIST SERVICES

INTERNATIONAL FUEL TAX AGREEMENT

TAX RETURN

PLEASE TYPE OR PRINT IN INK |

DELINQUENT AFTER |

TAX PERIOD ___________ THRU ___________ |

|

Enter Name, Address, FEI # and Customer #, if not Preprinted

FEI #____________________Customer #____________________

MILEAGE AND FUEL SUMMARY (FOR QUALIFIED IFTA VEHICLES)

RETURN TYPE (Check One)

ORIGINAL AMENDED FINAL RETURN RETURN RETURN

If FINAL RETURN, provide the date operations ceased and return decals:

________________________________

AMOUNT DUE with this tax return:

$_________________

MAKE CHECKS PAYABLE TO:

DIVISION OF MOTORIST

SERVICES

If NO OPERATIONS this period, CHECK HERE

IFTA Tax Returns MUST Be Filed

Regardless of Activity

1.Fuel Type (a separate FLORIDA SCHEDULE 1 – IFTA FUEL TAX COMPUTATION, HSMV 85922, is required on each fuel

type reported) |

|

|

FUEL TYPES |

|

|

|

|

|

|

|

Diesel |

Gasoline |

OTHER (Please indicate) |

|

|

Gasohol, Propane, Natural Gas, Etc. |

|

|

|

|

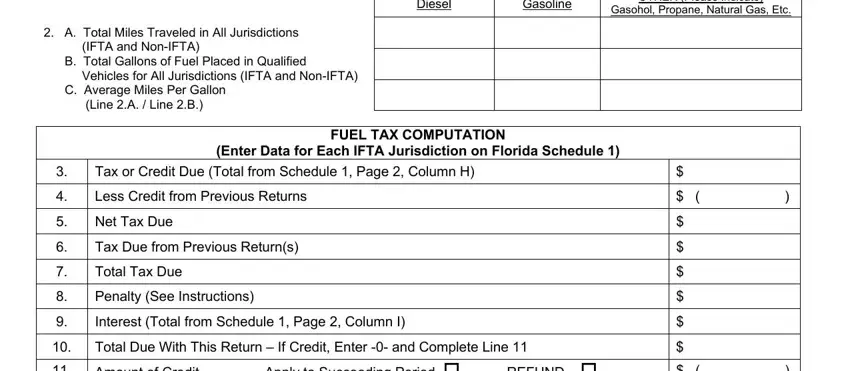

2. A. Total Miles Traveled in All Jurisdictions |

|

|

|

|

(IFTA and Non-IFTA) |

|

|

|

|

|

|

|

|

B. Total Gallons of Fuel Placed in Qualified |

|

|

|

|

Vehicles for All Jurisdictions (IFTA and Non-IFTA) |

|

|

|

|

|

|

|

|

C. Average Miles Per Gallon |

|

|

|

|

(Line 2.A. / Line 2.B.) |

|

|

|

|

FUEL TAX COMPUTATION

(Enter Data for Each IFTA Jurisdiction on Florida Schedule 1)

3. |

Tax or Credit Due (Total from Schedule 1, Page 2, Column H) |

|

$ |

|

|

|

|

|

|

|

|

4. |

Less Credit from Previous Returns |

|

$ |

( |

) |

|

|

|

|

|

|

|

5. |

Net Tax Due |

|

|

$ |

|

|

|

|

|

|

|

|

6. |

Tax Due from Previous Return(s) |

|

$ |

|

|

|

|

|

|

|

|

|

7. |

Total Tax Due |

|

|

$ |

|

|

|

|

|

|

|

|

|

8. |

Penalty (See Instructions) |

|

|

$ |

|

|

|

|

|

|

|

|

9. |

Interest (Total from Schedule 1, Page 2, Column I) |

|

$ |

|

|

|

|

|

|

|

10. |

Total Due With This Return – If Credit, Enter -0- and Complete Line 11 |

$ |

|

|

|

|

|

|

|

|

|

11. |

Amount of Credit. |

Apply to Succeeding Period |

REFUND |

$ |

( |

) |

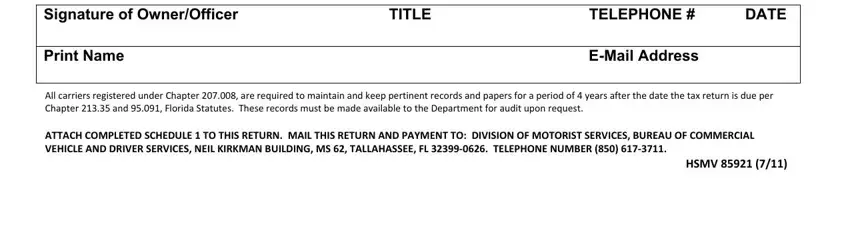

I hereby certify that this return has been examined by me and to the best of my knowledge and belief is a true and correct return and that any refund requested is now due and wholly unpaid.

Signature of Owner/Officer |

TITLE |

TELEPHONE # |

DATE |

|

|

|

|

Print Name |

|

E-Mail Address |

|

|

|

|

|

All carriers registered under Chapter 207.008, are required to maintain and keep pertinent records and papers for a period of 4 years after the date the tax return is due per Chapter 213.35 and 95.091, Florida Statutes. These records must be made available to the Department for audit upon request.

ATTACH COMPLETED SCHEDULE 1 TO THIS RETURN. MAIL THIS RETURN AND PAYMENT TO: DIVISION OF MOTORIST SERVICES, BUREAU OF COMMERCIAL VEHICLE AND DRIVER SERVICES, NEIL KIRKMAN BUILDING, MS 62, TALLAHASSEE, FL 32399‐0626. TELEPHONE NUMBER (850) 617‐3711.

HSMV 85921 (7/11)

INSTRUCTIONS FOR COMPLETING TAX RETURN

1.Designate the appropriate fuel type. (For more information, see the Important Note under Instructions for Completing Schedule 1.)

2.Enter total qualified motor vehicle fleet miles in all jurisdictions on Line 2.A for each fuel type used. When entering your total miles traveled, be sure to include both IFTA miles and Non-IFTA miles. On Line 2. B., be sure to include ALL fuel placed in the tanks of qualified vehicles, this means fuel obtained in both IFTA and Non-IFTA jurisdictions. Round to the nearest whole gallon. Divide Line 2. A. by Line 2. B. to find your average miles per gallon for Line 2. C.. Use 2 decimal places (0.00). CAUTION: ERRORS IN THIS SPACE CAN CAUSE OVER PAYMENT OR UNDERPAYMENT OF TAXES AND COULD RESULT IN PENALTY AND INTEREST BEING CHARGED TO YOUR ACCOUNT.

3.Enter the Tax or (Credit) due. (From Schedule 1, Page 2, Column H).

4.This is the current credit balance on your account from previous returns. If the credit is used to offset tax due and the credit is determined through an audit to be invalid, penalty and interest may be assessed.

5.Enter the Net Tax Due. (Subtract Line 4, from Line 3.).

6.Tax due from underpayment of prior tax returns.

7.This is the total tax amount due. (This amount should be added to Line 6, and would be used to calculate penalty, if the return is filed late).

8.PENALTY: If your tax return and all taxes due are not postmarked on or before the Delinquent Date, the penalty is $50.00 or 10% of the total net tax liability, whichever is greater. (the $50.00 minimum penalty is due on ALL LATE tax returns).

9.Enter the total interest due. (This is the total from Schedule 1, Page 2, Column 1).

10.Enter Total Due With This Return by totaling Lines 7 through 9. If you are due a Credit, enter”0”. Complete Line 11.

11.Enter Total Amount of Credit. Please check whether you want the amount of credit applied to the succeeding period or a refund. NO REFUND UNDER $10.00 WILL BE ISSUED.

SIGNATURE: An authorized Owner/Officer must sign the tax return. If the tax return is not signed by an Owner/Officer, a Power of Attorney, form HSMV 96440, MUST be on file in this office.

EMAIL ADDRESS: Enter the business e-mail address.

INSTRUCTIONS FOR COMPLETING SCHEDULE 1

IMPORTANT NOTICE: A separate Schedule 1 MUST BE completed for each type of fuel indicated on Page 1 of this Tax Return.

A.IFTA JURISDICTIONS. If additional space is needed, make a photocopy of the Schedule 1.

NOTE: Calculation of Surcharges – Use two lines for jurisdictions imposing a surcharge. Calculate fuel tax or credit due on the first line. Calculate surcharge due on the second line (next line down). When calculating surcharge, multiply the number of taxable gallons shown in Column D of the first line by the surcharge tax rate. On surcharge line DO NOT complete Columns B, C, E, or F.

B.Enter total miles traveled in each jurisdiction (taxable and non-taxable). Round to the nearest whole mile.

C.Enter the total taxable miles traveled in each jurisdiction. Round to the nearest whole mile.

D.Enter taxable gallons for each jurisdiction. Column C divided by Average Miles per Gallon (Line 2. C. on the Tax Return). Round to the nearest whole gallon.

E.Enter gallons of tax paid fuel placed in qualified motor vehicles for each jurisdiction. Round to the nearest whole gallon. Retain your invoices. If a jurisdiction does not tax the fuel at the pump then there would be no tax paid purchases to claim.

F.Subtract Column E from Column D and enter Net Taxable Gallons. If Column E is greater than Column D, enter credit balance in parentheses (0.00).

G.Enter the current tax rate for the fuel type indicated. Refer to the quarterly tax rate sheet, or the IFTA website at www.IFTACH.org.

H.Multiply Net Taxable Gallons (Column F) by the Tax Rate Column G). Enter credit balance in parentheses (0.00). NOTE: To calculate the surcharge amount, multiply the taxable gallons (Column D) by the surcharge rate (Column G).

I.Multiply Net Tax Due (Column H) by the interest rate of 1% per month. Interest is computed at a rate of 1% per month from the date tax was due for each month or fraction thereof until paid. DO NOT calculate interest on credits.

J.Add Tax Due/Credit (Column H) and Interest Due (Column I).

In the lines provided, explain any difference between TOTAL MILES and TAXABLE MILES for each jurisdiction where there is a difference. Also, explain any other adjustments that you may make to this Tax Return report.

CLOSE ACCOUNT INSTRUCTIONS

To close the account you must first complete and file any outstanding tax return(s) and submit any tax due the State of Florida. Your IFTA credentials must also be returned or a notarized letter stating they have been destroyed will need to be submitted.

REQUESTS FOR CERTIFIED COPIES

A $1.00 per page fee plus a $3.00 certification fee is required for certified copies of documents. DO NOT INCLUDE FEES FOR DOCUMENTS WITH YOUR IFTA TAX RETURN PAYMENT. THIS FEE MUST BE A SEPARATE CHECK AND HANDLED AS FOLLOWS: Make check payable to the Division of Motorist Services, and direct the request for certified copies to the attention of: Registration Records Section, PHOTOCOPY UNIT, Neil Kirkman Building, MS-73, 2900 Apalachee Parkway, Tallahassee, FL 32399-0620.

HSMV 85921 (7/11)

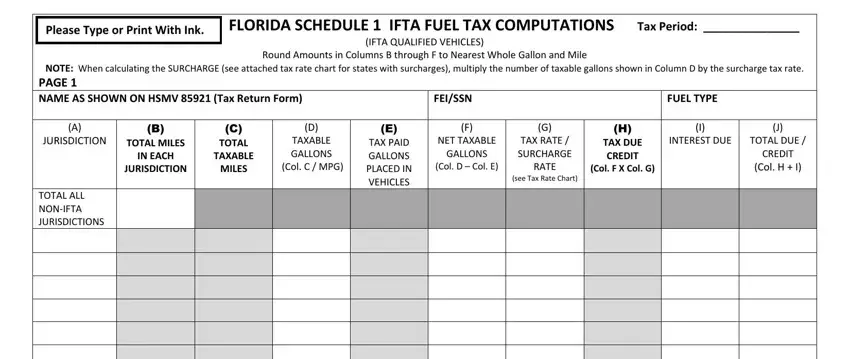

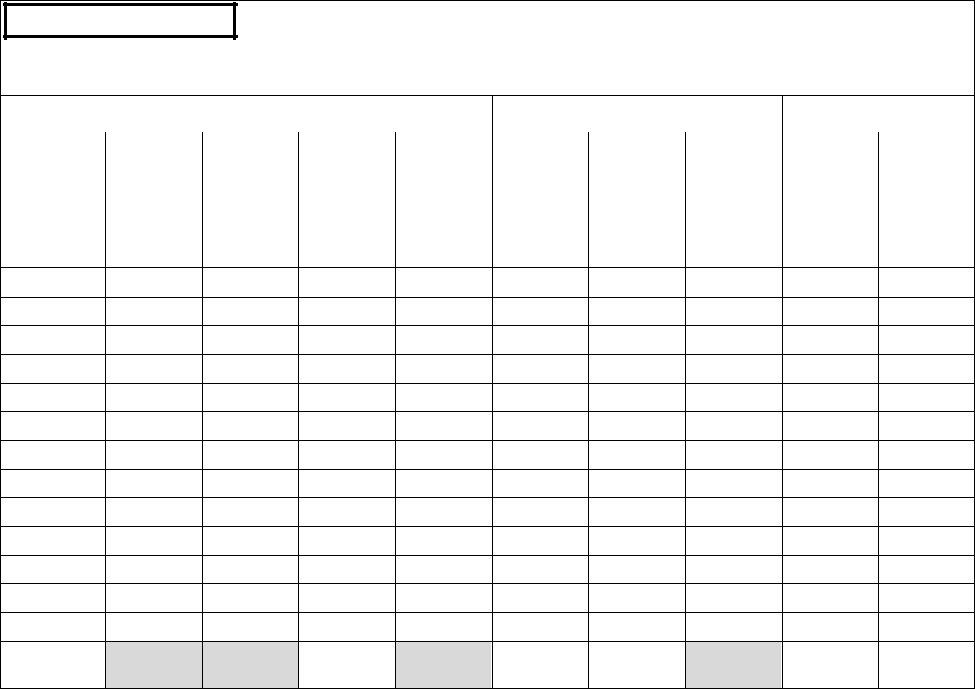

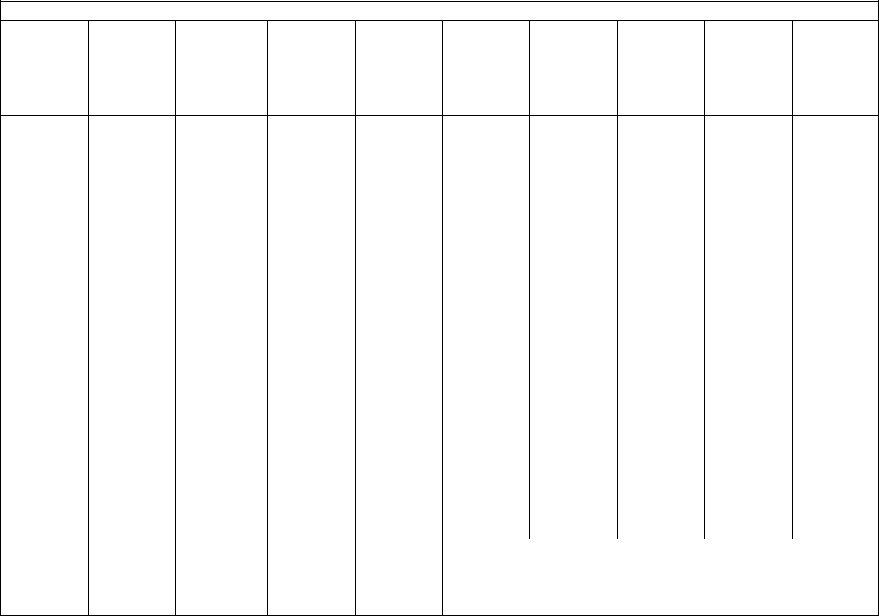

Please Type or Print With Ink.

FLORIDA SCHEDULE 1 IFTA FUEL TAX COMPUTATIONS Tax Period: _______________

(IFTA QUALIFIED VEHICLES)

Round Amounts in Columns B through F to Nearest Whole Gallon and Mile

PAGE 2

NAME AS SHOWN ON HSMV 85921 (Tax Return Form) |

|

|

FEI/SSN |

|

|

FUEL TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

(A) |

(B) |

(C) |

(D) |

|

(E) |

(F) |

(G) |

(H) |

(I) |

(J) |

JURISDICTION |

TOTAL MILES |

TOTAL |

TAXABLE |

|

TAX PAID |

NET TAXABLE |

TAX RATE / |

TAX DUE |

INTEREST DUE |

TOTAL DUE / |

|

IN EACH |

TAXABLE |

GALLONS |

|

GALLONS |

GALLONS |

SURCHARGE |

CREDIT |

|

CREDIT |

|

JURISDICTION |

MILES |

(Col. C / MPG) |

|

PLACED IN |

(Col. D – Col. E) |

RATE |

(Col. F X Col. G) |

|

(Col. H + I) |

|

|

|

|

|

VEHICLES |

|

(see Tax Rate Chart) |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ALL |

|

|

|

|

|

|

|

|

|

|

NON‐IFTA |

|

|

|

|

|

|

|

|

|

|

JURISDICTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

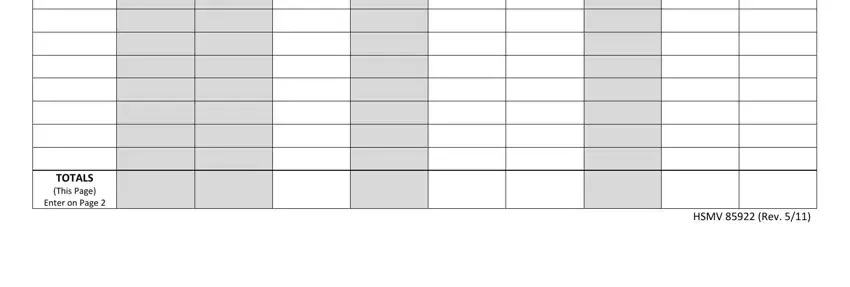

TOTALS

(This Page)

SUBTOTALS*

(Page 1 and

Additional Pages)

GRAND

TOTALS

Use these lines to explain any differences between TOTAL MILES and TAXABLE MILES for each jurisdiction where there is a difference. Explain any other adjustments that you have made to this Tax Return report. _________________________________________________________________________________

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

*The amounts on the surcharge lines, Columns H, I and J, should be included in the page subtotal. DO NOT include the surcharge line, Column D, in the page subtotal.

HELP SHEET FOR CARRIERS

FLORIDA SCHEDULE 1 – IFTA FUEL TAX COMPUTATION

Round Amounts in Columns (B through (F) to Nearest Whole Gallon and Mile

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

(G) |

(H) |

(I) |

(J) |

JURISDICTION |

TOTAL MILES IN |

TOTAL TAXABLE |

TAXABLE |

TAX PAID |

NET TAXABLE |

TAX RATE / |

TAX DUE / |

INTEREST DUE |

TOTAL DUE / |

|

EACH |

MILES |

GALLONS |

GALLONS |

GALLONS |

SURCHARGE |

CREDIT |

|

CREDIT |

|

JURISDICTION |

|

(Col. C / AMG) |

PURCHASED |

(Col D – Col. E) |

RATE |

(Col. F x Col. G) |

|

(Col. H + Col. I) |

|

|

|

|

|

|

(See Tax Rate |

|

|

|

|

|

|

|

|

|

Chart) |

|

|

|

|

|

|

FUEL |

FUEL |

|

|

|

|

|

|

|

|

USED |

PURCHASED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIST ALL |

LIST TOTAL |

SHOULD BE |

COLUMN C |

ALL FUEL YOU |

COLUMN D |

ENTER |

MULTIPLY |

1% OF TOTAL |

ADD COLUMN |

STATES |

MILES |

THE SAME AS |

DIVIDED BY |

WERE TAXED |

MINUS |

SPECIFIC TAX |

COLUMN F BY |

TAX FOR EACH |

H AND I |

|

TRAVELED |

(B) EXCEPT |

AVERAGE |

ON AT THE |

COLUMN E |

RATE |

COLUMN G |

MONTH FROM |

|

|

|

WITH A TRIP |

MILES PER |

PUMP OR |

|

|

|

DELINQUENT |

|

|

|

PERMIT |

GALLON |

BULK |

|

|

|

DATE UNTIL |

|

|

|

************* |

(Line 2.C) |

|

|

|

|

DATE TAX IS |

|

|

|

SUBTRACT |

|

|

|

|

|

PAID |

|

|

|

MILES UNDER |

|

|

|

|

|

|

|

|

|

TRIP PERMIT |

|

|

|

|

|

|

|

CALCULATION |

XXXXXXX |

XXXXXXX |

SAME AS |

xxxxxxx |

xxxxxxx |

SURCHARGE |

MULTIPLY |

SAME AS |

COLUMN (J) |

ON |

|

|

ABOVE |

|

|

RATE |

SURCHARGE |

ABOVE |

WILL BE THE |

SURCHARGE: |

|

|

|

|

|

|

RATE (Column |

|

SAME AS |

Write the |

|

|

|

|

|

|

G) TIMES |

|

COLUMN (H) |

jurisdiction |

|

|

|

|

|

|

TAXABLE |

|

(Unless |

name on two |

|

|

|

|

|

|

GALLONS |

|

interest is due |

lines and add |

|

|

|

|

|

|

(COLUMN D) |

|

in Column (I) – |

wording |

|

|

|

|

|

|

|

|

then add the |

“surcharge” |

|

|

|

|

|

|

|

|

figure to |

on the second |

|

|

|

|

|

|

|

|

Column (H) to |

line in Column |

|

|

|

|

|

|

|

|

obtain Column |

(A) – (there |

|

|

|

|

|

|

|

|

(J) total) |

will never be a |

|

|

|

|

|

|

|

|

|

credit on a |

|

|

|

|

|

|

|

|

|

surcharge) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR MORE DETAILED TAX CALCULATION INFORMATION, CALL 850‐617‐3711, |

|

|

|

|

|

AND REQUEST THE BUREAU OF COMMERCIAL VEHICLE AND DRIVER SERVICES |

|

|

|

|

|

PUBLICATION, “HOW TO CALCULATE FLORIDA’S INTERNATIONAL FUEL TAX |

|

|

|

|

|

AGREEMENT QUARTERLY TAX RETURN”. |

|

|