Whenever you need to fill out OMB, you don't need to install any programs - simply use our online PDF editor. To maintain our tool on the cutting edge of practicality, we work to put into practice user-oriented features and improvements on a regular basis. We are routinely pleased to receive feedback - join us in revolutionizing how we work with PDF docs. With a few easy steps, you'll be able to start your PDF editing:

Step 1: Just press the "Get Form Button" above on this webpage to see our form editing tool. This way, you'll find all that is required to work with your file.

Step 2: Once you open the PDF editor, you'll notice the form all set to be completed. Besides filling out different fields, you can also do some other actions with the Document, such as adding any textual content, changing the original text, adding illustrations or photos, putting your signature on the form, and more.

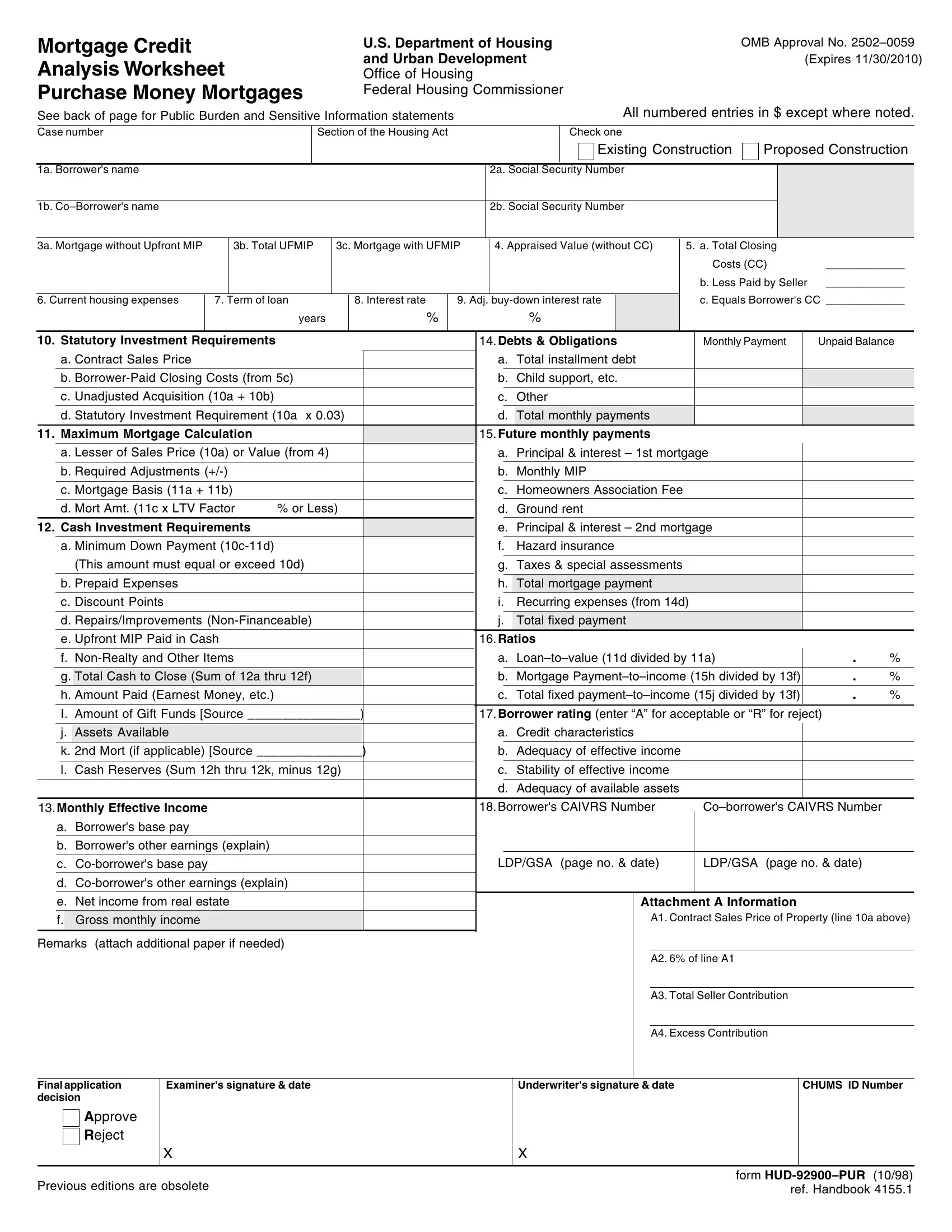

This PDF requires specific details to be filled out, hence ensure that you take your time to provide exactly what is asked:

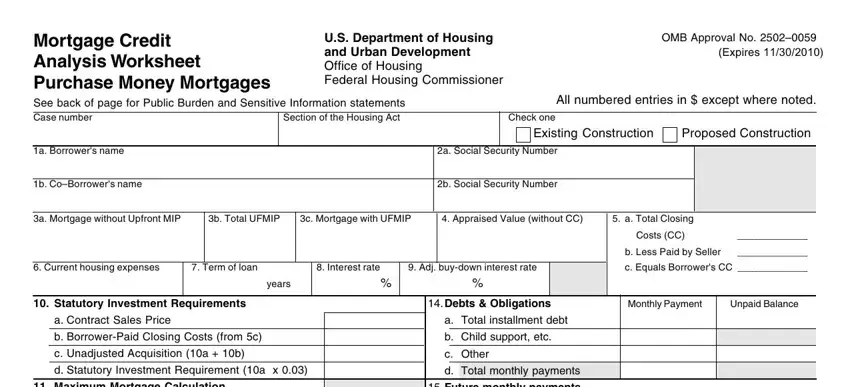

1. First of all, once completing the OMB, start with the form section that includes the next blank fields:

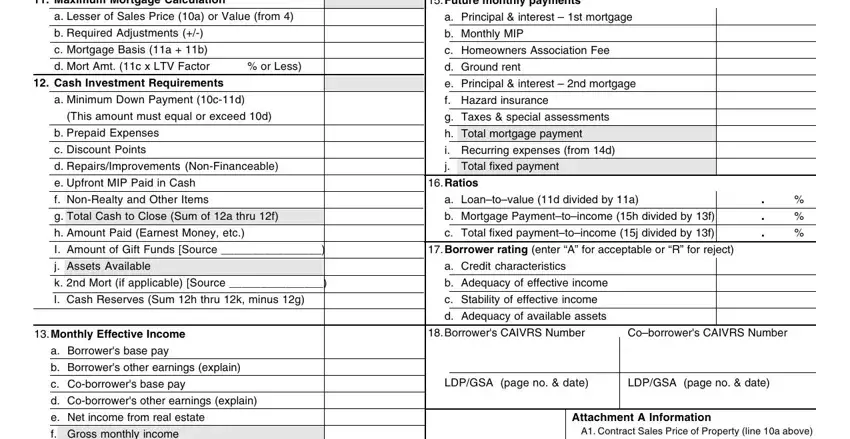

2. Your next part is usually to fill out the next few blanks: Maximum Mortgage Calculation, Future monthly payments, a Lesser of Sales Price a or Value, a Principal interest st mortgage, b Required Adjustments, c Mortgage Basis a b, b Monthly MIP, c Homeowners Association Fee, d Mort Amt c x LTV Factor or Less, d Ground rent, Cash Investment Requirements, a Minimum Down Payment cd, This amount must equal or exceed d, b Prepaid Expenses, and c Discount Points d.

Always be extremely attentive when filling out c Mortgage Basis a b and Cash Investment Requirements, because this is the section where most users make errors.

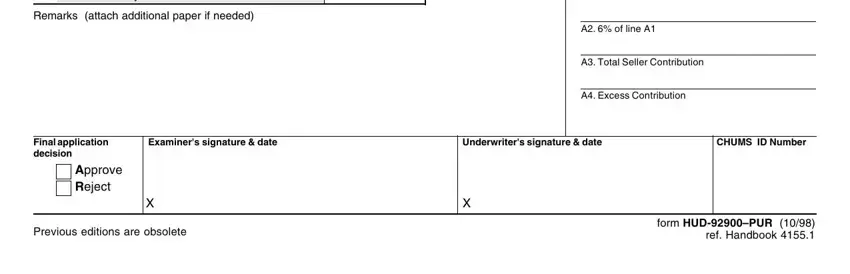

3. This third stage will be easy - fill out all of the fields in f Gross monthly income, Remarks attach additional paper if, A of line A, A Total Seller Contribution, A Excess Contribution, Examiners signature date, Underwriters signature date, CHUMS ID Number, Final application decision, Approve Reject, Previous editions are obsolete, and form HUDPUR ref Handbook to complete this part.

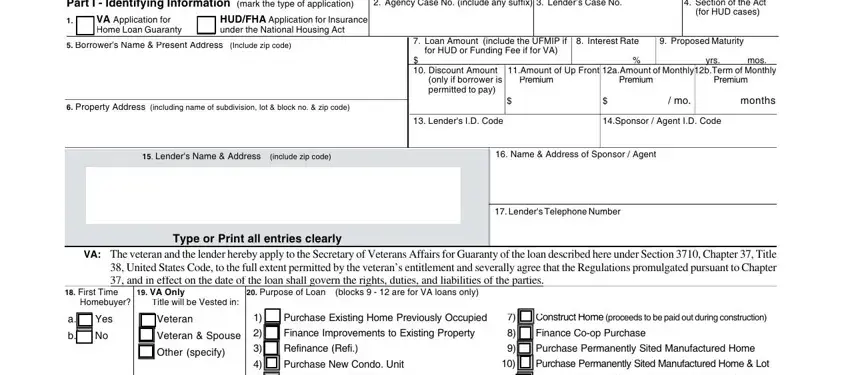

4. This next section requires some additional information. Ensure you complete all the necessary fields - Part I Identifying Information, Agency Case No include any suffix, VA Application for Home Loan, HUDFHA Application for Insurance, Borrowers Name Present Address, Section of the Act, for HUD cases, Loan Amount include the UFMIP if, Proposed Maturity, for HUD or Funding Fee if for VA, Discount Amount Amount of Up, mos, yrs y, Property Address including name, and only if borrower is permitted to - to proceed further in your process!

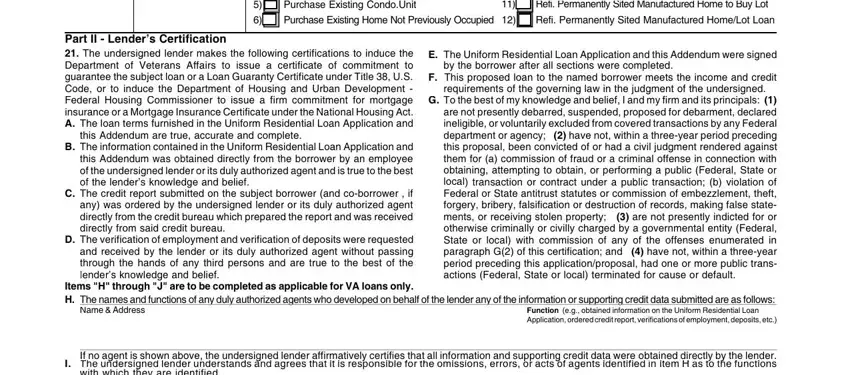

5. The last stage to conclude this document is essential. You need to fill out the necessary blank fields, and this includes Purchase Existing CondoUnit, Purchase Existing Home Not, Refi Permanently Sited, Refi Permanently Sited, Part II Lenders Certification, this Addendum are true accurate, B The information contained in the, C The credit report submitted on, D The verification of employment, E The Uniform Residential Loan, by the borrower after all sections, F This proposed loan to the named, requirements of the governing law, G To the best of my knowledge and, and Items H through J are to be, before submitting. Or else, it can generate an incomplete and probably incorrect paper!

Step 3: Make certain your details are accurate and then simply click "Done" to conclude the task. Sign up with FormsPal right now and immediately get access to OMB, ready for downloading. All alterations you make are saved , letting you modify the file further if necessary. FormsPal guarantees safe document tools with no personal information recording or distributing. Rest assured that your data is in good hands with us!