Using PDF forms online is actually easy using our PDF tool. You can fill in Hud Statement Online Form here with no trouble. To maintain our tool on the leading edge of convenience, we strive to put into operation user-oriented features and enhancements on a regular basis. We're at all times looking for feedback - help us with reshaping PDF editing. It merely requires a few basic steps:

Step 1: First, access the tool by pressing the "Get Form Button" in the top section of this site.

Step 2: This tool allows you to change your PDF file in a range of ways. Change it by writing your own text, correct original content, and include a signature - all within the reach of a couple of mouse clicks!

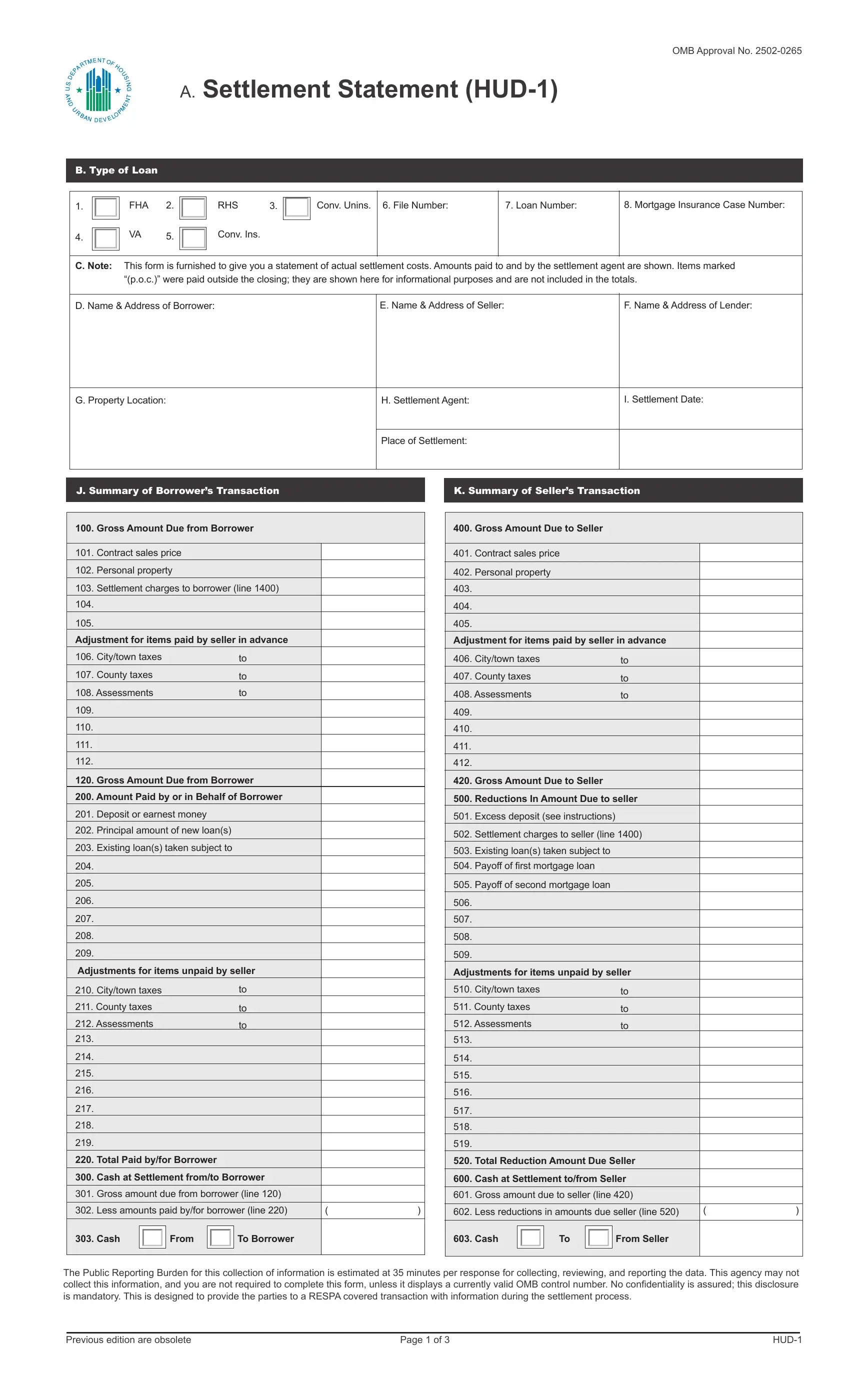

This document will require specific information to be filled out, therefore you should take some time to fill in exactly what is required:

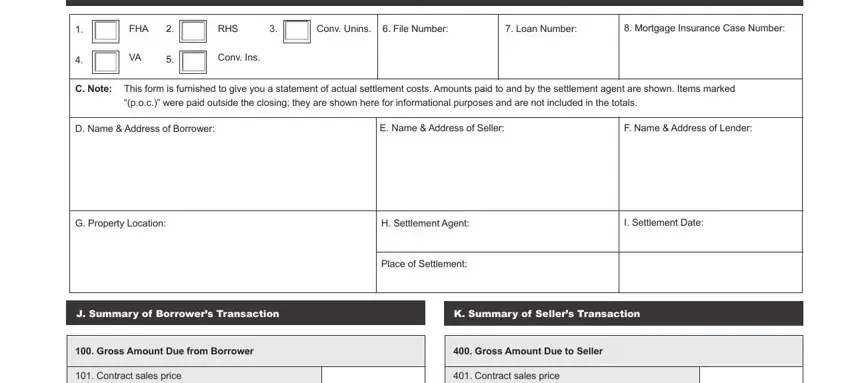

1. To start with, when filling out the Hud Statement Online Form, start out with the form section that has the next blanks:

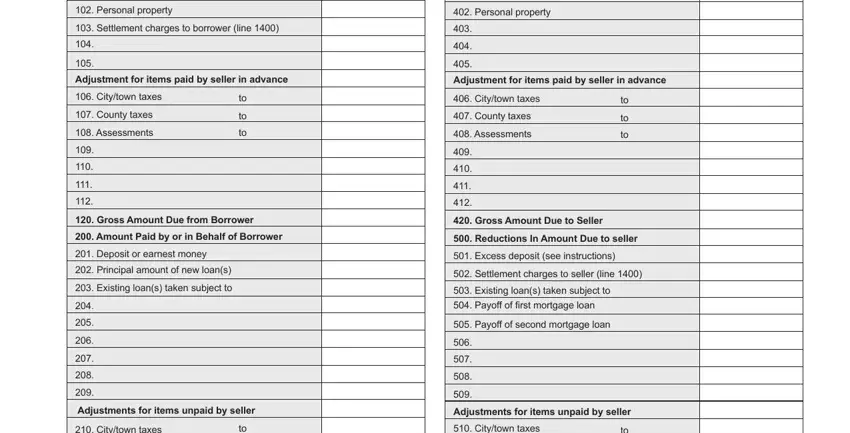

2. The subsequent step is usually to fill out all of the following fields: Personal property, Settlement charges to borrower, Personal property, Adjustment for items paid by, Adjustment for items paid by, Citytown taxes, County taxes, Assessments, Gross Amount Due from Borrower, Amount Paid by or in Behalf of, Deposit or earnest money, Principal amount of new loans, Existing loans taken subject to, Citytown taxes, and County taxes.

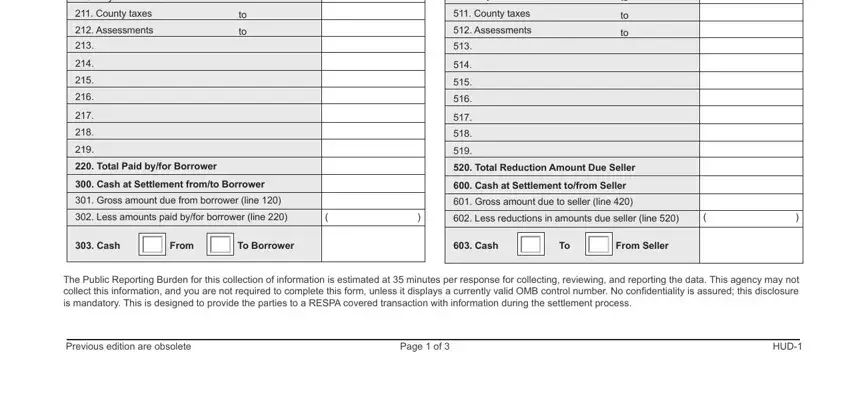

3. The following segment should also be quite straightforward, Citytown taxes, County taxes, Assessments, Citytown taxes, County taxes, Assessments, Total Paid byfor Borrower, Cash at Settlement fromto Borrower, Gross amount due from borrower, Total Reduction Amount Due Seller, Cash at Settlement tofrom Seller, Gross amount due to seller line, Less amounts paid byfor borrower, Less reductions in amounts due, and Cash - each one of these blanks has to be filled in here.

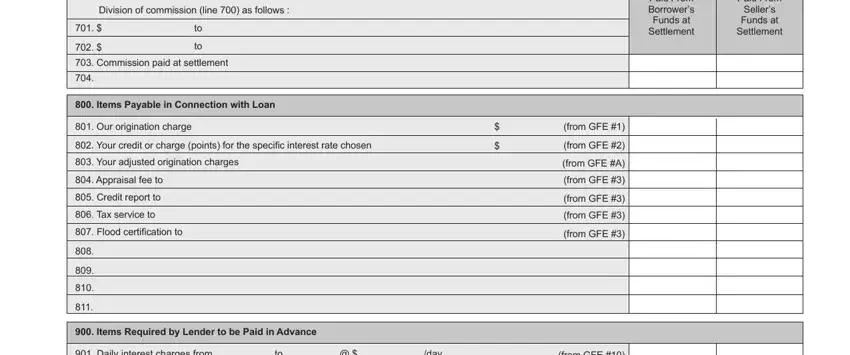

4. Completing Paid From Borrowers Funds at, Paid From, Sellers Funds at Settlement, Division of commission line as, Commission paid at settlement, Items Payable in Connection with, Our origination charge, Your credit or charge points for, Appraisal fee to, Credit report to, Tax service to Flood, Items Required by Lender to be, Daily interest charges from to, day, and from GFE is vital in this next step - ensure to invest some time and fill in every single blank!

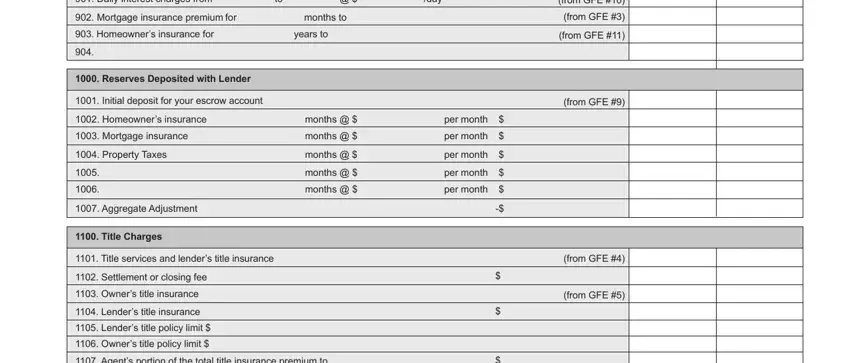

5. This document should be completed with this area. Further you will notice a comprehensive listing of blanks that require specific details for your form submission to be complete: Daily interest charges from to, day, Mortgage insurance premium for, Homeowners insurance for, years to, Reserves Deposited with Lender, Initial deposit for your escrow, Homeowners insurance, Mortgage insurance, Property Taxes, Aggregate Adjustment, months, months, months, and months.

Regarding Mortgage insurance and Homeowners insurance for, make sure you take a second look here. The two of these are definitely the most significant ones in this page.

Step 3: After you have reviewed the information in the file's blanks, simply click "Done" to finalize your form. Right after setting up afree trial account at FormsPal, you will be able to download Hud Statement Online Form or email it at once. The PDF document will also be available in your personal account page with all your changes. We don't share any information that you type in while completing documents at our website.