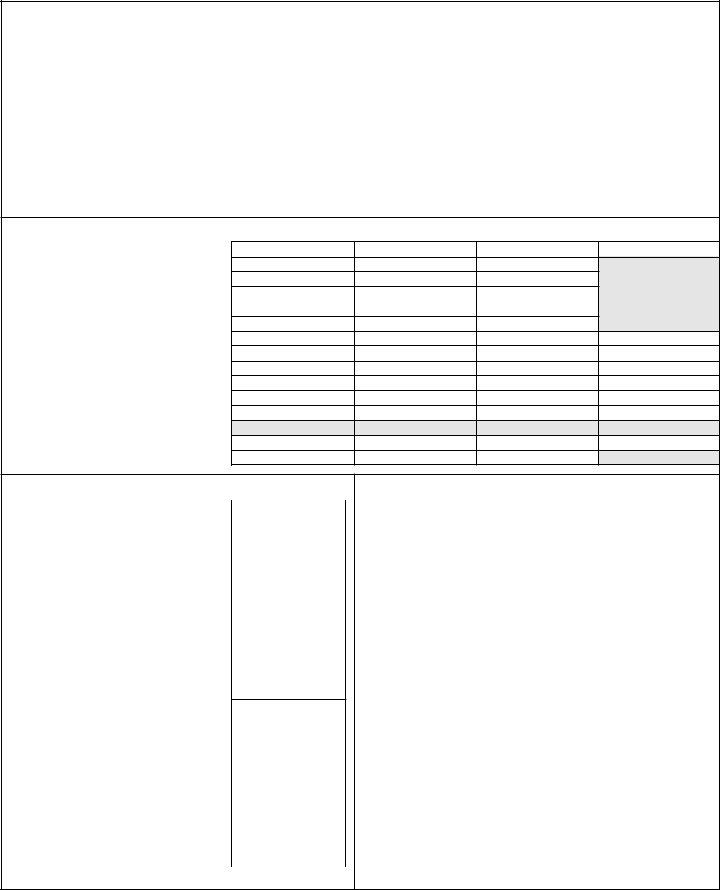

Navigating the complexities of fiduciary responsibilities can be a daunting task, especially when it comes to tax filings. The IA 1041 Iowa Fiduciary Return of Income form serves as a crucial document for estates or trusts required to report income within the state of Iowa. Filed for the calendar year 1997 or a specific fiscal year beginning and ending within 1997, this form encompasses various income and deduction categories that estates and trusts might encounter. Categories range from dividends and interest to income from partnerships, net rents, and royalties, right through to net business and farm income or loss. Additionally, it includes sections for calculating deductions such as fiduciary fees, charitable deductions, and attorney, accountant, and return preparer fees. The tax liability for both residents and nonresidents is carefully computed, incorporating credits and outlining payment instructions to ensure compliance with Iowa's tax regulations. Furthermore, supplemental schedules provide a framework for disclosing detailed background information about the estate or trust, beneficiary details, calculation of nonresident taxes, and a breakdown of expenses and tax rates. This form represents a comprehensive tool for managing the fiduciary income tax obligations in Iowa, ensuring that estates and trusts meet their legal requirements efficiently and effectively.

| Question | Answer |

|---|---|

| Form Name | Ia 1041 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 9763001 iowa 1041 online 2012 form |

IA 1041 |

IOWA FIDUCIARY RETURN OF INCOME |

1997 |

|

|

|

|

|

|

|

|

For Calendar Year 1997 or fiscal year beginning _____________________________ ,1997 and ending |

_____________________________ ,19 _____ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Estate or Trust |

|

|

|

|

Dept. of Revenue Number |

|

Check whether |

|

|||

|

|

|

|

|

|

|

|

|

|

|

j Estate |

|

TYPE |

|

|

|

|

|

|

|

|

|

|

j Simple Trust |

|

Name, Address and Title of Fiduciary |

|

|

|

|

Federal Identification Number |

|

j Complex Trust |

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

OR |

|

|

|

|

|

|

|

|

|

|

j Bankruptcy Estate |

|

|

|

|

|

|

|

|

|

|

|

If trust, check whether — |

|

|

|

Name of Attorney |

|

|

|

|

Iowa County in which estate is |

|

|

||||

|

|

|

|

|

|

j Testamentary |

|

|||||

PLEASE |

|

|

|

|

|

|

|

pending |

|

|

||

|

|

|

|

|

|

|

|

|

|

j Inter vivos |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Address (Number and Street) |

City |

State |

and Zip Code |

Probate Number |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

Have prior returns been filed for this estate or trust? |

j YES |

j NO |

|

|

|

|

|

|

|||

|

Is income tax certificate of acquittance requested? |

j YES |

j NO |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Dividends (enter full amount) |

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Interest |

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

3. |

Income from partnerships and other fiduciaries (attach supporting schedule) |

|

3. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME |

4. |

Net rents and royalties |

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Net business and farm income or loss (attach Schedules C (or |

5. |

|

|

|

|

|||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Net gain (loss) from capital assets |

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

7. |

Add gain excluded under section 641cIRC (see instructions) |

|

|

7. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

8. |

Ordinary gains (losses) (attach Federal Form 4797) |

|

|

8. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Other Income (state nature of income) |

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Total income (lines 1 to 9 inclusive) |

|

|

|

|

|

|

10. |

|

¶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Interest (Enter on Schedule D, page 2) |

|

|

|

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Taxes (Enter on Schedule D, page 2) |

|

|

|

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Fiduciary fees (Enter on Schedule D, page 2) |

|

|

|

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

14. |

Charitable deduction (from income in compliance with Will or Trust instrument) |

|

14. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

DEDUCTIONS |

15. |

Attorney, accountant, and return preparer fees (Enter on Schedule D, page 2) |

|

15. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

Other deductions not subject to 2% floor (Enter on Schedule D, page 2) |

|

16. |

|

|

|

|

||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

17. |

Allowable miscellaneous itemized deductions (Enter on Schedule D, page 2) |

|

17. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

Total (lines 11 to 17 inclusive) |

|

|

|

|

|

|

18. |

|

¶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

Balance - Subtract line 18 from line 10 |

|

|

|

|

|

19. |

|

¶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Distributions to beneficiaries (Complete Schedule B on page 2 or attach Federal Schedule |

20. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

|

21. |

Federal estate tax attributable to income in respect of a decedent (Fiduciary’s share) |

21. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. |

Total (Add lines 20 and 21) |

|

|

|

|

|

|

22. |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

23. |

Taxable income of fiduciary (line 19 minus line 22) Must be zero on final return |

|

|

|

23. |

|

¶ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residents complete lines 24 - 33. Nonresidents complete Schedule C and enter on line 33 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. |

Compute tax from rate schedule E, page 2 |

|

|

|

24. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

RESIDENT COMPUTEDTAX |

25. |

Iowa lump sum tax (Attach Federal Schedule 4972) |

|

|

25. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

Iowa minimum tax (Attach IA 6251) |

|

|

|

|

26. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27. |

Tax before credits (add lines 24 - 26) |

|

|

|

|

|

27. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28. |

Personal exemption credit |

|

|

|

|

28. |

20.00 |

|

|

|

|

|

29. |

|

|

29. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30. |

Motor Fuel Tax Credit (attach Schedule IA4136) |

|

|

|

30. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31. |

Other Credits |

|

|

|

|

31. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32. |

Total Credits (add lines 28 - 31 inclusive) |

|

|

|

|

|

32. |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

DUE |

33. |

Tax Liability - Residents (subtract line 32 from 27) Nonresidents enter amount from line 20 Schedule C. |

|

33. |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34. |

Tax Paid with Additional Payment Voucher |

|

|

|

|

|

34. |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

TAX |

|

|

|

|

|

|

|

|

|

|

|

|

35. |

Refund - If line 34 is larger than line 33 enter difference |

|

|

|

|

35. |

|

¶ |

|||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36. |

Amount Due — It line 34 is less than line 33 enter difference |

Make check payable to Treasurer - State of Iowa |

36. |

|

¶ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

MAIL THIS RETURN WITH PAYMENT AND COPY OF COMPLETE FEDERAL FIDUCIARY RETURN ATTACHED TO

Fiduciary Return Processing, Iowa Department of Revenue and Finance, P.O. Box 10467, Des Moines, Iowa 50306

DECLARATION

The undersigned hereby certifies and declares — That this return together with any schedules or papers attached hereto, has been duly examined; that to the best knowledge and belief of the undersigned, it is a true, correct and complete return for the taxable year as required by the income tax law of the State of Iowa and the rules and regulations issued under authority thereof.

|

Signature of fiduciary or officer representing fiduciary |

|

|

Date |

SIGN |

|

|

|

|

HERE |

|

|

|

|

|

Signature of preparer other than fiduciary |

Address |

|

Date |

Note: State tax information may be disclosed to tax officials of another state or of the United States for tax administrative purposes. |

1997 |

|||

STF IA14651F.1

FIDUCIARY SCHEDULES A, B, C, D AND E

SCHEDULE A - BACKGROUND INFORMATION — ANSWER ALL APPLICABLE QUESTIONS

1. |

Date estate was opened or created ___________________________________________ |

2. |

Date of decedent’s death ____________________________________________________ |

3. |

Decedent’s business or occupation ___________________________________________ |

4. Decedent’s age at death ____________________________________________________ |

|

5. |

Was a decedent’s final return filed? j Yes j No |

6. |

Did will of decedent create trust? j Yes j No |

7. |

Did decedent file IOWA return(s) up to date of death? j Yes j No (If no, attach earnings statement or explanatory affidavit) |

||

8.Enter decedent’s name, address, and Social Security Number on returns filed _________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________

9.Name and Social Security Number of decedent’s spouse _________________________________________________________________________________________________________

10.Enter name(s) of executor(s) ________________________________________________________________________________________________________________________________

11.Enter date(s) and amount(s) of executor’s fees paid to executor(s) __________________________________________________________________________________________________

12. |

Had federal audit been made on prior returns of decedent or the estate or trust? j Yes |

j No |

Is an audit now in the process? j Yes j No |

|

13. |

Have expenses of administration or selling expenses been deducted for federal estate tax purposes? |

j Yes |

j No |

|

14. |

Did you as fiduciary withhold on income distributions made to nonresident beneficiaries? |

j Yes |

j No |

|

15. |

Does the estate/trust elect to recognize the gain or loss on a distribution of property under section 643(d)(e)IRC? |

j Yes j No |

||

SCHEDULE B - BENEFICIARIES’ SHARES OF INCOME AND CREDITS (ATTACH ADDITIONAL PAGES AS NECESSARY)

1. Name of each beneficiary . . . . . . . . . . . . . . . . . . . . . . . .

2. Social Security Number . . . . . . . . . . . . . . . . . . . . . . . . .

3. Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Iowa Resident (Yes/No) . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Net

6. Net

7. Depreciation and depletion . . . . . . . . . . . . . . . . . . . . . . .

8. Ordinary income subject to Iowa Income Tax . . . . . . . . .

9. Income not subject to Iowa Income Tax . . . . . . . . . . . . .

10. Excess deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

REGARDING IOWA NONRESIDENT INCOME

11. Iowa income tax withheld, if any . . . . . . . . . . . . . . . . . . .

12. Withholding Agent’s Identification No. . . . . . . . . . . . . . .

Beneficiary “A”

Beneficiary “B”

Beneficiary “C”

TOTALS

|

SCHEDULE C - COMPUTATION OF NONRESIDENT’S TAX |

|

|

1. |

Federal taxable income from Federal 1041 |

|

|

|

|

||

2. |

Interest and dividends from Federal securities |

|

|

3. |

Balance - Subtract line 2 from line 1 |

|

|

4. |

Deduction taken for state income tax |

|

|

5. |

Interest & dividends from foreign, state & |

|

|

|

municipal securities |

|

|

6. |

Gains excluded by IRC §641(c) Trusts only |

|

|

7. |

Exemption credit from Federal 1041 |

|

|

8. |

Adjusted taxable income (add lines 3 through 7) |

|

|

9. |

Compute tax on the amount shown on |

|

|

|

line 8 using Schedule E |

|

|

10. |

Personal exemption credit |

|

20.00 |

11.Tax before being prorated (Subtract line 10 from line 9)

12.Nonresident percentage - divide amount on

|

line 23, page 1 by amount on line 8, Schedule C |

% |

13. |

Multiply line 11 by percentage on line 12 |

|

14. |

Iowa lump sum tax - attach Federal Schedule 4972 . . . |

|

15. |

Iowa minimum tax - attach IA 6251 |

|

16. |

Balance - add lines 13, 14 and 15 |

|

17. |

Motor fuel tax credit (attach IA 4136) |

|

18. |

Other credits |

|

19. |

Total credits - add lines 17 and 18 |

|

20. |

Total tax liability - subtract line 19 from line 16 |

|

|

Enter on line 33, page 1 |

|

SCHEDULE D - EXPLANATION OF EXPENSES

Line No. |

Explanation |

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE E - TAX RATES

|

|

(If Income Is) |

|

|

|

|

||

|

Over |

But Not Over |

|

Tax Rate |

of excess over |

|||

$ |

0 |

$ 1,112 |

$ |

0.00 0 0.40% |

$ |

0 |

||

|

1,112 |

2,224 |

|

4.45 0 |

0.80% |

|

1,112 |

|

|

2,224 |

4,448 |

|

13.35 |

0 |

2.70% |

|

2,224 |

|

4,448 |

10,008 |

|

73.40 |

0 |

5.00% |

|

4,448 |

|

10,008 |

16,680 |

|

351.40 |

0 |

6.80% |

|

10,008 |

|

16,680 |

22,240 |

|

805.10 |

0 |

7.20% |

|

16,680 |

|

22,240 |

33,360 |

|

1,205.42 |

0 7.55% |

|

22,240 |

|

|

33,360 |

50,040 |

|

2,044.98 |

0 8.80% |

|

33,360 |

|

|

50,040 |

over |

|

3,512.82 |

0 9.98% |

|

50,040 |

|

STF IA14651F.2