Using PDF files online is certainly a piece of cake using our PDF tool. You can fill in wh 5 here without trouble. FormsPal team is devoted to providing you with the absolute best experience with our editor by continuously releasing new features and enhancements. With all of these updates, using our tool becomes easier than ever before! To get the ball rolling, take these simple steps:

Step 1: Press the "Get Form" button above on this webpage to get into our PDF tool.

Step 2: Using this state-of-the-art PDF tool, you can accomplish more than merely fill in blank form fields. Try all the functions and make your forms appear great with custom textual content put in, or tweak the original input to excellence - all backed up by an ability to add stunning graphics and sign the PDF off.

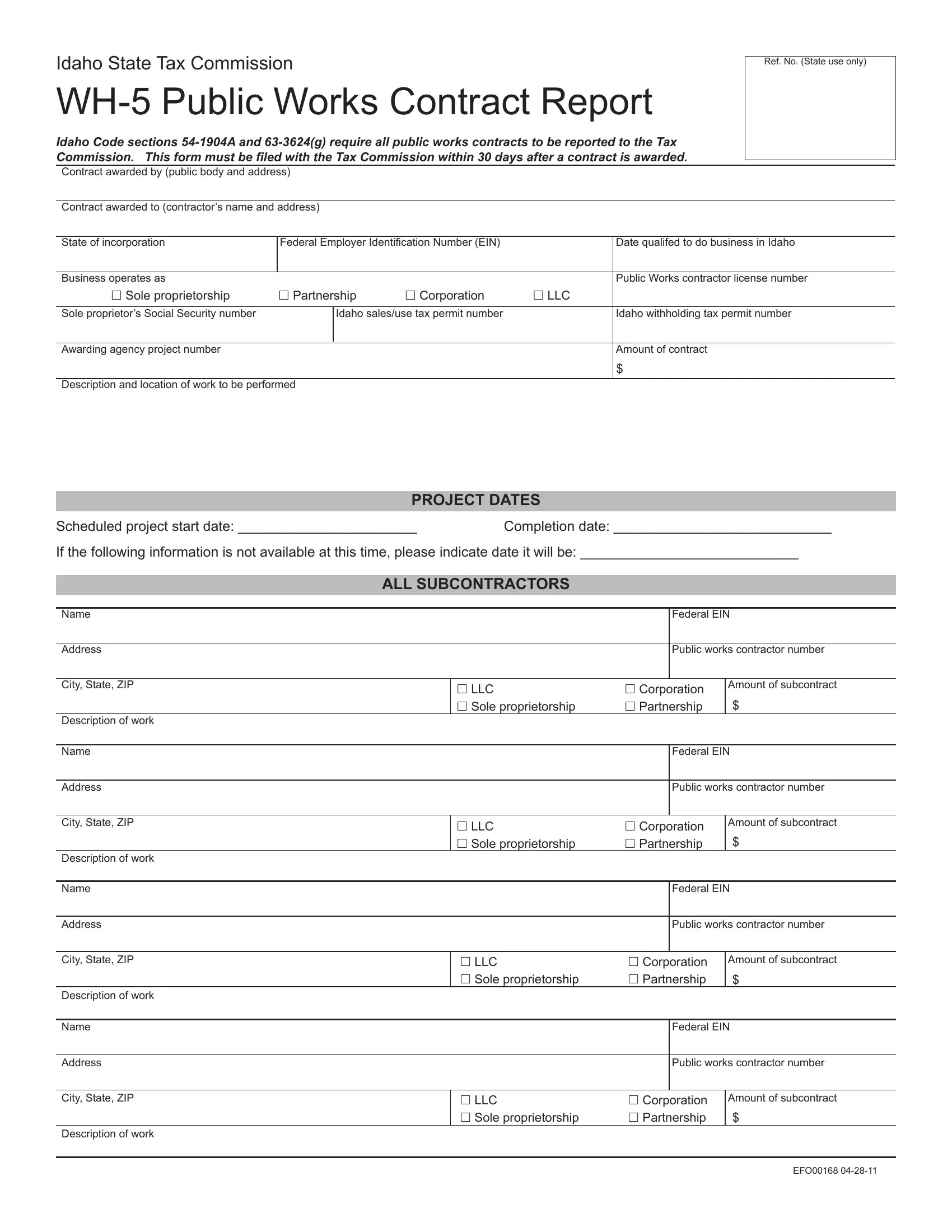

This PDF will require specific details to be typed in, thus be sure you take whatever time to enter what is requested:

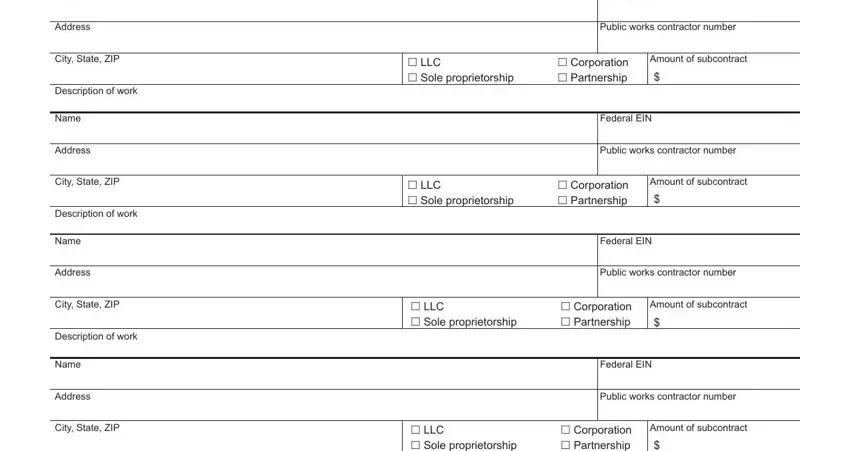

1. Begin completing your wh 5 with a selection of essential fields. Gather all the required information and make certain not a single thing omitted!

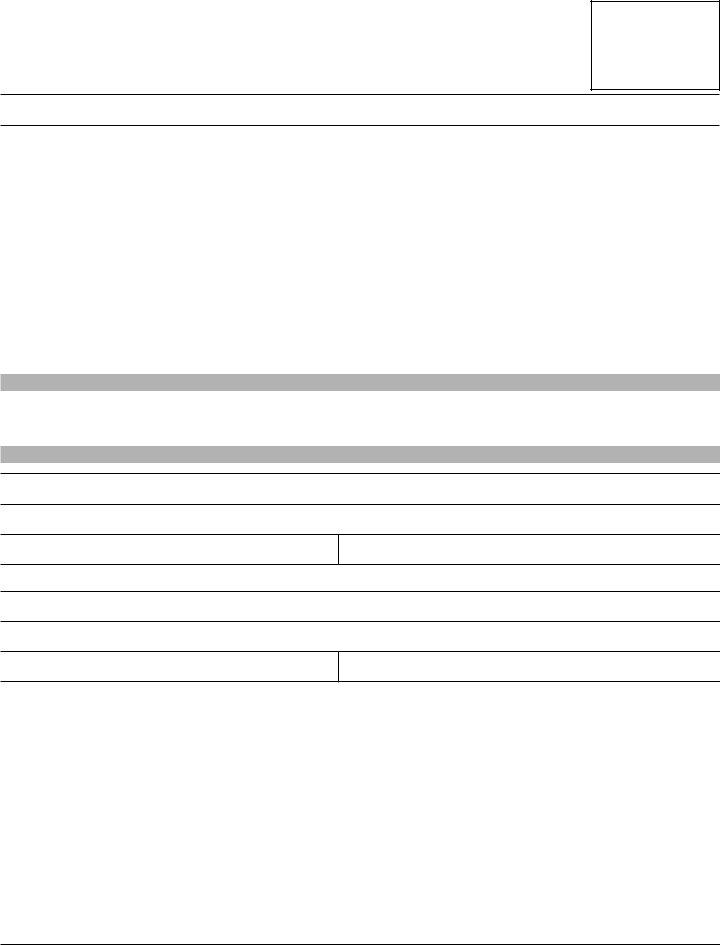

2. The third step is to fill in these particular blank fields: Name, Address, City State ZIP, Description of work, Name, Address, City State ZIP, Description of work, Name, Address, City State ZIP, Description of work, Name, Address, and City State ZIP.

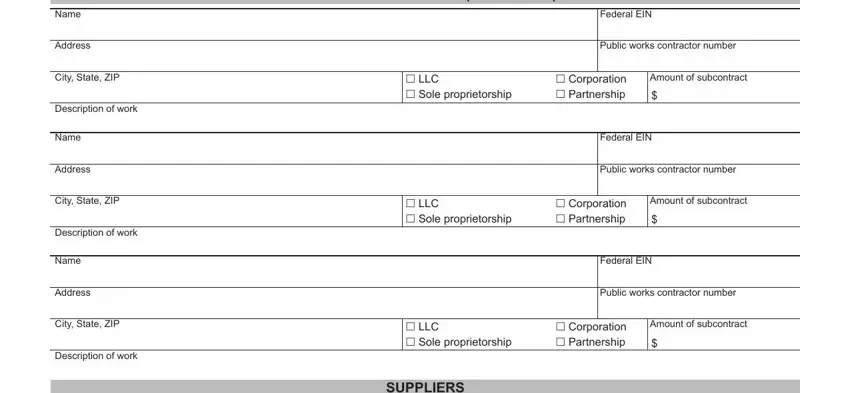

3. This third step is usually straightforward - fill in all of the empty fields in Description of work, LLC Sole proprietorship, Corporation Partnership, and EFO to finish this part.

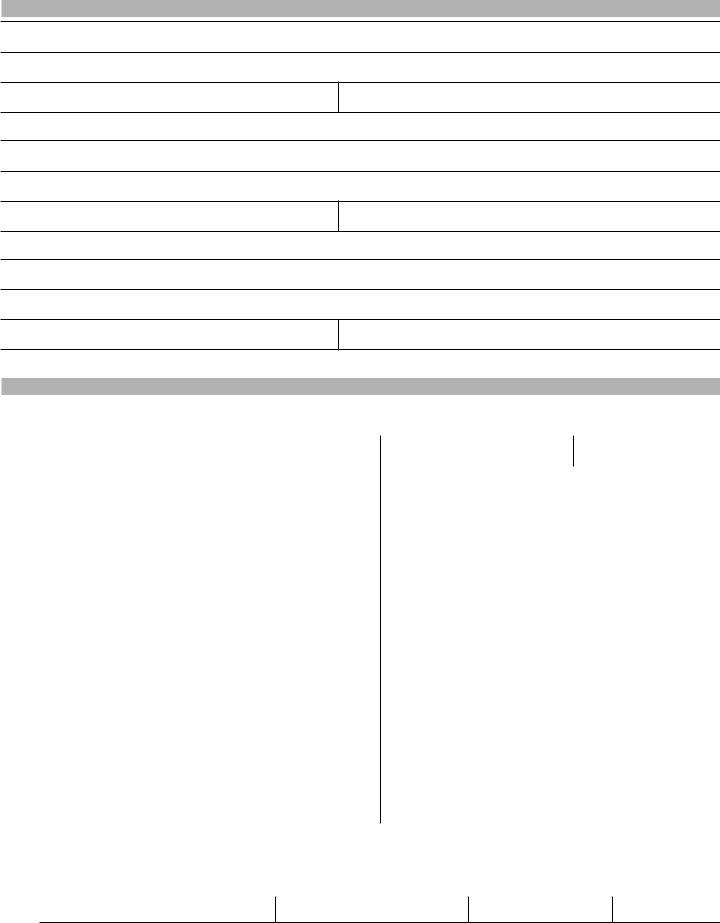

4. To move onward, this next form section involves completing a few empty form fields. Included in these are Name, Address, City State ZIP, Description of work, Name, Address, City State ZIP, Description of work, Name, Address, City State ZIP, Description of work, all subcontractors continueD, LLC Sole proprietorship, and LLC Sole proprietorship, which you'll find fundamental to going forward with this particular document.

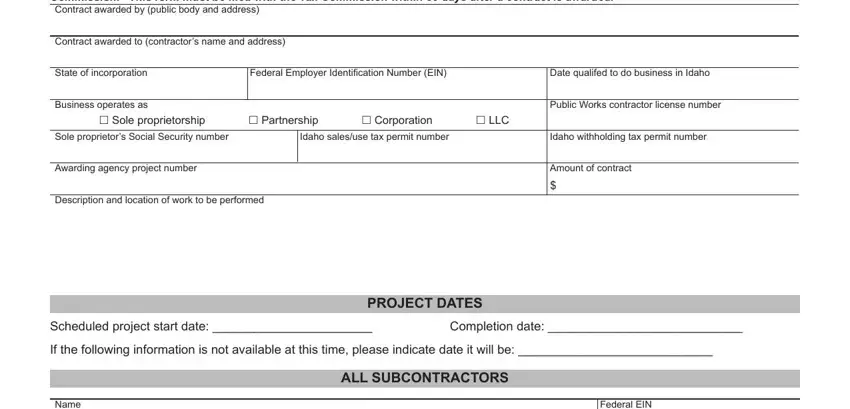

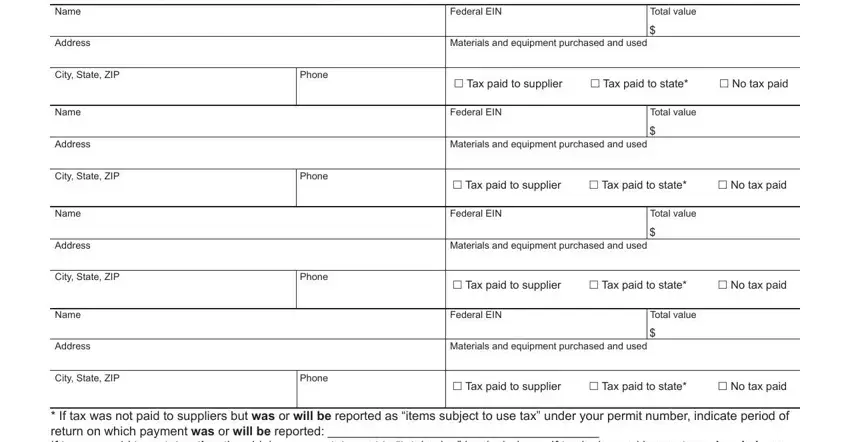

5. Finally, the following final part is precisely what you should finish prior to submitting the form. The blanks at issue include the next: Name, Address, City State ZIP, Name, Address, City State ZIP, Name, Address, City State ZIP, Name, Address, City State ZIP, Phone, Phone, and Phone.

As for Name and Address, be certain you get them right in this current part. The two of these are the most important ones in this page.

Step 3: Right after you've looked once again at the information entered, press "Done" to complete your form. Download the wh 5 when you subscribe to a 7-day free trial. Conveniently use the pdf inside your personal account page, together with any edits and changes automatically kept! We don't share or sell the information that you type in whenever completing forms at FormsPal.