Making use of the online editor for PDFs by FormsPal, you may fill out or alter Ides Form Bpp009F here. FormsPal is dedicated to providing you the best possible experience with our tool by regularly presenting new functions and enhancements. Our editor is now even more useful as the result of the latest updates! So now, filling out documents is simpler and faster than ever before. To get the ball rolling, consider these easy steps:

Step 1: Just click on the "Get Form Button" in the top section of this webpage to launch our pdf form editing tool. Here you will find everything that is needed to work with your file.

Step 2: Once you access the PDF editor, you will get the form all set to be filled out. Other than filling in different blanks, you can also do other sorts of actions with the file, specifically putting on custom textual content, changing the initial textual content, inserting images, placing your signature to the document, and much more.

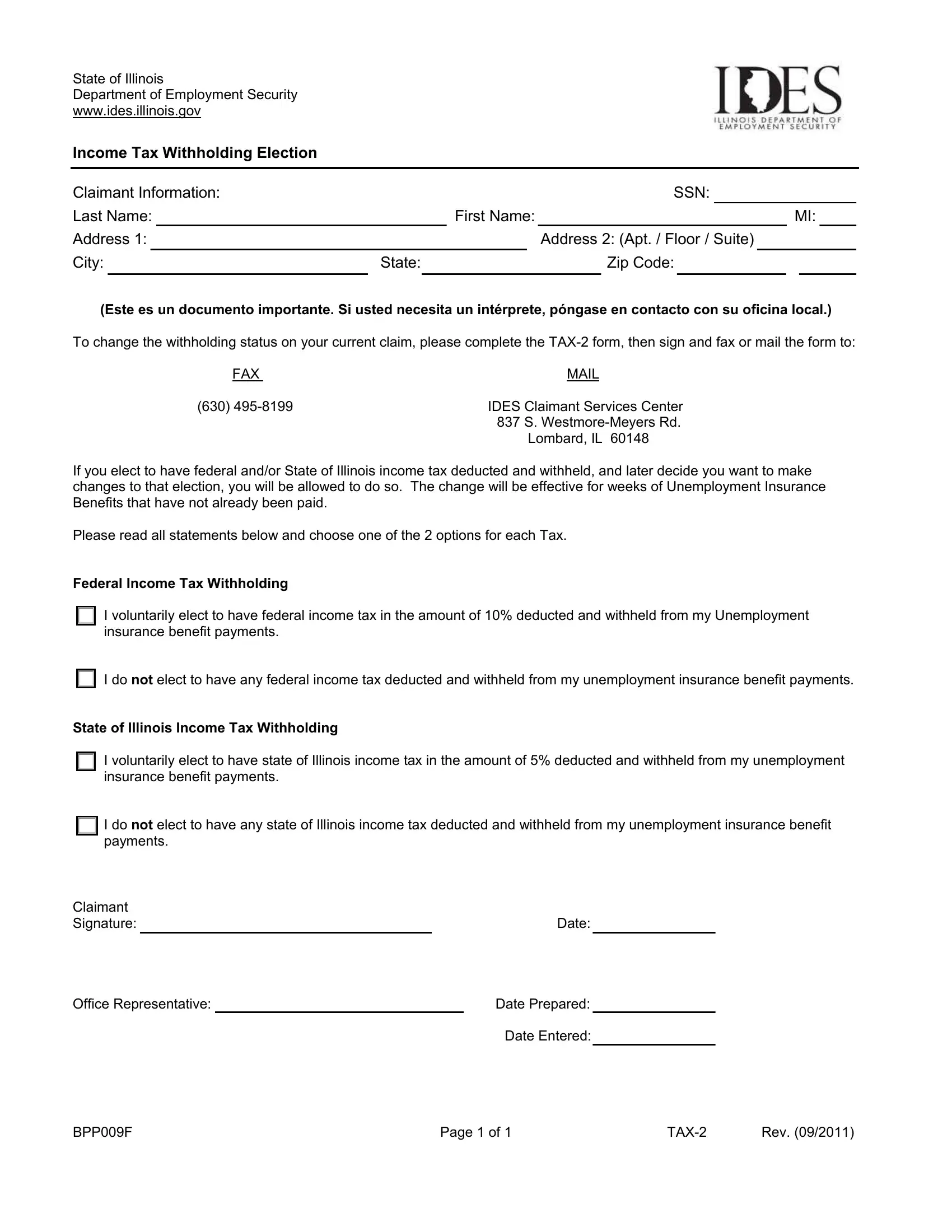

This PDF will need specific information to be entered, so you should take whatever time to provide what's asked:

1. You will need to complete the Ides Form Bpp009F correctly, so be mindful when filling in the parts containing these specific blank fields:

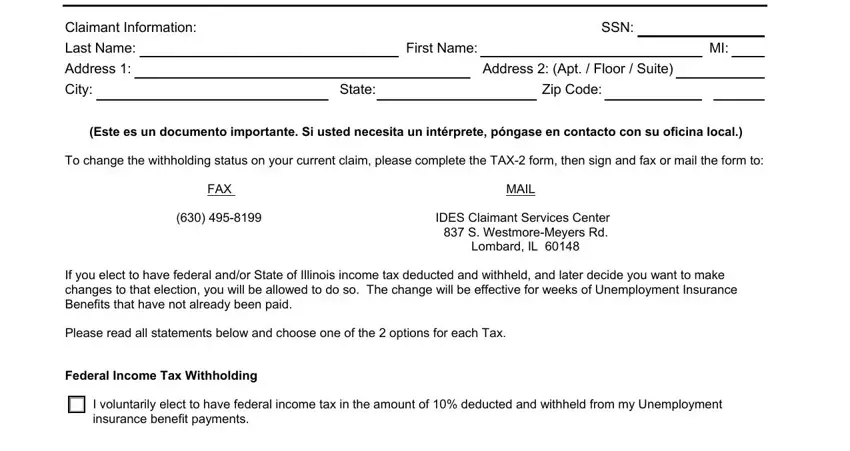

2. After the last part is done, it is time to put in the necessary details in Address Address Apt Floor allowing you to go further.

Be extremely attentive while completing Address Address Apt Floor and Address Address Apt Floor, since this is where many people make a few mistakes.

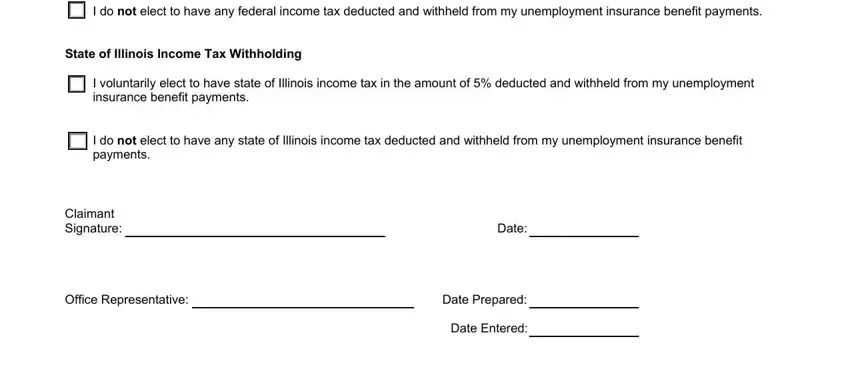

Step 3: Right after you have looked over the information you filled in, click "Done" to complete your FormsPal process. Try a 7-day free trial option at FormsPal and gain direct access to Ides Form Bpp009F - available inside your personal account page. FormsPal guarantees protected document completion with no personal data record-keeping or any sort of sharing. Feel comfortable knowing that your data is in good hands with us!