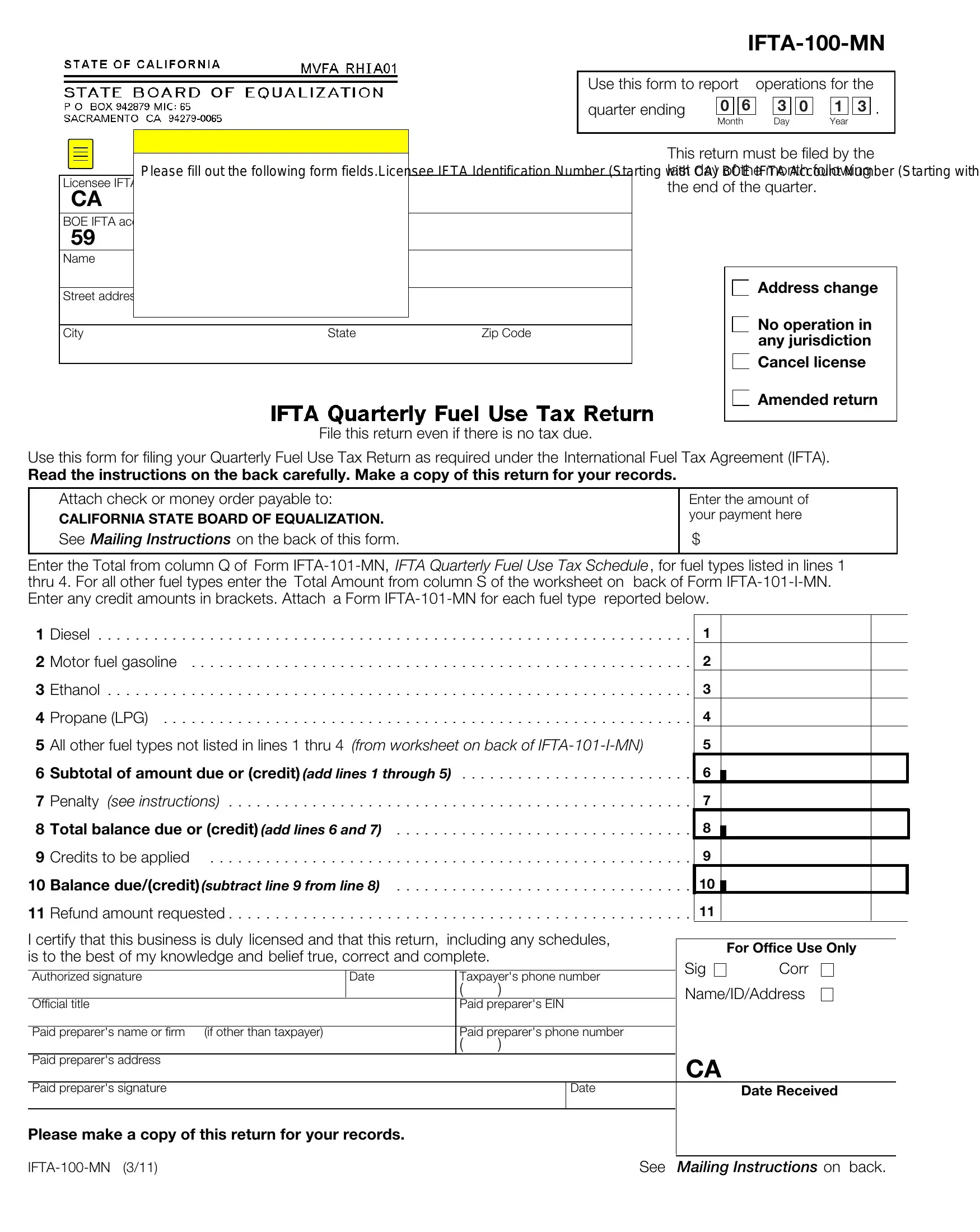

In case you wish to fill out ifta 100, there's no need to download and install any sort of programs - just give a try to our online PDF editor. Our editor is constantly developing to provide the very best user experience possible, and that's thanks to our dedication to constant improvement and listening closely to feedback from users. Should you be looking to get started, here's what you will need to do:

Step 1: Simply click the "Get Form Button" above on this site to start up our pdf form editor. This way, you will find everything that is needed to fill out your document.

Step 2: This tool will allow you to customize your PDF document in a range of ways. Enhance it with customized text, adjust existing content, and put in a signature - all within a couple of mouse clicks!

It is an easy task to finish the pdf using out detailed tutorial! Here is what you must do:

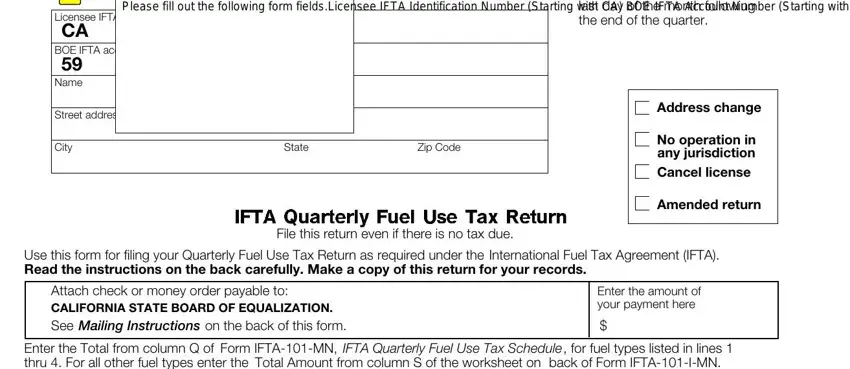

1. The ifta 100 involves certain details to be typed in. Be sure that the next blanks are completed:

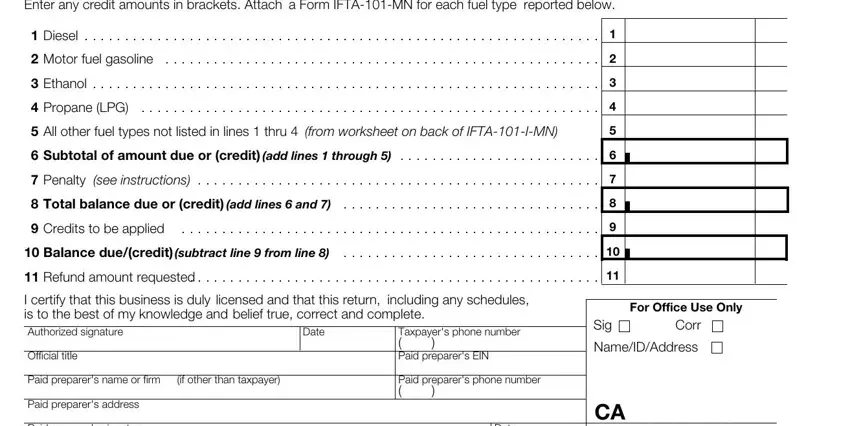

2. Soon after filling in the previous part, head on to the next step and complete the necessary particulars in these blanks - Enter the Total from column Q of, Diesel, Motor fuel gasoline, Ethanol, Propane LPG, All other fuel types not listed, Subtotal of amount due or credit, Penalty see instructions, Total balance due or credit add, Credits to be applied, Balance duecredit subtract line, Refund amount requested, I certify that this business is, Date, and Official title.

3. Completing Paid preparers signature, Please make a copy of this return, Date, Date Received, IFTAMN, and See Mailing Instructions on back is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

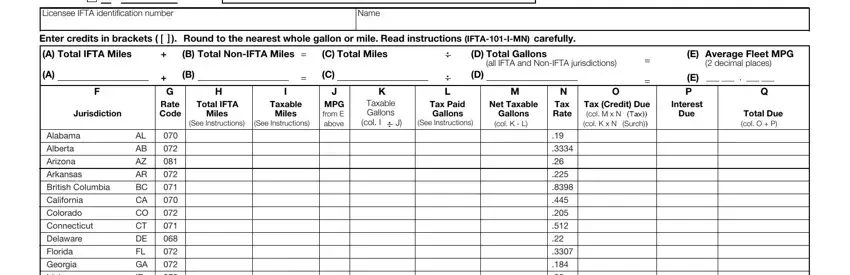

4. The form's fourth subsection arrives with all of the following fields to focus on: D G Motor fuel gasoline E P, Prepare a separate schedule for, Name, Enter credits in brackets Round, A Total IFTA Miles, B Total NonIFTA Miles, C Total Miles, Jurisdiction, Rate Code, Total IFTA Miles, Taxable, Miles, See Instructions, See Instructions, and MPG from E above.

Be very mindful while completing See Instructions and Total IFTA Miles, as this is where a lot of people make some mistakes.

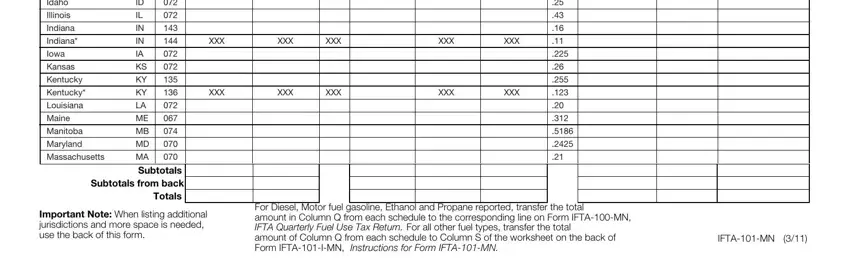

5. To conclude your form, the particular part involves several additional fields. Filling in XXX, XXX, XXX, XXX, XXX, XXX, XXX, XXX, XXX, XXX, Idaho, Illinois, Indiana, Indiana, and Iowa will certainly finalize the process and you can be done in the blink of an eye!

Step 3: Confirm that the details are accurate and then just click "Done" to continue further. Go for a 7-day free trial subscription at FormsPal and gain immediate access to ifta 100 - downloadable, emailable, and editable from your FormsPal account. FormsPal is dedicated to the privacy of all our users; we make certain that all information processed by our editor is confidential.