Navigating the complexities of fuel use taxation for commercial motor carriers in Kentucky is made more streamlined with the IFTA-100-MN form, issued by the Commonwealth of Kentucky Transportation Cabinet Division of Motor Carriers. This form is a vital tool for businesses operating within the International Fuel Tax Agreement (IFTA), enabling them to report quarterly fuel use and taxes due accurately. It covers a wide range of fuel types, from diesel and motor fuel gasoline to alternative fuels like ethanol/gasohol and propane (LPG), ensuring a comprehensive approach to fuel tax reporting. Not only does it facilitate the calculation of taxes owed across different jurisdictions, but it also provides a mechanism for reporting changes in business details, such as address changes or the cancellation of a license. Additionally, it includes instructions for applying for refunds or crediting overpayments, underscoring its role in ensuring both compliance and financial efficiency for carriers. By mandating the submission of this report by the last day of the month following the quarter's end, it ensures timely and orderly tax reporting, reflecting a structured approach to regulatory compliance in the transportation sector.

| Question | Answer |

|---|---|

| Form Name | Ifta 100 Mn Form |

| Form Length | 10 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 30 sec |

| Other names | return, 2011, nys ifta 100 mn on pdfiller, tax |

COMMONWEALTH OF KENTUCKY

Transportation Cabinet

Division of Motor Carriers

Frankfort, KY 40622

2Q/2011IFTA-100-MN

Use this form to report operations for the

quarter ending |

6/30/2011 |

This report must befiledby thelast day of themonthfollowingtheendof thequarter.

Date Rec'd/Processed

Licensee IFTA Identification number

KY

Name

Street address

City |

State |

Zip Code |

Address change No operation in any jurisdiction Cancel license Amended report

IFTA Quarterly Fuel Use Tax Return

File this report even if there is no tax due.

Usethis form for filingyour Quarterly Fuel UseTax Returnas requiredunder theInternational Fuel Tax agreement (IFTA). Readinstructionscarefully. Makeacopyfor your records.

|

Attach check or money order payable to: |

|

|

|

Enter the amount of |

|

|

KY STATE TREASURER |

|

|

|

|

your payment here |

|

See Mailing Instructions. |

|

|

|

$ |

|

Enter theTotal Duefrom columnQof Form |

||||||

Enter any credit amounts inbrackets. AttachaForm |

|

|

||||

1 |

Diesel |

|

|

|

|

|

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

1 |

|

|||

2 |

Motor fuel gasoline |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

2 |

|

|

3 |

Ethanol/gasohol |

. . . . . . . . . . . . . . . . . . . . . . |

|

3 |

|

|

4 |

. . . . . . . . . . . . . .Propane (LPG) |

. . . . . . . . . . . . . . . . . . . . . . |

|

4 |

|

|

5 |

. .All other fuel types not listed in lines 1 thru 4 (from worksheet onback of |

5 |

|

|||

|

Subtotal of amount due or (credit) (add lines 1 through 5) |

|

|

|

||

6 |

|

6 |

|

|||

7 |

. . . . . . . . . . . . . .Penalty (see instructions) |

. . . . . . . . . . . . . . . . . . . . . . |

7 |

|

||

8 |

. .Total balance due or (credit) (add lines 6 and 7) |

. . . . . . . . . . . . . . . . . . . . . . |

|

8 |

|

|

9 |

Credits to be applied |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

9 |

|

|

10 |

. .Balance due/(credit) (subtract line 9 from line 8) |

. . . . . . . . . . . . . . . . . . . . . |

|

10 |

|

|

11 |

Refund amount requested |

. . . . . . . . . . . . . . . . . . . . . . |

|

11 |

|

|

I certify that this business is duly licensedandthat this report, includingany schedules, is tothebest of my |

|

|||||

knowledgeandbelief true, correct andcomplete. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For OfficeUseOnly |

|

|

|

|

|

||

Authorizedsignature |

Date |

Taxpayer's phonenumber |

Sig |

Corr |

||

|

|

|

|

|||

Official title |

|

Paidpreparer's EIN |

Name/ID/Address |

|||

|

|

|

|

|||

Paidpreparer's nameor firm (if other thantaxpayer) |

Paidpreparer's phone# |

|

|

|||

|

|

|

|

|

|

|

Paidpreparer's address |

|

|

|

|

|

|

|

|

|

|

|

KY |

|

Paidpreparer's signature |

|

Date |

|

|

||

|

|

|

|

|

|

Date Received |

Pleasemakeacopyof thisreport for your records. |

|

|

|

|

||

|

SeeMailingInstructions. |

|||||

|

|

http://transportation.ky.gov/dmc |

|

|

||

Kentucky Transportation Cabinet |

2Q/2011 |

|

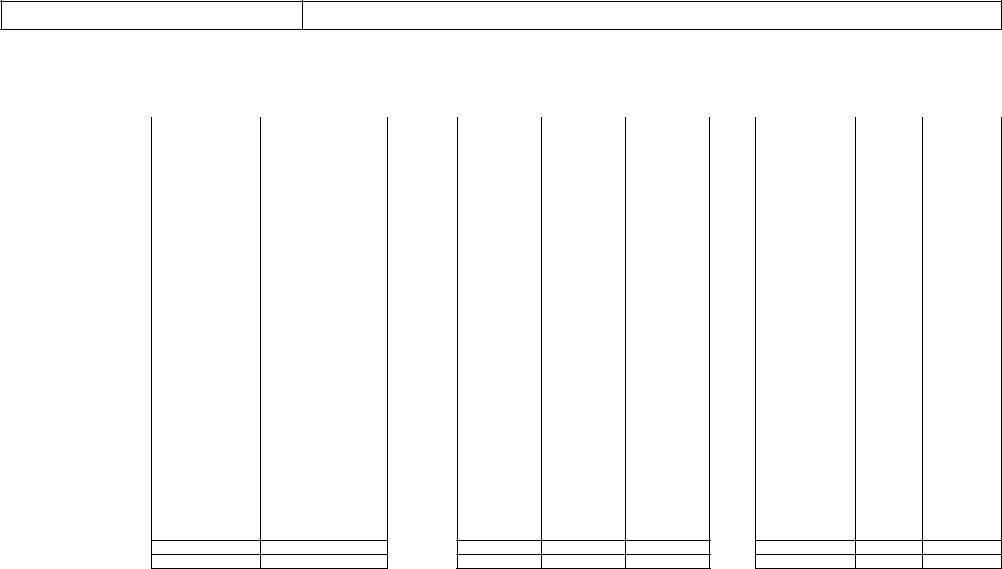

IFTA Quarterly Fuel Use Tax Schedule |

Tax on Fuel Type: D (Diesel) |

Attach this schedule to Form |

|

IFTA Quarterly Fuel Use Tax Return. |

|

Prepare a separate schedule for each fuel type. Use |

|

additional sheets if necessary. Make a copy for your records. |

|

|

Use this form to report operations |

|

for the quarter ending |

6/30/2011 |

Date due |

7/31/2011 |

Date Processed |

|

Licensee IFTA Identification number |

Name |

KY

Round to the nearest whole gallon or mile. Read instructions

|

|

|

Total |

|

Total |

|

|

|

|

|

|

|

|

Average |

|

|

|

(A) |

|

|

IFTA Miles |

+ (B) |

(C) Total Miles |

/ |

(D) |

Total Gallons |

|

= |

(E) |

Fleet MPG |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

(all IFTA and |

|

|

(2 decimal places) |

|

|

|

(A) |

|

|

|

(B) |

|

= |

(C) |

|

/ |

(D) |

|

|

= |

(E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Enter credits in brackets([ ]). |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

F |

G |

H |

|

I |

J |

|

K |

L |

M |

N |

O |

P |

Q |

|

|

|

|

|

Rate |

|

|

|

Taxable |

MPG |

|

Taxable |

Tax Paid |

Net Taxable |

Tax |

Tax (Credit) Due |

Interest |

|

|

Jurisdiction |

Code |

IFTA Miles |

|

Miles |

from E |

Gallons |

Gallons |

Gallons |

Rate |

(col. M x N (Tax)) |

Due |

Total Due |

||||

|

|

|

|

|

|

|

|

|

above |

|

(col. I / J) |

|

(col. K - L) |

|

(col. K x N (Surch)) |

|

(col. O + P) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotals

Subtotalsfrom continuation

Totals

|

|

|

|

|

|

|

|

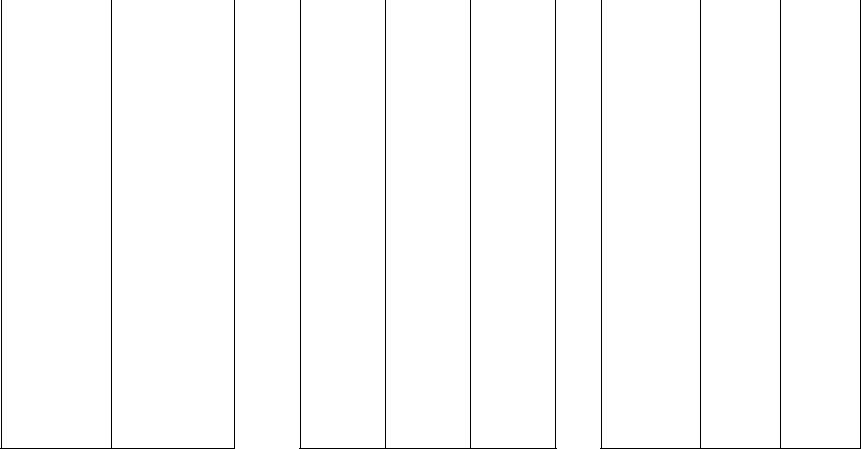

IFTA Quarterly Fuel Use Tax Schedule |

|

|

Use this form to report operations |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for the quarter ending |

|

6/30/2011 |

|

|

|

|

|

|

|

|

|

DIESEL - |

|

|

|

Date due |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

7/31/2011 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Processed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Licensee IFTA Identification number |

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|||||

KY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

Total |

|

|

|

|

|

|

|

|

|

Average |

|

|

|

(A) IFTA Miles |

+ |

(B) |

= |

(C) Total Miles |

/ |

(D) |

Total Gallons |

|

= |

(E) |

Fleet MPG |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

(all IFTA and |

|

|

(2 decimal places) |

|

|

||

(A) |

|

+ |

(B) |

|

= |

(C) |

|

/ |

(D) |

|

|

= |

(E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Enter credits in brackets([ ]). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

F |

G |

|

H |

|

|

I |

J |

|

K |

L |

M |

N |

O |

P |

Q |

|

|

|

|

Rate |

|

|

|

Taxable |

MPG |

|

Taxable |

Tax Paid |

Net Taxable |

Tax |

Tax (Credit) Due |

Interest |

|

||

Jurisdiction |

Code |

|

IFTA Miles |

|

|

Miles |

from E |

Gallons |

Gallons |

Gallons |

Rate (col. M x N (Tax)) |

Due |

Total Due |

|||||

|

|

|

|

|

|

|

|

|

above |

(col. I / J) |

|

(col. K - L) |

|

(col. K x N (Surch)) |

|

(col. O + P) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

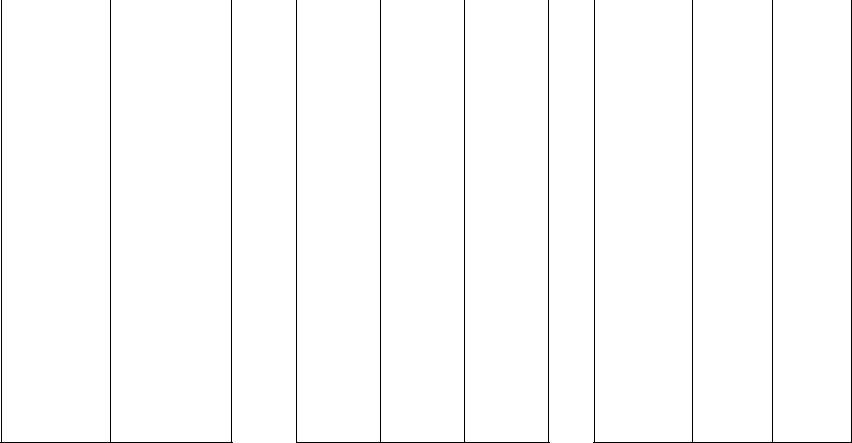

Totals

|

|

|

|

|

|

|

|

IFTA Quarterly Fuel Use Tax Schedule |

|

|

Use this form to report operations |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for the quarter ending |

|

6/30/2011 |

|

|

|

|

|

|

|

|

|

DIESEL - |

|

|

|

Date due |

|

7/31/2011 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Processed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Licensee IFTA Identification number |

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|||||

KY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

Total |

|

|

|

|

|

|

|

|

|

Average |

|

|

|

(A) IFTA Miles |

+ |

(B) |

= |

(C) Total Miles |

/ |

(D) |

Total Gallons |

|

= |

(E) |

Fleet MPG |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

(all IFTA and |

|

|

(2 decimal places) |

|

|

||

(A) |

|

+ |

(B) |

|

= |

(C) |

|

/ |

(D) |

|

|

= |

(E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Enter credits in brackets([ ]). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

F |

G |

|

H |

|

|

I |

J |

|

K |

L |

M |

N |

O |

P |

Q |

|

|

|

|

Rate |

|

|

|

Taxable |

MPG |

|

Taxable |

Tax Paid |

Net Taxable |

Tax |

Tax (Credit) Due |

Interest |

|

||

Jurisdiction |

Code |

|

IFTA Miles |

|

|

Miles |

from E |

Gallons |

Gallons |

Gallons |

Rate (col. M x N (Tax)) |

Due |

Total Due |

|||||

|

|

|

|

|

|

|

|

|

above |

(col. I / J) |

|

(col. K - L) |

|

(col. K x N (Surch)) |

|

(col. O + P) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Kentucky Transportation Cabinet |

2Q/2011 |

|

IFTA Quarterly Fuel Use Tax Schedule |

Tax on Fuel Type: G (Gasoline) |

Attach this schedule to Form |

|

IFTA Quarterly Fuel Use Tax Return. |

|

Prepare a separate schedule for each fuel type. Use |

|

additional sheets if necessary. Make a copy for your records. |

|

|

|

Use this form to report operations |

|

|

for the quarter ending |

|

6/30/2011 |

Date due |

|

7/31/2011 |

Date Processed |

|

|

Licensee IFTA Identification number |

Name |

KY

Round to the nearest whole gallon or mile. Read instructions

|

|

|

Total |

|

|

Total |

|

|

|

|

|

|

|

|

|

Average |

|

|

(A) |

|

|

IFTA Miles |

+ |

(B) |

= |

(C) Total Miles |

/ |

(D) |

Total Gallons |

|

= |

(E) |

Fleet MPG |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

(all IFTA and |

|

|

(2 decimal places) |

|

|

|

(A) |

|

|

|

+ |

(B) |

|

= |

(C) |

|

/ |

(D) |

|

|

= |

(E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Enter credits in brackets([ ]). |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

F |

G |

|

H |

|

|

I |

J |

|

K |

L |

M |

N |

O |

P |

Q |

|

|

|

|

Rate |

|

|

|

|

Taxable |

MPG |

|

Taxable |

Tax Paid |

Net Taxable |

Tax |

Tax (Credit) Due |

Interest |

|

|

Jurisdiction |

Code |

|

IFTA Miles |

|

|

Miles |

from E |

Gallons |

Gallons |

Gallons |

Rate |

(col. M x N (Tax)) |

Due |

Total Due |

|||

|

|

|

|

|

|

|

|

|

|

above |

|

(col. I / J) |

|

(col. K - L) |

|

(col. K x N (Surch)) |

|

(col. O + P) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sub totals

Subtotals from continu

Total

|

|

|

|

|

|

|

IFTA Quarterly Fuel Use Tax Schedule |

|

|

|

Use this form to report operations |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for the quarter ending |

6/30/2011 |

||

|

|

|

|

|

|

|

GASOLINE - |

|

|

|

Date due |

|

|

7/31/2011 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Processed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Licensee IFTA Identification number |

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

||||

KY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

Total |

|

|

|

|

|

|

|

|

|

|

Average |

|

|

|

(A) IFTA Miles |

+ |

(B) |

= |

(C) Total Miles |

/ |

(D) |

Total Gallons |

|

= |

(E) |

Fleet MPG |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

(all IFTA and |

|

|

(2 decimal places) |

|

|

|

||

(A) |

|

+ |

(B) |

|

= |

(C) |

|

/ |

(D) |

|

|

|

= |

(E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Enter credits in brackets([ ]). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

F |

G |

|

H |

|

|

I |

J |

|

K |

L |

M |

N |

O |

P |

Q |

||

|

|

Rate |

|

|

|

|

Taxable |

MPG |

|

Taxable |

Tax Paid |

Net Taxable |

Tax |

Tax (Credit) Due |

Interest |

|

||

Jurisdiction |

Code |

|

IFTA Miles |

|

|

Miles |

from E |

Gallons |

Gallons |

Gallons |

Rate |

(col. M x N (Tax)) |

Due |

Total Due |

||||

|

|

|

|

|

|

|

|

above |

|

(col. I / J) |

|

(col. K - L) |

|

(col. K x N (Surch)) |

|

|

(col. O + P) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals

JD |

Jurisdiction |

FUEL_TYPE |

Surcharge |

|||

AB |

Alberta |

GASOLINE |

0064 |

0.3486 |

|

N |

AL |

Alabama |

GASOLINE |

0062 |

0.16 |

|

N |

AR |

Arkansas |

GASOLINE |

0064 |

0.215 |

|

N |

AZ |

Arizona |

GASOLINE |

0064 |

0.18 |

|

N |

BC |

British Columbia |

GASOLINE |

0063 |

0.734 |

|

N |

CA |

California |

GASOLINE |

0062 |

0 |

|

N |

CO |

Colorado |

GASOLINE |

0064 |

0.22 |

|

N |

CT |

Connecticut |

GASOLINE |

0062 |

0.25 |

|

N |

DE |

Delaware |

GASOLINE |

0060 |

0.23 |

|

N |

FL |

Florida |

GASOLINE |

0064 |

0.2987 |

|

N |

GA |

Georgia |

GASOLINE |

67 |

0.151 |

|

N |

IA |

Iowa |

GASOLINE |

0064 |

0.21 |

|

N |

ID |

Idaho |

GASOLINE |

0062 |

0 |

|

N |

IL |

Illinois |

GASOLINE |

0064 |

0.34 |

|

N |

IN |

Indiana |

GASOLINE |

0127 |

0.18 |

|

N |

IN* |

SURCHARGE |

GASOLINE |

0128 |

0.11 |

|

Y |

KS |

Kansas |

GASOLINE |

0064 |

0.24 |

|

N |

KY |

Kentucky |

GASOLINE |

0119 |

0.245 |

|

N |

KY* |

SURCHARGE |

GASOLINE |

0120 |

0.043 |

|

Y |

LA |

Louisiana |

GASOLINE |

0064 |

0.2 |

|

N |

MA |

Massachusetts |

GASOLINE |

0062 |

0.21 |

|

N |

MB |

Manitoba |

GASOLINE |

0064 |

0.4455 |

|

N |

MD |

Maryland |

GASOLINE |

0062 |

0.235 |

|

N |

ME |

Maine |

GASOLINE |

0058 |

0 |

|

N |

MI |

Michigan |

GASOLINE |

0063 |

0 |

|

N |

MN |

Minnesota |

GASOLINE |

0065 |

0.275 |

|

N |

MO |

Missouri |

GASOLINE |

0063 |

0.17 |

|

N |

MS |

Mississippi |

GASOLINE |

0064 |

0.18 |

|

N |

MT |

Montana |

GASOLINE |

0064 |

0 |

|

N |

NB |

New Brunswick |

GASOLINE |

0062 |

0.5268 |

|

N |

NC |

North Carolina |

GASOLINE |

0064 |

0.325 |

|

N |

ND |

North Dakota |

GASOLINE |

0064 |

0.23 |

|

N |

NE |

Nebraska |

GASOLINE |

0064 |

0.264 |

|

N |

NH |

New Hampshire |

GASOLINE |

0058 |

0 |

|

N |

NJ |

New Jersey |

GASOLINE |

0060 |

0.145 |

|

N |

NL |

Newfoundland |

GASOLINE |

0062 |

0.6391 |

|

N |

NM |

New Mexico |

GASOLINE |

0062 |

0 |

|

N |

NS |

Nova Scotia |

GASOLINE |

0063 |

0.6004 |

|

N |

NV |

Neveda |

GASOLINE |

0062 |

0.23 |

|

N |

NY |

New York |

GASOLINE |

0062 |

0.41 |

|

N |

OH |

Ohio |

GASOLINE |

0104 |

0.28 |

|

N |

OK |

Oklahoma |

GASOLINE |

0064 |

0.16 |

|

N |

ON |

Ontario |

GASOLINE |

0058 |

0.5694 |

|

N |

OR |

Oregon |

GASOLINE |

0062 |

0 |

|

N |

PA |

Pennsylvania |

GASOLINE |

0069 |

0.312 |

|

N |

PE |

Prince Edward Island |

GASOLINE |

0063 |

0.612 |

|

N |

QC |

Quebec |

GASOLINE |

0062 |

0.6662 |

|

N |

RI |

Rhode Island |

GASOLINE |

0060 |

0.32 |

|

N |

SC |

South Carolina |

GASOLINE |

0062 |

0.16 |

|

N |

SD |

South Dakota |

GASOLINE |

0062 |

0 |

|

N |

SK |

Saskatchewan |

GASOLINE |

0064 |

0.581 |

|

N |

TN |

|

Tennessee |

|

GASOLINE |

|

0064 |

|

0.2 |

|

N |

TX |

|

Texas |

|

GASOLINE |

|

0064 |

|

0.2 |

|

N |

UT |

|

Utah |

|

GASOLINE |

|

0064 |

|

0.245 |

|

N |

VA* |

|

SURCHARGE |

|

GASOLINE |

|

0124 |

|

0.035 |

|

Y |

VA |

|

Virginia |

|

GASOLINE |

|

0123 |

|

0.175 |

|

N |

VT |

|

Vermont |

|

GASOLINE |

|

0059 |

|

0 |

|

N |

WA |

|

Washington |

|

GASOLINE |

|

0064 |

|

0.375 |

|

N |

WI |

|

Wisconsin |

|

GASOLINE |

|

0064 |

|

0.329 |

|

N |

WV |

|

West Virginia |

|

GASOLINE |

|

0062 |

|

0.322 |

|

N |

WY |

|

Wyoming |

|

GASOLINE |

|

0064 |

|

0.14 |

|

N |

GA** |

|

RATE CHANGE |

|

GASOLINE |

|

|

68 |

0.172 |

|

R |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

JD |

Jurisdiction |

FUEL_TYPE |

Surcharge |

|||

AB |

Alberta |

DIESEL |

0064 |

0.3486 |

|

N |

AL |

Alabama |

DIESEL |

0062 |

0.19 |

|

N |

AR |

Arkansas |

DIESEL |

0064 |

0.225 |

|

N |

AZ |

Arizona |

DIESEL |

0073 |

0.26 |

|

N |

BC |

British Columbia |

DIESEL |

0063 |

0.779 |

|

N |

CA |

California |

DIESEL |

0062 |

0.397 |

|

N |

CO |

Colorado |

DIESEL |

0064 |

0.205 |

|

N |

CT |

Connecticut |

DIESEL |

0063 |

0.396 |

|

N |

DE |

Delaware |

DIESEL |

0060 |

0.22 |

|

N |

FL |

Florida |

DIESEL |

0064 |

0.3207 |

|

N |

GA |

Georgia |

DIESEL |

63 |

0.16 |

|

N |

IA |

Iowa |

DIESEL |

0064 |

0.225 |

|

N |

ID |

Idaho |

DIESEL |

0064 |

0.25 |

|

N |

IL |

Illinois |

DIESEL |

0064 |

0.378 |

|

N |

IN |

Indiana |

DIESEL |

0127 |

0.16 |

|

N |

IN* |

SURCHARGE |

DIESEL |

0128 |

0.11 |

|

Y |

KS |

Kansas |

DIESEL |

0064 |

0.26 |

|

N |

KY |

Kentucky |

DIESEL |

0119 |

0.215 |

|

N |

KY* |

SURCHARGE |

DIESEL |

0120 |

0.102 |

|

Y |

LA |

Louisiana |

DIESEL |

0064 |

0.2 |

|

N |

MA |

Massachusetts |

DIESEL |

0062 |

0.21 |

|

N |

MB |

Manitoba |

DIESEL |

0065 |

0.4455 |

|

N |

MD |

Maryland |

DIESEL |

0062 |

0.2425 |

|

N |

ME |

Maine |

DIESEL |

0059 |

0.307 |

|

N |

MI |

Michigan |

DIESEL |

0086 |

0.373 |

|

N |

MN |

Minnesota |

DIESEL |

0065 |

0.275 |

|

N |

MO |

Missouri |

DIESEL |

0064 |

0.17 |

|

N |

MS |

Mississippi |

DIESEL |

0064 |

0.18 |

|

N |

MT |

Montana |

DIESEL |

0064 |

0.2775 |

|

N |

NB |

New Brunswick |

DIESEL |

0062 |

0.7437 |

|

N |

NC |

North Carolina |

DIESEL |

0064 |

0.325 |

|

N |

ND |

North Dakota |

DIESEL |

0064 |

0.23 |

|

N |

NE |

Nebraska |

DIESEL |

0064 |

0.264 |

|

N |

NH |

New Hampshire |

DIESEL |

0058 |

0.18 |

|

N |

NJ |

New Jersey |

DIESEL |

0060 |

0.175 |

|

N |

NL |

Newfoundland |

DIESEL |

0062 |

0.6391 |

|

N |

NM |

New Mexico |

DIESEL |

0064 |

0.21 |

|

N |

NS |

Nova Scotia |

DIESEL |

0062 |

0.5965 |

|

N |

NV |

Neveda |

DIESEL |

0064 |

0.27 |

|

N |

NY |

New York |

DIESEL |

0062 |

0.3925 |

|

N |

OH |

Ohio |

DIESEL |

0104 |

0.28 |

|

N |

OK |

Oklahoma |

DIESEL |

0064 |

0.13 |

|

N |

ON |

Ontario |

DIESEL |

0058 |

0.5539 |

|

N |

OR |

Oregon |

DIESEL |

0062 |

0 |

|

N |

PA |

Pennsylvania |

DIESEL |

0069 |

0.381 |

|

N |

PE |

Prince Edward Island |

DIESEL |

0063 |

0.7824 |

|

N |

QC |

Quebec |

DIESEL |

0064 |

0.705 |

|

N |

RI |

Rhode Island |

DIESEL |

0060 |

0.32 |

|

N |

SC |

South Carolina |

DIESEL |

0062 |

0.16 |

|

N |

SD |

South Dakota |

DIESEL |

0064 |

0.22 |

|

N |

SK |

Saskatchewan |

DIESEL |

0064 |

0.581 |

|

N |

TN |

|

Tennessee |

|

DIESEL |

|

0064 |

|

0.17 |

|

N |

TX |

|

Texas |

|

DIESEL |

|

0064 |

|

0.2 |

|

N |

UT |

|

Utah |

|

DIESEL |

|

0064 |

|

0.245 |

|

N |

VA* |

|

SURCHARGE |

|

DIESEL |

|

0124 |

|

0.035 |

|

Y |

VA |

|

Virginia |

|

DIESEL |

|

0123 |

|

0.175 |

|

N |

VT |

|

Vermont |

|

DIESEL |

|

0072 |

|

0.29 |

|

N |

WA |

|

Washington |

|

DIESEL |

|

0064 |

|

0.375 |

|

N |

WI |

|

Wisconsin |

|

DIESEL |

|

0064 |

|

0.329 |

|

N |

WV |

|

West Virginia |

|

DIESEL |

|

0062 |

|

0.322 |

|

N |

WY |

|

Wyoming |

|

DIESEL |

|

0064 |

|

0.14 |

|

N |

GA** |

|

RATE CHANGE |

|

DIESEL |

|

|

64 |

0.183 |

|

R |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

0 |

|

0 |