Whenever you would like to fill out illinois 700, you don't have to install any sort of programs - just make use of our online PDF editor. FormsPal is devoted to giving you the perfect experience with our editor by regularly adding new features and upgrades. With these updates, working with our editor gets easier than ever before! To begin your journey, go through these basic steps:

Step 1: Open the PDF file in our editor by clicking on the "Get Form Button" at the top of this page.

Step 2: With the help of our advanced PDF tool, you can actually do more than merely complete blank fields. Try each of the features and make your documents seem sublime with custom text put in, or modify the original content to excellence - all that comes along with an ability to incorporate stunning graphics and sign the document off.

It really is straightforward to complete the document following this helpful guide! Here's what you need to do:

1. First, when filling in the illinois 700, start with the section that features the subsequent fields:

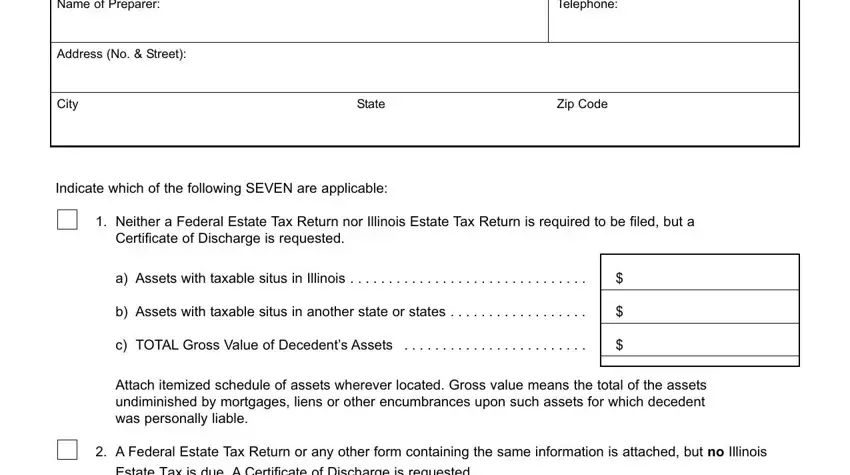

2. Right after filling in the previous step, go to the subsequent step and complete the necessary details in these blanks - Name of Preparer, Telephone, Address No Street, City, State, Zip Code, Indicate which of the following, Neither a Federal Estate Tax, Certificate of Discharge is, a Assets with taxable situs in, b Assets with taxable situs in, c TOTAL Gross Value of Decedents, Attach itemized schedule of assets, A Federal Estate Tax Return or, and Estate Tax is due A Certificate of.

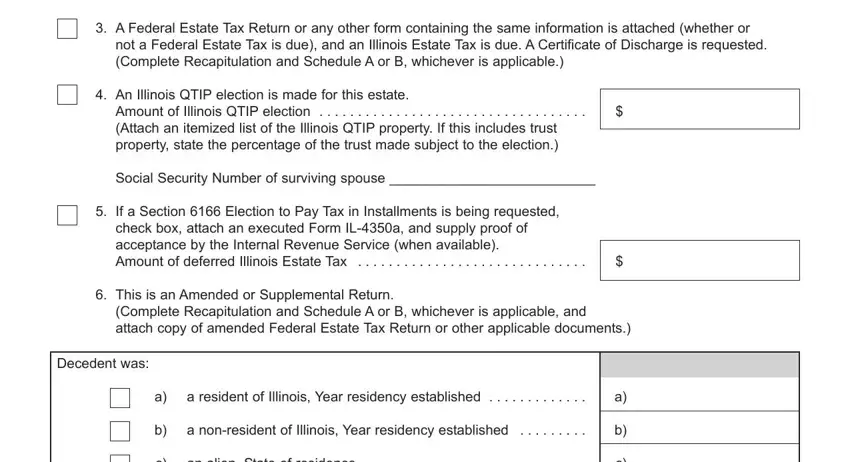

3. This 3rd section is typically fairly easy, A Federal Estate Tax Return or, not a Federal Estate Tax is due, An Illinois QTIP election is made, Amount of Illinois QTIP election, Social Security Number of, If a Section Election to Pay Tax, This is an Amended or, Complete Recapitulation and, Decedent was, a resident of Illinois Year, a nonresident of Illinois Year, and an alien State of residence - every one of these empty fields will have to be completed here.

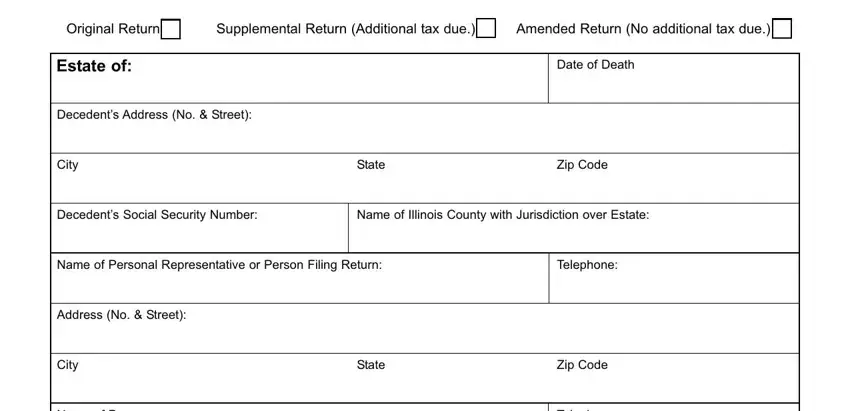

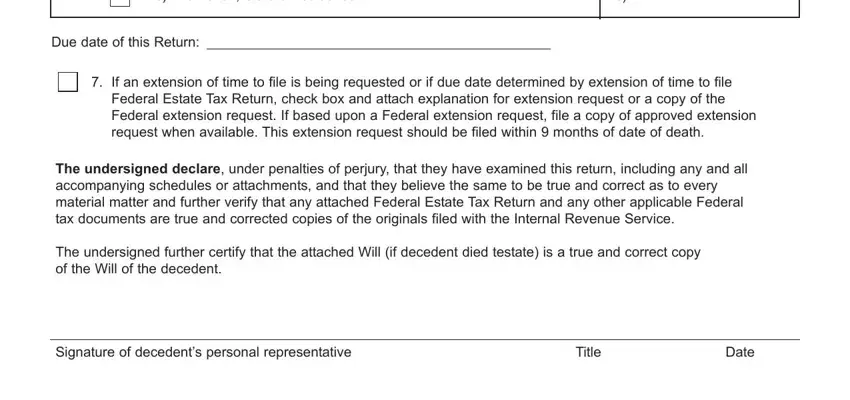

4. Your next paragraph requires your attention in the following places: an alien State of residence, Due date of this Return, If an extension of time to file is, The undersigned declare under, The undersigned further certify, Signature of decedents personal, Title, and Date. Ensure that you provide all requested details to go onward.

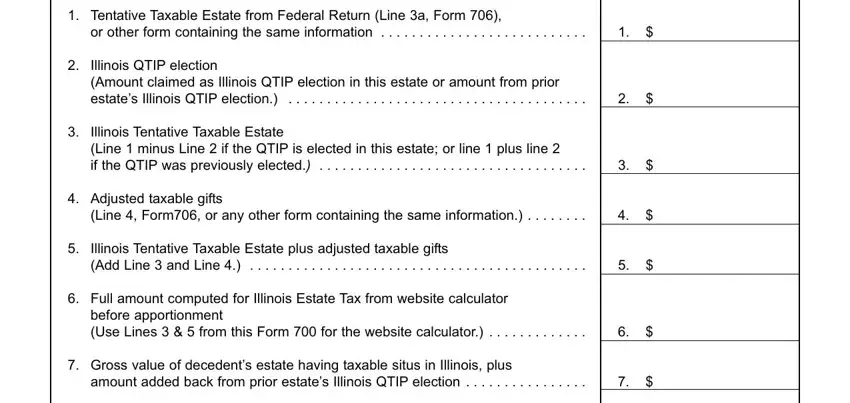

5. And finally, the following final segment is precisely what you'll have to finish prior to finalizing the PDF. The fields under consideration are the following: Tentative Taxable Estate from, or other form containing the same, Illinois QTIP election Amount, Illinois Tentative Taxable Estate, Adjusted taxable gifts, Line Form or any other form, Illinois Tentative Taxable Estate, Full amount computed for Illinois, before apportionment Use Lines, Gross value of decedents estate, and amount added back from prior.

People who work with this form frequently make some errors when completing or other form containing the same in this part. Make sure you read twice whatever you enter right here.

Step 3: Before finalizing the document, ensure that all blank fields were filled in as intended. When you believe it is all fine, press “Done." Sign up with us right now and instantly obtain illinois 700, ready for downloading. All modifications made by you are saved , so that you can modify the form later when necessary. FormsPal guarantees your data confidentiality via a protected system that never saves or distributes any kind of sensitive information typed in. You can relax knowing your paperwork are kept confidential when you use our services!