Are you looking to save money on your taxes while staying compliant with the Texas Comptroller’s Office? The Houston Form 22-15 may be an excellent choice for you. This one-page form is provided by the Texas Comptroller and allows businesses in Houston to report their quarterly sales tax collections. With a few easy steps, this form can help organizations take advantage of local and state tax savings opportunities, reducing their operating costs significantly. Keep reading to learn how filing your Houston Form 22-15 will benefit your company!

| Question | Answer |

|---|---|

| Form Name | Houston Form 22 15 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | PCs, Jan, harris rendition 2215 form, harris county appraisal district forms |

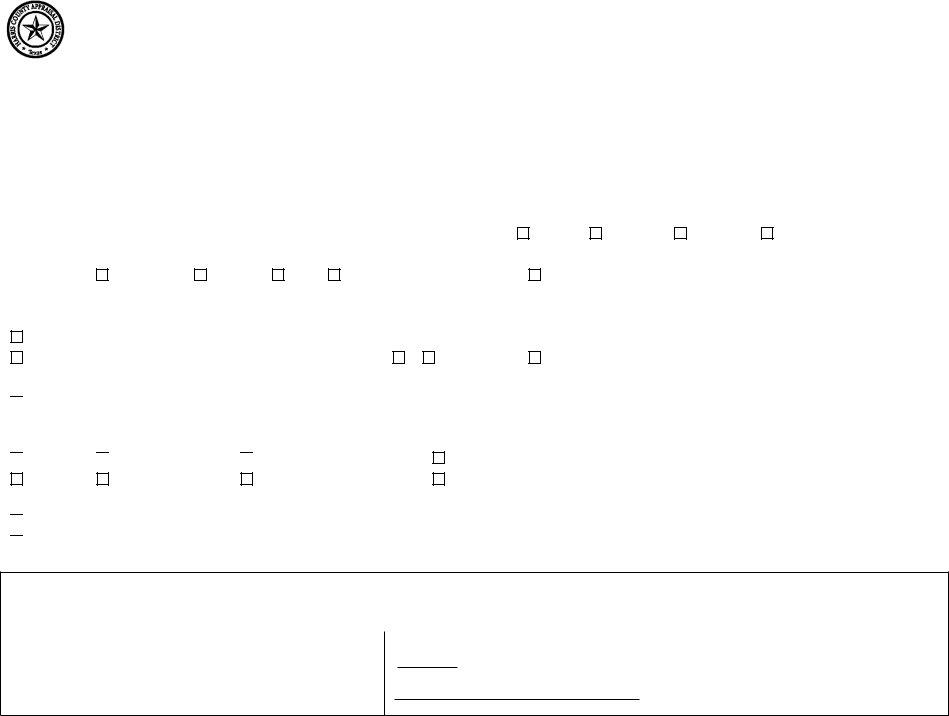

Return to: |

|

CONFIDENTIAL - BUSINESS |

|

*NEWPP130* |

||||||||||

|

|

|

|

|

||||||||||

Harris County Appraisal District |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Business & Industrial Property Div. |

|

|

|

|

|

|

|

|

|

*2013* |

||||

Houston TX |

PERSONAL PROPERTY RENDITION |

|||||||||||||

PO Box 922007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 1, 2013 |

|

|

|

|

|

|||

Form 22.15 (02/13) |

For assistance with this form please refer to instructions |

|

|

|

|

|||||||||

Part 1. Property Owner Name, Address, and Physical Location or Situs [Required]: |

|

|

|

Account Number __________________ |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Business Name ________________________________________ |

Business Owner ______________________________________ |

iFile™ Number |

__________________ |

|||||||||||

Mail Address |

________________________________________ |

Property Address ______________________________________ |

Agent's Name |

__________________ |

||||||||||

Mail Address |

________________________________________ |

City/State/Zip |

______________________________________ |

Agent ID No. |

__________________ |

|||||||||

City/State/Zip |

________________________________________ Ownership Type (optional) |

Individual |

Corporation |

Partnership |

Other _____________________ |

|||||||||

Part 2. Business Information: Please address all that apply. Optional but very important. |

|

|

|

|

|

|

||||||||

Business Type |

Manufacturing |

Wholesale |

Retail |

Service |

|

|

|

Business Sold: Date _________ Phone No. ___________________ |

||||||

Business Description ____________________________ |

SQFT Occupied _______________ |

New Owner (if sold) ____________________________________________ |

||||||||||||

Business Start Date at Location ____________________ Sales Tax Permit _______________ |

Mail Address |

________________________________________________ |

||||||||||||

Business Moved: Date ____________ New Location_____________________________ |

City/State/Zip |

________________________________________________ |

||||||||||||

Business Closed: Date ____________ Assets in place on Jan 1? |

Y |

N |

|

Business Owned No Assets as of Jan 1 |

|

|

||||||||

Part 3. Affirmation of Prior Year Rendition: Check only if applicable and your personal property assets on January 1, were exactly the same as those assets contained in the most recent rendition statement filed.

I affirm that the information contained in the most recent rendition statement filed by the property owner in a prior tax year is accurate with respect to the current tax year in accordance with Section 22.01(I) of the Texas Property Tax Code. [If checked, you may skip to "Signature and Affirmation"]

Part 4. Description of Assets: A description of assets is required unless you checked Part 3 of this form. Below, please check all that apply.

Inventory

Supplies

Raw Materials

Work in Process

Furniture & Fixtures

Machinery & Equipment

Computers |

Location (if different from above)___________________________________ |

Miscellaneous |

Describe Miscellaneous Assets ____________________________________ |

Part 5. Market Value: What do you estimate to be the total market value of your business assets? [Required, unless you checked Part 3 of this form.]

Under $20,000 [If checked Page 2 is optional as long as a general description of the property by type or category has been provided in Part 4]

$20,000 and over [You must complete all of Page 2. Original Cost (Historical Cost) and year acquired can be provided in lieu of a Good Faith Estimate of Value.]

Complete the signature block below and return the form to the address shown above. Unless you receive an extension (see instructions), your form must be delivered or postmarked no later than April 15, 2013.

Signature and Affirmation: Information contained in this rendition and all attachments, if any, is accurate and complete to the best of my knowledge and belief.

Owner/Agent Signature |

Title |

Printed Name |

Date |

|

|

|

|

Company Name |

|

Email (optional) |

Phone No. |

|

|

|

|

Section 22.26 of the Property Tax Code states: (a) Each rendition statement or property report required or authorized by this chapter must be signed by an individual who is required to file the statement or report. (b) When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent who has been designated in writing by the board of directors or by an authorized officer to sign in behalf of the corporation must sign the statement or report.

Notary Statement: Complete if signer is not an owner, employee, or officer of the company or affiliated company SUBSCRIBED AND SWORN TO BEFORE ME this the

day of |

|

, 20 |

|

. |

SEAL |

Notary Public, State of Texas

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal Code.

If you fail to timely file a rendition or property report required by Texas law, the chief appraiser must impose a penalty in an amount equal to 10 percent of the total taxes due on the property for the current year. If the court determines that you filed a false rendition or report with the intent to commit fraud, or to evade the tax, or you alter, destroy, or conceal any record, document, or thing or present to the chief appraiser any altered or fraudulent record, document, or thing, or otherwise engage in fraudulent conduct for the purpose of affecting the outcome of an inspection, investigation determination, or other proceeding before the appraisal district, the chief appraiser must impose an additional penalty equal to 50 percent of the total taxes due on the property for the current year.

Page 1

Page 2 is Optional if Part 3 is checked OR if "Under $20,000" is checked in Part 5 on Page 1

Owner Name: |

_________________________________________ |

Account Number: ___________________________ |

|

||

September 1, Inventory Appraisal - Check this box if you made written application to the appraisal district for September 1 inventory appraisal by July 31, 2012. Enter cost data or your good |

||

faith opinion of market value for your inventory as of September 1. Cost data or owner's good faith estimate for assets other than inventory must be as of January 1. |

||

|

|

|

Part 6. Inventory, Supplies, Raw Materials, Work in Process, and Consigned Goods. Original cost can be provided in lieu of a Good Faith Estimate of Value.

Description |

A. Inventory |

B. Supplies |

C. Raw Materials |

D. Work in Process |

E. Assets You Own, Leased. Loaned, Consigned, Rented, etc., to Others |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Value |

Description |

Location |

|

|

|

|

|

|

|

|

Good Faith Estimate of |

|

|

|

|

|

|

|

Market Value* |

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

(optional) |

|

|

|

|

|

|

|

Part 7. Fixed Assets: (should include expensed and fully depreciated assets): Original cost and year acquired can be provided in lieu of a Good Faith Estimate of Value.

|

|

|

A. |

B. |

C. |

D. |

E. |

F. |

G. |

|

|

|

|

||

Description |

|

Furniture & |

Office |

Mobile Radio, |

All Other |

Computers: |

Computers: |

Miscellaneous |

|

Describe Miscellaneous Assets |

|||||

|

|

|

Fixtures |

Machines |

Telephone, PBX, |

Machinery & |

PCs, Servers & |

Mainframes |

(signs, rental |

|

|

(from column G) |

|||

|

|

|

|

|

Cell Phone, Fax |

Equipment |

Peripherals |

|

|

inventory, etc.) |

|

|

|

|

|

Good Faith Estimate of |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Market Value* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1998 & Prior |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(optional) |

2001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost |

2005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Original |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost Totals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 8. Personal Property Leased, Loaned, Consigned, or Rented to You. |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Property Owner's Name, Address, and Phone Number |

|

|

Description |

|

|

Selling Price in Lease |

|

Annual Rent |

|

||||

|

|

|

|

|

|

|

|

|

|

|

(Optional) |

|

(Optional) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||

Part 9. Personal Property You Manage or Control as a Fiduciary |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Property Owner's Name, Address, and Phone Number |

|

|

Description |

|

|

Quantity / Units |

|

SQFT Occupied |

|

||||

|

|

|

|

|

|

|

|

|

|

|

(Optional) |

|

(Optional) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location of assets (if different from page 1) ___________________________________________________________________________________________

*If "Over $20,000" is checked in Part 5 and original cost is not provided, the chief appraiser may later ask you to provide a supporting statement detailing the basis for your good faith estimate of market value.

Page 2