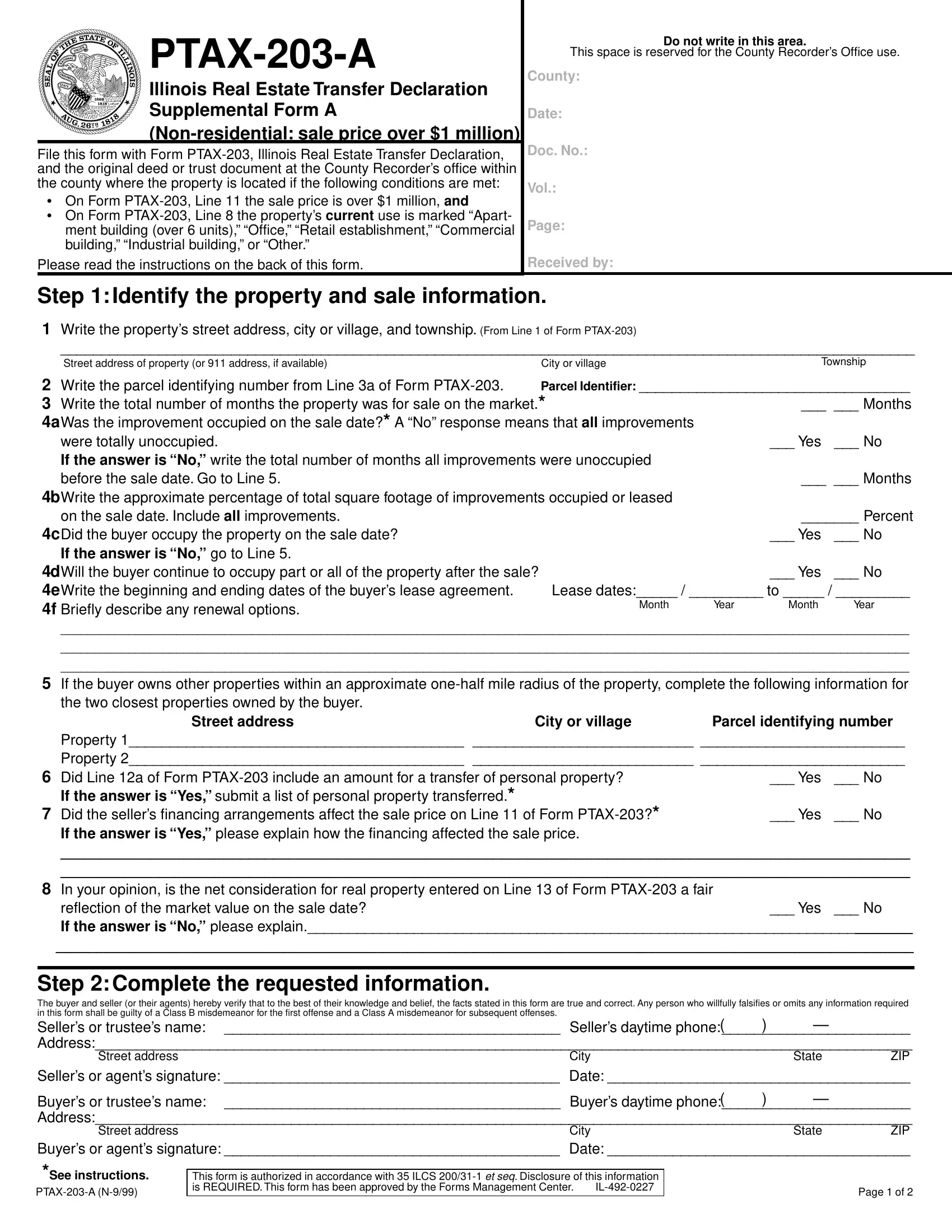

Instructions for Completing Form PTAX-203-A

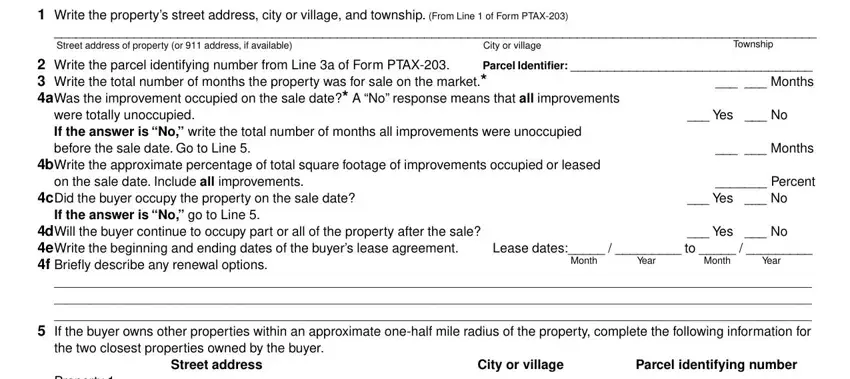

Step 1: Identify the property and sale information.

Line 3

Write the total number of months that the property was advertised for sale by a real estate agent, newspaper, trade publication, radio/electronic media, or a sign. If the property has been advertised for sale for more than 99 months, enter “99.”

Lines 4a through 4f

Line 4a — Answer “Yes” or “No” (indicate with an “X”) depending on whether or not the improvement (i.e., structure) was occupied on the sale date. If the property has more than one improvement, answer “No” only if all the improvements were totally unoccupied on the sale date.

If the answer to Line 4a is “No,” write the total number of months that all improvements were totally unoccupied before the sale date and go to Line 5. If the property has been unoccupied for more than 99 months, enter “99.” If the answer to Line 4a is “Yes,” go to Lines 4b and 4c.

Line 4b — Write the approximate percentage of the total square footage of all the improvements that was occupied or leased on the sale date. This applies to the improvements only, not the land.

Line 4c — Answer “Yes” or “No” (indicate with an “X”) depending on whether or not the buyer was a current occupant of the property at the time of the sale. If the answer is “No,” go to Line 5. If the answer is “Yes,” go to Line 4d.

Line 4d — Answer “Yes” or “No” (indicate with an “X”) depending on whether or not the buyer will continue to occupy part or all of the property after the sale. If the answer is “No,” go to Line 5. If the answer is “Yes,” go to Line 4e.

Line 4e — Write the beginning and ending dates of the buyer’s lease agreement, if applicable.

Line 4f — Briefly describe in the space provided any options to renew the lease agreement between the seller and the buyer.

Example: “10-year lease agreement with two 5-year options to renew; rental amount to be renegotiated at the time of renewal.”

Line 5

If the buyer owns other properties within an approximate one-half mile radius of the property, write the street addresses, the names of the cities or villages (if applicable), and the parcel identifying numbers of the two closest properties owned by the buyer. The PIN is printed on the real estate tax bill and assessment notice. The chief county assessment officer can assist you with this information.

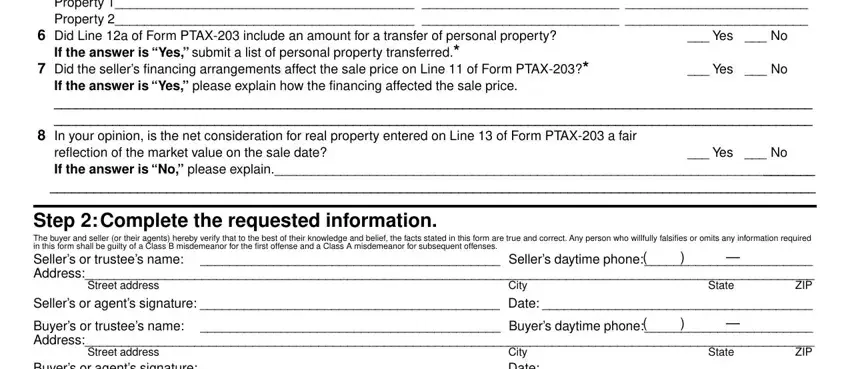

Line 6

Answer “Yes” or “No” (indicate with an “X”) depending on whether or not Line 12a of Form PTAX-203 included an amount for personal property. If the answer is “Yes,” you must submit an itemized list of personal property transferred from the seller to the buyer. Include the value attributed to each item and on Form PTAX-203, Step 4, mark “Itemized list of personal property.” If you prepared a list for Line 12a of Form PTAX-203, do not prepare an additional list.

Line 7

Answer “Yes” or “No” (indicate with an “X”) depending on whether or not the amount on Line 11 of the Form PTAX-203 was affected by the seller monetarily participating in the financing arrangements. This includes, but is not limited to, seller paying points, seller providing all or a portion of the financing, etc. If the answer is “No,” go to Line 8.

If the answer is “Yes,” please explain, in the space provided, how the financing affected the sale price.

Line 8

Answer “Yes” or “No” (indicate with an “X”) depending on whether or not, in your opinion, the net consideration for real property entered on Line 13 of the Form PTAX-203 is a fair reflection of the market value on the sale date. If the answer is “Yes,” go to Step 2 of this form. If the answer to is “No,” please provide an explanation in the space provided.

Step 2: Complete the requested information.

Write the requested information for the seller and the buyer. Write the addresses and daytime phone numbers where the seller and buyer can be contacted after the sale. The seller and the buyer (or their agents) must sign this form. By signing the form, the parties involved in the real estate transfer verify that

•they have examined the completed Form PTAX-203-A;

•the information provided on this form is true and correct; and

•they are aware of the criminal penalties of law (printed in the instructions for Form PTAX-203) associated with falsifying or omitting any information on this form.