Whenever you intend to fill out senior ze exemption application, you won't have to download any programs - just make use of our PDF tool. In order to make our editor better and less complicated to utilize, we consistently design new features, with our users' suggestions in mind. All it requires is just a few simple steps:

Step 1: Open the PDF inside our tool by clicking on the "Get Form Button" at the top of this page.

Step 2: When you start the file editor, there'll be the form ready to be filled out. Other than filling out different blank fields, you could also do other sorts of actions with the file, including writing your own words, editing the initial text, inserting graphics, signing the form, and more.

It really is straightforward to finish the form using out helpful tutorial! This is what you need to do:

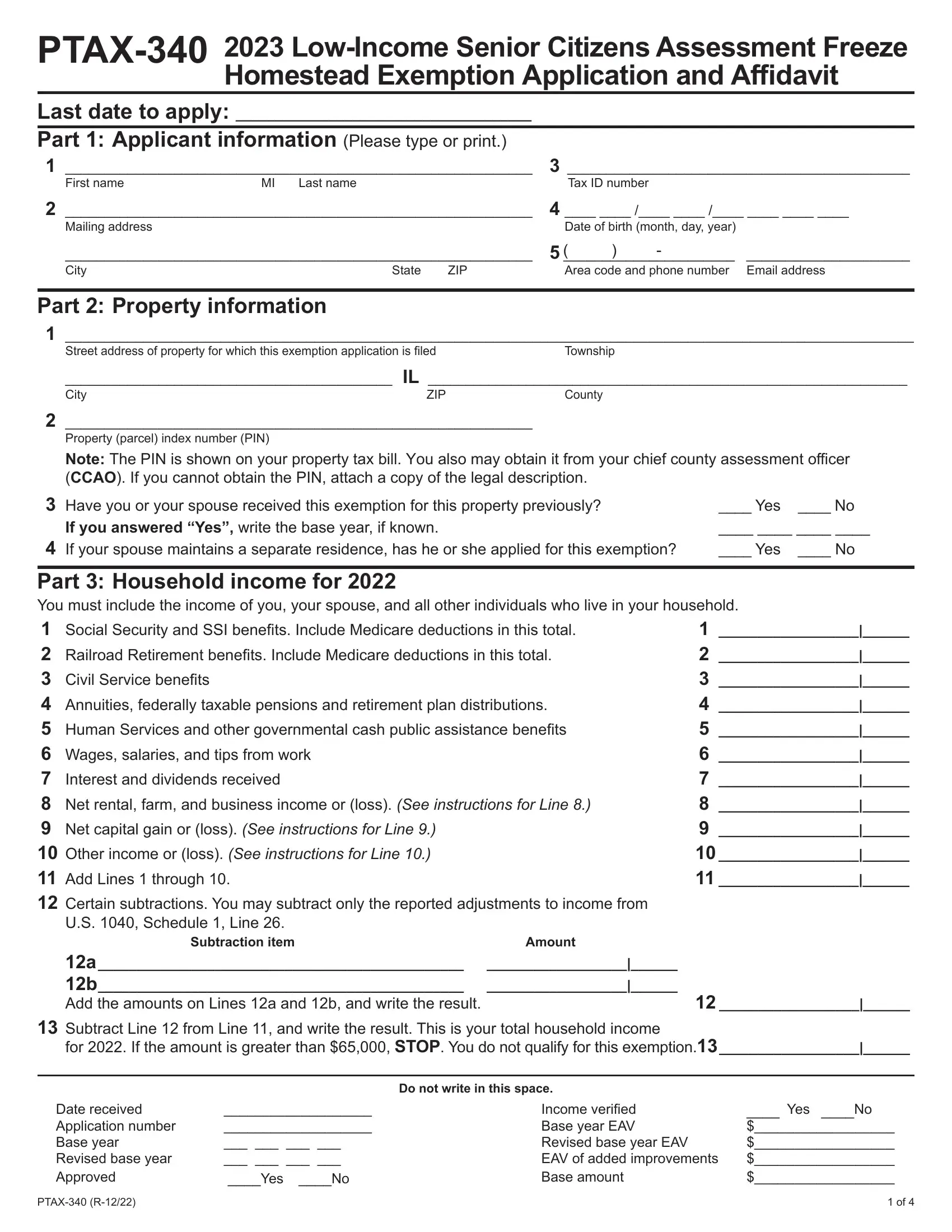

1. Begin completing the senior ze exemption application with a number of necessary blanks. Collect all of the information you need and make sure nothing is missed!

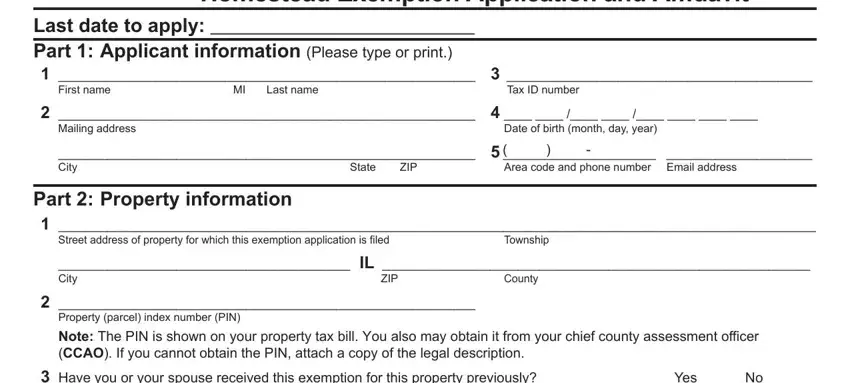

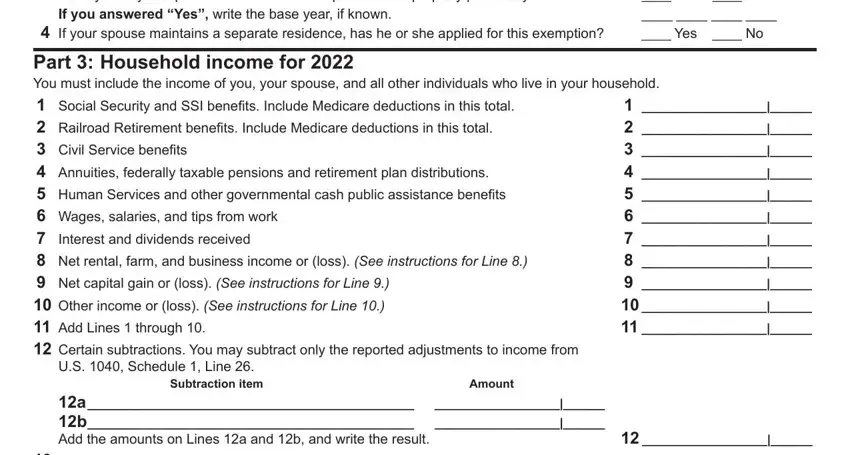

2. Your next part is to submit the following blanks: Have you or your spouse received, If you answered Yes write the base, Yes No Yes No, Interest and dividends received, Part Household income for You, US Schedule Line, Subtraction item, and Amount.

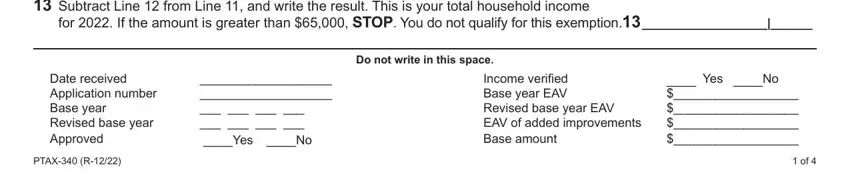

3. Completing Part Household income for You, for If the amount is greater than, Do not write in this space, Date received Application number, PTAX R, Yes No, Income verified Base year EAV, and Yes No is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

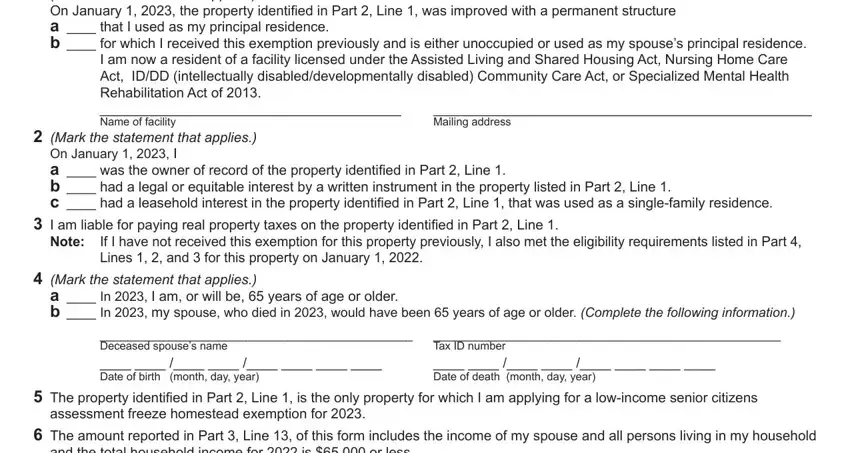

4. Filling out Part Affidavit Sworn under oath I, On January the property, I am now a resident of a facility, Mailing address, Mark the statement that applies, a was the owner of record of the, I am liable for paying real, Note, If I have not received this, Mark the statement that applies, a In I am or will be years of, Tax ID number Date of, Deceased spouses name, The property identified in Part, and assessment freeze homestead is paramount in this stage - make sure you don't rush and be mindful with each blank area!

You can easily get it wrong while filling in your a was the owner of record of the, for that reason be sure to go through it again before you decide to submit it.

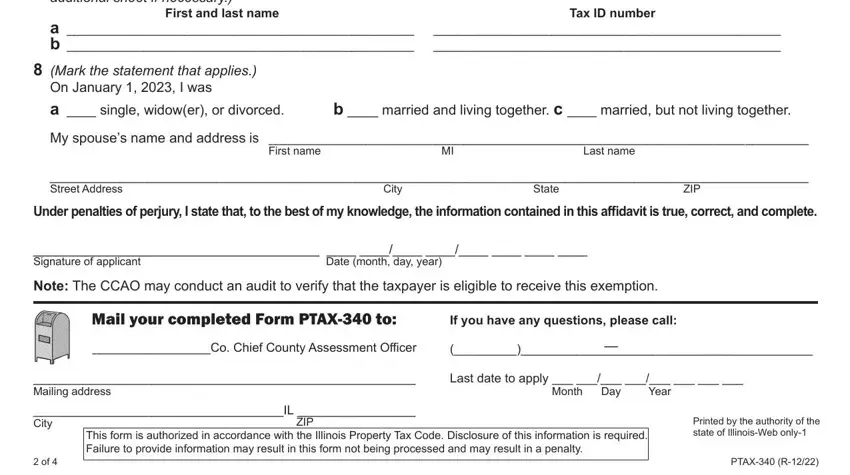

5. This last notch to submit this form is crucial. Ensure to fill in the mandatory blanks, for instance My spouse is included if he or she, a b, First and last name, Tax ID number, Mark the statement that applies, b married and living together c, My spouses name and address is, First name, Last name, Street Address Under penalties of, State, City, ZIP, Signature of applicant Date, and Note The CCAO may conduct an audit, prior to using the document. In any other case, it could result in an unfinished and potentially incorrect document!

Step 3: As soon as you have reread the details in the file's blank fields, click on "Done" to complete your form at FormsPal. Right after registering a7-day free trial account here, you'll be able to download senior ze exemption application or email it directly. The form will also be at your disposal via your personal account menu with all your changes. FormsPal is invested in the personal privacy of our users; we make sure all personal data handled by our tool is kept secure.