With the online PDF tool by FormsPal, it is easy to complete or alter il qildro form right here. FormsPal development team is continuously endeavoring to expand the tool and insure that it is much faster for people with its handy functions. Enjoy an ever-evolving experience now! To get started on your journey, consider these easy steps:

Step 1: Access the PDF file inside our editor by clicking on the "Get Form Button" above on this webpage.

Step 2: The editor will let you work with PDF documents in many different ways. Change it by writing personalized text, adjust existing content, and include a signature - all close at hand!

This PDF will require specific information to be entered, so you should take the time to fill in what's asked:

1. It's important to complete the il qildro form accurately, thus be mindful when filling out the segments containing all of these fields:

2. Your next stage is usually to complete these blank fields: East Erie Street Suite Chicago, Member, Name, Mailing Address, Social Security Number, Alternate payee, Name, Mailing Address, Social Security Number, The alternate payee is the members, current or former spouse, and child or other dependent check one.

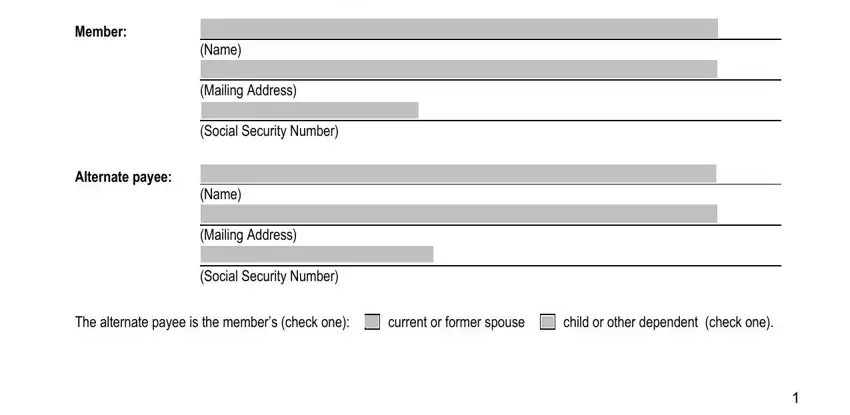

3. This next portion is all about that applies, per month enter amount or, enter percentage per month of, enter percentage per month of, alternate payees benefit commences, members, Check alternate payee only if the, B If the members retirement, checkcomplete the ONE option that, as soon as administratively, on the date of, Enter any benefit payment date, C If the members retirement, the members retirement benefit, and D Payments to the alternate payee - complete all of these blank fields.

Always be extremely mindful when filling out D Payments to the alternate payee and members, as this is where most users make some mistakes.

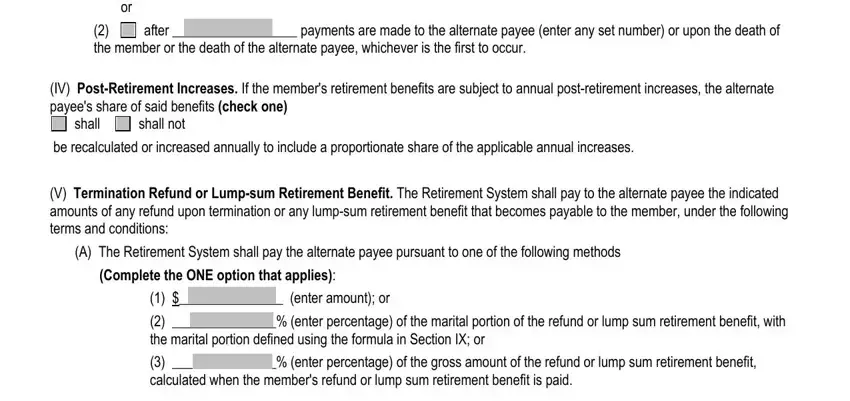

4. The form's fourth part comes next with these blanks to focus on: after payments are made to the, the member or the death of the, IV PostRetirement Increases If the, shall, shall not, be recalculated or increased, V Termination Refund or Lumpsum, A The Retirement System shall pay, Complete the ONE option that, enter amount or, enter percentage of the marital, and enter percentage of the gross.

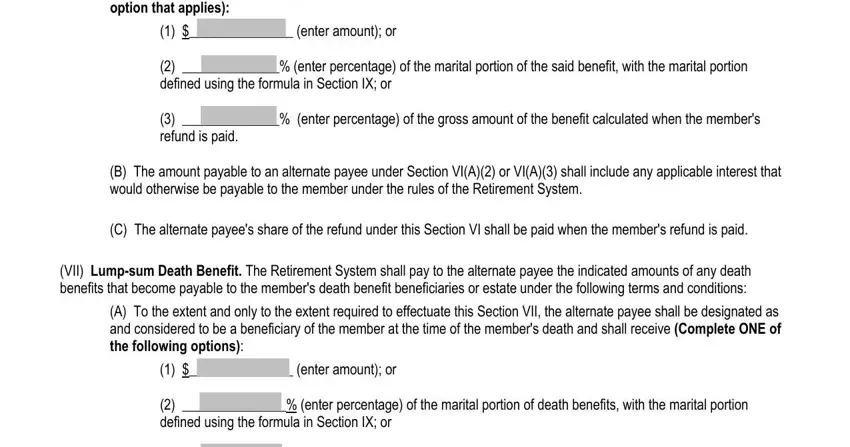

5. This pdf must be wrapped up within this section. Here you will see a comprehensive set of blanks that have to be filled in with appropriate information to allow your document usage to be faultless: A The Retirement System shall pay, enter amount or, enter percentage of the marital, enter percentage of the gross, B The amount payable to an, C The alternate payees share of, VII Lumpsum Death Benefit The, A To the extent and only to the, enter amount or, and enter percentage of the marital.

Step 3: As soon as you have looked over the details entered, press "Done" to conclude your document generation. Join FormsPal right now and easily use il qildro form, prepared for download. All changes made by you are kept , so that you can edit the pdf at a later stage when necessary. At FormsPal.com, we strive to make sure all of your details are kept private.