Working with PDF documents online is always easy with this PDF tool. You can fill out illinois tax il here effortlessly. To keep our editor on the cutting edge of practicality, we work to implement user-oriented features and enhancements regularly. We are routinely grateful for any suggestions - assist us with reshaping PDF editing. With just a few simple steps, you can start your PDF journey:

Step 1: Click the orange "Get Form" button above. It's going to open up our editor so that you can begin filling in your form.

Step 2: This tool enables you to customize PDF documents in many different ways. Change it with any text, correct original content, and place in a signature - all manageable within a few minutes!

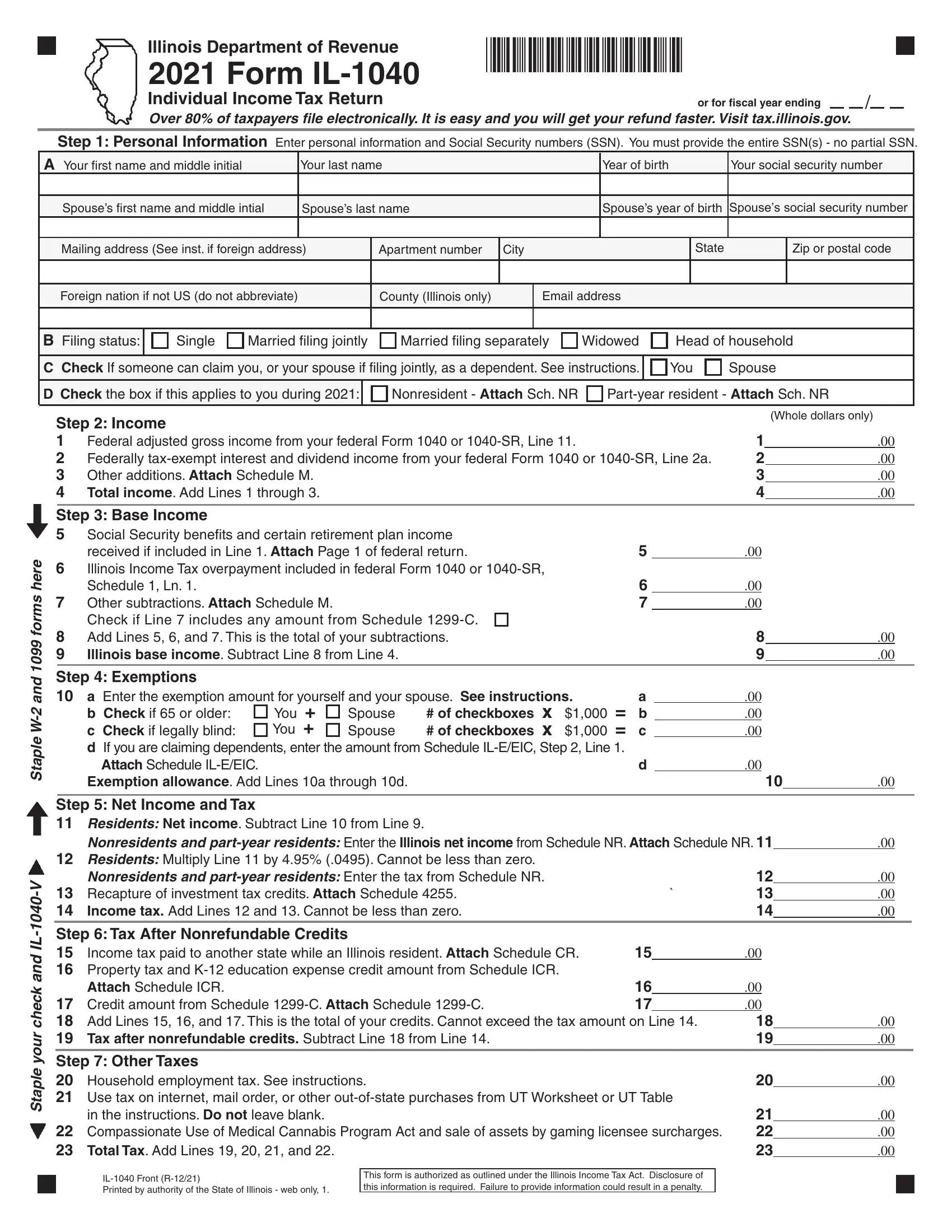

This PDF form will need particular information to be filled in, therefore you need to take the time to fill in precisely what is requested:

1. It's important to fill out the illinois tax il correctly, therefore be careful when filling out the areas that contain these specific blank fields:

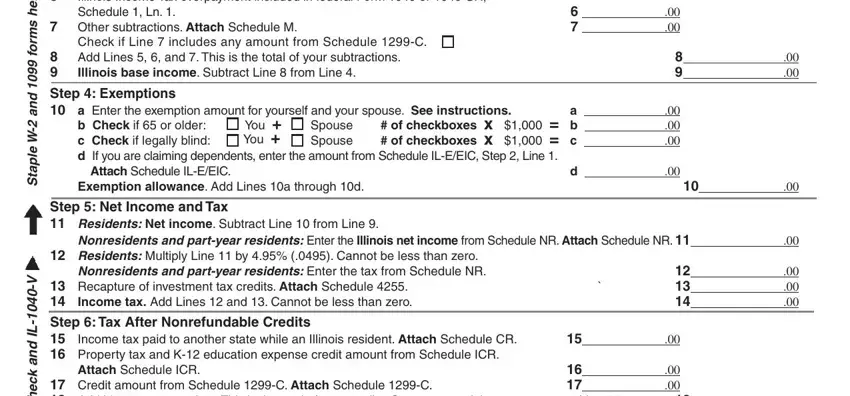

2. Now that the previous section is complete, you should insert the needed particulars in Illinois base income Subtract Line, Check if Line includes any amount, received if included in Line, e r e h s Other subtractions, b Check if or older c Check if, a of checkboxes x b of, Spouse Spouse, You You, Step Net Income and Tax, Nonresidents and partyear, Residents Multiply Line by, Nonresidents and partyear, Income tax paid to another state, V Recapture of investment tax, and Attach Schedule ICR allowing you to proceed further.

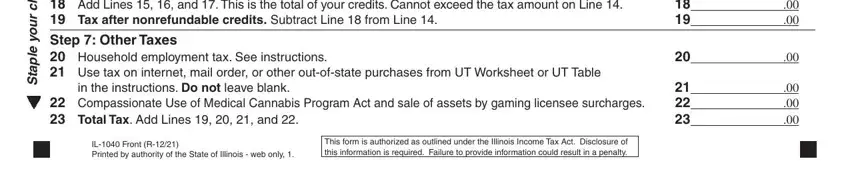

3. Completing V Recapture of investment tax, in the instructions Do not leave, Compassionate Use of Medical, Total Tax Add Lines and, IL Front R Printed by authority of, and This form is authorized as is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

As to This form is authorized as and Compassionate Use of Medical, make sure you double-check them in this current part. Both of these are certainly the most important fields in the page.

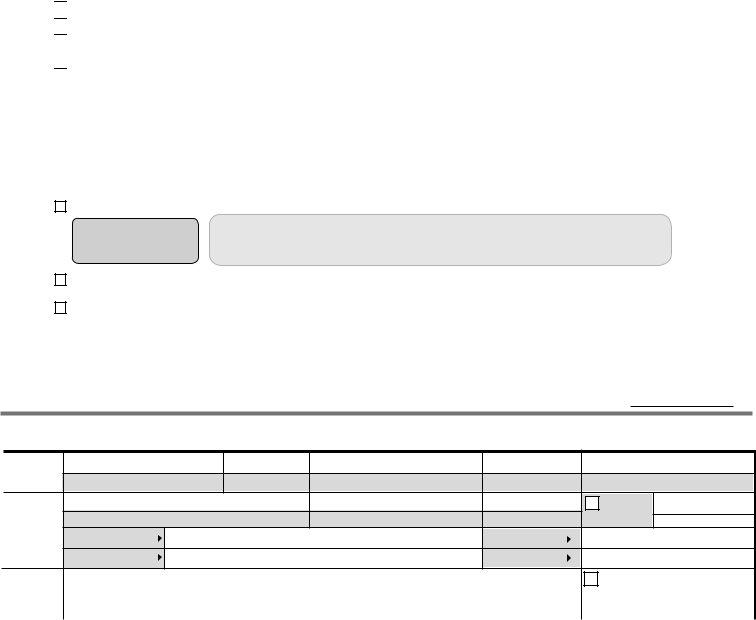

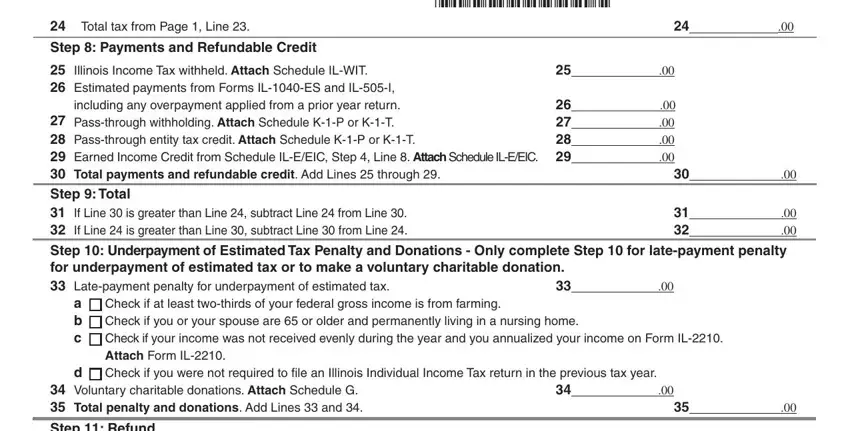

4. The subsequent subsection requires your involvement in the subsequent places: Total tax from Page Line, Step Payments and Refundable, Illinois Income Tax withheld, Passthrough withholding Attach, Check if at least twothirds of, a b c Attach Form IL d, Check if you were not required to, Voluntary charitable donations, and Step Refund. Make sure that you fill in all of the needed info to move onward.

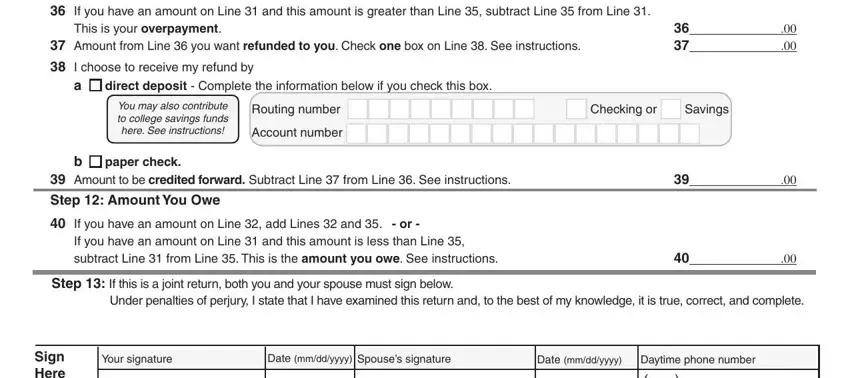

5. To conclude your form, the particular part incorporates a number of additional blanks. Filling out If you have an amount on Line, This is your overpayment, Amount from Line you want, I choose to receive my refund by, direct deposit Complete the, You may also contribute to college, Routing number, Account number, Checking or, Savings, paper check, Amount to be credited forward, Step Amount You Owe, If you have an amount on Line, and If you have an amount on Line and will wrap up everything and you're going to be done in the blink of an eye!

Step 3: Proofread everything you have typed into the blank fields and hit the "Done" button. Go for a free trial account with us and get direct access to illinois tax il - downloadable, emailable, and editable inside your FormsPal account. FormsPal guarantees your information privacy via a secure method that never saves or distributes any type of private data used. Be assured knowing your docs are kept protected when you use our tools!