Any time you need to fill out illinois form ui ha, you don't need to install any kind of software - just make use of our online tool. Our tool is consistently evolving to give the best user experience attainable, and that is because of our dedication to continual development and listening closely to user comments. For anyone who is looking to begin, this is what it will take:

Step 1: Click the "Get Form" button above on this page to open our PDF tool.

Step 2: With our handy PDF editor, it is easy to do more than just fill in blank fields. Edit away and make your documents seem sublime with customized text incorporated, or optimize the original input to excellence - all comes with an ability to incorporate stunning graphics and sign the document off.

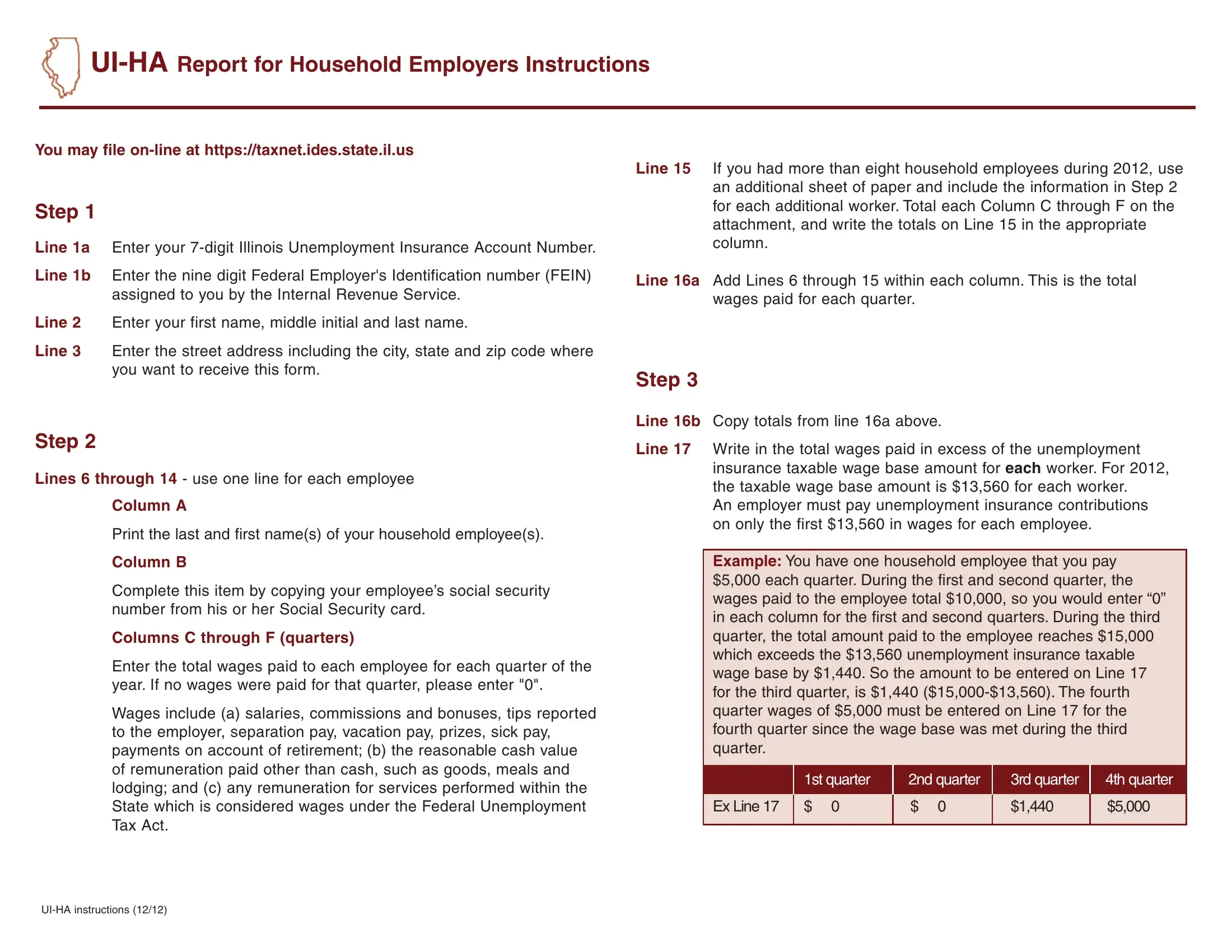

So as to finalize this document, be certain to provide the right information in every area:

1. To begin with, when filling out the illinois form ui ha, start with the area that has the next fields:

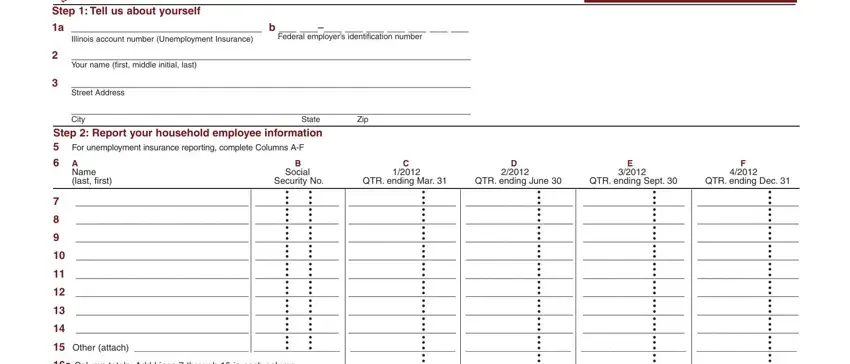

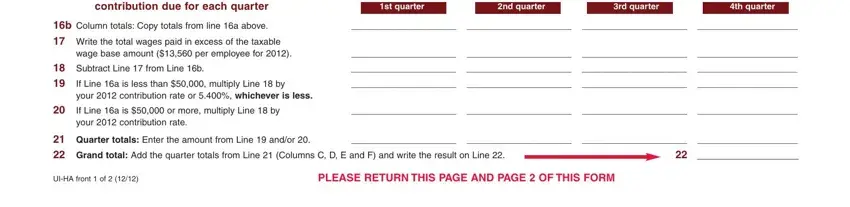

2. Your next stage would be to fill in these fields: contribution due for each quarter, b Column totals Copy totals from, Write the total wages paid in, st quarter, nd quarter, rd quarter, th quarter, wage base amount per employee for, Subtract Line from Line b If, your contribution rate or, If Line a is or more multiply, your contribution rate, Quarter totals Enter the amount, UIHA front of, and PLEASE RETURN THIS PAGE AND PAGE.

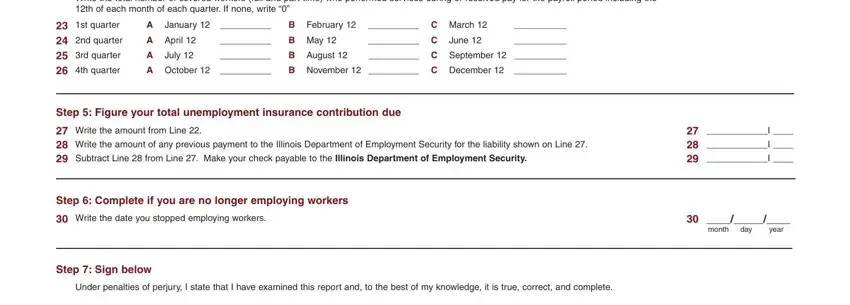

3. Completing Write the total number of covered, st quarter nd quarter rd, A January, B February, C March, A April, B May, C June, A July, B August, C September, A October, B November C December, Step Figure your total, and Write the amount from Line is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It's simple to make a mistake when filling out your A October, and so make sure to reread it before you'll send it in.

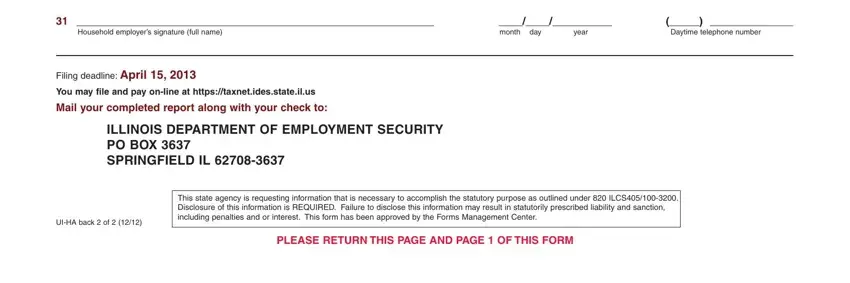

4. This next section requires some additional information. Ensure you complete all the necessary fields - Household employers signature full, Filing deadline April, You may file and pay online at, Mail your completed report along, ILLINOIS DEPARTMENT OF EMPLOYMENT, month, year, day, Daytime telephone number, UIHA back of, This state agency is requesting, and PLEASE RETURN THIS PAGE AND PAGE - to proceed further in your process!

Step 3: Spell-check the information you have typed into the blanks and then click on the "Done" button. Grab your illinois form ui ha as soon as you register online for a 7-day free trial. Quickly access the pdf file in your FormsPal account, along with any edits and adjustments being automatically preserved! FormsPal guarantees your data confidentiality with a secure system that in no way saves or shares any type of sensitive information provided. Feel safe knowing your files are kept confidential any time you work with our service!