Office of the Illinois State Treasurer

Unclaimed Property Division

PO Box 19496

Springfield IL 62794-9496

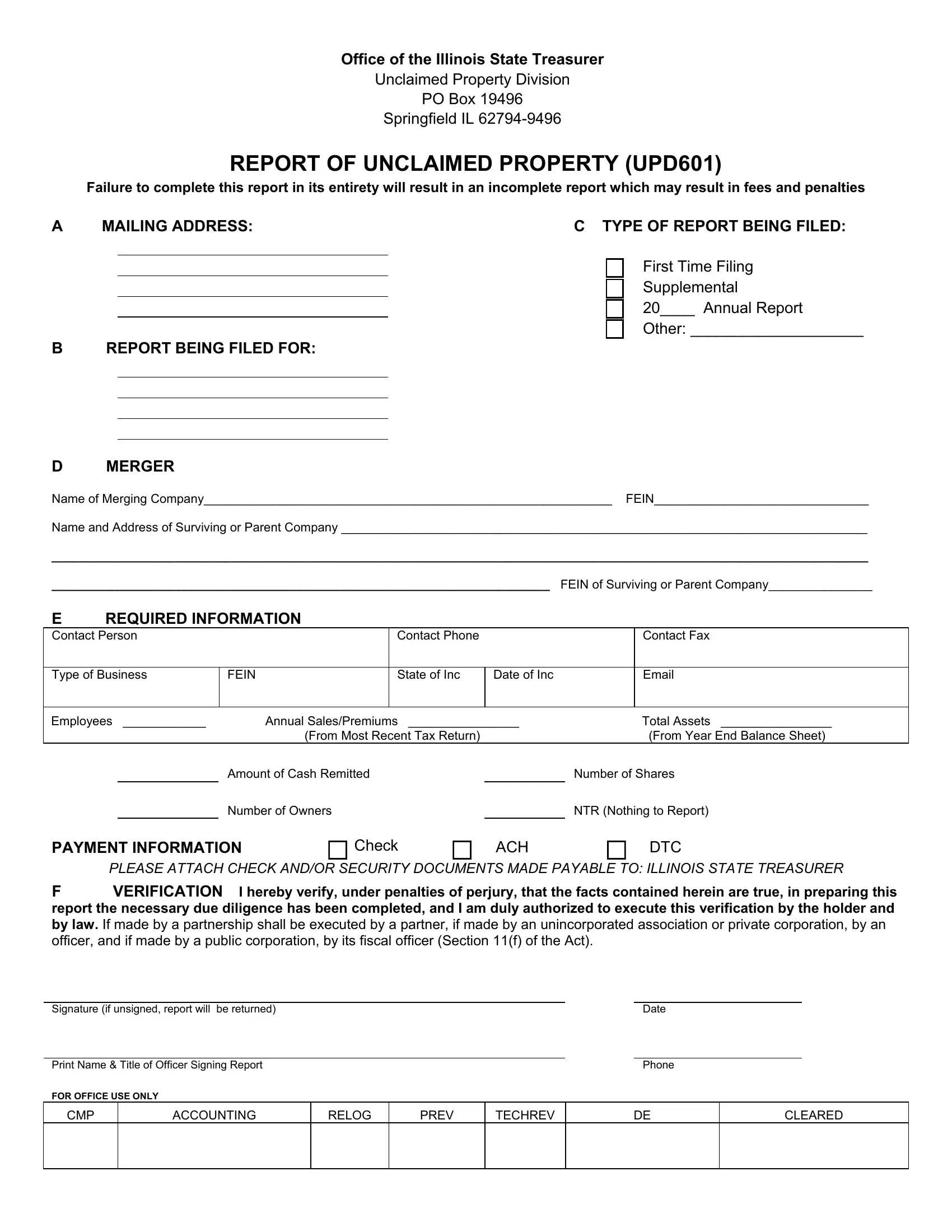

REPORT OF UNCLAIMED PROPERTY (UPD601)

Failure to complete this report in its entirety will result in an incomplete report which may result in fees and penalties

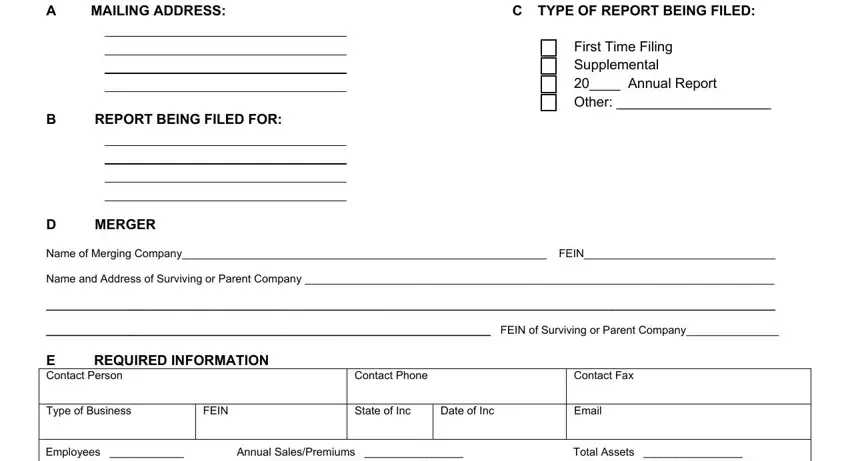

A |

MAILING ADDRESS: |

C TYPE OF REPORT BEING FILED: |

|

|

|

|

|

First Time Filing |

|

|

|

|

|

|

|

|

|

|

Supplemental |

|

|

|

|

|

|

|

|

|

|

20____ Annual Report |

|

|

|

|

|

|

|

|

|

|

Other: ____________________ |

|

|

|

|

|

BREPORT BEING FILED FOR:

DMERGER

Name of Merging Company___________________________________________________________ FEIN_______________________________

Name and Address of Surviving or Parent Company ____________________________________________________________________________

______________________________________________________________________________________________________________________

________________________________________________________________________ FEIN of Surviving or Parent Company_______________

EREQUIRED INFORMATION

Contact Person |

|

|

Contact Phone |

|

|

Contact Fax |

|

|

|

|

|

|

|

|

|

Type of Business |

FEIN |

|

State of Inc |

Date of Inc |

|

Email |

|

|

|

|

|

|

|

|

|

Employees ____________ |

|

Annual Sales/Premiums ________________ |

|

Total Assets ________________ |

|

|

|

(From Most Recent Tax Return) |

|

|

(From Year End Balance Sheet) |

|

|

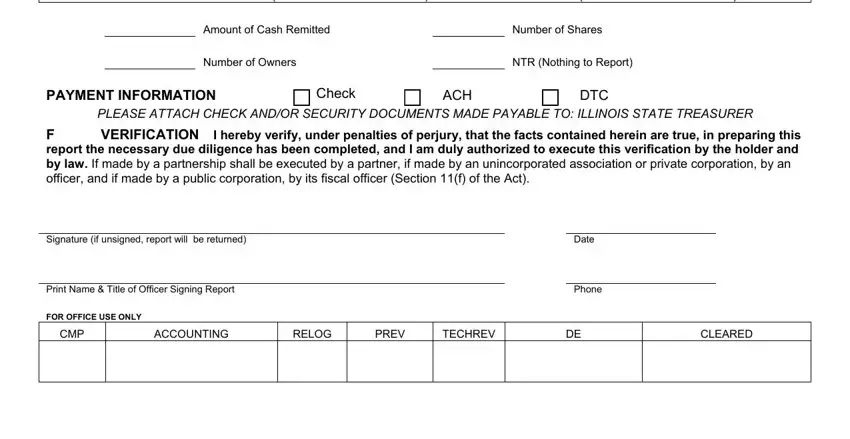

Amount of Cash Remitted |

|

|

Number of Shares |

|

|

Number of Owners |

|

|

NTR (Nothing to Report) |

PAYMENT INFORMATION |

|

Check |

|

|

|

PLEASE ATTACH CHECK AND/OR SECURITY DOCUMENTS MADE PAYABLE TO: ILLINOIS STATE TREASURER

FVERIFICATION I hereby verify, under penalties of perjury, that the facts contained herein are true, in preparing this report the necessary due diligence has been completed, and I am duly authorized to execute this verification by the holder and by law. If made by a partnership shall be executed by a partner, if made by an unincorporated association or private corporation, by an officer, and if made by a public corporation, by its fiscal officer (Section 11(f) of the Act).

Signature (if unsigned, report will be returned) |

|

Date |

|

|

|

Print Name & Title of Officer Signing Report |

|

Phone |

FOR OFFICE USE ONLY |

|

|

Office of the Illinois State Treasurer

Unclaimed Property Division

STEPS TO COMPLETE YOUR REPORT

1.Who Must Report. The State of Illinois Uniform Disposition of Unclaimed Property Act (765 ILCS 1025/1-30) requires businesses and organizations to review their records each year to determine if they possess any unclaimed property and file a report with the Treasurer’s Office. Common “holders” of reportable property include financial and banking institutions, insurance companies, business associations, state and local government agencies, retailers, and utility companies.

MAY |

|

WHAT TO REPORT |

Business Associations |

|

Property abandoned for 5 years with last activity dates prior to December 31, 20XX.* |

Utilities |

|

Property abandoned for 5 years with last activity dates prior to December 31, 20XX.* |

Life Insurance Companies |

|

Property abandoned for 5 years with last activity dates prior to December 31, 20XX.* |

NOVEMBER |

|

WHAT TO REPORT |

Banking Organizations |

|

Property abandoned for 5 years with last activity dates prior to July 1, 20XX.* |

Financial Organizations |

|

Property abandoned for 5 years with last activity dates prior to July 1, 20XX.* |

All Insurance Corporations |

|

Property abandoned for 5 years with last activity dates prior to July 1, 20XX.* |

other than Life Insurance |

|

|

|

Governmental Entities |

|

Property abandoned for 7 years with last activity dates prior to July 1, 20XX. |

*Effective 8/8/11, Wages, Payroll & Salary are reportable after 1 year of no activity for all holders with the

exception of government entities.

2.Search Your Records. Your accountant or controller should search your records for any unclaimed property your organization may be holding. See the Property Type Code chart on page 6 for types of reportable funds.

3.Due Diligence. Issue due diligence letters to the property’s owners between 60 and 120 days before filing your report. Section 1025/11(e) requires due diligence letters must be issued for all items over $10.00. If a diligent search has shown that your organization is not holding any unclaimed funds, file a negative report using UPD601 by marking “NTR” in the “Payment Information” section.

4.Choose a Method of Reporting.

Reporting Software

NAUPA electronic reporting is required for holders reporting more than 10 records. The reporting software, HRS Pro, can be found on our website. If the information you have to report is already in Microsoft Excel, detailed instructions for transferring your information can be located in HRS Pro.

•Submit paper copy of report with file saved on CD or Diskette. We do not accept reports on tape media.

•Your diskette or CD-ROM must be accompanied by a completed UPD601 form.

•Send instructions for data files which are password protected to UP_Report@treasurer.state.il.us or provide a contact person and telephone number with the report submission.

Paper Forms

To report by paper, complete the applicable forms contained in this packet. All forms may be duplicated. Basic information about your organization and summary information about your unclaimed property report should be provided on the UPD601. Owner detail for your report should be provided on UPD602. A computer printout is acceptable for owner detail if all required information is included.

5.Complete Your Report. For your convenience, statute allows items under $25.00 to be combined together into a single “aggregate” amount. Security related property, safety deposit box contents, and all other non-cash items must be listed individually.

6.Delivery of Report and Remittance. You can deliver your report and remittance using the delivery instructions on page 2.

7.If you have any questions, please call (217)524-0023 between 8:00 AM and 4:30 PM Central Time.

Office of the Illinois State Treasurer

Unclaimed Property Division

DELIVERY OF REPORT & REMITTANCE

¾A holder must file the unclaimed property report on either the paper forms (UPD601 and UPD602) provided by the Agency or on a computer diskette formatted according to the instructions located on our Web site at icash.illinois.gov.

¾The Annual Report of Unclaimed Property form (UPD601) must be completed and filed regardless of whether you have abandoned property to report.

¾The Annual Remittance Detail form (UPD602) is required only if you have property to report.

¾If a professional service is filing your report, you must provide them with forms UPD601 and UPD602 to file your report. Copies of completed forms should be kept for your files.

¾Inaccurate or incomplete reports are not considered to be in compliance with reporting requirements, and may result in fees and charges as provided for in Section 1025/25.5 of the Act.

REMITTING CASH: Include a check for the total, payable to: Treasurer of the State of Illinois, Unclaimed Property Division

ACH PAYMENTS: Automated Clearing House Transfer payments are now available. Instructions for electronic payments can be found at www.treasurer.il.gov. A hard copy of the UPD601 reporting form is still required for reports submitted using ACH.

REMITTING STOCKS OR BONDS: Include all certificates. Certificates should be reissued in the name of “Springfield &

Co.”, FEIN # 90-0169148.

DO NOT enroll the State in dividend reinvestment plans. Dividend reinvestment plans currently in effect are to be closed and remitted to the State, whole shares are to be certificated and issued to the Treasurer and all fractional shares are to be remitted in cash. Future dividends that accrue are to be remitted in cash.

You may DTC the shares to our account. Detailed instructions can be found within the Instructions for filing the Annual Report of Unclaimed Property. NOTE: All reports along with a listing of securities MUST be in the possession of the Unclaimed Property Division before you will be allowed to DTC the securities.

REMITTING MUTUAL FUNDS

All remittable mutual funds shall be registered and delivered to:

Treasurer of the State of Illinois, Unclaimed Property Division 1 West Old State Capitol Plaza, Suite 400

Springfield, IL 62701-1390 FEIN 36-3716228

Remittable mutual funds shall be transferred to an account for each fund within the family of funds.

DO NOT enroll the State in dividend reinvestment plans. All dividends and other income accruing on mutual fund shares are to be paid in cash.

No debits may be made to an account without written authorization from the office of the Treasurer. Monthly account statements sent to the above-listed address are mandatory.

For any owner account reported that is less than one share, or does not meet a minimum balance requirement, liquidate the shares and remit the cash value of the account.

|

HOW TO REACH US BY MAIL |

If by: |

Regular Mail (U.S. Postal Service) |

If by: |

Express Mail Service |

Send to: Illinois State Treasurer’s Office |

Send to: Illinois State Treasurer’s Office |

|

Unclaimed Property Division |

|

Unclaimed Property Division |

|

PO Box 19496 |

|

1 West Old State Capitol Plaza, Suite 400 |

|

Springfield, IL 62794-9496 |

|

Springfield, IL 62701-1390 |

|

|

|

|

- 2 -

Office of the Illinois State Treasurer

Unclaimed Property Division

INSTRUCTIONS FOR FILING THE ANNUAL REPORT AND ANNUAL REMITTANCE DETAIL

OF UNCLAIMED PROPERTY USING FORMS UPD601 & UPD602

REPORT OF UNCLAIMED PROPERTY—UPD601:

IMPORTANT: This cover page must be remitted with all unclaimed property reports. You may use your own form, however it must contain the same information as the UPD601 and it must be signed by an authorized employee of your company.

1.Enter your organization’s basic information, including name and mailing address. Section A identifies the name and address of the business that is responsible for filing the annual report. Section B shows the name and address of the company for which the report is being filed if different from Section A (branch and subsidiaries).

2.Indicate which type of report you are filing. First time Filing: Never filed with the State previously.

Supplemental: An additional report filed to supplement a regular report you have already submitted. Annual: Your standard report due each year.

3.Enter in all other required information requested on the UPD601, including name, telephone number, fax number, and email address of the contact person who would be able to answer questions concerning the report, FEIN number, state and date of incorporation, and type of business (see page 5). Enter the holder’s total assets, annual sales/income and number of employees nationwide.

4.Answer the due diligence question. Law requires you to perform due diligence 60 to 120 days before filing your report. Section 1025/11(e) requires that due diligence is performed for those accounts over $10.00.

5.Complete the Payment Information. Check the appropriate box for the payment method used and fill out the total amount of cash, number of owners, and shares included on the report. If your company does not have unclaimed funds to report, mark NTR.

6.Verification. Report must be signed by an employee who is authorized to certify that the property remitted to the Illinois State Treasurer Office is true and correct.

REPORT OF UNCLAIMED PROPERTY—UPD602:

The Annual Remittance Detail, form UPD602, may be duplicated as needed. Use this form to report all pertinent information concerning owners and their property.

1.Holder Name and Holder Number. Enter your organization’s (holder) name and holder number, if available.

2.Complete Owner Record for each property. If there is only one owner check ‘Single’, if a property has multiple owners check ‘Joint Owner’ and indicate which record it is (e.g. owner 1 of 2 or owner 2 of 2). List owner record 1 first and additional owners immediately afterward.

3.Relationship Codes indicate the type of relationship that exists between properties with more than one owner. See the table on page 5 for a listing of possible relationship codes.

- 3 -

4.Owner Name. Enter in the last name, first name, and middle name or initial, if available. Be sure to include any information that would aid in the identification of the owner including prefixes (titles) and suffixes (Jr., Sr., MD, etc.).

a.Company names should be entered into the last name field. If a name begins with ‘The’, remove ‘The’.

b.If a single item has two or more owners, the names and addresses of each must be listed.

c.If name is not known, type the word ‘Unknown’ in this field and provide any available property information.

d.If reporting items less than $25.00 in an aggregate, enter ‘Aggregate’ in the last name field.

e.Omit punctuation.

5.Owner address. Each line indicates the kind of address information to be typed on that line. Omit punctuation.

6.Social Security Number, Company FEIN, and Date of Birth should be included if the information is available. This can accelerate the claims process and may be the only information a person can document to prove ownership.

7.Property Type Codes. This code describes the type of property being remitted. All property must have a property type code. Refer to page 6 for most appropriate code types.

8.Owner account or check number. Identify the account, policy, and check, serial or other property identifying number. This number should apply specifically to the owner being reported, not to a general ledger number.

9.Security Name. Describe the security related property being remitted.

10.CUSIP Number. The CUSIP number of the security being reported is required.

11.Certificate/MF#. The certificate or bond number associated with the securities reissued in the name of Springfield & Co., FEIN 90-0169148, or the mutual fund account number associated with the securities registered in the name of the Treasurer of the State of Illinois Unclaimed Property Division, FEIN 36-3716228.

12.Transfer Date for Security. The date of issue of a stock/bond certificate or the date of transfer of a mutual fund account into the Treasurer’s account.

13.Number of Shares. Enter the number of shares for the owner.

a.Do not report fractional shares on certificated stock – remit cash in lieu of the fractional shares (SC09).

b.Mutual fund shares are to be reported up to the 4th decimal.

14.Last Activity Date. Record the date of last activity for this property.

15.Cash Amount is the principal amount available on the date of last activity. If you are reporting security related cash property, please combine items together per each owner.

16.Interest/Dividends. The total interest/dividends earned on the principal amount since the date of last activity. Applies only to deposit accounts.

17.Service Charge. The lawful charges that may be deducted as defined in 760.60 of applicable rules. When backup withholding has been applied to an account, reflect this by reducing the amount of cash or interest/dividends reported whichever appropriate.

18.Mailing Charge. The actual costs of a due diligence mailing as required by Section 11(e) of the Act, and as defined in Section 760.40 of the applicable rules may be deducted.

19.Amount Remitted. The total of Cash Amount and Interest/Dividends less Service and Mailing Charges. The total of the amounts remitted for all owners must equal the amount of the check submitted with this report.

20.Comments. This line may be used for AKA, DBA, FKA, or other descriptive information not included in the relationship code, prefix, suffix, property code, or account information fields.

-4 -

TYPE OF BUSINESS

*10 |

|

Agriculture/Forestry/Fishing |

*40-49 |

Trade (Wholesale/Retail) |

Financial Services (cont'd) |

|

|

|

|

*40 |

Other |

#71 |

Securities/Commodities |

*12 |

|

Mining |

*41 |

Clothing/Home Furnishings |

#72 |

Mutual Funds |

|

|

|

|

*42 |

Light Industrial |

#73 |

Pension Funds |

*17 |

|

Construction |

*43 |

Heavy Industrial |

#74 |

Holding Companies |

|

|

|

|

*44 |

Food/Drug |

#75 |

Real Estate/Title Insurance |

*20-29 |

Manufacturing |

|

|

#76 |

Non Life Insurance |

*20 |

|

Other |

*50-59 |

Services |

*79 |

Life Insurance |

*21 |

|

Clothing/Home Furnishings |

*50 |

Other |

|

|

*22 |

|

Light Industrial |

*51 |

Health |

*80-89 |

Communications |

*23 |

|

Heavy Industrial |

*52 |

Education |

*80 |

Other |

*24 |

|

Food/Drug |

*53 |

Professional |

*81 |

Telephone |

|

|

|

|

*56 |

Holding Company |

*82 |

Radio |

*30-38 |

Utilities/Transportation |

|

|

*83 |

Television/Cable |

*30 |

|

Other |

#60-79 Financial Services |

*84 |

Newspaper/Magazine |

*31 |

|

Oil |

|

#60 |

Other |

|

|

*32 |

|

Gas |

|

#61 |

Banks |

#90-95 |

Public Services |

*33 |

|

Electric |

#62 |

Trusts |

#90 |

Other |

*34 |

|

Water |

#63 |

Credit Unions |

#91 |

Federal |

*35 |

|

Air Transportation |

#64 |

Currency Exchanges |

#92 |

State |

*36 |

|

Water Transportation |

#65 |

Savings & Loan |

#93 |

County |

*37 |

|

Rail Transportation |

#67 |

Safe Deposit Box |

#94 |

Municipal |

*38 |

|

Highway Transportation |

#68 |

Finance / Mortgage |

#95 |

Education (Public) |

|

|

|

|

|

|

#96 |

Utility (Government) |

|

* - Reports Due May 1 |

|

|

#97 |

Transportation (Government) |

|

# - Reports Due November 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RELATIONSHIP CODES |

|

|

|

|

|

Reminder - Single owner accounts do not require a relationship code. |

Code |

Description |

Code Description |

Code |

Description |

|

A |

|

Joint (and) |

I |

Administrator |

Q |

Payee |

|

B |

|

Joint (or) |

J |

Administrator (and) |

R |

Insured |

|

|

|

|

|

|

|

|

C |

|

Custodian |

K |

Administrator (or) |

S |

Beneficiary |

|

D |

|

Custodian (and) |

L |

Executor |

T |

Other |

|

E |

|

Custodian (or) |

M |

Executor (and) |

U |

Owner |

|

F |

|

Trustee |

N |

Executor (or) |

V |

Agent |

|

G |

|

Trustee (and) |

O |

Uniform Gift To Minors Act |

W |

Authorized Signature |

|

H |

|

Trustee (or) |

P |

Remitter |

X |

Sole Owner |

|

|

|

|

|

|

|

|

|

|

|

RELATIONSHIP CODE EXAMPLES |

|

|

JOHN AND MARY DOE, JT TEN |

|

(Use 'A' for each) |

MARY DOE, CUST OF JOHN (UGMA) |

|

(Use 'O' for JOHN, 'C' for MARY) |

MARY DOE, CUST OF JOHN |

|

(Use 'U' for JOHN, 'C' for MARY) |

JOHN & MARY DOE, CUST OF SUE |

|

(Use 'U' for SUE, 'D' for JOHN & for MARY) |

MARY DOE, TRUSTEE OF JOHN |

|

(Use 'U' for JOHN, 'F' for MARY) |

MARY DOE, ADM OF EST OF JOHN |

|

(Use 'U' for JOHN, 'I' for MARY) |

MARY DOE, EXEC OF EST OF JOHN |

|

(Use 'U' for JOHN, 'L' for MARY) |

MARY DOE, GURD OF JOHN |

|

(Use 'U' for JOHN, 'T' for MARY) |

MARY DOE, NFO OF JOHN |

|

(Use 'U' for JOHN, 'T' for MARY) |

MARY DOE, ASSG OF JOHN |

|

(Use 'U' for JOHN, 'T' for MARY) |

MARY DOE, SUB OF JOHN |

|

(Use 'U' for JOHN, 'T' for MARY) |

MARY DOE, FBO OF JOHN |

|

(Use 'S' for JOHN, 'T' for MARY) |

|

|

|

|

|

|

|

|

- 5 -

Code Description

Account Balances

AC01 Checking Accounts

AC02 Savings Accounts

AC03 Matured CD or Saving Certificate AC04 Christmas Club Funds

AC05 Money on Deposit to Secure Fund AC06 Security Deposit

AC07 Unidentified Deposits

AC08 Suspense Accounts AC09 Money Market

Some Uncashed Checks

CK01 |

Cashiers Checks |

CK02 |

Certified Checks |

CK03 |

Registered Checks |

CK04 |

Treasurer's Checks |

CK05 |

Drafts |

CK06 |

Warrants |

CK07 |

Money Orders |

CK08 |

Traveler's Checks |

CK09 |

Foreign Exchange Checks |

CK10 |

Expense Checks |

CK11 |

Pension Checks |

CK12 Credit Checks or Memos |

CK13 |

Vendor Checks |

CK14 Checks Written Off to Income

CK15 |

Outstanding Official Checks |

CK16 |

CD Interest Checks |

Educational Accounts |

CS01 |

Cash |

CS02 |

Mutual Funds |

CS03 |

Securities |

Court Deposits

CT01 Escrow Funds

CT02 Condemnation Awards

CT03 Missing Heirs' Funds

CT04 Suspense Accounts

CT05 Other Court Deposits

Health Savings Accounts

HS01 Cash

HS02 Investment

Insurance

IN01 Individual Policy Benefits or Claim Payments

Code Description

IN02 Group Policy Benefits or Claim Payments

IN03 Proceeds Due Beneficiaries IN04 Proceeds Due From Matured Policies, Endowments, and

or Annuities IN05 Premium Refunds

IN06 Unidentified Remittances IN07 Other Amounts Due Under

Policy Terms

IN08 Agent Credit Balances

IRA & Roth IRA

IR01 IRA Cash

IR02 IRA Mutual Funds

IR03 IRA Securities

IR05 Roth IRA Cash

IR06 Roth IRA Mutual Funds

IR07 Roth IRA Securities

Mineral Proceeds/Interest

MI01 |

Net Revenue Interest |

MI02 |

Royalties |

MI03 |

Overriding Royalties |

MI04 |

Production Payments |

MI05 |

Working Interest |

MI06 |

Bonuses |

MI07 |

Delay Rentals |

MI08 Shut-In Royalties |

MI09 |

Minimum Royalties |

Misc Property

MS01 Wages, Payroll, Salary MS02 Commissions

MS03 Workers' Compensation

MS04 Payment of Goods & Services

MS05 Customer Overpayments

MS06 Unidentified Remittances

MS07 Unrefunded Overcharges

MS08 Accounts Payable

MS09 Credit Balances & Accounts

Receivable

MS10 Discounts Due

MS11 Refunds Due

MS12 Unredeemed Gift Certificates

MS13 Unclaimed Loan Collateral

Code Description

MS14 Pension & Profit Sharing Plans

MS15 Dissolution/Liquidation

MS16 Misc Outstanding Checks

MS17 Misc Intangible Property

MS18 Suspense Liabilities

Securities

SC01 Dividends

SC02 Interest (Bond Coupons) SC03 Principal Payments SC04 Equity Payments SC05 Profits

SC06 Funds Paid To Purchase Shares SC07 Funds For Stocks & Bonds SC08 Shares of Stock

(Returned by Post Office) SC09 Cash For Fractional Shares

SC10 Unexchanged Stock of Successor Corp SC11 Other Certificate of Ownership

SC12 Underlying Shares or Other

|

Outstanding Certificates |

SC13 |

Funds For Liquidation |

SC14 |

Debentures |

SC15 |

US Government Securities |

SC16 |

Mutual Fund Shares |

SC17 |

Warrants (Rights) |

SC18 |

Matured Bond Principal |

SC19 |

Dividend Reinvestment Plans |

SC20 |

Credit Balances |

SC21 Sum of Various Stock Related |

|

Cash Items |

SC22 |

Cash In Lieu |

SC23 Sum of Various Stock Related |

|

Stock Items |

SC24 |

Money Market |

Trusts, Investments, Escrows

TR01 Paying Agents Accounts

TR02 Undelivered or Uncashed Dividends TR03 Funds Held In Fiduciary Capacity TR05 Trust Vouchers

TR06 Pre-Need Funeral Plans TR07 Escrow Taxes

TR08 Escrow Earnest Money

Utilities

UT01 Utility Deposits

UT02 Membership Fees

UT03 Refunds or Rebates

UT04 Capital Credit Distributions