When you intend to fill out imrf application imrf pension online, you don't have to install any kind of software - simply try our PDF editor. Our professional team is relentlessly working to improve the tool and enable it to be much faster for clients with its handy functions. Capitalize on today's progressive opportunities, and find a myriad of emerging experiences! Here's what you will have to do to get going:

Step 1: Open the PDF in our editor by pressing the "Get Form Button" above on this webpage.

Step 2: The tool allows you to modify your PDF document in many different ways. Transform it by writing any text, adjust original content, and put in a signature - all at your convenience!

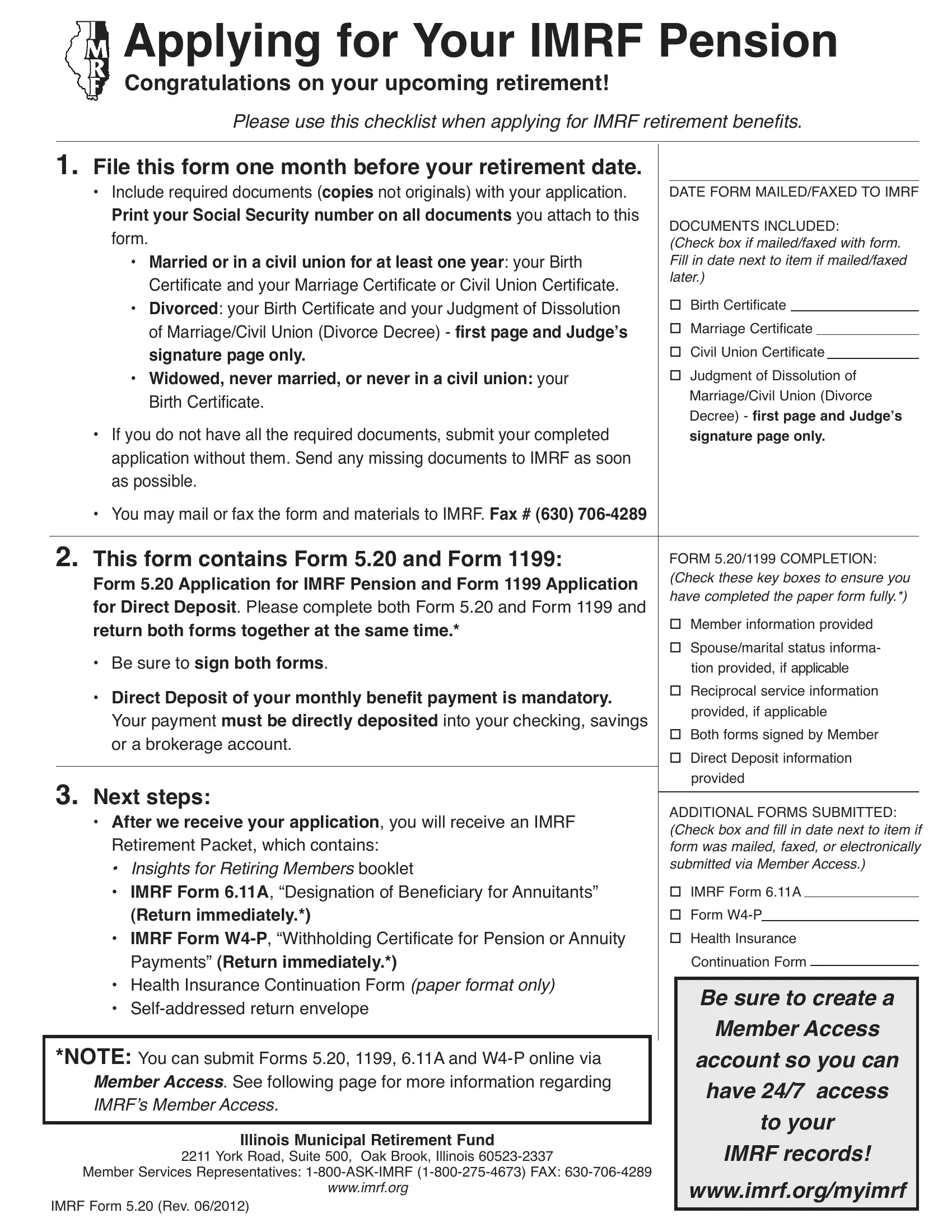

This PDF doc will need you to provide some specific information; in order to ensure consistency, please heed the following tips:

1. While filling out the imrf application imrf pension online, be certain to include all essential fields within its corresponding area. It will help to hasten the work, allowing for your details to be processed swiftly and properly.

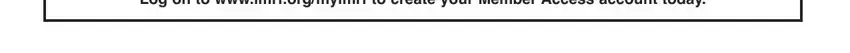

2. Just after performing the last step, go to the subsequent stage and fill in the necessary particulars in all these blanks - Log on to wwwimrforgmyimrf to.

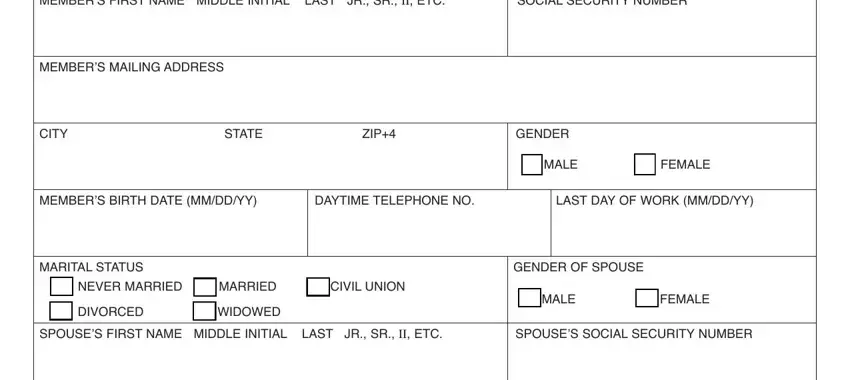

3. This next segment is considered pretty easy, MEMBERS FIRST NAME MIDDLE INITIAL, SOCIAL SECURITY NUMBER, MEMBERS MAILING ADDRESS, CITY STATE ZIP, GENDER, MALE, FEMALE, MEMBERS BIRTH DATE MMDDYY DAYTIME, LAST DAY OF WORK MMDDYY, MARITAL STATUS, NEVER MARRIED MARRIED, CIVIL UNION, DIVORCED, WIDOWED, and GENDER OF SPOUSE - all these blanks is required to be completed here.

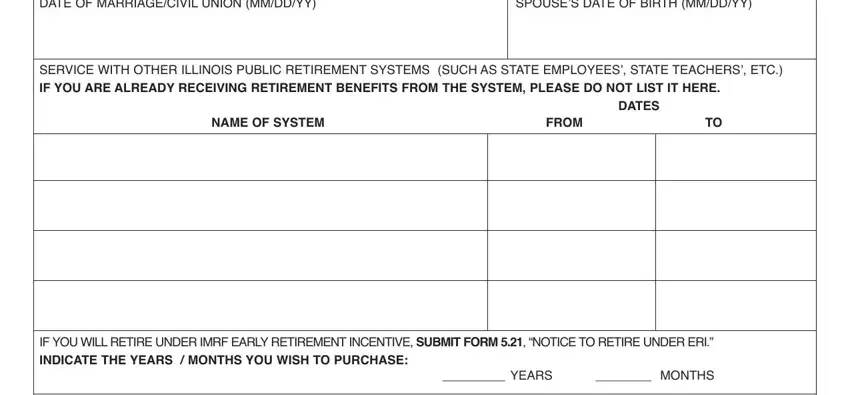

4. This next section requires some additional information. Ensure you complete all the necessary fields - DATE OF MARRIAGECIVIL UNION MMDDYY, SPOUSES DATE OF BIRTH MMDDYY, SERVICE WITH OTHER ILLINOIS PUBLIC, IF YOU ARE ALREADY RECEIVING, NAME OF SYSTEM, FROM TO, DATES, IF YOU WILL RETIRE UNDER IMRF, INDICATE THE YEARS MONTHS YOU, YEARS, and MONTHS - to proceed further in your process!

As for DATE OF MARRIAGECIVIL UNION MMDDYY and INDICATE THE YEARS MONTHS YOU, be certain you do everything properly in this current part. These are thought to be the most significant fields in the form.

5. While you come close to the completion of this file, you will find just a few more requirements that must be met. In particular, I CERTIFY THAT THE ABOVE, MEMBERS SIGNATURE WRITE DO NOT, DATE, Completed form may be mailed to, York Road Suite Oak Brook, Member Services Representatives, wwwimrforg, and IMRF Form Rev should all be filled out.

Step 3: Reread the details you've inserted in the blank fields and press the "Done" button. Acquire the imrf application imrf pension online the instant you sign up for a 7-day free trial. Immediately get access to the pdf inside your personal account page, with any modifications and changes all saved! FormsPal guarantees your data privacy via a protected method that never saves or distributes any type of private data used. Rest assured knowing your documents are kept confidential any time you work with our service!