|

Privacy Act Notice. The Privacy Act of 1974 (5 U.S.C. |

|

To assist program administrators with tracking refunds |

|

552a) requires that the following notice be provided to you: |

and cancellations, disclosures may be made to guaranty |

|

The authorities for collecting the requested information |

agencies, to financial and educational institutions, or to |

|

federal or state agencies. To provide a standardized method |

|

from and about you are §421 et seq., §451 et seq., or §461 |

|

for educational institutions to efficiently submit student |

|

et. seq. of the Higher Education Act of 1965, as amended (20 |

|

enrollment statuses, disclosures may be made to guaranty |

|

U.S.C. 1071 et seq., 20 U.S.C. 1087a et seq., or 20 U.S.C. |

|

|

|

agencies or to financial and educational institutions. To |

|

1087aa et seq.) and the authorities for collecting and using |

|

counsel you in repayment efforts, disclosures may be made |

|

your Social Security Number (SSN) are §§428B(f) and 484(a) |

|

to guaranty agencies, to financial and educational |

|

(4) of the HEA (20 U.S.C. 1078-2(f) and 1091(a)(4)) and 31 |

|

|

|

institutions, or to federal, state, or local agencies. |

|

U.S.C. 7701(b). Participating in the William D. Ford Federal |

|

|

|

Direct Loan (Direct Loan) Program, Federal Family Education |

In the event of litigation, we may send records to the |

|

Loan (FFEL) Program, or Federal Perkins Loan (Perkins Loan) |

Department of Justice, a court, adjudicative body, counsel, |

|

Program and giving us your SSN are voluntary, but you must |

party, or witness if the disclosure is relevant and necessary |

|

provide the requested information, including your SSN, to |

to the litigation. If this information, either alone or with |

|

participate. |

|

other information, indicates a potential violation of law, we |

|

The principal purposes for collecting the information on |

may send it to the appropriate authority for action. We may |

|

send information to members of Congress if you ask them |

|

this form, including your SSN, are to verify your identity, to |

|

to help you with federal student aid questions. In |

|

determine your eligibility to receive a loan or a benefit on a |

|

circumstances involving employment complaints, |

|

loan (such as a deferment, forbearance, discharge, or |

|

|

|

grievances, or disciplinary actions, we may disclose relevant |

|

forgiveness) under the Direct Loan, FFEL, or Federal Perkins |

|

records to adjudicate or investigate the issues. If provided |

|

Loan Programs, to permit the servicing of your loans, and, if |

|

for by a collective bargaining agreement, we may disclose |

|

it becomes necessary, to locate you and to collect and |

|

|

|

records to a labor organization recognized under 5 U.S.C. |

|

report on your loans if your loans become delinquent or |

|

|

|

Chapter 71. Disclosures may be made to our contractors for |

|

default. We also use your SSN as an account identifier and to |

|

the purpose of performing any programmatic function that |

|

permit you to access your account information |

|

|

|

requires disclosure of records. Before making any such |

|

electronically. |

|

|

|

disclosure, we will require the contractor to maintain Privacy |

|

The information in your file may be disclosed, on a case- |

|

Act safeguards. Disclosures may also be made to qualified |

|

by-case basis or under a computer matching program, to |

|

|

|

researchers under Privacy Act safeguards. |

|

third parties as authorized under routine uses in the |

|

|

|

Paperwork Reduction Notice. According to the |

|

appropriate systems of records notices. The routine uses of |

|

Paperwork Reduction Act of 1995, no persons are required |

|

this information include, but are not limited to, its disclosure |

|

to respond to a collection of information unless such |

|

to federal, state, or local agencies, to private parties such as |

|

collection displays a valid OMB control number. The valid |

|

relatives, present and former employers, business and |

|

|

|

OMB control number for this information collection is |

|

personal associates, to consumer reporting agencies, to |

|

|

|

1845-0011. Public reporting burden for this collection of |

|

financial and educational institutions, and to guaranty |

|

|

|

information is estimated to average 10 minutes per |

|

agencies in order to verify your identity, to determine your |

|

response, including time for reviewing instructions, |

|

eligibility to receive a loan or a benefit on a loan, to permit |

|

searching existing data sources, gathering and maintaining |

|

the servicing or collection of your loans, to enforce the |

|

|

|

the data needed, and completing and reviewing the |

|

terms of the loans, to investigate possible fraud and to verify |

|

collection of information. The obligation to respond to this |

|

compliance with federal student financial aid program |

|

|

|

collection is required to obtain a benefit in accordance with |

|

regulations, or to locate you if you become delinquent in |

|

|

|

34 CFR 674.34, 674.35, 674.36, 674.37, 682.210, or 685.204. |

|

your loan payments or if you default. To provide default rate |

|

If you have comments or concerns regarding the |

|

calculations, disclosures may be made to guaranty agencies, |

|

status of your individual submission of this form, please |

|

to financial and educational institutions, or to state |

|

|

|

contact your loan holder directly (see Section 7). |

|

agencies. To provide financial aid history information, |

|

|

|

|

|

disclosures may be made to educational institutions. |

Page 4 of 4 |

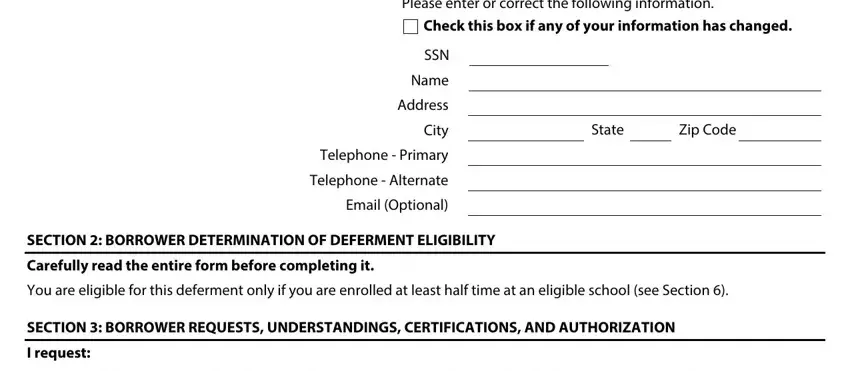

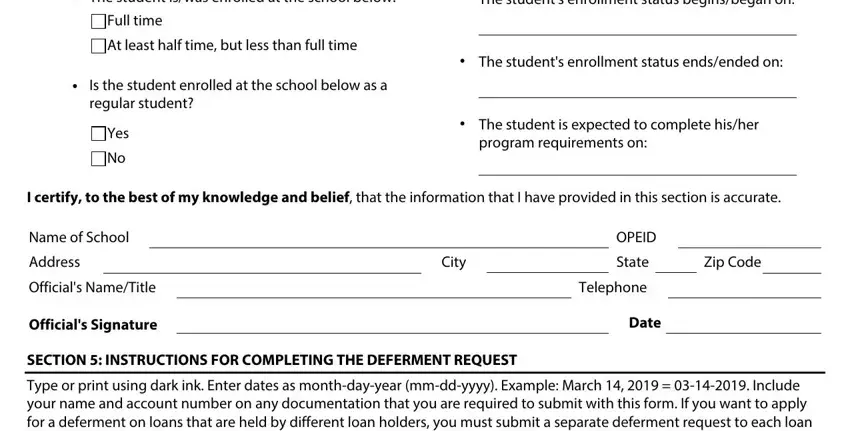

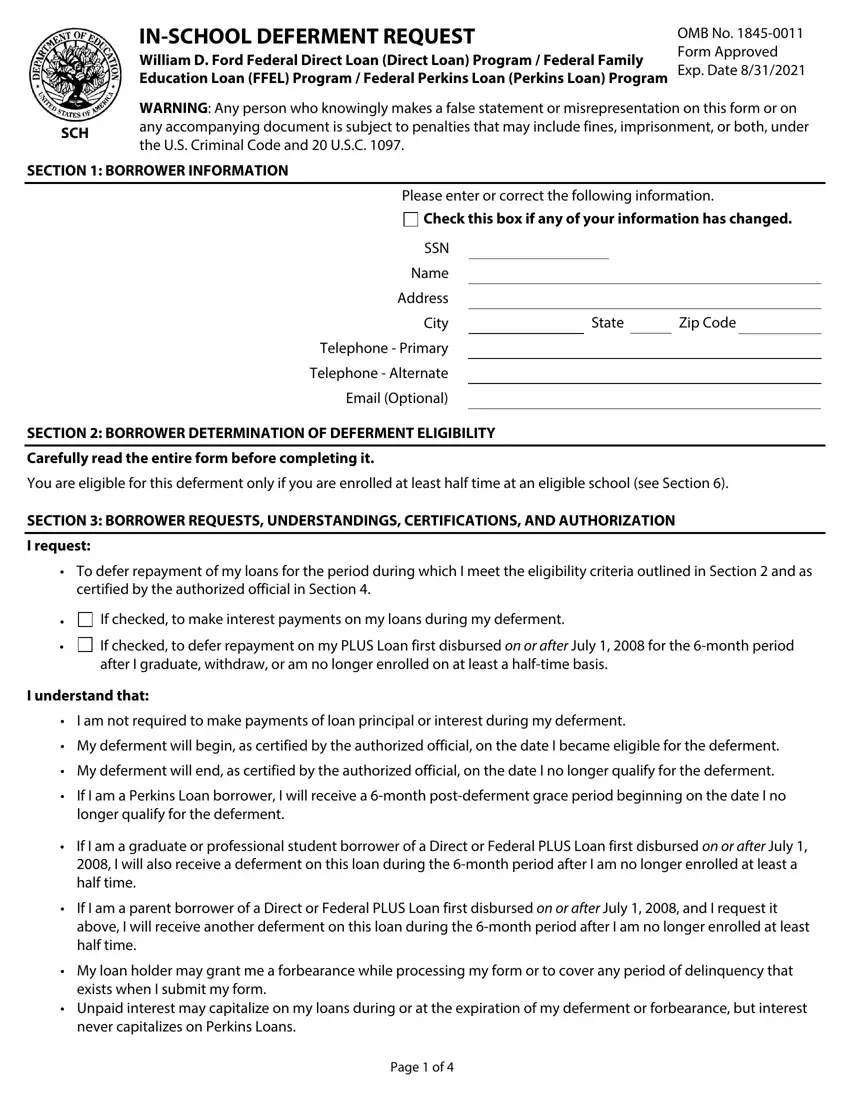

Check this box if any of your information has changed.

Check this box if any of your information has changed.

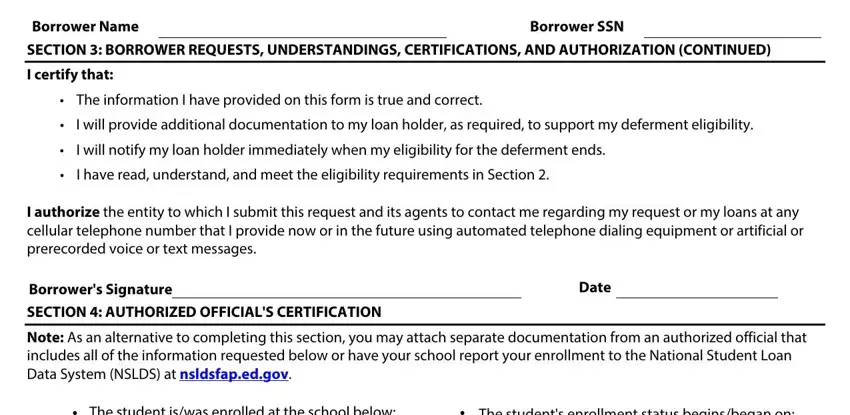

Full time

Full time At least half time, but less than full time

At least half time, but less than full time

Yes

Yes

No

No