Filing an Income Tax Return is an annual obligation that ensures individuals contribute to public services and infrastructure, dictated by the CITY OF SPRINGFIELD DIVISION OF TAXATION. The form, due by April 15 of the following year, is targeted at individuals, accounting for wages, compensation, and additional income with provisions for those who have moved during the tax year. Key components of the return include declaring non-taxable income, calculating taxable earnings from various sources, and determining the city tax based on a 2% rate. Taxpayers also need to navigate through adjustments to income, credits for taxes paid to other cities or developments, and penalties for underpayment or late submissions. Detailed instructions accompany each section to guide the taxpayer, highlighting the necessity of attaching documentation such as W-2 and 1099 forms, along with federal schedules for a coherent submission. The form emphasizes accurate reporting, reflecting figures used for federal tax purposes, and mandates an amendment if audits alter the reported tax liability. Individuals must declare their understanding and compliance by signing, indicating whether a tax practitioner was involved, thereby ensuring accountability and adherence to the taxation process in Springfield.

| Question | Answer |

|---|---|

| Form Name | Income Tax Return Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | springfield ohio tax, city of sringfield ohio 2019 tax forms, city of springfield income tax, city taxes springfield ohio |

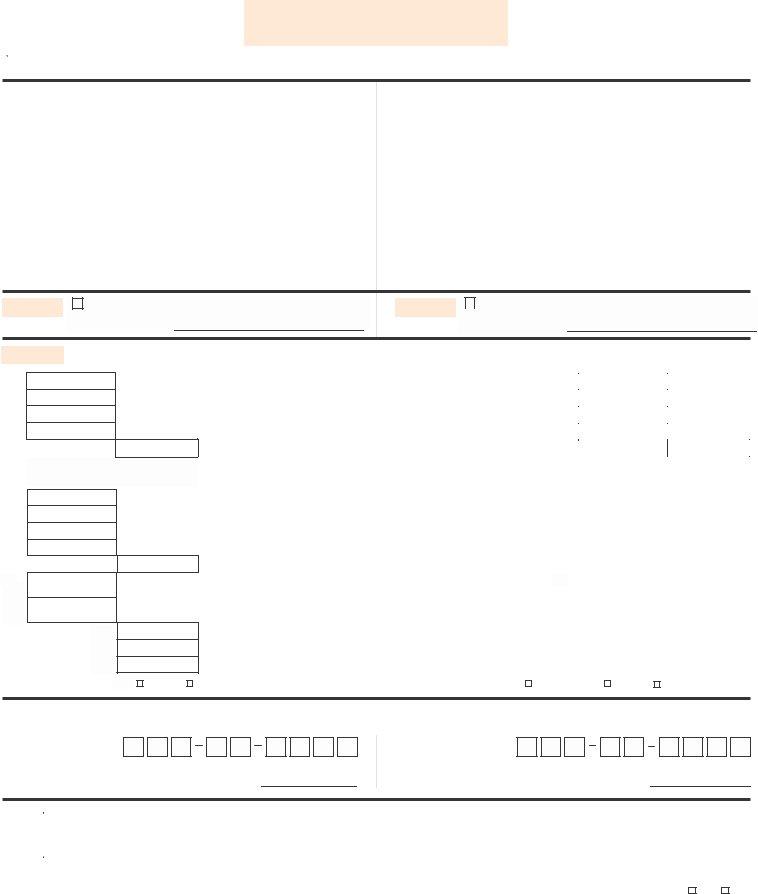

CITY OF SPRINGFIELD DIVISION OF TAXATION P.O. BOX 5200 SPRINGFIELD, OH 45501 TELEPHONE: (937)

______ INCOME TAX RETURN

DUE BY APRIL 15 OF FOLLOWING YEAR

INDIVIDUAL FILING ONLY

www.ci.springfield.oh.us

TAXPAYER |

ACCT # |

SPOUSE |

ACCT # |

|

|

|

|

TELEPHONEPHONE NUMBERr |

|

|

|

|

|

|

TELEPHONELEPHONE NUMBERr |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

IF YOU MOVED DURING THE YEAR: DATE MOVED: IN |

|

OUT |

|

IF YOU MOVED DURING THE YEAR: DATE MOVED: IN |

|

OUT |

|||||||

FORMER ADDRESS |

|

|

|

|

|

FORMER ADDRESS |

|

|

|

|

|||

PART I

I HAVE ONLY

I AM NOT REQUIRED TO FILE |

SEE INSTRUCTIONS |

STASTATEREASONSOURCE

PART I

I HAVE ONLY

|

|

SEE INSTRUCTIONS |

I AM NOT REQUIRED TO FILE |

||

STASTATEREASONSOURCE

PART II

1.

2.

3.

4.

5.

|

|

INCOME |

|

|

|

|

|

PART II |

|

1. |

TOTAL WAGES AND COMPENSATION (See instructions) |

|

1. |

|

|

|

|

||

|

|

(See W2 Sample) |

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

TOTAL OTHER INCOME((FrorommWWorksheet BtonB onreversreversside,e sideNot. |

.) |

2. |

|

|

|

|

|||

|

|

|

|

||||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

3. |

NET ADJUSTMENTS (From Worksheet C on reverse side) |

|

3. |

|

|

|

|

||

4. |

TOTAL TAXABLE INCOME (Add lines 1 through 3) |

|

4. |

|

|

|

|

||

5. |

SPRINGFIELD CITY TAX 2% (Multiply line 4 by .02) |

|

5. |

|

|

|

|||

|

|

|

|

||||||

PAYMENTS AND CREDITS

6.

7.

8.

9.

10.

11.

11.

12.

12.

13.

13.14.

145.

156.

CHECK ONE: CREDIT

REFUND

6. |

ESTIMATED PAYMENTS / PRIOR YEAR OVERPAYMENT CREDIT |

6. |

|

|

|

|

|

||||

7. |

WITHHELD FOR SPRINGFIELD (From |

7. |

|

|

|

|

|

||||

|

|

|

|

|

|||||||

8. |

OTHER CITY TAX CREDIT OR J.E.D.D. TAX CREDIT (From Worksheet D on reverse side) |

8. |

|

|

|

|

|

||||

|

|

|

|

|

|||||||

|

TOTAL PAYMENTS AND CREDITS |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||||

9. |

(Add Linesesli 66ththroughough 8)8. See Instructions) |

9. |

|

|

|

|

|

||||

10. |

BALANCE OF TAX DUE (line 5 minus line 9) |

10. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

|

11. |

|

|

|

|

|

||

|

11. |

INTEREST DUE (See Instructions.) |

|

|

11. |

|

|

|

|

|

|

|

12. |

LATE PENALTY |

|

12. |

|

|

|

|

|

||

|

|

|

|

|

|

||||||

|

12. |

LATE PENALTIES (See Instructions.) |

|

12. |

|

|

|

|

|

||

|

13. |

INTEREST |

|

13. |

|

|

|

|

|

||

|

13. |

TOTAL PENALTY AND INTEREST (add Lines 11 and 12) |

|

|

|

13. |

|

||||

|

14. |

TOTAL PENALTY AND INTEREST (Add Lines 11 through 13) |

|

14. |

|

||||||

|

14. |

10 |

|

|

|

|

|

|

|

||

|

5. |

TOTAL TAX,PENALTYANDINTEREST((AddLLines10 anand1413) |

|

145.. |

|

||||||

|

165.. |

OVERPAYMENTPAYMENT (If(IfLiLinee 9 9exceedsis moreLithane 5)Line 5. See Instructions) |

|

156.. |

|

||||||

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRANSFER TO SPOUSE |

(NO REFUNDS OR CREDIT IF LESS THAN $1.00) |

CHECK ONE: |

CREDIT |

2008 |

REFUND |

TRANSFER TO SPOUSE |

PART III |

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that |

the figures used herein are the same |

|

as used for Federal Income Tax purposes, and if an audit of Federal return is made which affects tax liability shown on this return, an amended return |

will be filed within 3 months. |

||

|

SOCIAL SECURITY NUMBER

TAXPAYER |

|

(DATE) |

SOCIAL SECURITY NUMBER

SPOUSE |

|

(DATE) |

PPARTEPA ER SIVGS |

|

|

|

|

|

|

|

|

|

|

PREPARER S SIGNATURE (OTHER THAN TAXPAYER) |

|

(DATE) |

|

F.E.I.N. OR SOC. SEC. NO. |

|

|

|

|||

ADDRESS (AND ZIP CODE) |

|

|

|

|

TELEPHONE |

|

|

|

|

|

IF THIS RETURN WAS PREPARED BY A TAX PRACTITIONER, MAY WE CONTACT YOUR PRACTITIONER DIRECTLY WITH QUESTIONS REGARDING THE PREPARATION OF THIS RETURN? |

YES |

NO |

||||||||

|

(MAKE CHECK OR MONEY ORDER PAYABLE TO COMMISSIONER OF TAXATION, SPRINGFIELD, OHIO, IF $1.00 OR MORE) |

|

|

|||||||

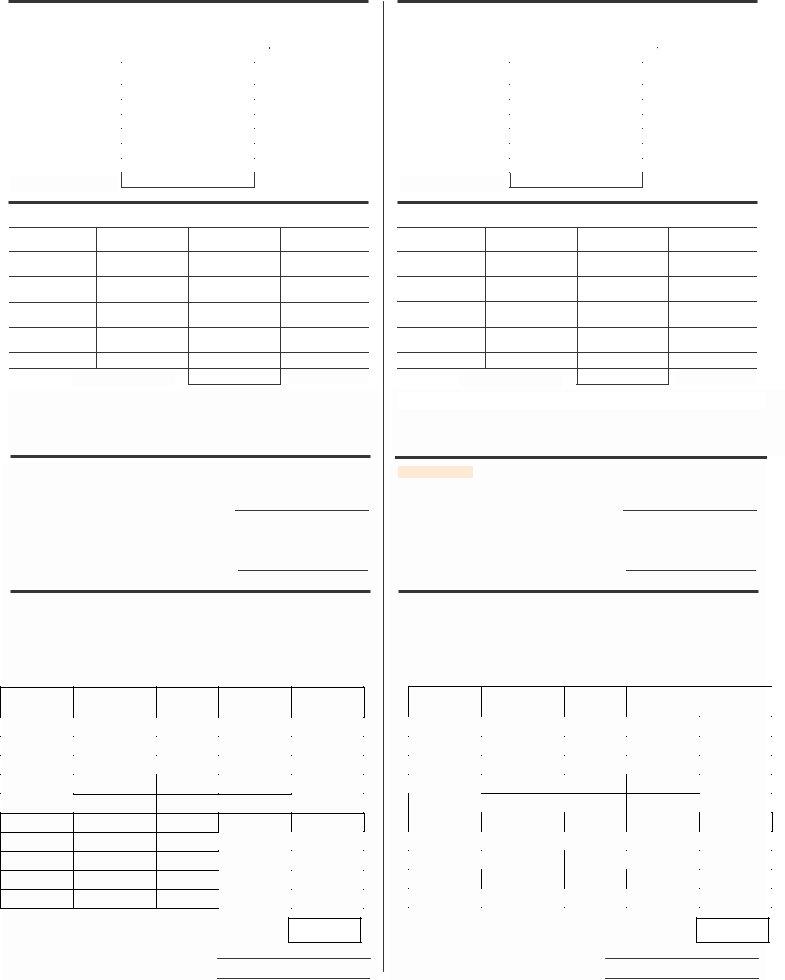

PLEASE ATTACH COPIES OF ALL

TAXPAYER

WORKSHEET A - WAGES AND COMPENSATION (From

Location where earned - |

Total wages |

Withheld for |

List separately |

(as shown on |

Springfield |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To Part B,II, Line 1)

WORKSHEET B - OTHER INCOME (From Schedules and Attachments)

SPOUSE

WORKSHEET A - WAGES AND COMPENSATION (From

Location where earned - |

Total wages |

Withheld for |

List separately |

(as shown on |

Springfield |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To Partt B,II Line 1)

WORKSHEET B - OTHER INCOME (From Schedules and Attachments)

TYPE

Proprietorship Income (Schedule C)

Rental Income

(Schedule E)

Partnership Income (Schedule

Farm Income

(Schedule F)

Other Income

LOCATION

(To(Part B,II Line 2)

Net Taxable Gain From Fed. Schedule

Net Taxable Loss From Fed. Schedule

(Not Less Than

TYPE

Proprietorship Income (Schedule C)

Rental Income

(Schedule E)

Partnership Income (Schedule

Farm Income

(Schedule F)

Other Income

LOCATION

(To(Partt B,II Line 2)

Net Taxable Gain From Fed. Schedule

Net Taxable Loss From Fed. Schedule

(Not Less Than

Losses from schedules or businesses, including multiple partnerships, may not offset gains from other |

|||||

Losses from schedules or businesses, including multiple partnerships, may not offset gains from |

|

||||

or |

|

sole |

farms in the |

of |

indi- |

scheduleschedulbusinessessother |

or businessexcepts exceptproprietorships,ole proprietorshiprentals, reandtals and farms inameth |

namtheofsameth |

|

||

vidual. Net |

may not offset |

|

or |

|

|

same individualosses. Net losses may |

notpersonalffset serviceonalpcompensation,ervice compenwagesation, wages or |

||||

Partnership losses may not offset partnership, sole proprietorship, rental or farm gains. Partnership losses may not offset partnership, sole proprietorship, rental or farm gains.

Jointly owned rental property gains/losses are allocated equally among owners of record, unless Jointly owned rental property gains/losses are allocated equally among owners of record. otherwise indicated.

WORKSHEETT C

with documentation and calculations. Proration of income results in proration of credit.

EMPLOYEE BUSINESS EXPENSE |

$ |

|

|

|

......................EMPLOYEE BUSINESS EXPENSE (e) |

$ |

|

|

|

(See Instructions) |

* |

|

(To Part B, Line 3) |

|

|

|

|

(To Part B,II, Line 3) |

|

|

FEDERAL |

A AND FORM 2106 |

|

|

*MUSTATTACHH BOTH SCHEDULSCHEDULEA AN 2106 |

|

|

||

SEE INSTRUCTIONS FOR DEDUCTION LIMITATIONS. |

|

|

|

|

OTHER ADJUSTMENTS |

$ |

|

|

|

OTHER ADJUSTMENTS |

$ |

(To Part B, Line 3) |

|

|

|

|

|

|

|

(To Part B,II, Liine 3)) Must fully explain, plus support with documentation and calculations. Proration of

income results in proration of credit.

WORKSHEET D - CREDIT FOR OTHER CITY TAX OR JOINT ECONOMIC DEVELOPMENT DISTRICT (JEDD) TAX PAID - SEE INSTRUCTIONS WORKSHEET D - OTHER CITY TAX CREDIT AND JOINT ECONOMIC

DEVELOPMENTOther City CreditDISTRICTAllowed: 1/2TAXofCREDITtax correctly- SEEpaid,INSTRUCTIONSmaximum allowable credit 1% of taxable income earned in other jurisdictions.

Cities orA J.E.D.D. with tax rateB UP TO 2%. |

C |

D |

E |

Credit Allowed: 1/2 of tax correctly paid, max. 1% of taxable income earned in other entity.

|

TAXABLE |

OTHER |

|

2 % of |

LESSER of |

|

L CATION |

TAXABLE INCOME |

|||||

|

|

TAX PAID |

||||

LOCATION |

INCOME |

CITY TAX |

Column B |

Column C or D |

||

|

PAID |

|||||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

ALLOWABLE CREDIT, (To Part B, |

Line 8) |

|

X .5 |

||

|

|

|

||||

|

|

|||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Cities with tax rate GREATER than 2% (i.e. Dayton - 2.25%, Oakwood - 2.5%)

Other City Credit Allowed: 1/2 of tax correctly paid, max. 1% of taxable income earned in other city.

Losses fromm schedulesles or businesses,nesses, iincludingcluding mmultipleltiple ppartnerships,rtnerships, mamay nonot ooffsetset ggainsins ffromom |

other |

|||

or |

sole |

farms in the |

of |

indi- |

scheduleschedulbusinessessother |

or businessexcepts exceptproprietorships,le pr |

prietorshiprentals, reandtals and farms innameth namtheofsameth |

|

|

vidual. Net |

may not offset |

or |

|

|

same individualosses. Net losses may notpersonalffset servicersonalpcompensation,ervice compenwagesation, wages or

Partnership losses may not offset partnership, sole proprietorship, rental or farm gains. Partnership losses may not offset partnership, sole proprietorship, rental or farm gains.

Jointly owned rental property gains/losses are allocated equally among owners of record, unless Jointly owned rental property gains/losses are allocated equally among owners of record. otherwise indicated.

WORKSHEETT C

with documentation and calculations. Proration of income results in proration of credit.

EMPLOYEE BUSINESS EXPENSE |

$ |

|

|

|

......................EMPLOYEE BUSINESS EXPENSE (e) |

$ |

|

|

|

(See Instructions) |

* |

|

(To Part B, Line 3) |

|

|

|

|

(To Part B,II, Line 3) |

|

|

FEDERAL |

A AND FORM 2106 |

|

|

*MUSTATTACH BOTH SCHEDULSCHEDULEA AN 2106 |

|

|

||

SEE INSTRUCTIONS FOR DEDUCTION LIMITATIONS. |

|

|

|

|

OTHER ADJUSTMENTS |

$ |

|

|

|

OTHER ADJUSTMENTS |

$ |

(To Part B, Line 3) |

|

|

|

|

|

|

|

(To Part B,II, Liine 3)) Must fully explain, plus support with documentation and calculations. Proration of

income results in proration of credit.

WORKSHEET D - CREDIT FOR OTHER CITY TAX OR JOINT ECONOMIC

DEVELOPMENT DISTRICT (JEDD) TAX PAID - SEE INSTRUCTIONS |

|

|

|

||||||||||

WORKSHEET D - OTHER CITY TAX CREDIT AND JOINT ECONOMIC |

|

|

|

||||||||||

DEVELOPMENTOther City CreditDISTRICTAllowed: 1/2TAXofCREDITtax correctly- SEEpaid,INSTRUCTIONSmaximum allowable credit 1% of |

|

||||||||||||

taxable income earned in other jurisdictions. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Cities orA J.E.D.D. with tax rateB UP TO 2%. |

|

C |

D |

|

|

E |

|

||||||

Credit Allowed: 1/2 of tax correctly paid, max. 1% of taxable income earned in other |

|

entity. |

|

||||||||||

|

|

|

TAXABLE |

|

|

OTHER |

2 % of |

|

|

LESSER of |

|

||

LOCATLOCATIONN |

|

TAXABLECITYNCOMETAX |

TAX |

|

|

||||||||

|

INCOME |

Column B |

|

PAID |

|

||||||||

|

|

|

|

|

PAID |

|

|

Column C or D |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLOWABLE CREDIT, |

|

(To Part B, Line 8) |

|

X |

|

.5 |

|

|||

|

|

|

|

|

|

|

|

|

|||||

D- |

2 |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cities with tax rate GREATER than 2% (i.e. Dayton - 2.25%, Oakwood - 2.5%) |

Other City Credit Allowed: 1/2 of tax correctly paid, max. 1% of taxable income earned in other city. |

A

LOCATION

B

TAXABLE INCOME

C

OTHER CITY

TAX PAID

D |

E |

|

LESSER of |

2% of Column B |

Column C or D |

|

|

|

|

TOTALTAL

XX ..55

A |

|

|

|

|

B |

|

|

C |

|

|

D |

|

E |

|

|

|

|

|

|

|

OTHER CITY |

|

|

|

|

LESSER of |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOCATION |

TAXABLE INCOME |

TAX PAID |

2% of Column B |

|

Column C or D |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTOTALAL

XX ..5

ALLOWABLE CREDIT, (To Part B, Line 8) ALLOWABLE CREDIT, (To Part II, Line 8)

ALLOWABLE CREDIT, (To Part B, Line 8) ALLOWABLE CREDIT, (To Part II, Line 8)