The fl 195 support filling out procedure is easy. Our editor lets you work with any PDF document.

Step 1: Click the "Get Form Now" button to get started on.

Step 2: So you're on the document editing page. You can enhance and add information to the document, highlight words and phrases, cross or check certain words, include images, insert a signature on it, delete unrequired fields, or remove them completely.

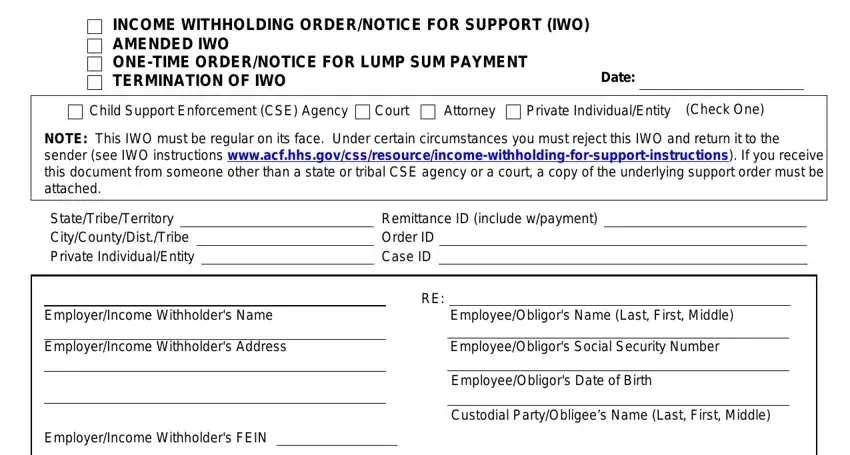

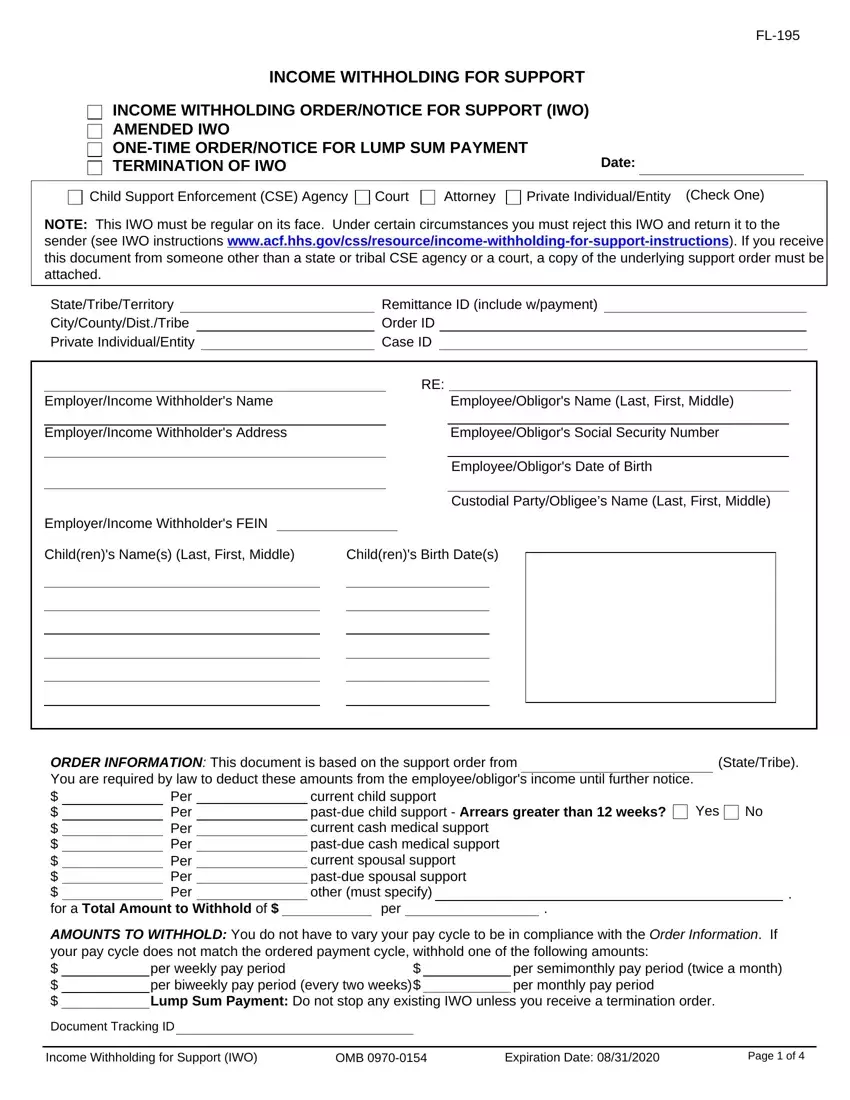

These sections will help make up your PDF file:

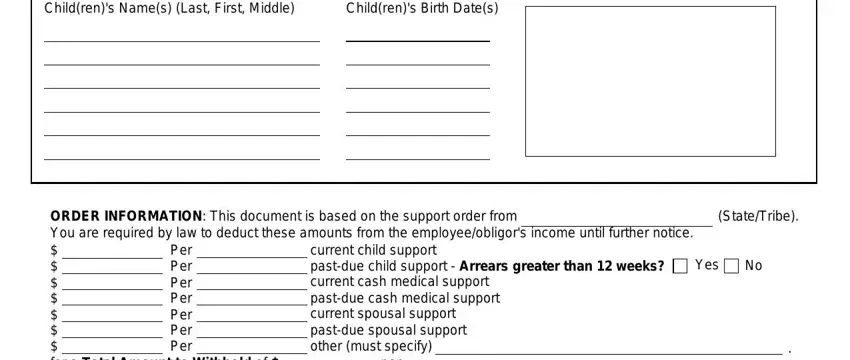

Make sure you note the necessary data in the Childrens Names Last First Middle, Childrens Birth Dates, ORDER INFORMATION This document is, Per Per Per Per Per Per Per, Yes, and per field.

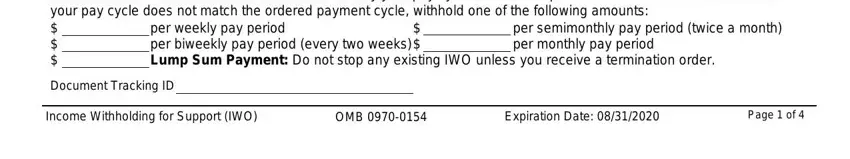

Inside the field discussing AMOUNTS TO WITHHOLD You do not, per weekly pay period per, per semimonthly pay period twice a, Document Tracking ID, Income Withholding for Support IWO, OMB, Expiration Date, and Page of, you are required to type in some vital particulars.

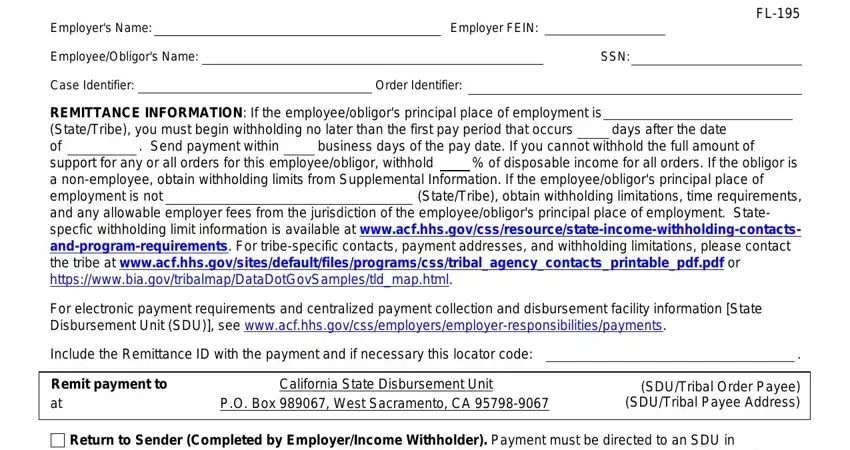

The field Employers Name, EmployeeObligors Name, Employer FEIN, SSN, Case Identifier, Order Identifier, REMITTANCE INFORMATION If the, For electronic payment, Include the Remittance ID with the, Remit payment to California State, SDUTribal Order Payee SDUTribal, and Return to Sender Completed by should be for you to add all sides' rights and obligations.

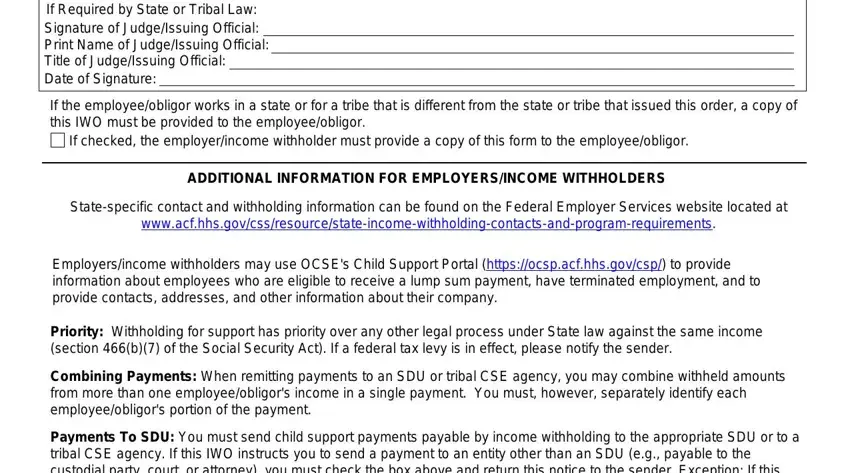

Finish the template by checking these particular areas: If Required by State or Tribal Law, If the employeeobligor works in a, ADDITIONAL INFORMATION FOR, Statespecific contact and, Employersincome withholders may, Priority Withholding for support, Combining Payments When remitting, and Payments To SDU You must send.

Step 3: When you are done, click the "Done" button to export the PDF document.

Step 4: Generate at least several copies of the form to keep clear of any specific potential troubles.

Child Support Enforcement (CSE) Agency

Child Support Enforcement (CSE) Agency  Court

Court

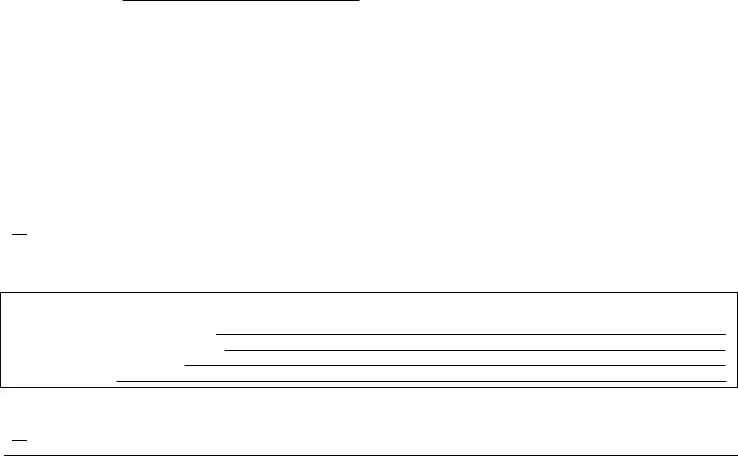

Return to Sender (Completed by Employer/Income Withholder).

Return to Sender (Completed by Employer/Income Withholder).

If checked, the employer/income withholder must provide a copy of this form to the employee/obligor.

If checked, the employer/income withholder must provide a copy of this form to the employee/obligor.

This person has never worked for this employer nor received periodic income.

This person has never worked for this employer nor received periodic income.

This person no longer works for this employer nor receives periodic income.

This person no longer works for this employer nor receives periodic income.