In an era where transparency and fairness in legal proceedings are paramount, the Indiana Financial Declaration Form stands as a crucial document for those navigating through the complexities of family law within the jurisdiction of the Porter Superior Court. This comprehensive form is designed to ensure that all financial information is disclosed accurately and completely by both parties in cases such as divorce, child support, and alimony. It is meticulously structured to cover a wide array of financial aspects, including—in but not limited to—personal details, employment history, income, health insurance information, and monthly living expenses. Each section serves to paint a clear picture of an individual's financial situation, thereby aiding the court in making informed decisions that affect the well-being of families. By adhering to Local Rule 18, along with Indiana Trial Rules 26, 33, 34, 35, and 37, the form underscores the importance of a verified financial statement in the equitable distribution of assets and responsibilities. Moreover, it emphasizes the necessity of including an Indiana Child Support Guideline Worksheet for cases involving child support, ensuring that the needs of children are considered carefully and compassionately. This document not only facilitates a smoother legal process but also embodies the principles of justice and equity that govern the resolution of family law matters in Indiana.

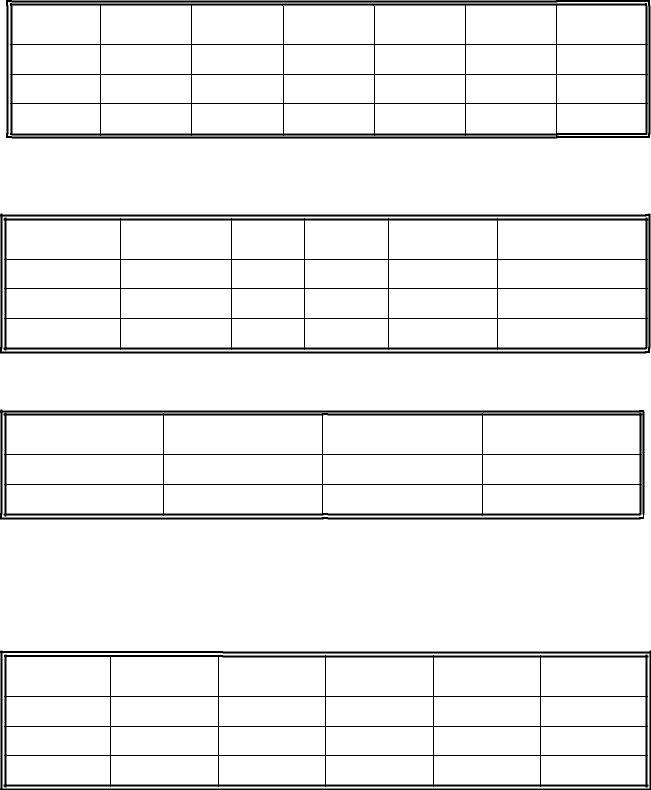

| Question | Answer |

|---|---|

| Form Name | Indiana Financial Form |

| Form Length | 13 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min 15 sec |

| Other names | financial indiana form declaration, filing weekly declaration, financial indiana declaration form, financial declaration form indiana |

FINANCIAL DECLARATION FORM

STATE OF INDIANA: CIRCUIT AND SUPERIOR COURTS

OF PORTER COUNTY

IN RE THE MARRIAGE OF: |

Cause Number: |

Petitioner,

And

Respondent

In accordance with Local Rule 18 of the Porter Superior Court and Indiana Trial Rules 26, 33, 34, 35 and 37, the undersigned, Petitioner or Respondent, hereby submits the following

VERIFIED FINANCIAL DISCLOSURE STATEMENT:

FINANCIAL DECLARATION OF |

|

|

|

|

|

|

|

|

Dated: |

|

|||||||||

I. PRELIMINARY INFORMATION: |

|

|

|

|

|

|

|

|

|

||||||||||

Husband: |

|

|

Wife: |

|

|||||||||||||||

Address: |

|

|

Address: |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Soc. Sec. No.: |

|

|

Soc. Sec No.: |

|

|||||||||||||||

Badge/Payroll No.: |

|

|

Badge/Payroll No.: |

|

|||||||||||||||

Occupation: |

|

|

Occupation: |

|

|||||||||||||||

Employer: |

|

|

Employer: |

|

|||||||||||||||

Birth Date: |

|

|

Birth Date: |

|

|||||||||||||||

|

|

|

|

|

Date of Marriage: |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Date of Physical Separation: |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

Date of Filing: |

|

|

|

|

|

|

|

|

|

|

||||

Children: |

|

|

|

|

|

|

Name: |

|

Age: |

|

DOB: |

|

SSN: |

Name: |

|

Age: |

|

DOB: |

|

SSN: |

Name: |

|

Age: |

|

DOB: |

|

SSN: |

1

II. HEALTH INSURANCE INFORMATION:

Name and Address of health care insurance company:

Name all persons covered under plan(s):

Weekly cost of total health insurance premium:

Weekly cost of health insurance premium for children only:

Name of the children’s health care providers:

The names of the schools and grade level for each child are:

List any extraordinary health care concerns of any family member:

List any educational concerns of any family member:

III.INCOME INFORMATION:

A.EMPLOYMENT HISTORY:

Current Employer:

Address:

Telephone No.: |

|

|

|

|

Length of Employment: |

|

|

|

|||

Job Description: |

|

|

|

|

|

|

|

|

|

|

|

Gross Income: |

|

|

|

|

|

|

|

|

|

||

|

|

Per week |

|

|

|

Per month |

|

|

Yearly |

||

Net Income: |

|

|

|

|

|

|

|

|

|

||

|

|

Per week |

|

|

|

Per month |

|

|

Yearly |

||

2

B.EMPLOYMENT HISTORY FOR LAST 5 YEARS:

Employer |

|

Dates of Employment |

|

Compensation (per wk/mo/yr) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C.INCOME SUMMARY:

1.GROSS WEEKLY INCOME from: Salary and wages, including commissions, bonuses, allowances, and

Note: If paid monthly, determine weekly income by dividing monthly income by 4.3

Pensions & Retirement

Social Security

Disability and unemployment insurance

Public Assistance (welfare, AFDC payments, etc.)

Food Stamps

Child supports received for any child(ren) not both of the parties to this marriage

Dividends and Interest

Rents received

All other sources (specify)

TOTAL GROSS WEEKLY INCOME

2.ITEMIZED WEEKLY DEDUCTIONS: from gross income

State and Federal Income Taxes:

Social Security & Medicare Taxes:

Medical Insurance |

|

|

|

|

Coverage: |

Health |

( |

|

) |

|

Dental |

( |

|

) |

|

Eye Care |

( |

|

) |

|

Psychiatric |

( |

|

) |

3

Union or other dues:

Retirement:

Pension fund: Mandatory ( )Optional ( )

Profit sharing: Mandatory ( )Optional( )

401(K): Mandatory ( ) Optional ( )

SEP: Mandatory ( ) Optional ( )

ESOP: Mandatory ( ) Optional ( )

IRA: Mandatory ( ) Optional ( )

403 B: Mandatory ( ) Optional ( )

Child Support withheld from pay (not including this case)

Garnishments (itemize on separate sheet)

Credit Union debts

Direct Withdrawals Out of Paychecks:

Car Payments

Life Insurance

Disability Insurance

Thrift plans

Credit Union Savings

Bonds

Donations

Other (specify)

Other (specify)

TOTAL WEEKLY DEDUCTIONS:

3. WEEKLY DISPOSABLE INCOME:

(A minus B: Subtract Total Weekly Deduction from Total Weekly Gross Income)

IN ALL CASES INVOLVING CHILD SUPPORT: Prepare and attach an Indiana Child Support Guideline Worksheet (with documentation verifying your income); or, supplement with such a Worksheet within ten (10) days of the exchange of this Form.

IV. MONTHLY LIVING EXPENSES:

House

1.Rent (Mortgage)

2.2nd Mortgage

4

3.Line of Credit

4.Gas/Electric

5.Telephone

6.Water

7.Sewer

8.Sanitation (garbage)

9.Cable

10.Satellite

11.Internet

12.Taxes (real estate – if not included in mortgage payment

13.Insurance (house – if not included in mortgage payment)

14.Lawn Care/Snow Removal

Groceries

1.Food

2.Toiletries

3.Cleaning Products

4.Paper Products

Clothing

1.Clothes

2.Shoes

3.Uniforms

Health Care

1.Health Insurance not deducted from pay

2.Dental Insurance not deducted from pay

3.Doctor visits

4.Dental visits

5.Prescription Pharmaceutical

5

6.

7.Glass/contact lenses

8.Other

Car & Travel

1.Car Payment

2.Gasoline

3.Oil/Maintenance

4.Insurance (car)

5.Car Wash

6.Tolls

7.Train/Bus

8.Parking Lot Fees

9.License Plates

Beauty Care

1.Hair Dress/Barber

2.Cosmetics

School Needs

1.Lunches

2.Books

3.Tuition/Registration

4.Uniforms

5.School Supplies

6.

Infant Care

1.Diapers

2.Baby Food

6

Miscellaneous

1.Church Donations

2.Charitable Donations

3.Life Insurance

4.Babysitter

5.Newspapers & Magazines

6.Cigarettes

7.Dry Cleaning

8.Entertainment

9.Cell Phone

10.Dues/Subscriptions

11.Charge Cards

12.Other (specify)

Average Weekly Expenses (multiply monthly expenses by 12 and divide by 52)

V. PROVISIONAL ARREARAGE COMPUTATIONS:

If you allege the existence of a child support, maintenance, or other arrearage, attach all records or other exhibits regarding the payment history and complete the child support arrearage.

You must attach a Child Support Guideline Worksheet to your Financial Declaration Form or one must be exchanged with the opposing party/counsel within 10 days of receipt of the other parties= Financial Declaration Form.

7

ASSETS

All property is to be listed regardless of whether it is titled in your name only or jointly of if the property you own is being held for you in the name of a third party.

VI. PROPERTY:

A. MARITAL RESIDENCE:

Description:

Location:

Date Acquired: |

|

Titled: |

|

||

Purchase Price: |

|

Down Payment: |

|

||

Source of down payment: |

|

|

|

|

|

Current Indebtedness: |

|

|

|

|

|

Monthly Payment: |

|

|

|

|

|

Current Market Value: |

|

|

|

|

|

B.OTHER REAL PROPERTY: (Complete B on a separate sheet of paper for each additional parcel of real estate owned etc.)

Description:

Location:

Date Acquired: |

|

Titled: |

|

||

Purchase Price: |

|

Down Payment: |

|

||

Source of down payment: |

|

|

|

|

|

Current Indebtedness: |

|

|

|

|

|

Monthly Payment: |

|

|

|

|

|

Current Market Value: |

|

|

|

|

|

8

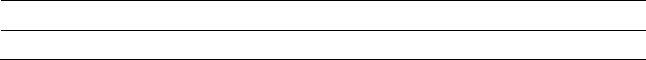

C.PERSONAL PROPERTY: (motor vehicles, boats, motorcycles, furnishings, household goods, jewelry, firearms, etc. Household furnishings and household goods such as pots and pans need not

be itemized).

Description

Titled

Current Value

Indebtedness

Payment

Present User

VII. BANK ACCOUNTS:

Name

Type of Account

(Checking, Savings,

CD’s, etc.)

Owner

Account No.

Balance on Date of Filing

VIII.

Name

Type of Account

(Money Mkt, Stocks,

Bonds, Mutual Funds)

Owner

Account No.

Value on date of filing

9

IX. LIFE INSURANCE POLICIES (whole life, variable life, annuities, term)

Company

Owner

Policy #.

Beneficiary

Face Value

Loan

Amount

Cash Value

X.RETIREMENT ACCOUNTS (Pension, Profit Sharing, 401(K), SEP, IRA, KEOGH, ESOP, etc.)

Company

Type of Plan

Owner

Account #

Vested (yes/no)

Value as of date of filing

XI. OTHER PROFESSIONAL OR BUSINESS INTERESTS:

Name of Business

Type (Corp., Part., Sole Owner

% Owned

Estimated Value

XII. MARITAL BILLS, DEBTS, AND OBLIGATIONS: (list every single bill, debt and obligation regardless of whether the bill is title in your name, your spouse=s name, or jointly. Please include all mortgages, 2nd mortgages, home equity loans, charge cards, other loans, credit union loans, car payments, and unpaid medical bills, etc. Do not include monthly expenses such as utilities that are paid in full every month).

Creditor

Description

Acct. #

Monthly

Payment

Balance as of

Date of Filing

Current

Balance

10

XIII. RECAPITULATION: A summary of the marital estate is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSET: |

|

|

In Name of Husband |

|

In Name of Wife |

Jointly held |

Total |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Family Dwelling |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Real Estate |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Property |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Accounts |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Securities |

|

|

|

|

|

|

|

|

||

|

Life Insurance |

|

|

|

|

|

|

|

|

||

|

Policies |

|

|

|

|

|

|

|

|

||

|

Retirement Accounts |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

||

|

Professional/Business |

|

|

|

|

|

|

|

|

||

|

Interests |

|

|

|

|

|

|

|

|

||

|

|

Total Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

|

|

|

||

|

General Creditors |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage on Family |

|

|

|

|

|

|

|

|

||

|

Dwelling |

|

|

|

|

|

|

|

|

||

|

Mortgages on Other |

|

|

|

|

|

|

|

|

||

|

Real Estate |

|

|

|

|

|

|

|

|

||

|

Notes to Banks and |

|

|

|

|

|

|

|

|

||

|

Others |

|

|

|

|

|

|

|

|

||

|

Loans on Insurance |

|

|

|

|

|

|

|

|

||

|

Policies |

|

|

|

|

|

|

|

|

||

|

Other liabilities |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

Total of Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

ASSETS MINUS |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

XIV. PERSONAL STATEMENT REGARDING DIVISION OF PROPERTY:

Indiana law presumes that the marital property be split in a 50/50 basis. However, the Judge may order a division which may differ from an exact 50/50 division of your property. Please provide a brief statement as to your reasons, if there be any, why the Court should divide or divide on anything other than a 50/50 basis.

XV. MANDATORY EXHIBITS:

The following exhibits must be attached to your Financial Declaration Form:

1.The last three years of Individual State and Federal income tax returns together with all

2.The immediate preceding six paycheck stubs showing

3.Documents showing the amount of income received from any other source in the past three years including irregular income in an amount greater than $500 per year plus any expenses relating thereto.

4.Child support worksheet, if applicable.

5.Arrearage calculation, if application under V of this Financial Declaration Form.

6.With regard to all real estate listed under VI (A) and (B):

a..The title insurance policy, if available, b. The deed,

c. An amortization schedule from the lending institution, if available,

d.Documents showing the mortgage balance as of the date of the filing of the Petition for Dissolution of Marriage.

7.As to all bank accounts identified in VII of this Financial Declaration Form:

a.Copy of the bank statement closest to the date of the filing of the Petition for Dissolution of Marriage.

b.Copies of the bank statements for the five months immediately preceding the filing of the Petition for Dissolution of Marriage.

8.As to all

a.Copy of the statement closest to the date of the filing of the Petition for Dissolution of Marriage, and

b.Copies of the statements for the five months immediately preceding the filing of the Petition for Dissolution of Marriage.

9.As to all Life Insurance policies identified in IX of this Financial Declaration Form attach statements as of cash value as of the date of the filing of the Petition for Dissolution of Marriage.

12

10.As to all Retirement Accounts identified in X of this Financial Declaration Form attach statements showing the value of the accounts as of the filing of the Petition for Dissolution of Marriage and for the preceding five months, if such statements available, except for pension accounts and other defined benefit plans, in which event attach a statement from the employer describing the benefits.

11.As to all marital bills, debts, and obligations identified in XII of the Financial Declaration Form, attach a statement showing the amount of each bill, debt, and obligation as of the date of the filing of the divorce and for the immediately preceding five months.

XV. VERIFICATION:

I declare, under the penalty of perjury, that the foregoing, including statements of my income, expenses, assets, and liabilities, are true and correct to the best of my knowledge and that I have made a complete and absolute disclosure of all sources of income, all assets, and all liabilities. If it is proven to the Court that I have intentionally failed to disclose all of my income, any asset, or liability, I may lose the asset and may be required to pay the liability.

Further, this Financial Declaration Form is considered as a Request for Admissions to the recipient under Trial Rule 35 and should the recipient fail to fully prepare and exchange this statement then the Court may prohibit the party who did not properly complete the Financial Declaration Form from introducing any evidence at any hearing to contradict the evidence of the other party on the issues of income, expenses, assets, and liabilities.

Date: ____________________________ |

________________________________ |

|

Signature |

XVI. ATTORNEY=S CERTIFICATION: |

|

I have reviewed with my client the foregoing information, including any valuations and attachments, and sign this certificate consistent with my obligation under Trial Rule 11 of the Indiana Rules of Procedure.

Date: ____________________________ |

__________________________________ |

13