Handling PDF files online is certainly a piece of cake with this PDF tool. Anyone can fill in 2011 here and try out a number of other functions we provide. FormsPal is committed to providing you the best possible experience with our tool by constantly presenting new features and upgrades. With all of these improvements, working with our editor becomes better than ever! It merely requires a few easy steps:

Step 1: Click the "Get Form" button at the top of this webpage to open our PDF editor.

Step 2: This tool offers the ability to modify your PDF file in many different ways. Improve it by including your own text, adjust what is originally in the file, and place in a signature - all within the reach of several clicks!

As for the blank fields of this specific document, this is what you should do:

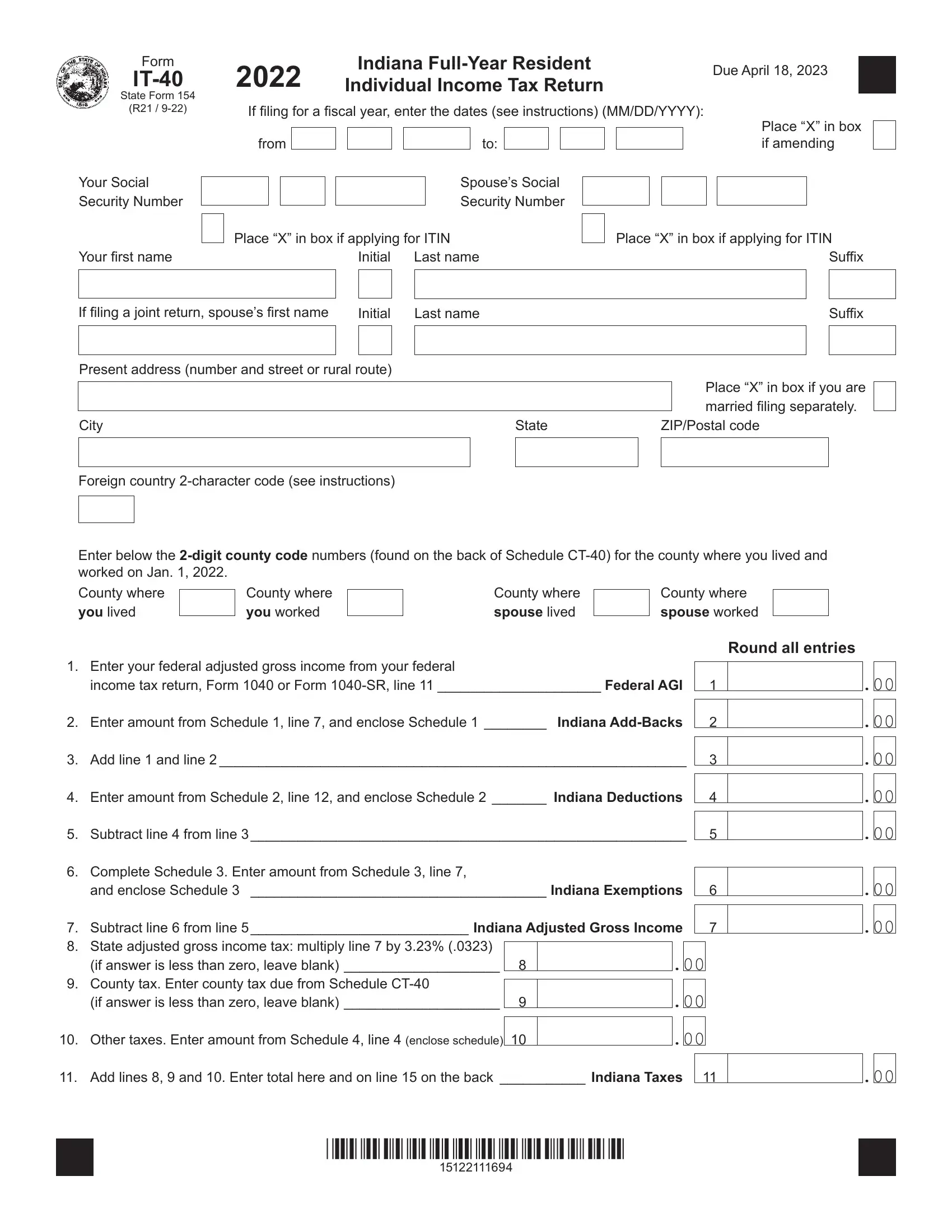

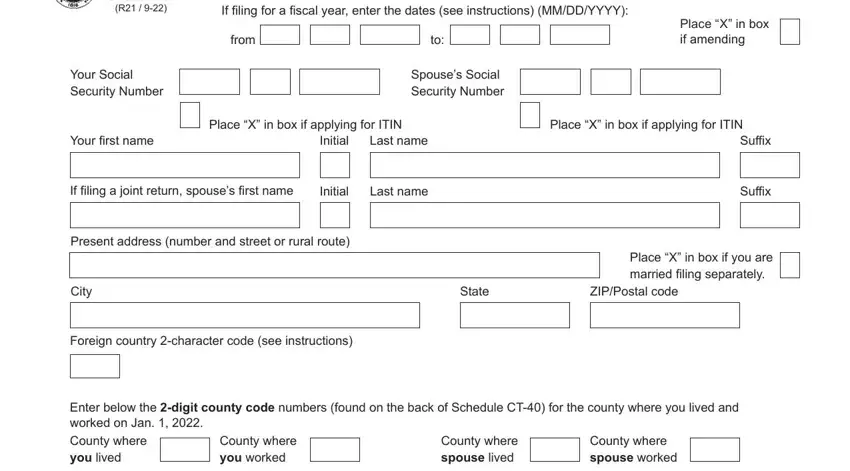

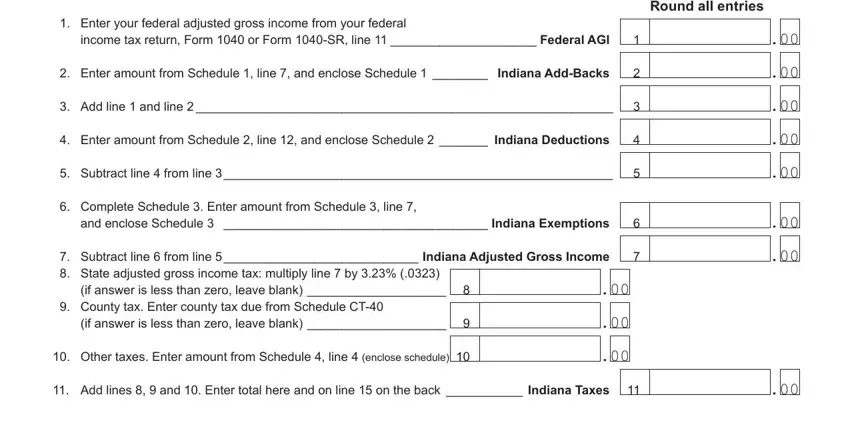

1. First, once completing the 2011, start in the area that has the next blank fields:

2. Once your current task is complete, take the next step – fill out all of these fields - Enter your federal adjusted gross, income tax return Form or Form SR, Enter amount from Schedule line, Round all entries, Add line and line, Enter amount from Schedule line, Subtract line from line, Complete Schedule Enter amount, and enclose Schedule Indiana, Subtract line from line, if answer is less than zero leave, County tax Enter county tax due, if answer is less than zero leave, Other taxes Enter amount from, and Add lines and Enter total here with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

A lot of people generally make mistakes while filling in Enter amount from Schedule line in this area. You should definitely reread what you type in here.

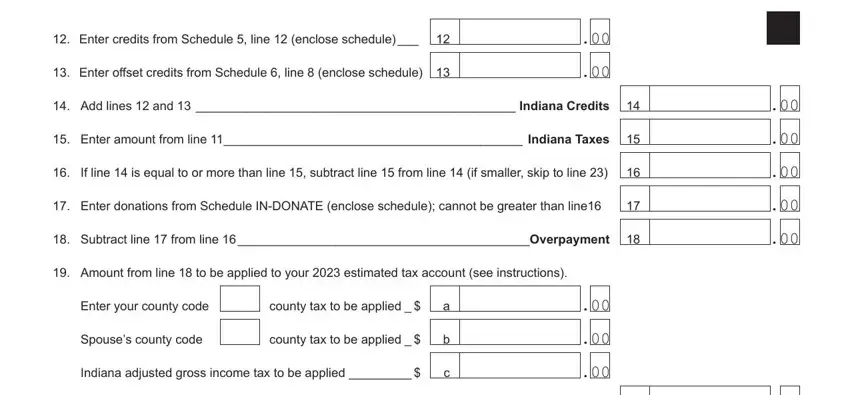

3. The next part is considered fairly straightforward, Enter credits from Schedule line, Enter offset credits from, Add lines and Indiana Credits, Enter amount from line Indiana, If line is equal to or more than, Enter donations from Schedule, Subtract line from line, Amount from line to be applied, Enter your county code, county tax to be applied, Spouses county code, county tax to be applied, and Indiana adjusted gross income tax - every one of these empty fields will need to be filled in here.

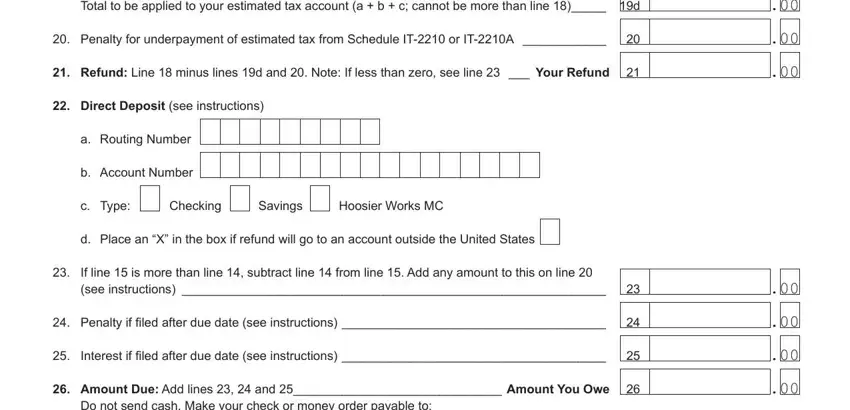

4. You're ready to complete this next section! In this case you've got these Total to be applied to your, Penalty for underpayment of, Refund Line minus lines d and, Direct Deposit see instructions, a Routing Number, b Account Number, c Type, Checking, Savings, Hoosier Works MC, d Place an X in the box if refund, If line is more than line, see instructions, Penalty if filed after due date, and Interest if filed after due date blank fields to fill out.

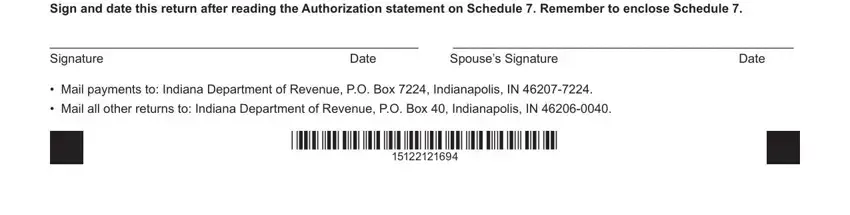

5. The final step to conclude this document is crucial. Make sure that you fill in the required fields, particularly Sign and date this return after, Signature, Date, Spouses Signature, Date, and Mail payments to Indiana, before submitting. Neglecting to do so could generate an unfinished and potentially incorrect paper!

Step 3: Ensure your details are accurate and then simply click "Done" to continue further. Try a 7-day free trial plan with us and get direct access to 2011 - downloadable, emailable, and editable inside your personal cabinet. FormsPal is committed to the confidentiality of our users; we always make sure that all personal data handled by our system remains protected.