tennessee inheritance tax return can be filled in effortlessly. Simply make use of FormsPal PDF editing tool to do the job in a timely fashion. The tool is continually updated by us, receiving new features and growing to be much more convenient. Here's what you'll have to do to start:

Step 1: Hit the "Get Form" button at the top of this webpage to open our PDF editor.

Step 2: This tool allows you to customize your PDF form in many different ways. Improve it by writing your own text, adjust what is originally in the PDF, and add a signature - all within a few mouse clicks!

It's easy to complete the pdf using this practical guide! Here's what you should do:

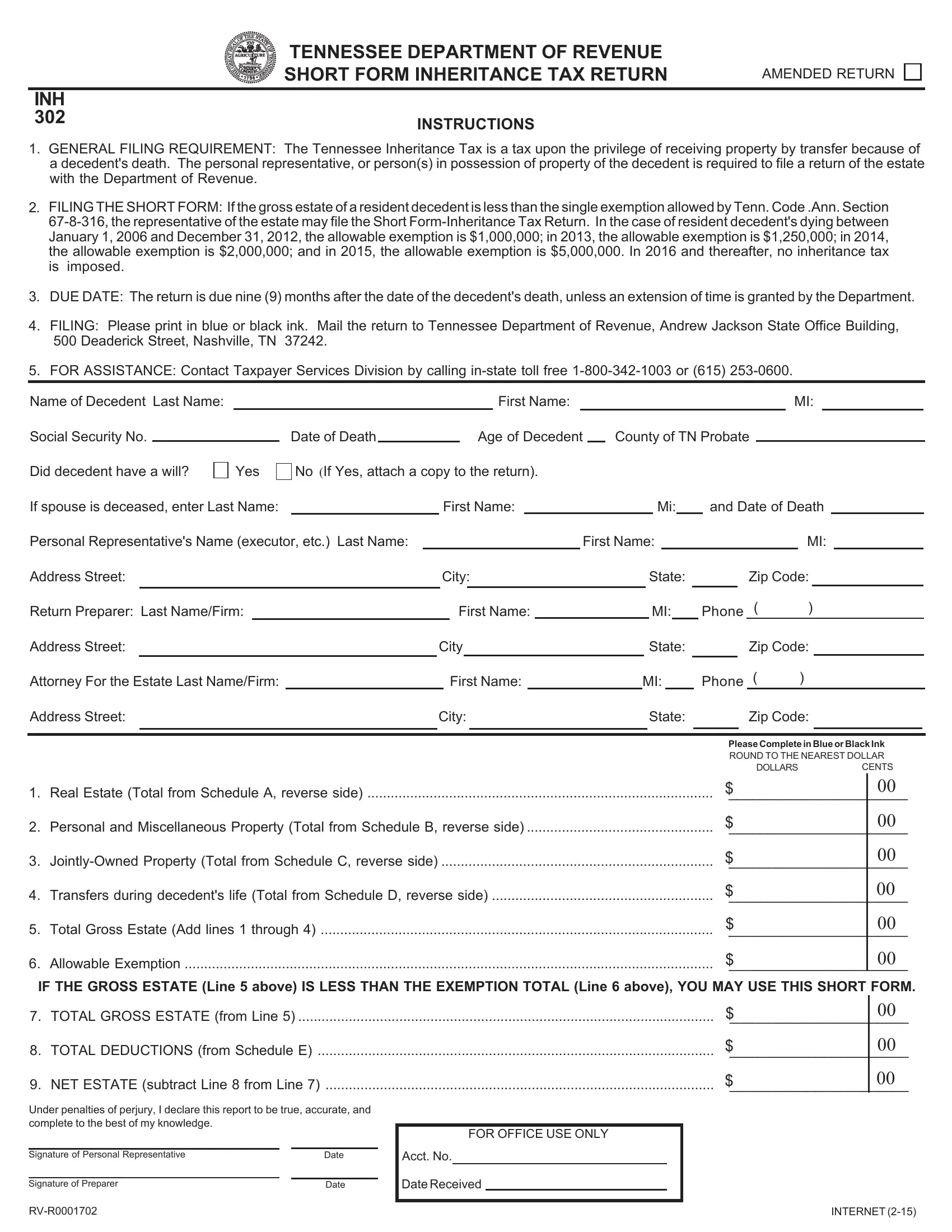

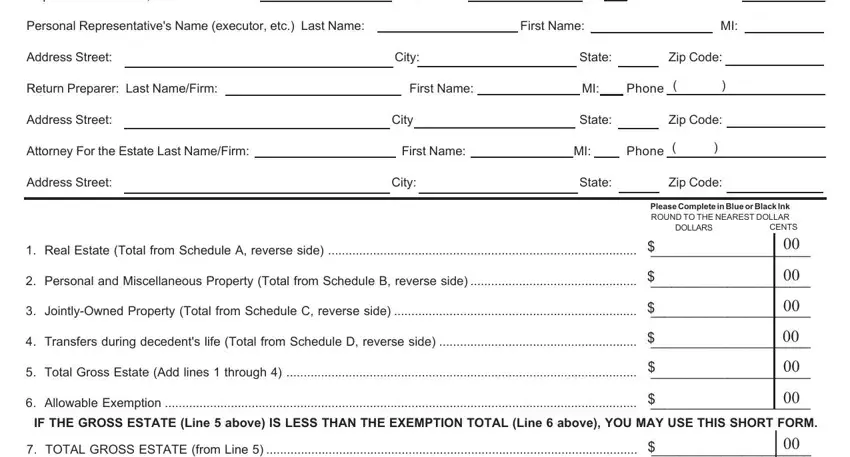

1. The tennessee inheritance tax return usually requires certain information to be inserted. Be sure that the next blank fields are completed:

2. When this section is finished, it's time to put in the needed details in If spouse is deceased enter Last, and Date of Death, Personal Representatives Name, Address Street City State Zip Code, Return Preparer Last NameFirm, Phone, Address Street City State Zip Code, Attorney For the Estate Last, Phone, Address Street City State Zip Code, Please Complete in Blue or Black, Real Estate Total from Schedule A, DOLLARS, CENTS, and Personal and Miscellaneous so you can proceed further.

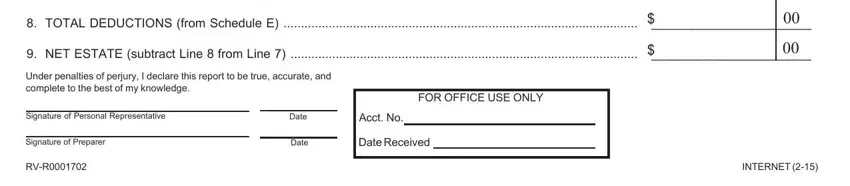

3. This next section should also be fairly easy, TOTAL GROSS ESTATE from Line, TOTAL DEDUCTIONS from Schedule E, NET ESTATE subtract Line from, Under penalties of perjury I, FOR OFFICE USE ONLY, Signature of Personal, Signature of Preparer, RVR, Date, Date, Acct No, Date Received, and INTERNET - all these form fields is required to be completed here.

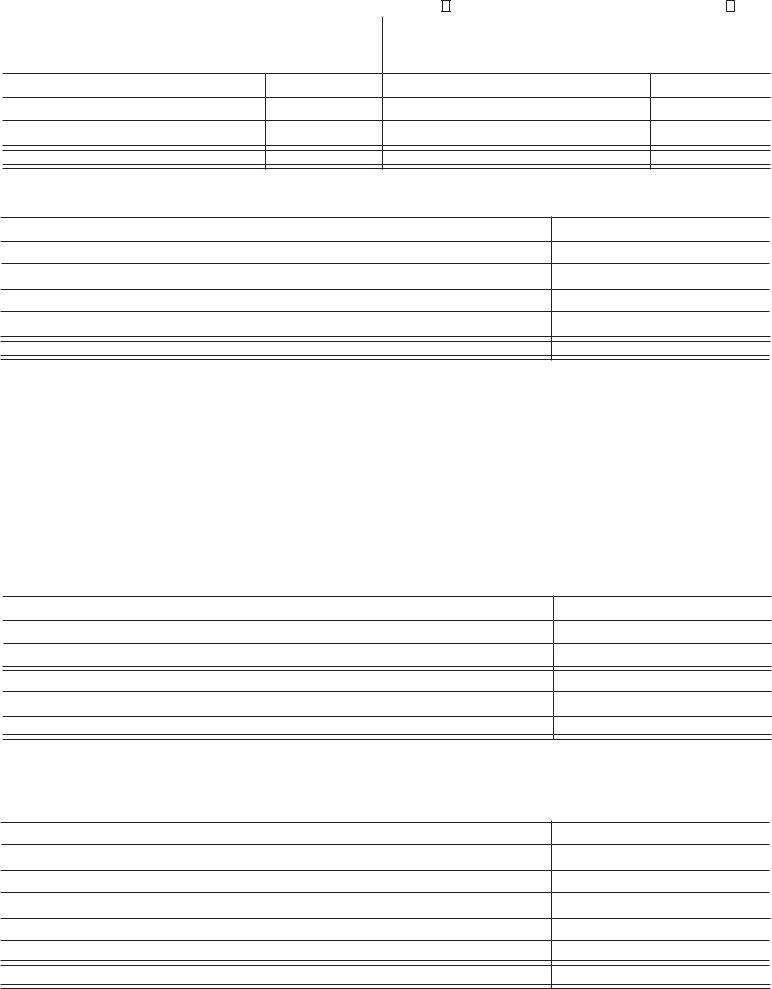

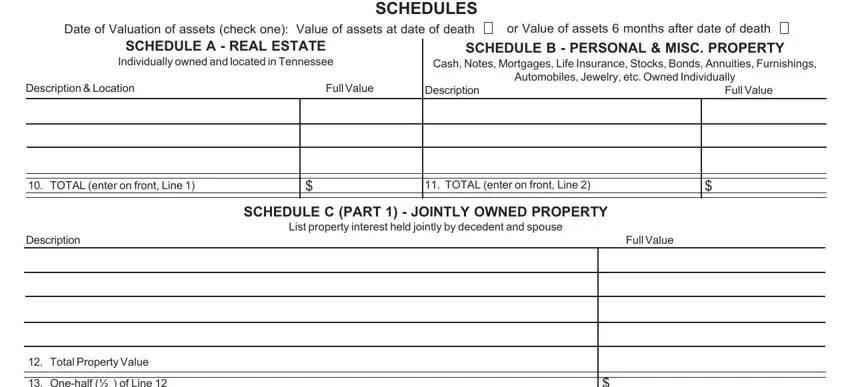

4. Your next paragraph will require your input in the subsequent areas: SCHEDULES Date of Valuation of, or Value of assets months after, SCHEDULE A REAL ESTATE, Individually owned and located in, SCHEDULE B PERSONAL MISC PROPERTY, Cash Notes Mortgages Life, Automobiles Jewelry etc Owned, Description Location, Full Value, Description, Full Value, TOTAL enter on front Line, TOTAL enter on front Line, Description, and Full Value. Make sure you provide all needed info to go forward.

Be very mindful while filling in Individually owned and located in and SCHEDULES Date of Valuation of, as this is the part where many people make some mistakes.

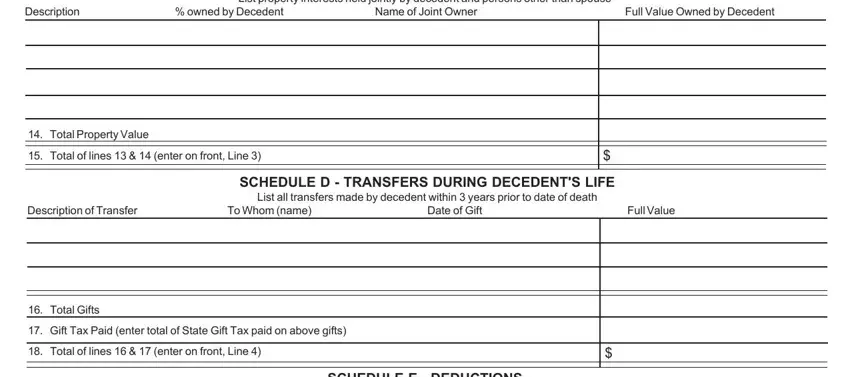

5. This final point to finish this PDF form is pivotal. You'll want to fill out the mandatory fields, like SCHEDULE C PART JOINTLY OWNED, Description, owned by Decedent, Name of Joint Owner, Full Value Owned by Decedent, Total Property Value, Total of lines enter on front, Description of Transfer, To Whom name, Date of Gift, Full Value, SCHEDULE D TRANSFERS DURING, List all transfers made by, Total Gifts, and Gift Tax Paid enter total of, before finalizing. Failing to do so might produce a flawed and possibly unacceptable document!

Step 3: Prior to submitting your file, make certain that blank fields were filled out correctly. When you think it is all fine, click “Done." Try a 7-day free trial account at FormsPal and get direct access to tennessee inheritance tax return - available in your FormsPal cabinet. FormsPal guarantees protected document editor with no data recording or any type of sharing. Be assured that your information is in good hands with us!