The California Earthquake Authority (CEA) Earthquake Insurance Application form is a comprehensive document designed to guide applicants through the process of securing earthquake insurance. The application instructions consist of several critical sections, including the specification of policy effective and expiration dates, which must align with those of a companion policy. The form requires detailed information about the applicant, including contact details and the physical location of the insured property. It also necessitates information on the companion policy, such as the insurer's name, policy number, and dwelling limit of the companion policy, which is crucial for establishing the baseline of coverage needed. Furthermore, the application differentiates between various types of policies—ranging from homeowner to renters insurance—each with unique rating and coverage information requirements. Payment options laid out in the form offer the choice between annual payments and installments, addressing financial flexibility for the insured. Additionally, provisions for documenting additional interests, such as mortgagees or additional insured parties, ensure all stakeholders are appropriately noted. A mandatory signature from the applicant certifies the accuracy of the provided information and avows their application for insurance. Last, but not least, it addresses earthquake-specific considerations, such as unrepaired structural damage, that could affect policy eligibility. Overall, this form serves as a pivotal step in obtaining earthquake insurance, reflecting the complexity and importance of accurate and thorough documentation in the process.

| Question | Answer |

|---|---|

| Form Name | Insurance Application Cea Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | earthquake cea application, information earthquake expiration, earthquake instructions cea form, name earthquake cea make |

CALI FORNI A EARTHQUAKE AUTHORI TY

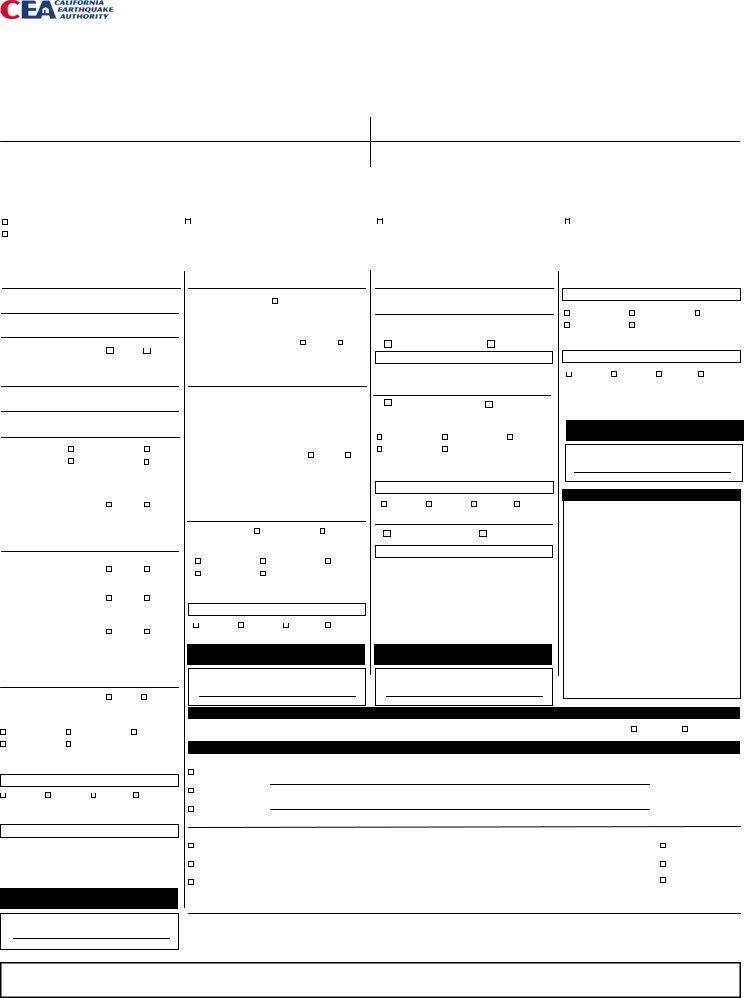

EARTHQUAKE I NSURANCE APPLI CATI ON I NSTRUCTI ONS

POLI CY EFFECTI VE DATE AND EXPI RATI ON DATE

Provide CEA policy effective date and expiration date. Expiration dat e must be the same as the expiration date of the companion policy.

APPLI CANT

Complete all requested information for applicant(s) including:

Name(s)

Telephone number(s)

Street address of physical location of insured propert y

Mailing address (if different from street address of property’s physical location)

COMPANI ON POLI CY I NFORMATI ON

Complete all requested information for companion policy including:

Name of Participating I nsurer

Policy number of companion policy

Dwelling limit (i.e., Coverage A) of companion policy (if companion policy has dwelling limit)

Expiration dat e of companion policy

Type of companion policy

POLI CY TYPE – RATI NG AND COVERAGE I NFORMATI ON

I dentify CEA policy t ype based on the t ype of companion policy as follows:

•Homeow ner (Companion policy must be either a Homeowners

O M an u f act u r ed Ho m e ( M o b ileh o m e) (Written on CEA Homeowner Policy form; however, requires unique rating information.)

Condominium ( i.e. Common I nterest Development) ( Companion policy must be a Condominium Unit Owners

Renters (Companion policy must be a Renters

Complete all information requested under the applicable CEA policy type. Select desired CEA policy limits and coverage options.

PAYMENT OPTI ONS

Select payment option:

Annual; or I nstallment s

SEND BI LL TO

Select who should receive the bill:

I nsured; or

Mortgagee

ADDI TI ONAL I NTERESTS

Complete information requested for each additional interest, including:

Type:

OMortgagee;

OAdditional insured; or

OLoss payee

Name and address

Loan number (if applicable)

REMARKS

I nclude any additional remarks as needed.

SI GNATURE

Secure the applicant’s signature on the applicat ion, the date, and time the application is complet ed. Provide the producer’s name, address and license number.

CEA Earthquake Insurance Application Instructions 01/2012 Revision

|

Earthquake Insurance Application |

Effective Date |

|

Expiration Date |

|||||

Applicant Information |

|

|

|

|

|

|

|

|

|

Applicant |

|

|

|

|

Telephone Numbers |

|

|

|

|

Last Name |

First Name |

|

Middle Initial |

Home |

|

Work |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Numbers |

|

|

|

|

|

Last Name |

First Name |

|

Middle Initial |

Home |

|

Work |

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address of Physical Location of Insured Property |

|

|

Mailing Address (if different) |

|

|

|

|

|

|

Number and Street Address |

|

|

Unit |

Number and Street Address |

|

|

|

Unit |

|

City |

State |

ZIP Code |

County |

City |

|

State |

ZIP Code |

Country |

|

|

|

|

|

|

|

|

|

|

|

Companion Policy Information |

|

|

|

|

|

|

|

|

|

Participating Insurer |

Companion Policy Number |

|

Dwelling — Coverage A Limit |

|

Expiration Date (must be same as CEA policy) |

|

|||

|

|

|

|

|

|

|

|

|

|

Type of Policy |

|

|

|

|

|

|

|

|

|

Homeowner |

Manufactured Home/Mobilehome |

Condominium |

|

|

Renters |

|

|

||

Dwelling Fire |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Homeowners/Dwelling Fire |

Manufactured Home/Mobilehome |

Condominium |

|

|

Renters |

|

|||

Basic Program |

|

Basic Program |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rating Territory

Year Built

Number of Stories,

Including Basement

Construction Type |

Frame Other |

|

|

Number of Chimneys

Square Footage

Foundation Type Raised Slab Other

Roof Type |

Composition |

Tile |

|

|

Wood Shake |

Other |

|

|

|

|

|

Is there unrepaired |

|

|

|

structural earthquake |

|

|

|

damage to the dwelling? |

Yes |

No |

|

If yes, DO NOT BIND and explain in Remarks

NOTE: Inspections are required on all properties with existing

Dwelling secured to |

Yes |

No |

|

foundation? |

|||

|

|

||

|

|

|

|

Cripple walls braced with |

Yes |

No |

|

plywood or equivalent? |

|||

|

|

||

|

|

|

|

Water heater secured to |

Yes |

No |

|

building frame? |

|||

|

|

||

|

|

||

Dwelling — Coverage A |

|

||

Dwelling Limit $ |

|

|

|

Same as Companion Policy |

|

|

|

Rating Territory

Construction Type |

Manufactured or Mobile |

||

|

|

|

|

Is there unrepaired |

|

|

|

structural earthquake |

|

|

|

damage to the dwelling? |

Yes |

No |

|

If yes, DO NOT BIND and explain in Remarks NOTE: Inspections are required on all properties with existing

Is the home reinforced by an |

|

|

|

earthquake resistant bracing |

|

|

|

system or installed upon an |

|

|

|

approved foundation system |

|

|

|

certified by the California |

|

|

|

Department of Housing and |

|

|

|

Community Development? |

Yes |

No |

|

If yes, attach a copy of the certification |

|||

|

|

|

|

|

Dwelling — Coverage A |

|

|

Dwelling Limit $ |

|

|

|

Same as Companion Policy |

|

|

|

Deductible |

15% |

|

10% |

|

|||

Personal Property — Coverage C |

|||

$5,000 |

$25,000 |

|

$50,000 |

$75,000 |

$100,000 |

|

|

No deductible for this coverage if Coverage A deductible is met. No coverage if Coverage A deductible is not met.

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

$25,000 |

No deductible for this coverage

Manufactured Home/Mobilehome

Basic Program Annual Premium

Rating Territory

Number of Stories in building

Choose any combination of one or more

of the following options

Option One |

Decline |

Building Property — Coverage A

Real Property — $25,000

There is a $3,750 deductible for this coverage

Option Two |

|

Decline |

|

||

Personal Property — Coverage C |

||

$5,000 |

$25,000 |

$50,000 |

$75,000 |

$100,000 |

|

There is a $750 deductible for this coverage

«AND »

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

$25,000 |

|

No deductible for this coverage |

|

|

Option Three |

Decline |

|

|

Loss Assessment — Coverage E

$25,000

$3,750 deductible

Only available if value of property is $135,000 or less

$50,000

$7,500 deductible

$75,000

$11,250 deductible

Condominium

Annual Premium

Rating Territory

Personal Property — Coverage C

$5,000 |

$25,000 |

$50,000 |

$75,000 |

$100,000 |

|

There is a $750 deductible for this coverage

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

$25,000 |

|

No deductible for this coverage |

|

|

Renters

Annual Premium

$

Remarks

$ |

$ |

Deductible |

15% |

10% |

|

||

Personal Property — Coverage C |

||

$5,000 |

$25,000 |

$50,000 |

$75,000 |

$100,000 |

|

No deductible for this coverage if Coverage A deductible is met. No coverage if Coverage A deductible is not met.

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

$25,000 |

No deductible for this coverage

— optional —

Additional Limited Building Code Upgrade

Premium Calculation

Please reference the latest Rate Manual for the applicable Premium Calculation tables.

Additional Interests

|

Name |

Loan Number |

|

Mortgagee |

|

|

|

Additional Insured Address |

|

|

|

Loss Payee |

City |

State |

ZIP Code |

|

|||

|

Name |

Loan Number |

|

Payment Options

Annual |

Installments |

Send Bill To

Insured

Mortgagee

Increase Limited Building Code Upgrade coverage from $10,000 to a total limit of $20,000

No deductible for this coverage if Coverage A deductible is met. No coverage if Coverage A deductible is not met.

Homeowner/Dwelling Fire

Basic Program Annual Premium

2nd Mortgagee |

|

|

|

Insured |

|

|

|

|

|

Additional Insured Address |

|

|

Mortgagee |

|

Loss Payee |

|

|

|

2nd Mortgagee |

|

City |

State |

ZIP Code |

|

$

I am applying for the insurance indicated, and certify that the information supplied on this application is true and correct.

X

CEA Earthquake Insurance Application 01/2012 |

Applicant Signature |

Producer Name, License Number, and Address |

Application Date and Time |