Our PDF editor was created with the aim of making it as effortless and intuitive as possible. These steps will make completing the tax motor vehicle inventory statement easy and quick.

Step 1: Click the "Get Form Now" button to get started on.

Step 2: The file editing page is right now open. You can include text or change current information.

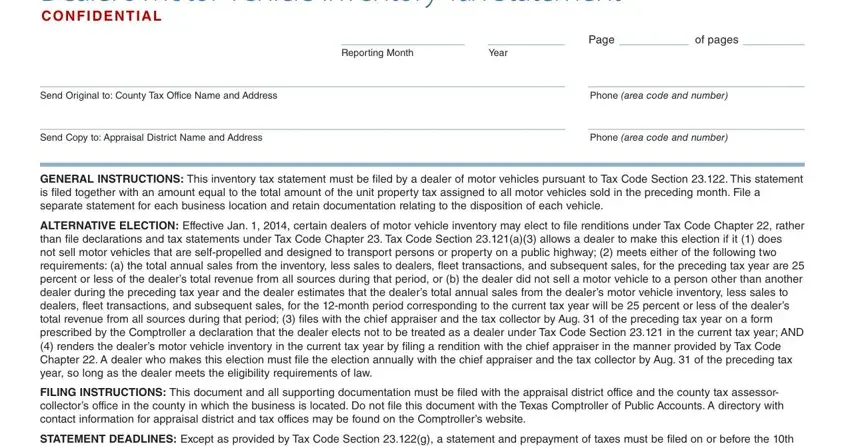

The next sections are what you are going to create to receive the ready PDF file.

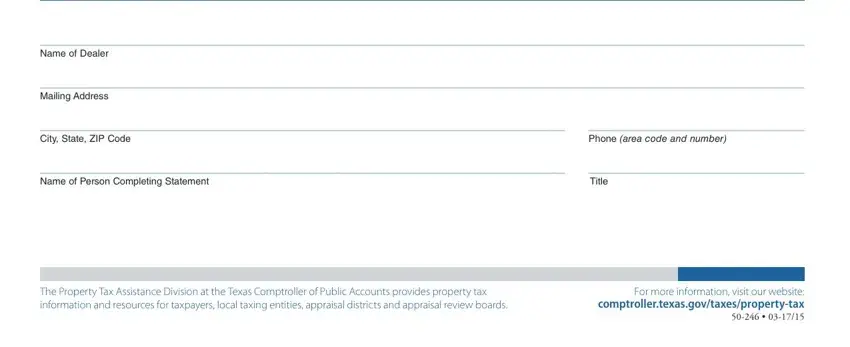

Write down the demanded data in the segment Name of Dealer, Mailing Address, City State ZIP Code, Phone area code and number, Name of Person Completing, Title, The Property Tax Assistance, and For more information visit our.

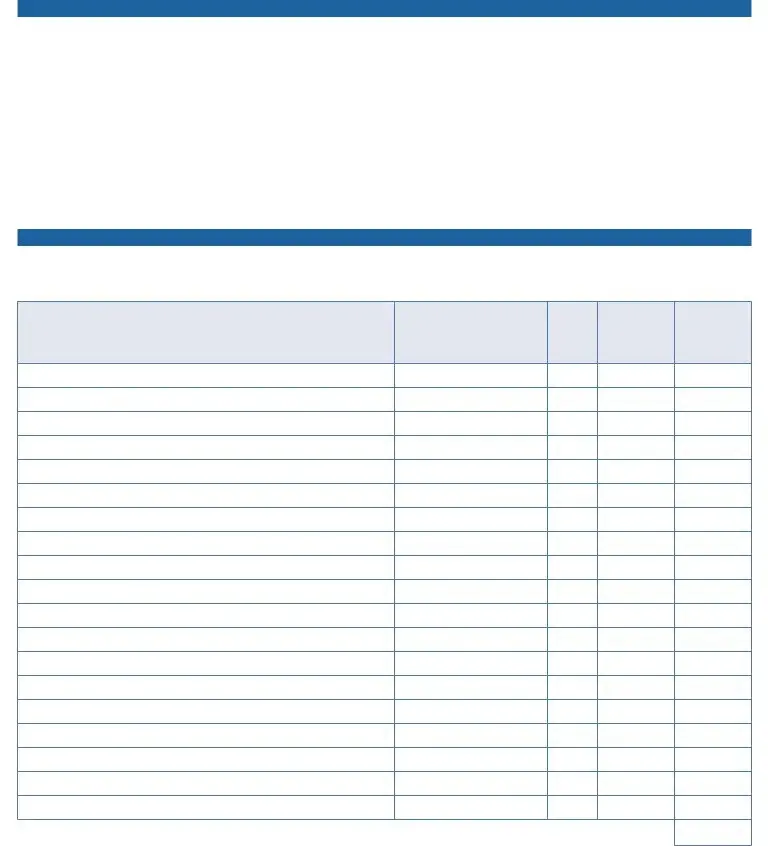

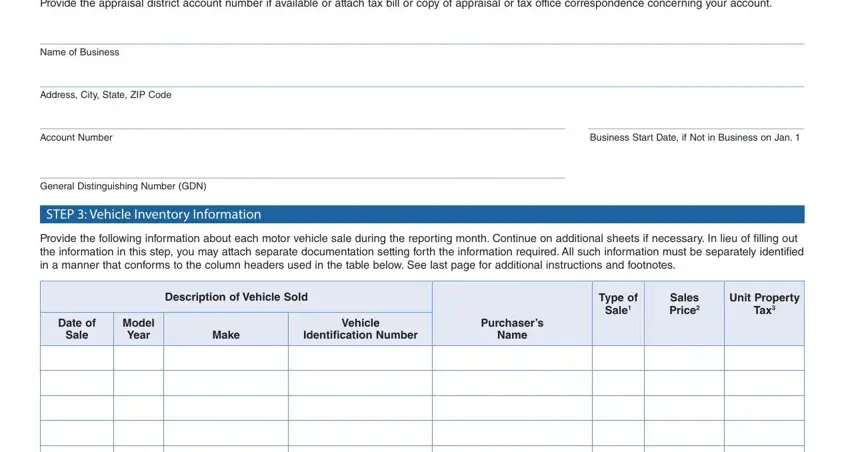

You'll be requested to write down the details to let the application fill out the field Provide the appraisal district, Name of Business, Address City State ZIP Code, Account Number, Business Start Date if Not in, General Distinguishing Number GDN, STEP Vehicle Inventory Information, Provide the following information, Description of Vehicle Sold, Type of Sale, Sales Price, Unit Property Tax, Date of Sale, Model Year, and Make.

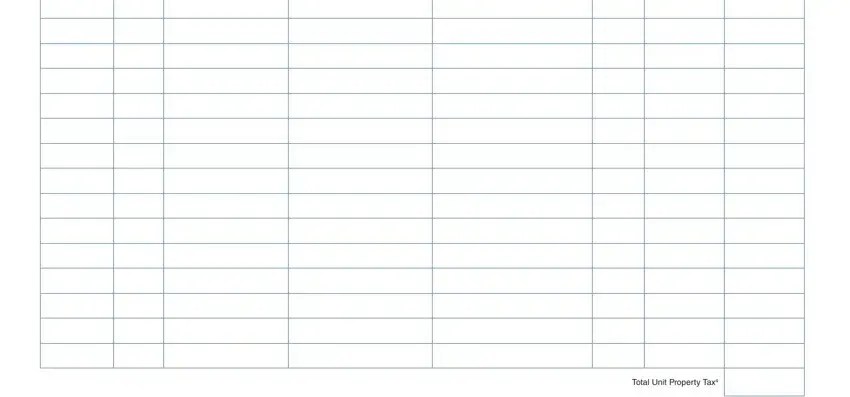

In space Total Unit Property Tax, define the rights and responsibilities.

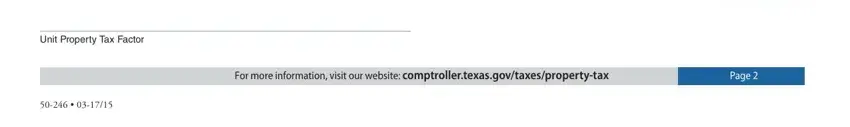

Look at the areas Unit Property Tax Factor, For more information visit our, and Page and then fill them in.

Step 3: Select the Done button to make certain that your finished form could be transferred to any gadget you decide on or delivered to an email you specify.

Step 4: It could be safer to create duplicates of your file. You can rest assured that we will not share or check out your particulars.