In the realm of construction and economic development within Iowa, grasping the details and utility of the Iowa 35 003A form becomes essential. Aimed at a diverse audience, including governmental units, private nonprofit educational institutions, nonprofit museums, businesses in economic development areas, rural water districts, and Habitat for Humanity, this form serves a crucial role in facilitating the refund claims process for sales and use taxes. The form mandates a comprehensive disclosure of project descriptions, the final settlement date of the contract—which underscores the necessity of filing the claim within a one-year window from this date—and the imperative that the contract be in writing. Concerns such as whether a claim has been previously filed for the same project and if tax credit certificates, which necessitate inclusion if a refund is being claimed on their basis, are addressed directly. Furthermore, it specifies the need for a detailed listing of contractors and subcontractors along with their corresponding material purchases and the tax amounts eligible for refund. The meticulous breakdown required for the local option sales tax, per county, highlights the form's role in ensuring accurate tax refund distribution, pointing to its significance in the broader fiscal landscape of Iowa's infrastructure and community development projects.

| Question | Answer |

|---|---|

| Form Name | Iowa Form 35 003A |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | opwa department of revenue form 35 003a, 10-BUCHANAN, 87-TAYLOR, 20-CLARKE |

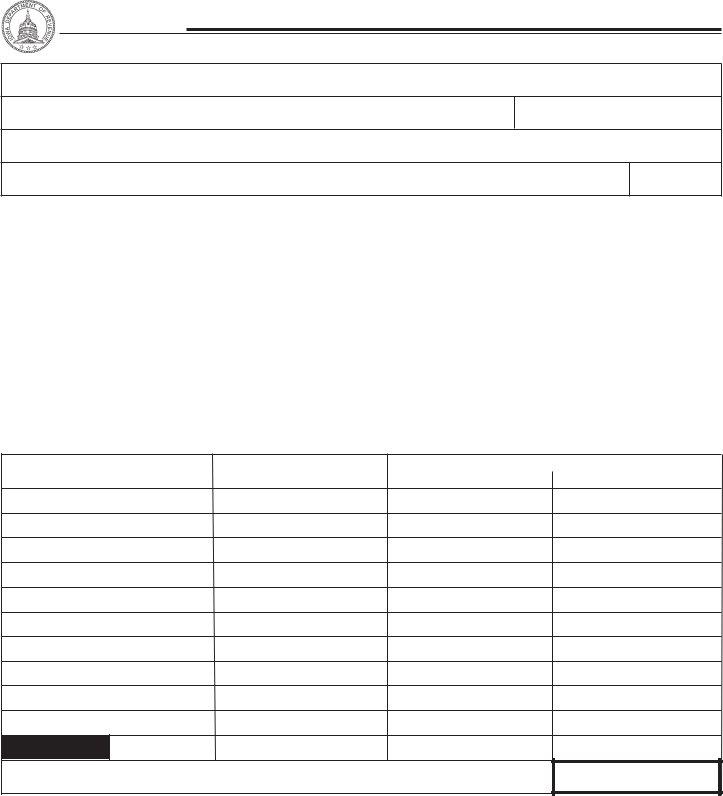

Iowa Department of Revenue

www.iowa.gov/tax

Construction Contract Claim for Refund

NAME OF governmental unit, private nonprofit educational institution, nonprofit museum, business in economic development area, rural water district, or Habitat for Humanity

CURRENT MAILING ADDRESS

FEIN

ADDRESS 2

CITY. STATE, ZIP

COUNTY NO.

1.Description of project: _________________________________________

2.Final settlement date of contract: _____________ Claim must be filed within one year of final settlement.

3. Was contract in writing? ________ If so, date signed: _________________ Contract must be in writing to be eligible

for a refund.

4.Have you previously filed a claim for this project? _______

5.Are you claiming a refund for which you received a tax credit certificate? _______ If yes, a copy of the tax credit certificate must be included with this claim for refund.

Items 1 – 5 and the local option tax summary on the reverse side must be completed before your claim can be processed.

LIST CONTRACTORS AND SUBCONTRACTORS ONLY. ATTACH ADDITIONAL SHEETS IF NEEDED.

NAME OF CONTRACTOR/ |

MATERIAL PURCHASES |

SUBCONTRACTOR |

AMOUNT |

TAX TO BE REFUNDED

Iowa Sales/Use |

Local Option |

SUBTOTALS

TOTAL REFUND DUE: Add Iowa sales/use tax and local option tax columns.

I, the undersigned, declare under penalty of perjury that I have examined this claim, including all attached contractors statements, and, to the best of my knowledge and belief, it is a true, correct, and complete claim. This claim is filed pursuant to section 423.4 Code of Iowa.

Signature: ________________________________________________ Print Name: _______________________________________

Title: __________________________________ Daytime Telephone Number: ______________________ Date: _______________

SUBMIT COMPLETED FORM WITH ORIGINAL CONTRACTOR’S STATEMENTS TO:

TAX MANAGEMENT DIVISION

IOWA DEPARTMENT OF REVENUE

PO BOX 10465

DES MOINES IA

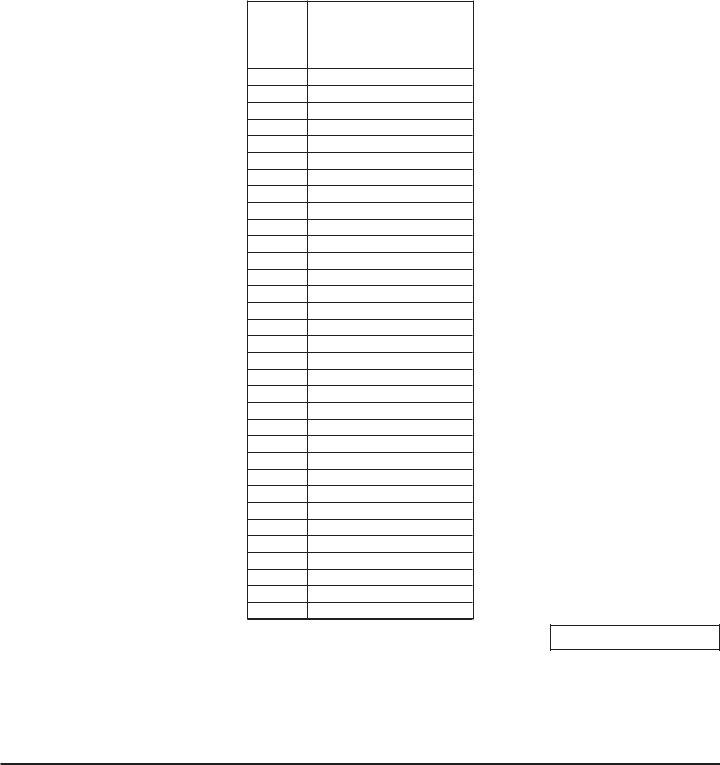

Local Option Tax Summary

Construction Contract Claim for Refund

County |

|

Number |

Local Option Sales Tax |

|

|

01 |

|

|

|

02 |

|

|

|

03 |

|

|

|

04 |

|

|

|

05 |

|

|

|

06 |

|

|

|

07 |

|

|

|

08 |

|

|

|

09 |

|

|

|

10 |

|

|

|

11 |

|

|

|

12 |

|

|

|

13 |

|

|

|

14 |

|

|

|

15 |

|

|

|

16 |

|

|

|

17 |

|

|

|

18 |

|

|

|

19 |

|

|

|

20 |

|

|

|

21 |

|

|

|

22 |

|

|

|

23 |

|

|

|

24 |

|

|

|

25 |

|

|

|

26 |

|

|

|

27 |

|

|

|

28 |

|

|

|

29 |

|

|

|

30 |

|

|

|

31 |

|

|

|

32 |

|

|

|

33 |

|

|

|

County |

|

Number |

Local Option Sales Tax |

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

County |

|

Number |

Local Option Sales Tax |

|

|

67 |

|

|

|

68 |

|

|

|

69 |

|

|

|

70 |

|

|

|

71 |

|

|

|

72 |

|

|

|

73 |

|

|

|

74 |

|

|

|

75 |

|

|

|

76 |

|

|

|

77 |

|

|

|

78 |

|

|

|

79 |

|

|

|

80 |

|

|

|

81 |

|

|

|

82 |

|

|

|

83 |

|

|

|

84 |

|

|

|

85 |

|

|

|

86 |

|

|

|

87 |

|

|

|

88 |

|

|

|

89 |

|

|

|

90 |

|

|

|

91 |

|

|

|

92 |

|

|

|

93 |

|

|

|

94 |

|

|

|

95 |

|

|

|

96 |

|

|

|

97 |

|

|

|

98 |

|

|

|

99 |

|

|

|

Total Local Option Sales Tax

Instructions: |

Report the total local option sales tax as found on all the contractor’s statements attached to this claim for refund. They must be |

|

broken down by county in order to process your claim. The totals should match the local option sales tax subtotal on the front side |

|

of the form. This information is necessary to make appropriate distributions of the local option sales tax. Failure to provide this |

|

breakdown will delay processing of your refund claim. |

IOWA COUNTIES AND COUNTY NUMBERS

|

|

|

|

|

|