Understanding the Iowa 54 130A form is key for residents who wish to claim rent reimbursement, a helpful financial relief program administered by the Iowa Department of Revenue and Finance. Designed to support individuals by offsetting a portion of the rent they've paid within the state, this form is pivotal for claimants in 2003 for the rent paid in the year 2002. To be eligible, applicants must have been either 65 years or older by the end of 2002 or totally disabled and aged 18 or over, alongside other criteria such as residency requirements and income limits. The form itself requires detailed information including personal identification, household income, rental period, and the total rent paid, with the ultimate goal of calculating a reimbursement that can go up to $1,000 based on the allowable percentage and rate determined by the state. Ensuring accuracy is crucial as any errors or incomplete information can delay the processing of the reimbursement. Additionally, the back of the form contains essential worksheets and rates tables that assist in the correct calculation of the amount to be reimbursed. Getting to grips with the intricacies of the Iowa 54 130A form is the first step towards making a successful rent reimbursement claim.

| Question | Answer |

|---|---|

| Form Name | Iowa Form 54 130A |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | fia54 130[0702] iowa form 54 130a |

I OWA

department of Revenue and Finance IOWA RENT REIMBURSEMENT CLAIM www.state.ia.us/tax

2002 TO BE FILED IN 2003

File early to receive your rent reimbursement sooner.

Claimant’s Last Name |

First Name |

|

Claimant’s Social Security Number |

Claimant’s Birth Date |

|

County |

|||

|

|

|

/ |

/ |

/ |

/ |

|

Number |

|

Spouse’s Last Name |

First Name |

|

Spouse’s Social Security Number |

|

|

|

|||

|

Month Day |

Year |

|

___ |

___ |

||||

|

|

|

/ |

/ |

|

||||

|

|

|

|

|

|

|

|

||

Mailing Address |

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt #, Lot #, Suite#, PO Box |

|

Apt #, Lot #, Suite# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, Zip Code |

|

City, State, Zip Code |

|

|

|

|

|

||

|

|

|

|

|

Do not write in this space. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANSWER THESE QUESTIONS TO DETERMINE ELIGIBILITY: |

|

|

YES |

NO |

|

||||

1.Did you file a Rent Reimbursement claim last year? _____________________________________

2a. Were you 65 or older 12/31/02? __________________________________________________

2b. Were you totally disabled and 18 or older as of 12/31/02? Attach Proof of Disability _____________

3.Were you a resident of Iowa during any part of 2002? __________________________________

4.Do you presently live in Iowa? ____________________________________________________

5.Were you a resident of a nursing home or care facility during 2002? _________________________

COMPLETE THE WORKSHEET ON THE REVERSE SIDE |

Use Whole Dollars Only |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.Total household income from line K side 2__________________________ |

|

|

|

, |

|

|

|

|

|

. |

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. Rental period in Iowa from ___________ , 2002, to ____________ , 2002 |

|

|

|

|

|

|

|

|

|

|

|

|

||

8. Total rent paid in Iowa for 2002 _________________________________ |

|

|

|

, |

|

|

|

|

|

. |

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9.Allowable percentage _________________________________________________________ X . |

2 |

|

3 |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

10. Multiply line 8 by line 9 (NOT TO EXCEED $1,000) ____________________________ |

|

, |

|

|

|

|

|

. |

0 |

|

0 |

|

||

11. Reimbursement rate from table on reverse side 2 __________________________________ X |

|

|

|

|

|

|

|

|||||||

|

|

. |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

12.This is yourreimbursement(multiplyline10 byline 11) ____________________ |

|

, |

|

|

|

|

|

. |

0 |

|

0 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.Name of apartment, nursing home or facility: ____________________________________________________

Landlord: Name _______________________________________ Telephone ( ______ ) ______________

Address: ______________________________________________________________________

City, State, Zip Code: ____________________________________________________________

14.I declare under penalty of perjury that I have reviewed this claim and to the best of my knowledge and belief, it is true, correct and complete.

________________________________________ |

_________ |

_________________________________ |

Claimant’sSignature |

Date |

Preparer’s Signature |

( _________ ) ___________________________ |

|

( __________ ) ___________________ |

Claimant’sTelephoneNumber |

|

Preparer’s Telephone Number |

Review your claim for accuracy. Incomplete claims and errors will delay processing of your reimbursement check.

Side 1 |

IT MAY TAKE AS LONG AS 14 WEEKS TO PROCESS YOUR CLAIM. |

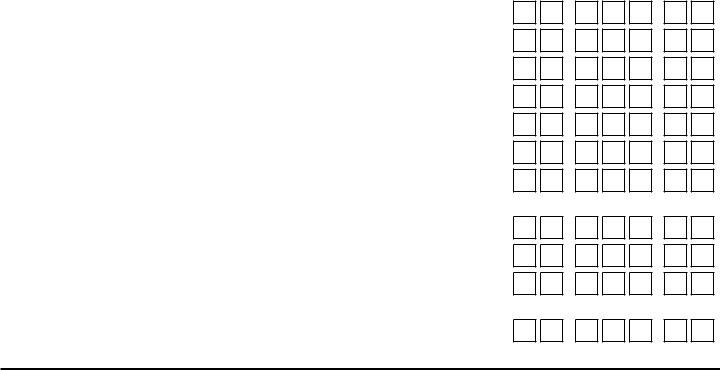

Worksheet for line 6

2002 TOTAL YEARLY HOUSEHOLD INCOME

“Household income” includes the income of the claimant, the claimant’s spouse and monetary contributions received from other persons living with the claimant.

Use Whole DOLLARS Only

A. Wages, salaries, tips, etc. ________________________________________

B. Rent subsidy/utilities assistance____________________________________

C. Title 19 Benefits for housing only (see instructions) ____________________

D. Social Security income received in 2002 ____________________________

E. Disability income for 2002 _______________________________________

F.All pensions and annuities from 2002 _______________________________

G. Interest and dividend income from 2002 ____________________________

H. Profit from business and/or farming and capital gains

if less than zero, enter 0 (see instructions) ________________________

I.Actual money received from others living with you in 2002 (see instructions) _ J. Other income (read instructions before making this entry) _______________

K. ADD amounts on lines

This is your total household income

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

|

|

|

|

, |

. |

0 |

0 |

REIMBURSEMENT RATE TABLE FOR LINE 11

If your total household income from Line K above is:

$ 0.00 |

- |

9,060.99 |

enter 1.00 on Line 11, Side 1 |

9,061 |

- |

10,126.99 |

enter 0.85 on Line 11, Side 1 |

10,127 |

- |

11,192.99 |

enter 0.70 on Line 11, Side 1 |

11,193 |

- |

13,324.99 |

enter 0.50 on Line 11, Side 1 |

13,325 |

- |

15,456.99 |

enter 0.35 on Line 11, Side 1 |

15,457 |

- |

17,588.99 |

enter 0.25 on Line 11, Side 1 |

17,589 or greater |

no reimbursement allowed |

||

|

|

|

|

For assistance in completing this form, call

|

Where’s my refund check? |

Call |

|

|

|

You must provide claimant’s Social Security Number |

|

|

|

and date of birth when calling |

|

|

Mail this form to: |

IOWA DEPARTMENT OF REVENUE AND FINANCE |

|

|

|

RENT REIMBURSEMENT PROCESSING |

|

|

|

PO BOX 10459 |

|

|

|

DES MOINES IA |

|

|

Claims must be filed no later than June 1, 2003, unless the Director of Revenue and Finance |

||

Side 2 |

has granted an extension of the time to file through December 31, 2004. |

||