Making use of the online editor for PDFs by FormsPal, you'll be able to fill in or modify iowa rent reimbursement here and now. We at FormsPal are devoted to making sure you have the best possible experience with our tool by regularly releasing new capabilities and upgrades. Our editor is now much more user-friendly thanks to the latest updates! Now, filling out documents is simpler and faster than before. If you are looking to get going, this is what it's going to take:

Step 1: Click the "Get Form" button above. It's going to open our editor so that you can start completing your form.

Step 2: As you start the tool, there'll be the form all set to be completed. In addition to filling out different fields, you may as well do other things with the PDF, specifically adding any words, modifying the initial text, inserting images, putting your signature on the form, and more.

This document will need specific details to be filled out, so you need to take your time to type in what's asked:

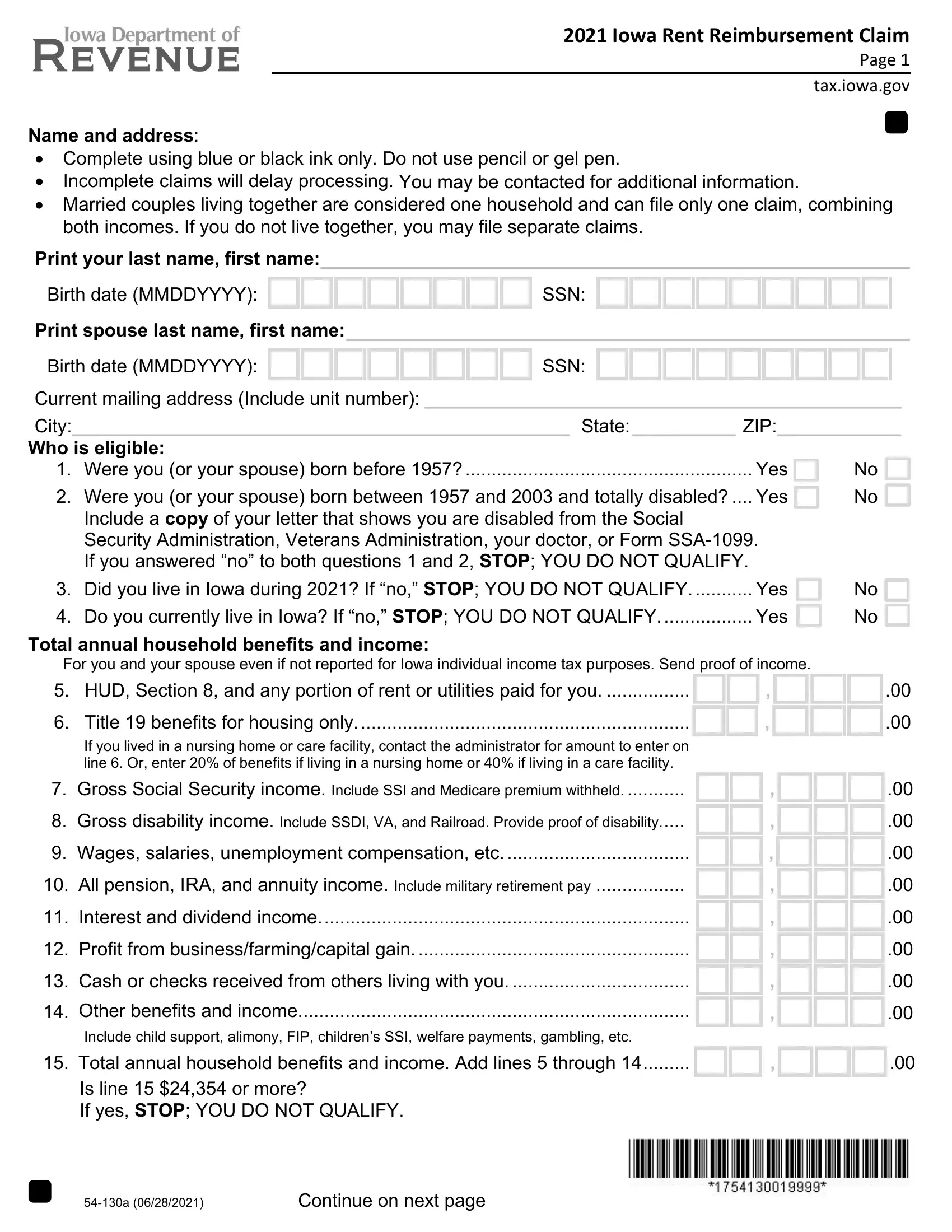

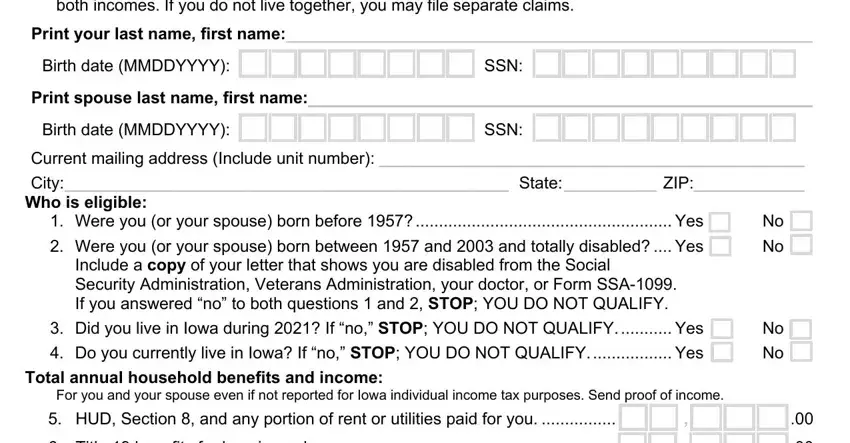

1. To begin with, when filling in the iowa rent reimbursement, beging with the page that has the following fields:

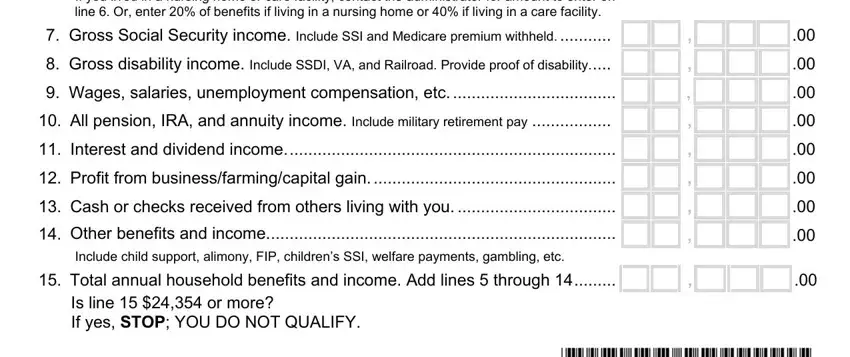

2. The third stage is usually to fill in all of the following fields: Title benefits for housing only, Gross Social Security income, Gross disability income Include, Wages salaries unemployment, All pension IRA and annuity, Interest and dividend income, Profit from, Cash or checks received from, Other benefits and income, Include child support alimony FIP, Total annual household benefits, and Is line or more If yes STOP YOU.

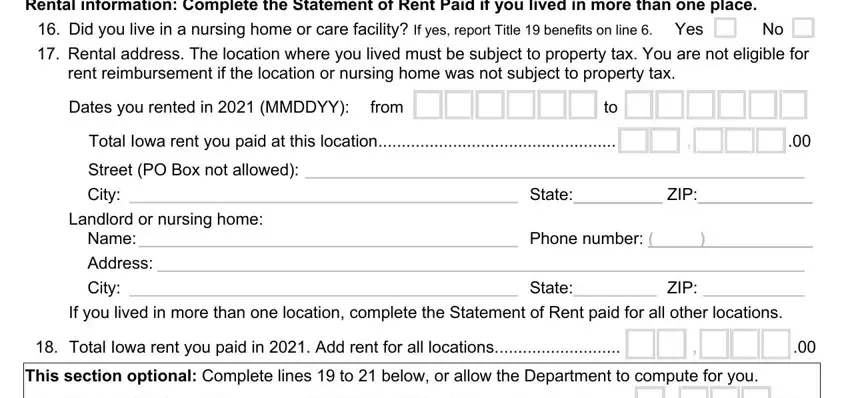

3. The following step is related to Rental information Complete the, Did you live in a nursing home or, rent reimbursement if the location, Dates you rented in MMDDYY, from, Total Iowa rent you paid at this, Street PO Box not allowed City, ZIP, Landlord or nursing home, Name Phone number Address City, If you lived in more than one, Total Iowa rent you paid in Add, and This section optional Complete - type in these empty form fields.

Lots of people generally make errors when filling in Landlord or nursing home in this part. You need to double-check what you enter right here.

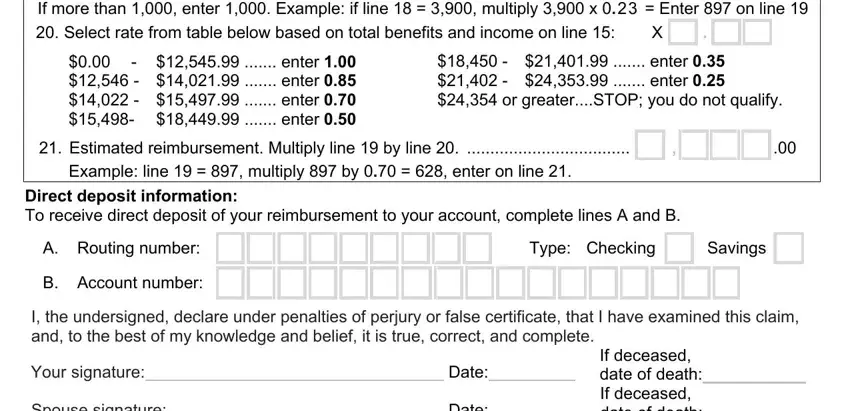

4. To go forward, this step will require typing in a few blank fields. Included in these are Rent eligible for reimbursement, enter enter enter, enter enter or, Estimated reimbursement Multiply, Example line multiply by, Direct deposit information To, A Routing number, B Account number, Type Checking, Savings, I the undersigned declare under, Your signature, Spouse signature, Date, and Date, which are fundamental to continuing with this PDF.

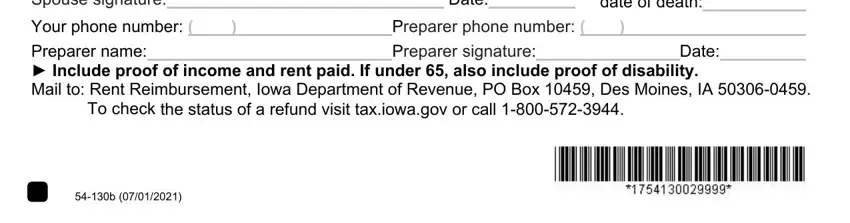

5. Because you near the finalization of the document, there are actually just a few extra things to undertake. Mainly, Spouse signature, Date, If deceased date of death If, Your phone number Preparer name, Preparer phone number Preparer, Date, and To check the status of a refund should be filled out.

Step 3: Make certain the information is accurate and press "Done" to proceed further. Right after registering afree trial account with us, you will be able to download iowa rent reimbursement or email it directly. The file will also be available through your personal cabinet with your edits. FormsPal guarantees risk-free document editor without personal data record-keeping or distributing. Rest assured that your data is safe with us!