Navigating through employment and taxation can be a complex journey filled with various official documents, each serving its crucial role in ensuring compliance with the nation's tax laws. Among these essential documents, the IRP5 form stands as a fundamental bridge between employers, employees, and the South African Revenue Service (SARS). This document is designed to provide a comprehensive overview of an individual's earnings and the taxes deducted by the employer throughout the tax year. The versatility of the IRP5 allows employers to include their logo, ensuring a personalized touch while strictly prohibiting the use of the SARS logo to maintain integrity and avoid confusion. Detailed within its structure are sections dedicated to employer and employee information, including official names, identification numbers, and addresses, all tailored to authenticate the employer-employee relationship and facilitate accurate tax reporting. Furthermore, it encapsulates a broad spectrum of income sources, deductions, and tax calculation information, meticulously coded for streamlined processing and auditing purposes. As a certificate of employees' tax, it plays a vital role in an individual’s tax assessment and serves as a key document for tax submissions. Understanding the intricacies of the IRP5 is imperative for both employers and employees, as it not only reflects income and taxes for the given year but also safeguards against potential tax disputes, making it a cornerstone document within the realm of financial and tax management.

| Question | Answer |

|---|---|

| Form Name | IRP-5 Form |

| Form Length | 1 pages |

| Fillable? | Yes |

| Fillable fields | 74 |

| Avg. time to fill out | 15 min 7 sec |

| Other names | rp5 form, sars irp5 form, where can i download my irp5, ipr5 |

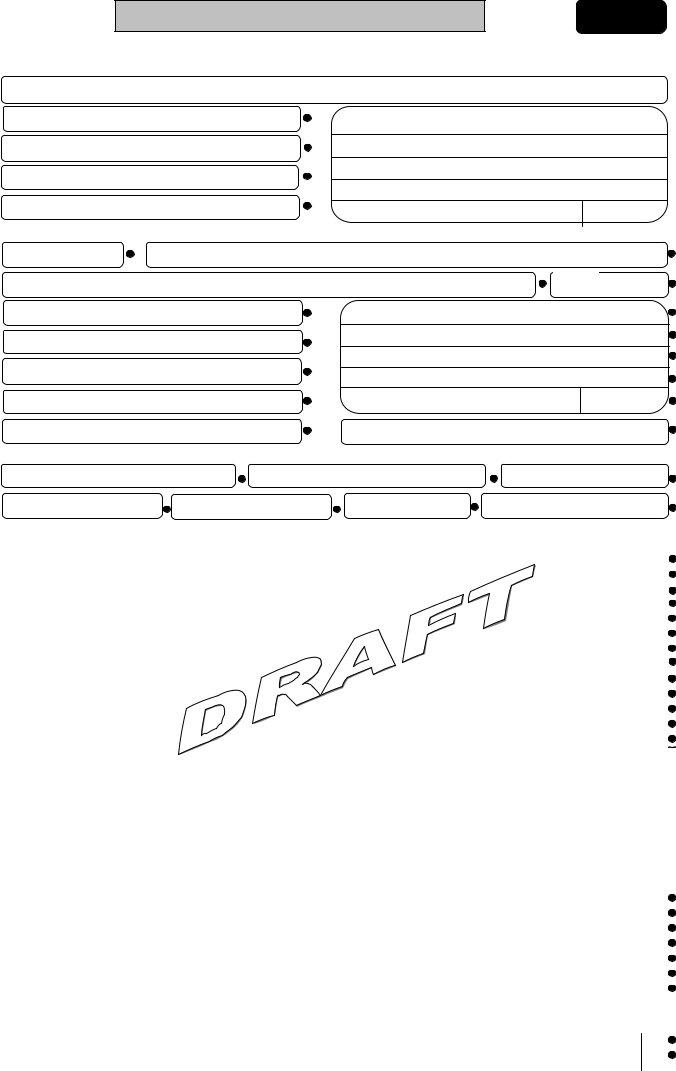

The employer may use his/her own logo. |

IRP 5 |

Under no circumstances may the employer use the SARS logo |

EMPLOYEES TAX CERTIFICATE / WERKNEMERSBELASTINGSERTIFIKAAT

EMPLOYER INFORMATION / WERKGEWER INLIGTING

TRADING OR OTHER NAME

HANDELS- OF ANDER NAAM

IRP 5 NUMBER |

|

00000001 |

|

EMPLOYER BUSINESS ADDRESS / WERKGEWER BESIGHEIDSADRES |

IRP 5 NOMMER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REFERENCE NUMBER

VERWYSINGSNOMMER

TAX YEAR

BELASTINGJAAR

EMPLOYER ENJOYS DIPLOMATIC INDEMNITY WERKGEWER GENIET DIPLOMATIEKE VRYWARING

POSTAL CODE POSKODE

EMPLOYEE INFORMATION / WERKNEMER INLIGTING

NATURE OF PERSON AARD VAN PERSOON

FIRST TWO NAMES EERSTE TWEE NAME

IDENTITY NUMBER IDENTITEITSNOMMER

PASSPORT NUMBER PASPOORT NOMMER

DATE OF BIRTH GEBOORTEDATUM

EMPLOYEE SURNAME OR TRADING NAME WERKNEMER SE VAN OF HANDELSNAAM

INITIALS

VOORL

EMPLOYEES RESIDENTIAL ADDRESS / WERKNEMER SE RESIDENSIëLE ADRES

COMPANY / CC /TRUST NUMBER MAATSKAPPY / CC / TRUST NOMMER

INCOME TAX NUMBER INKOMSTEBELASTINGNOMMER

POSTAL CODE

POSKODE

EMPLOYEE NUMBER

WERKNEMERNOMMER

TAX CALCULATION INFORMATION / BELASTING BEREKENING INLIGTING

PERIOD EMPLOYED FROM TYDPERK IN DIENS VANAF

PAY PERIODS IN TAX YEAR PERIODES IN BELASTINGJAAR

|

PERIOD EMPLOYED TO |

|

|

|

|

VOLUNTARY |

||

|

TYDPERK IN DIENS TOT |

|

|

|

|

VRYWILLIGE |

||

|

|

|

|

|

|

|

|

|

NUMBER OF PAY PERIODS WORKED |

|

FIXED RATE INCOME |

|

DIRECTIVE NUMBER |

|

|||

AANTAL PERIODES GEWERK |

|

VASTE KOERS INKOMSTE |

|

AANWYSINGNOMMER |

|

|||

|

|

|

|

|

|

|

|

|

INCOME SOURCES / INKOMSTE BRONNE

CODE / KODE |

DESCRIPTION / BESKRYWING |

RF IND / UFD IND |

AMOUNT / BEDRAG |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS REMUNERATION / BRUTO BESOLDIGING

CODE / KODE |

DESCRIPTION / BESKRYWING |

|

AMOUNT / BEDRAG |

3695 |

GROSS TAXABLE ANNUAL PAYMENTS / BRUTO BELASBARE JAARLIKSE BETALINGS |

|

|

3696 |

GROSS |

|

|

3697 |

GROSS RETIREMENT FUNDING INCOME / BRUTO UITTREDINGSFUNDERINGSDIENS INKOMSTE |

|

|

3698 |

GROSS |

|

|

3699 |

GROSS TOTAL / TOTALE BRUTO BESOLDIGING |

|

|

DEDUCTIONS / AFTREKKINGS |

|

|

|

CODE / KODE |

DESCRIPTION / BESKRYWING |

CLEARANCE NO |

AMOUNT / BEDRAG |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEES TAX DEDUCTIONS / WERKNEMERSBELASTING AFGETREK

CODE / KODE |

DESCRIPTION / BESKRYWING |

AMOUNT / BEDRAG |

4101 |

STANDARD INCOME TAX ON EMPLOYEES |

|

4102 |

PAY AS YOU EARN - PAYE / LOPENDE BETAALSTELSEL - LBS |

|

4103 |

TOTAL EMPLOYEES TAX / TOTALE WERKNEMERSBELASTING |

|

VALIDATION RULES FROM 2001 TAX YEAR

EMPLOYER HEADER RECORD |

|

|

||

|

|

(m) Mandatory, |

|

|

Code |

Field name |

(o) Optional or |

|

Validation rules |

|

|

(r) rules |

|

|

2010 |

Employer name / |

M |

∙ A70 |

|

|

trading name |

|

∙ First code of record |

|

|

|

|

∙ Code not to be preceded by any other character (e.g. |

|

|

|

|

space or comma) |

|

2020 |

Employer PAYE |

M |

∙ N10 (fixed no of characters) |

|

|

reference no |

|

∙ Valid PAYE reference no |

|

|

|

|

∙ Modulus 10 test |

|

2030 |

Employer Tax |

M |

∙ N4 (fixed no of characters) |

|

|

Year |

|

∙ Format = CCYY |

|

|

|

|

∙ Cannot be greater than current tax year + 1 |

|

|

|

|

∙ Cannot be less than current tax year — 10 (not less than |

|

|

|

|

1999) |

|

2040 |

Employer address |

M |

∙ A35 |

|

|

line 1 |

|

∙ 1999 & 2000 - no commas allowed in address information |

|

|

|

|

∙ 2001 - commas allowed |

|

2050 |

Employer address |

O |

∙ A35 |

|

|

line 2 |

|

|

|

2060 |

Employer address |

O |

∙ A35 |

|

|

line 3 |

|

|

|

2070 |

Employer address |

O |

∙ A35 |

|

|

line 4 |

|

|

|

2080 |

Employer postal |

M |

∙ N4 (fixed no of characters) |

|

|

code |

|

∙ 0000 to be rejected (must be valid postal code) |

|

|

|

|

∙ not to be included in address lines (specified separately) |

|

2090 |

Employer enjoys |

O |

∙ A1 (fixed no of characters) |

|

|

diplomatic |

|

∙ Value can only be Y, J or N |

|

|

indemnity |

|

|

|

9999 |

End of record |

M |

∙ Last code of record |

|

|

|

|

∙ Must no be followed by any other character |

|

EMPLOYEE IRP5 / IT3(a) RECORD |

|

|

||

|

|

(m) Mandatory, |

|

|

Code |

Field name |

(o) Optional or |

|

Validation rules |

|

|

(r) rules |

|

|

3010 |

IRP5/IT3(a) |

M |

∙ A8 (fixed no of characters) |

|

|

number |

|

∙ First code of record |

|

|

|

|

∙ Code not to be preceded by a any other character (e.g. |

|

|

|

|

space or comma) |

|

|

|

|

∙ Electronic — must be 8 numeric digits and be supplied |

|

|

|

|

with leading zeroes |

|

|

|

|

∙ Manual — alphanumeric number |

|

|

|

|

∙ Number cannot be a duplication of another certificate |

|

|

|

|

already submitted or on same submission (same |

|

|

|

|

employer & tax year) |

|

|

|

|

∙ Employers reference no starting with 799… or 9… will be |

|

|

|

|

rejected if IRP5 (only allowed to issue IT3(a) |

|

3020 |

Nature of person |

M |

∙ A1 (fixed no of characters) |

|

|

|

|

∙ Value |

A - Individual with ID or Passport no |

|

|

|

∙ |

B - Individual without ID or Passport no |

|

|

|

∙ |

C - Director of private company / Member of CC |

|

|

|

|

/ Sole Proprietor |

|

|

|

∙ |

D - Trust |

|

|

|

∙ |

E - Company or CC |

|

|

|

∙ |

F - Partnership |

|

|

|

∙ |

G - Corporation |

|

|

|

∙ |

H - Employment company |

|

|

|

∙ |

K - Employment trust |

3030 |

Employee |

M |

∙ A120 |

|

|

surname / trading |

|

∙ Value if nature |

A, B, C - Individual's surname |

|

name |

|

∙ |

D , K - Name of Trust |

|

|

|

∙ |

E , H - Company / CC trading name |

|

|

|

∙ |

F - Partnership name |

|

|

|

∙ |

G - Corporation name |

3040 |

First two names |

R |

∙ A90 |

|

|

|

|

∙ Mandatory if nature of person = A, B or C |

|

|

|

|

∙ Reject if supplied iro other nature of persons |

|

3050 |

Initials |

R |

∙ A5 |

|

|

|

|

∙ Mandatory if nature of person = A, B or C |

|

|

|

|

∙ Reject if supplied iro other nature of persons |

|

3060 |

Identity number |

R |

∙ N13 |

|

|

|

|

∙ Mandatory if nature of person = A or C and Passport no is |

|

|

|

|

not available |

|

|

|

|

∙ Accept as specified - no further validation |

|

|

|

|

∙ Reject if supplied iro other nature of persons |

|

3070 |

Passport number |

R |

∙ A13 |

|

|

|

|

∙ Mandatory if nature of person = A or C and ID no is not |

|

|

|

|

available |

|

|

|

|

∙ Accept as specified - no further validation |

|

|

|

|

∙ Reject if supplied iro other nature of persons |

|

3080 |

Date of birth |

R |

∙ N8 (fixed no of characters) |

|

|

|

|

∙ Format - CCYYMMDD |

|

|

|

|

∙ Mandatory if nature of person = A, B or C |

|

|

|

|

∙ Accept if supplied iro other nature of persons |

|

|

|

|

∙ Cannot be greater than current date |

|

3090 |

Company / CC / |

R |

∙ A16 |

|

|

Trust number |

|

∙ Mandatory if nature of person = D, E, K or H |

|

|

|

|

∙ Accept as specified - no further validation |

|

|

|

|

∙ Reject if supplied iro other nature of persons |

|

3100 |

Income Tax |

O |

∙ N10 (fixed no of characters) |

|

|

number |

|

∙ 1999 & 2000 - Accept as specified (no validation) |

|

|

|

|

∙ 2001 - Modulus |

10 test (if specified - must be valid |

|

|

|

number) |

|

3110 |

Employee |

M |

∙ A35 |

|

|

address line 1 |

|

∙ 1999 & 2000 - no commas allowed in address information |

|

|

|

|

∙ 2001 - commas allowed |

|

3120 |

Employee |

O |

∙ A35 |

|

|

address line 2 |

|

|

|

3130 |

Employee |

O |

∙ A35 |

|

|

address line 3 |

|

|

|

3140 |

Employee |

O |

∙ A35 |

|

|

address line 4 |

|

|

|

3150 |

Employee postal |

M |

∙ A20 |

|

|

code |

|

∙ 0000 accepted if specified |

|

|

|

|

∙ not to be included in address lines (specified separately) |

|

3160 |

Employee number |

R |

∙ A25 |

|

|

|

|

∙ Mandatory if nature of person = B, F or G |

|

|

|

|

∙ Accept if supplied iro other nature of persons |

|

3170 |

Date employed |

M |

∙ N8 (fixed no of characters) |

|

|

from |

|

∙ Format - CCYYMMDD |

|

|

|

|

∙ Valid date not greater than current date |

|

|

|

|

∙ Value cannot be greater than value of code 3180 |

|

3180 |

Date employed to |

M |

∙ N8 (fixed no of characters) |

|

|

|

|

∙ Format - CCYYMMDD |

|

|

|

|

∙ Valid date not greater than current date + 30 days |

|

|

|

|

∙ Value cannot be less than value of code 3170 |

|

3190 |

Voluntary over |

O |

∙ A1 (fixed no of characters) |

|

deduction |

|

∙ Reject if IT3(a) |

|

|

|

∙ Value can only be Y, J or N |

3200 |

Pay periods in tax |

R |

∙ N3.4 (fixed no of characters) |

|

year |

|

∙ Mandatory if IRP5 - accept if supplied iro IT3(a) |

|

|

|

∙ Must have a decimal point |

|

|

|

∙ Cannot be less than value of code 3210 |

|

|

|

∙ Value - 1.0000 up to 380.0000 |

3210 |

Pay periods |

R |

∙ N3.4 (fixed no of characters) |

|

worked |

|

∙ Mandatory if IRP5 - accept if supplied iro IT3(a) |

|

|

|

∙ Must have a decimal point |

|

|

|

∙ Cannot be greater than value of code 3200 |

3220 |

Fixed rate income |

O |

∙ A1 (fixed no of characters) |

|

|

|

∙ Value can only be Y, J or N |

|

|

|

∙ Not applicable if IT3(a) |

3230 |

Directive number |

O |

∙ A13 |

|

|

|

∙ Accept if specified - interface with NITS |

|

|

|

∙ Only one number per certificate |

3601 |

Normal Income |

R |

∙ N15 |

to |

|

|

∙ Code mandatory if amount is specified |

3612 |

|

|

∙ Cents must be omitted (decimal in amount is invalid) |

3701 |

Allowances |

|

∙ 1999 & 2000 - negative amounts allowed |

|

∙ 2001 - reject if negative amounts are specified |

||

to |

|

|

∙ Total income amounts must = sum of 3696 + 3699 |

3714 |

|

|

|

3801 |

Fringe benefits |

|

∙ A1 (fixed no of characters for RF indicator) |

to |

|

|

∙ RF indicator must be inserted between code and amount |

3810 |

|

|

|

|

|

(value Y, J, N or empty field) |

|

|

|

|

|

3901 |

Lump sum |

|

|

to |

payments |

|

|

3907 |

|

|

|

3695 |

Gross annual |

R |

∙ N15 |

|

income |

|

∙ Only applicable from 2001 |

|

|

|

∙ Code mandatory if amount is specified |

|

|

|

∙ Cents must be omitted (decimal in amount is invalid) |

3696 |

Gross non- |

R |

∙ N15 |

|

taxable income |

|

∙ Code mandatory if amount is specified |

|

|

|

∙ Cents must be omitted (decimal in amount is invalid) |

|

|

|

∙ Must equal sum of amounts iro codes 3602, 3604, 3609, |

|

|

|

3612, 3703, 3705, 3709 and 3714 |

|

|

|

∙ Allow R20 deviation for rounding off |

3697 |

Gross retirement |

R |

∙ N15 |

|

funding income |

|

∙ Code mandatory if amount is specified |

|

|

|

∙ Cents must be omitted (decimal in amount is invalid) |

|

|

|

∙ Allow R20 deviation for rounding off |

3698 |

Gross non- |

R |

∙ N15 |

|

retirement funding |

|

∙ Code mandatory if amount is specified |

|

income |

|

∙ Cents must be omitted (decimal in amount is invalid) |

|

|

|

∙ Allow R20 deviation for rounding off |

3699 |

Gross |

R |

∙ N15 |

|

remuneration |

|

∙ Code mandatory if income amounts are specified |

|

|

|

∙ Cents must be omitted (decimal in amount is invalid) |

|

|

|

∙ 2000 - amount = sum of 3697 + 3698 |

|

|

|

∙ 2001 - amount = total of amounts for all income codes |

|

|

|

specified (excluding 3602, 3604, 3609, 3612, |

|

|

|

3703, 3705, 3709 and 3714) |

|

|

|

- sum of 3696 + 3699 = sum of amounts for all |

|

|

|

income codes |

|

|

|

- amount = sum of 3697 + 3698 |

|

|

|

∙ Allow R20 deviation for rounding off |

4001 |

Deduction |

R |

∙ N15 |

to |

amounts |

|

∙ Code mandatory if amount is specified |

4007 |

|

|

∙ Cents must be omitted (decimal in amount is invalid) |

|

|

|

∙ If employee contributed to more than one fund, then |

|

|

|

contributions to each fund must be shown separate |

|

|

|

∙ No negative amounts allowed |

|

|

|

∙ N11 (fixed no of characters for clearance no |

|

|

|

∙ Fund clearance no must be inserted between code and |

|

|

|

amount, except for 4005 (value = clearance number |

|

|

|

18204xxxxxx or empty field) |

|

|

|

∙ Format of clearance number = ,code,,amount, |

|

|

|

,code,18204 no, amount, |

4101 |

SITE deduction |

R |

∙ N12.2 |

|

|

|

∙ 2 decimal digits mandatory (cents must be specified even |

|

|

|

if zero) |

|

|

|

∙ decimal point - no comma allowed |

|

|

|

∙ negative amounts not allowed |

|

|

|

∙ invalid if IT3(a) - use code 4150 |

4102 |

PAYE deduction |

R |

∙ N12.2 |

|

|

|

∙ 2 decimal digits mandatory (cents must be specified even |

|

|

|

if zero) |

|

|

|

∙ decimal point - no comma allowed |

|

|

|

∙ negative amounts not allowed |

|

|

|

∙ mandatory if fixed rate income & voluntary over deduction |

|

|

|

= Y or J (amount must be greater than 0) |

|

|

|

∙ invalid if IT3(a) - use code 4150 |

4103 |

Total tax |

R |

∙ N12.2 |

|

deduction |

|

∙ 2 decimal digits mandatory (cents must be specified even |

|

|

|

if zero) |

|

|

|

∙ decimal point - no comma allowed |

|

|

|

∙ negative amounts not allowed |

|

|

|

∙ amount = sum of 4101 + 4102 |

|

|

|

∙ invalid if IT3(a) - use code 4150 |

4150 |

IT3(a) reason |

R |

∙ N2 |

|

code |

|

∙ Mandatory if IT3(a) |

|

|

|

∙ If code specified - codes 4101, 4102 or 4103 may not be |

|

|

|

supplied |

|

|

|

∙ If no value then 4103 cannot be zero |

|

|

|

∙ Value: 01 = Director's remuneration (private co / CC) |

|

|

|

02 = Income less than tax threshold |

|

|

|

03 = Independent contractor |

|

|

|

04 = |

|

|

|

directives) |

9999 End of record

M

∙Last code of record

∙Must not be followed by any other character

EMPLOYER TRAILER RECORD |

|

||

|

|

(m) Mandatory, |

|

Code |

Field name |

(o) Optional or |

Validation rules |

|

|

(r) rules |

|

6010 |

Employer total |

M |

∙ N15 |

|

records |

|

∙ First code of record |

|

|

|

∙ Total = Employer header (2010) + All certificates (3010) - |

|

|

|

must be correct |

|

|

|

∙ Code not to be preceded by any other character (e.g. |

|

|

|

comma or space) |

6020 |

Employer total |

M |

∙ N15 |

|

code value |

|

∙ Total = Sum of all codes 2010 - 2090, 3010 - 4150 + all |

|

|

|

9999 in the specific records (must be correct) |

6030 |

Employer total |

M |

∙ N12.2 |

|

amount |

|

∙ 2 decimals mandatory (cents must be specified) |

|

|

|

∙ Decimal point - comma not allowed |

|

|

|

∙ Total = total of amounts values for employer for codes |

|

|

|

3601 - 4103 (must be correct) |

|

|

|

∙ Rounding off in records — if there is discrepancy, multiply |

|

|

|

the number of occurrences of amounts with 99 cents. If |

|

|

|

figure is greater than or equal to the difference - accept |

|

|

|

submission |

9999 |

End of record |

M |

∙ Last code of record |

|

|

|

∙ Must not be followed by any other character |