It is really simple to fill in the online lc form empty blanks. Our PDF tool makes it practically effortless to fill in any specific form. Down the page are the basic four steps you need to follow:

Step 1: Hit the orange button "Get Form Here" on the webpage.

Step 2: When you have accessed your online lc form edit page, you'll discover all actions you can take with regards to your document within the top menu.

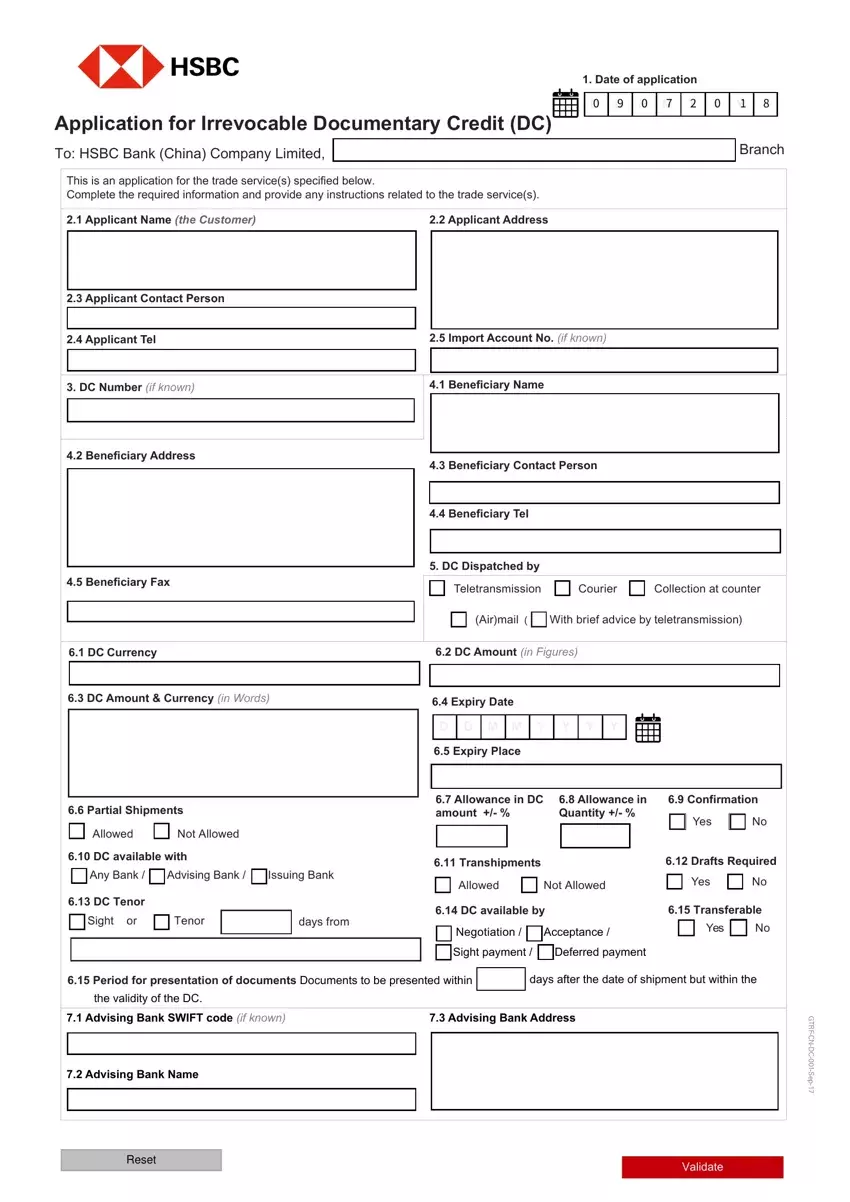

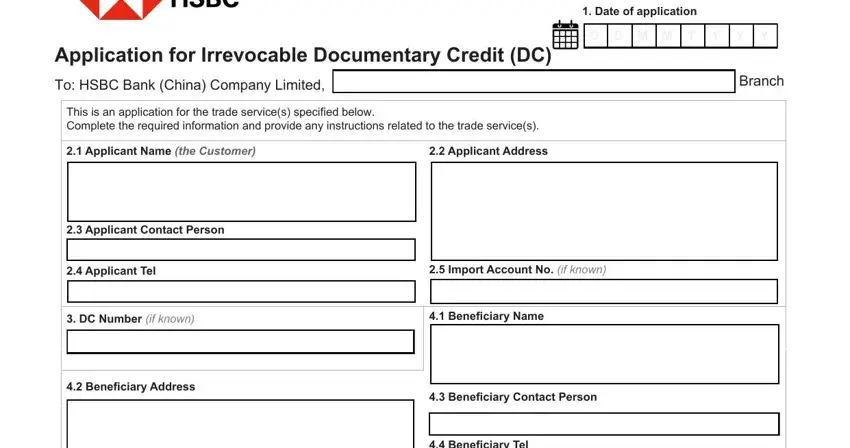

All of these areas are contained in the PDF form you will be filling out.

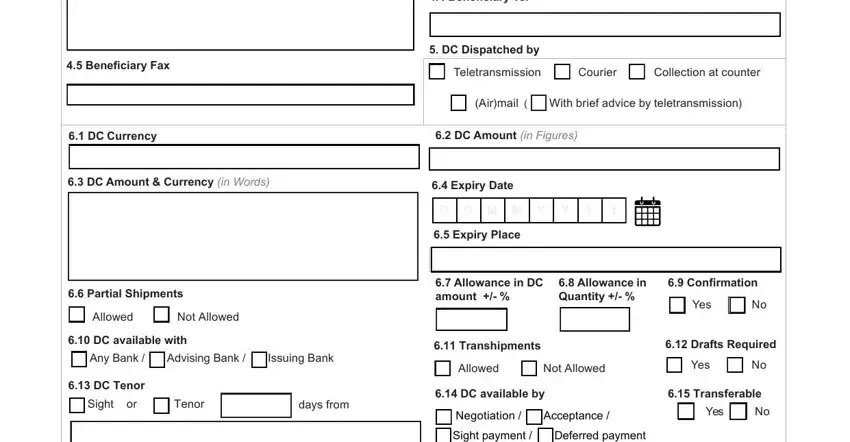

Type in the requested particulars in Beneficiary Fax, Beneficiary Tel, DC Dispatched by, Teletransmission, Courier, Collection at counter, Airmail, With brief advice by, DC Currency, DC Amount in Figures, DC Amount Currency in Words, Expiry Date, Partial Shipments, Allowed, and Not Allowed part.

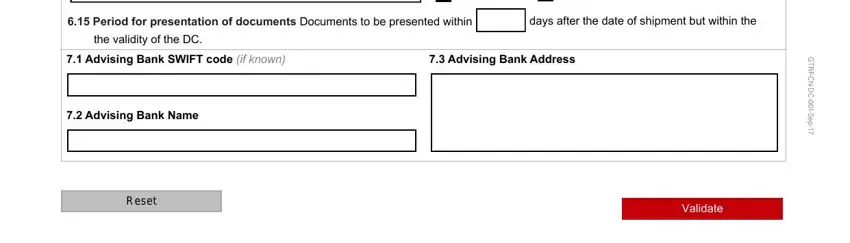

Identify the most crucial information on the Sight payment Deferred payment, Period for presentation of, days after the date of shipment, the validity of the DC, Advising Bank SWIFT code if known, Advising Bank Address, Advising Bank Name, and G T R F C N D C S e p segment.

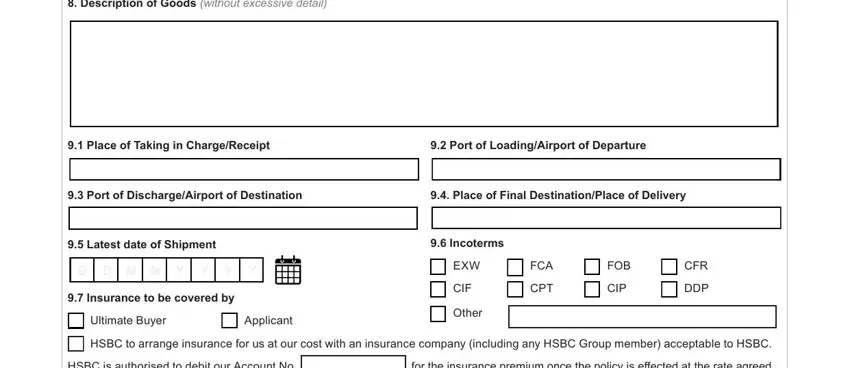

You should record the rights and responsibilities of the sides inside the Description of Goods without, Place of Taking in ChargeReceipt, Port of LoadingAirport of, Port of DischargeAirport of, Place of Final DestinationPlace, Latest date of Shipment, D D M M Y Y Y Y, Insurance to be covered by, Ultimate Buyer, Applicant, Incoterms, EXW, CIF, Other, and FCA section.

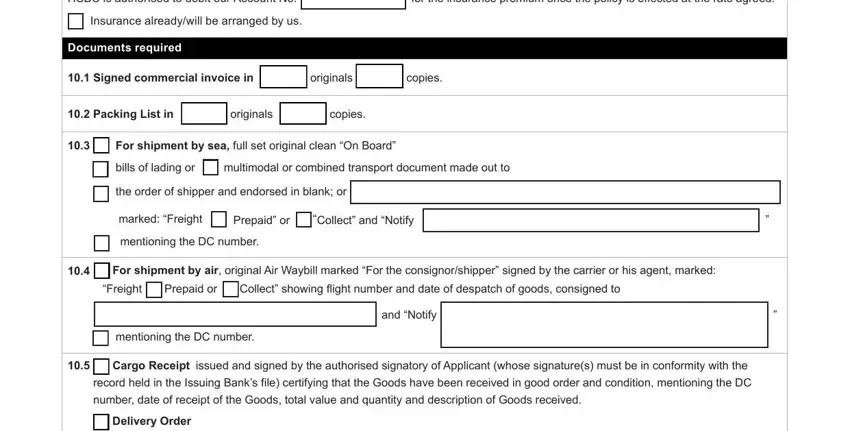

Prepare the form by looking at these particular sections: HSBC is authorised to debit our, for the insurance premium once the, Insurance alreadywill be arranged, Documents required, Signed commercial invoice in, originals, copies, Packing List in, originals, copies, For shipment by sea full set, bills of lading or, multimodal or combined transport, the order of shipper and endorsed, and marked Freight.

Step 3: Choose the Done button to be sure that your completed file could be transferred to any kind of electronic device you decide on or sent to an email you indicate.

Step 4: In order to avoid any type of headaches as time goes on, you will need to make a minimum of a few copies of your file.