You are able to fill out 4562 form easily in our online editor for PDFs. Our development team is continuously working to enhance the tool and help it become much better for people with its cutting-edge features. Discover an constantly progressive experience now - take a look at and uncover new possibilities as you go! It just takes a couple of basic steps:

Step 1: Access the PDF file inside our tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: This editor offers the capability to work with your PDF in various ways. Enhance it with any text, adjust original content, and put in a signature - all readily available!

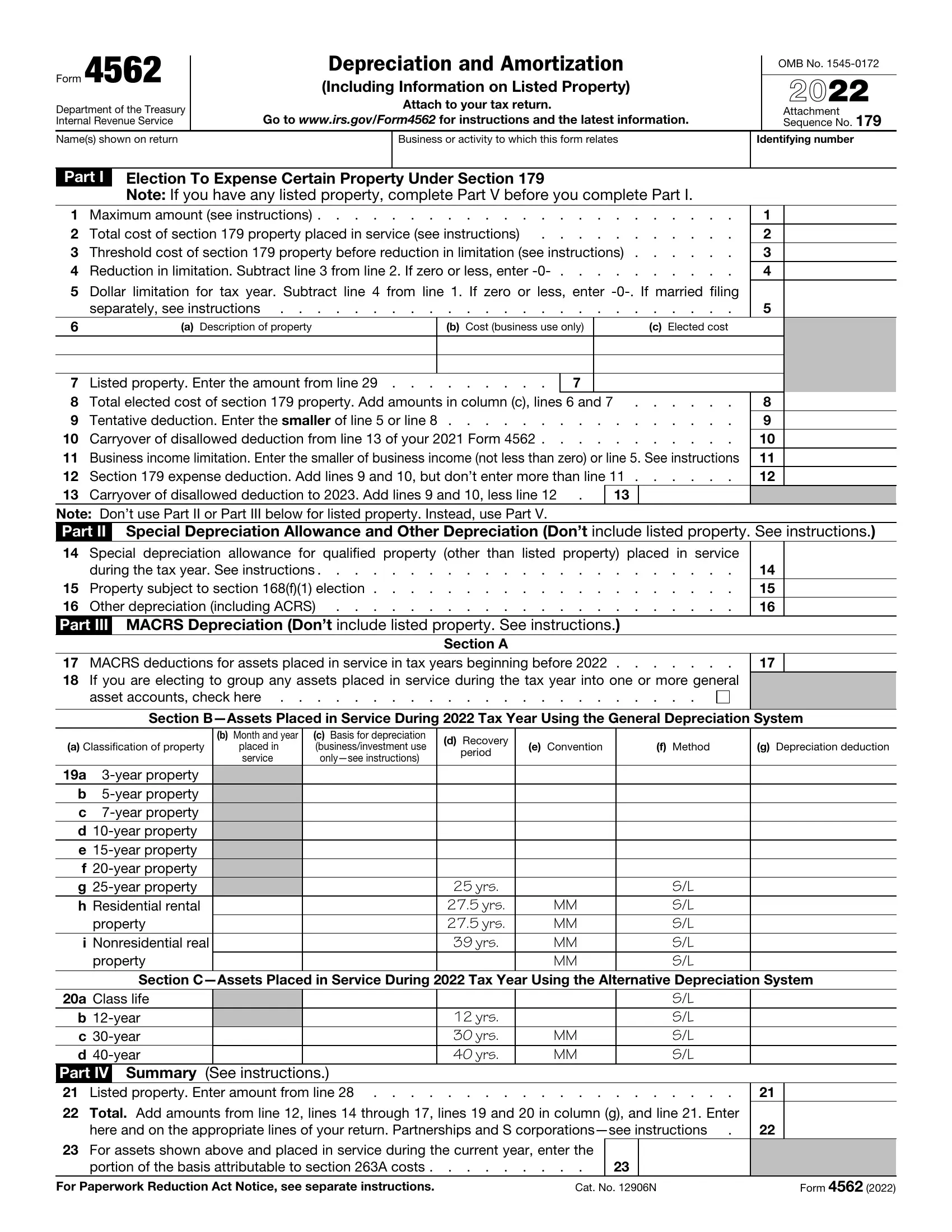

When it comes to fields of this particular document, this is what you need to do:

1. While filling in the 4562 form, make sure to include all needed blanks in its corresponding section. It will help facilitate the work, enabling your details to be handled swiftly and properly.

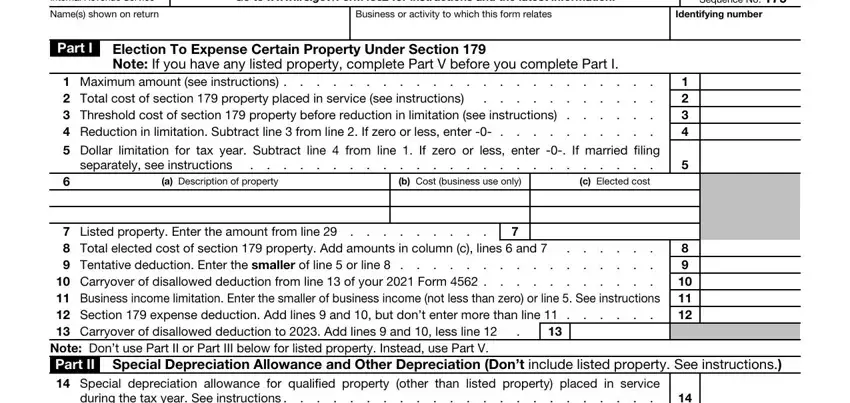

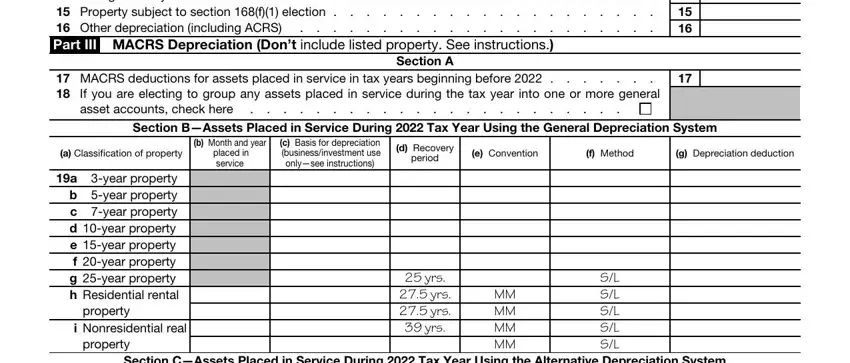

2. Just after filling in the previous part, go on to the next stage and complete the necessary particulars in these blanks - during the tax year See, Property subject to section f, Section A, MACRS deductions for assets, asset accounts check here, Section BAssets Placed in Service, b Month and year, placed in, service, a Classification of property, a year property b year property c, property i Nonresidential real, c Basis for depreciation, onlysee instructions, and d Recovery.

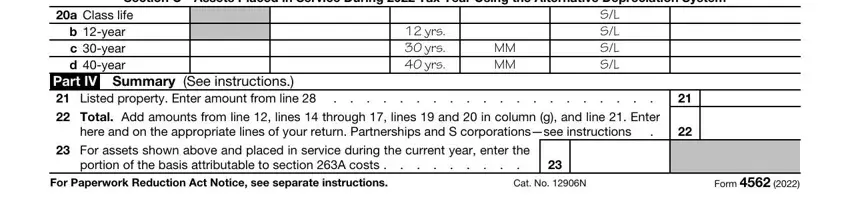

3. This next portion is all about Section CAssets Placed in Service, a Class life, b year c year d year, yrs yrs yrs, MM MM, SL SL SL SL, Part IV Summary See instructions, Total Add amounts from line, here and on the appropriate lines, For assets shown above and placed, portion of the basis attributable, For Paperwork Reduction Act Notice, Cat No N, and Form - fill out all these blank fields.

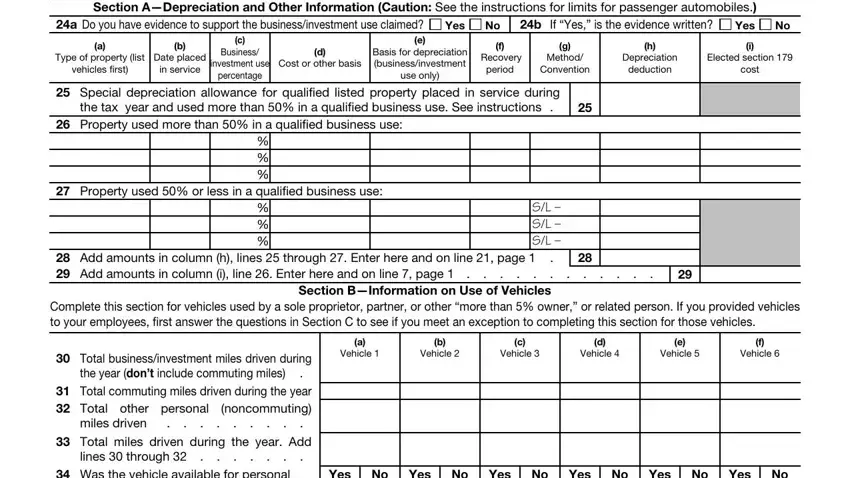

4. To go forward, the next form section will require filling in a handful of empty form fields. Examples include Section ADepreciation and Other, a Do you have evidence to support, Yes, b If Yes is the evidence written, Yes, Type of property list, Date placed, vehicles first, in service, Business, investment use, Cost or other basis, percentage, Basis for depreciation, and use only, which you'll find essential to continuing with this form.

It is possible to make an error while filling out the Yes, so ensure that you take a second look before you'll submit it.

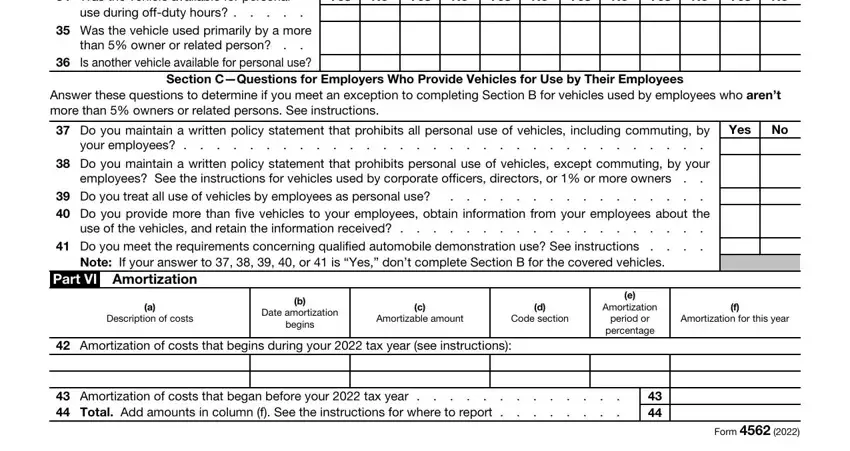

5. Now, the following last subsection is precisely what you'll want to complete prior to closing the form. The fields at issue include the following: Was the vehicle available for, use during offduty hours, Was the vehicle used primarily by, than owner or related person, Is another vehicle available for, Yes, Yes, Yes, Yes, Yes, Yes, Section CQuestions for Employers, Answer these questions to, Do you maintain a written policy, and Yes.

Step 3: Once you have reviewed the details in the file's blanks, simply click "Done" to conclude your form. After getting afree trial account at FormsPal, it will be possible to download 4562 form or email it directly. The PDF form will also be available in your personal account with your every change. Here at FormsPal, we do everything we can to be certain that your details are stored protected.