When using the online PDF editor by FormsPal, you're able to fill in or change irs 8734 here and now. The tool is consistently maintained by us, getting awesome features and turning out to be better. Here is what you would have to do to begin:

Step 1: Hit the "Get Form" button in the top section of this webpage to access our tool.

Step 2: When you access the online editor, you will get the document ready to be filled in. In addition to filling out different blank fields, you might also do other sorts of things with the form, such as writing your own textual content, changing the original text, inserting graphics, signing the form, and much more.

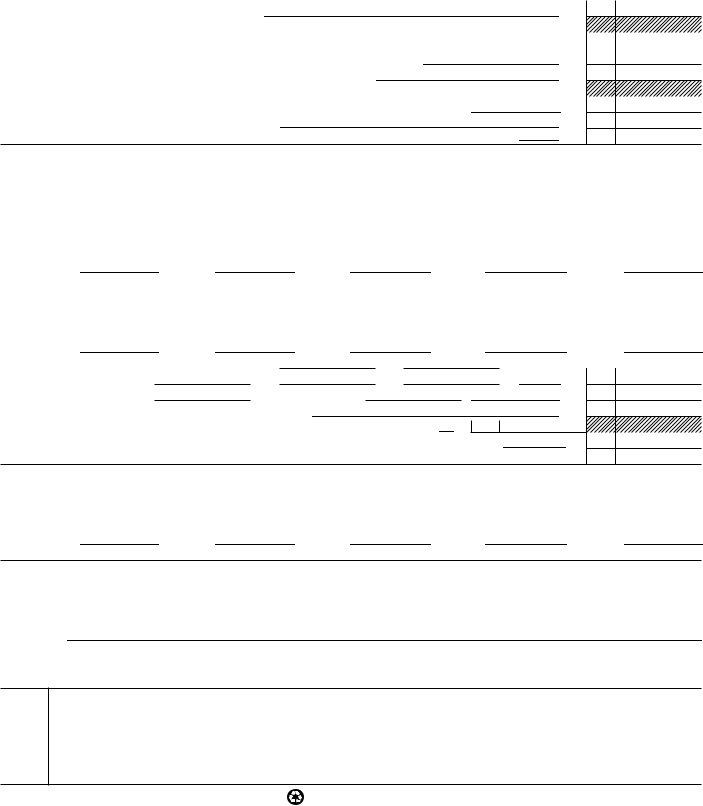

This document will need specific details; in order to guarantee correctness, you need to take note of the next suggestions:

1. Start completing the irs 8734 with a group of major fields. Consider all the important information and ensure not a single thing overlooked!

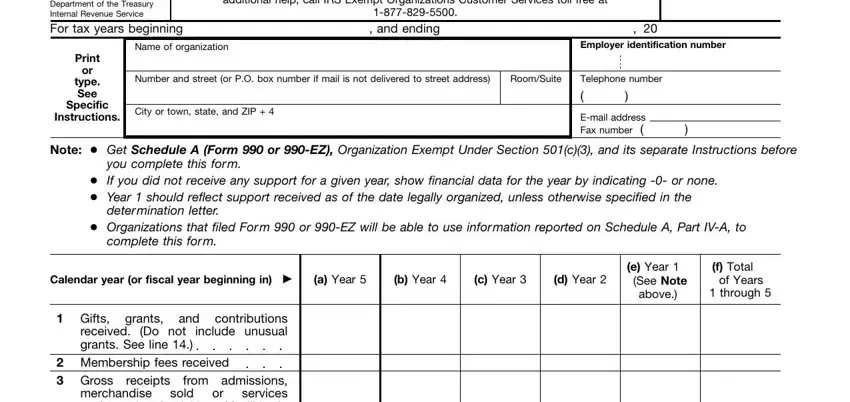

2. Given that the previous section is completed, you need to insert the needed specifics in from admissions merchandise, charitable, Gross, from, income, interest dividends amounts, taxes by, royalties, acquired, rents, Net income from unrelated business, activities not included in line, Tax revenues levied for your, Other income Attach a schedule Do, and For Paperwork Reduction Act Notice allowing you to progress to the 3rd step.

When it comes to charitable and activities not included in line, make sure you do everything properly in this section. These are the most important fields in the document.

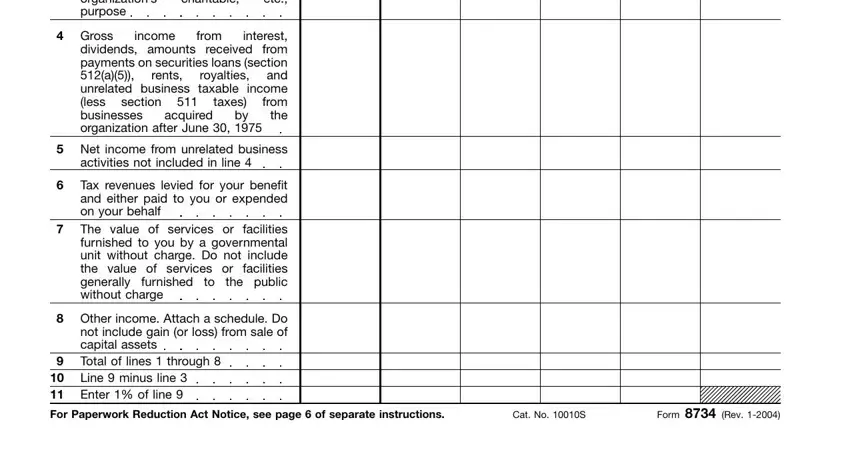

3. Through this step, check out If you are an organization that, a Enter of amount in column f, b Attach a list showing the name, c Total support for section a test, e Public support line c minus line, b c, d e f, If you are an organization that, a For amounts included in lines, and total amounts received in each, Year, Year, Year, Year, and Year. These will have to be filled in with utmost precision.

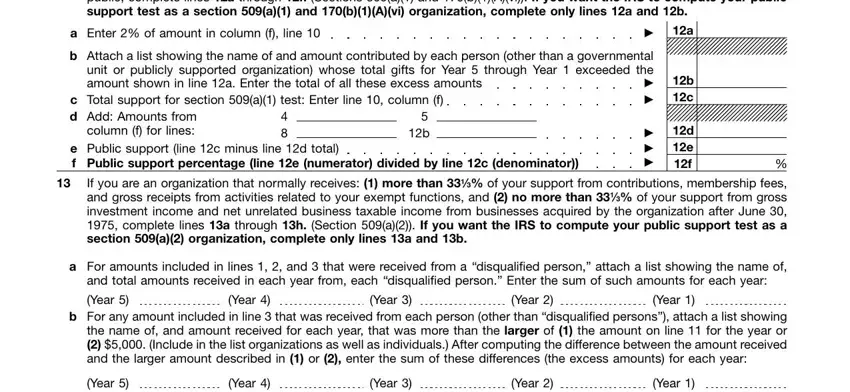

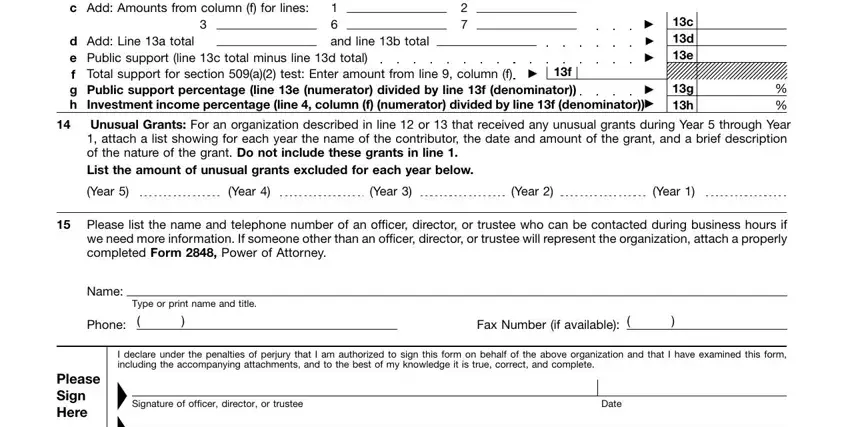

4. All set to complete this fourth part! Here you have all of these c Add Amounts from column f for, and line b total, d Add Line a total e f g h, Public support line c total minus, c d e, g h, Unusual Grants For an, Year, Year, Year, Year, Year, Please list the name and, Name, and Type or print name and title fields to fill in.

Step 3: When you've looked once more at the details provided, click on "Done" to finalize your FormsPal process. After getting a7-day free trial account at FormsPal, you'll be able to download irs 8734 or send it via email right off. The PDF will also be readily available through your personal account with all of your changes. FormsPal guarantees safe document tools with no data recording or any type of sharing. Rest assured that your information is safe with us!