Dealing with PDF documents online is definitely very easy with this PDF editor. Anyone can fill in irs form 14420 here effortlessly. Our editor is consistently developing to give the best user experience attainable, and that is due to our resolve for constant enhancement and listening closely to customer comments. With a few simple steps, you are able to start your PDF journey:

Step 1: Click on the "Get Form" button above on this page to get into our editor.

Step 2: With the help of our handy PDF file editor, it is possible to accomplish more than just complete blank form fields. Express yourself and make your forms appear perfect with custom textual content put in, or fine-tune the file's original input to excellence - all supported by an ability to incorporate your own pictures and sign the document off.

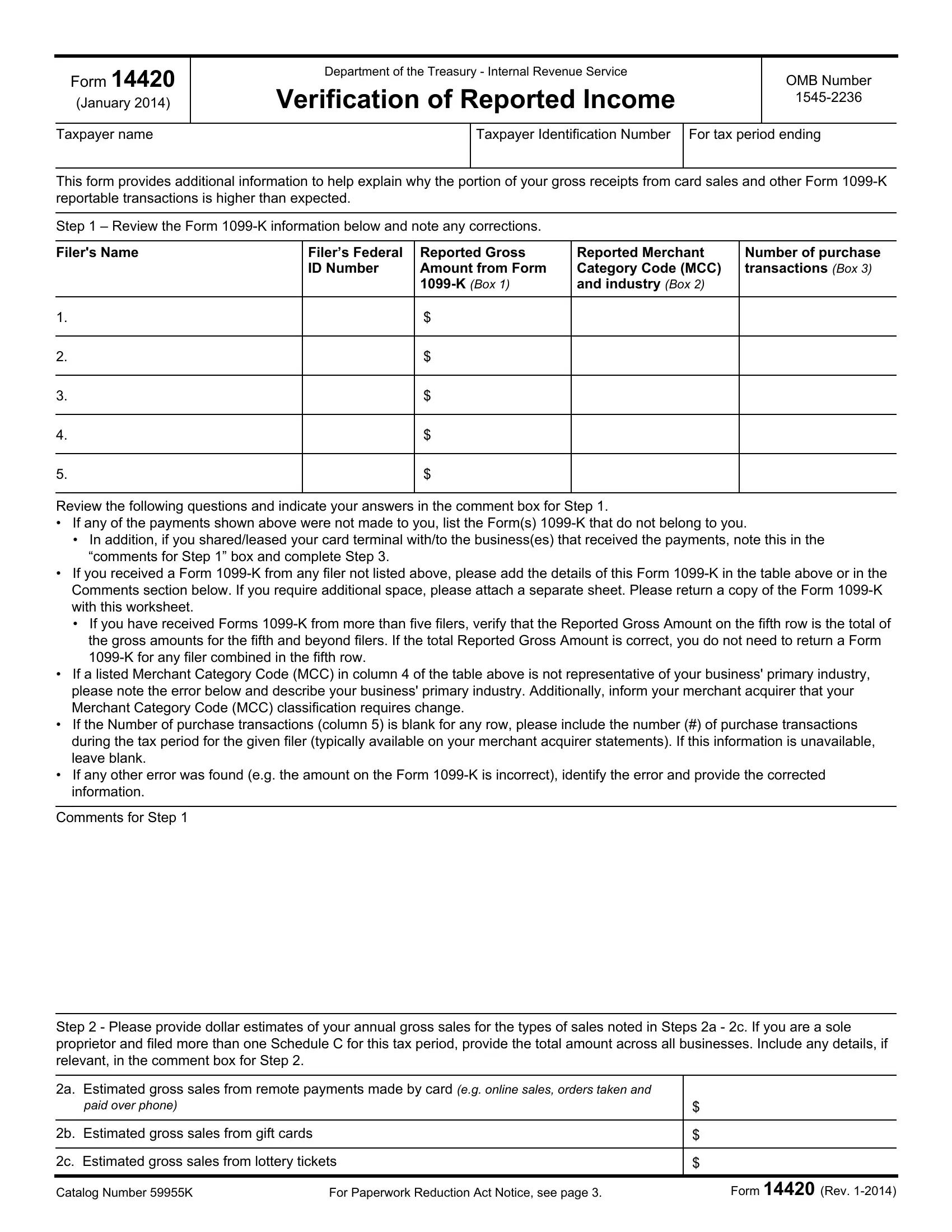

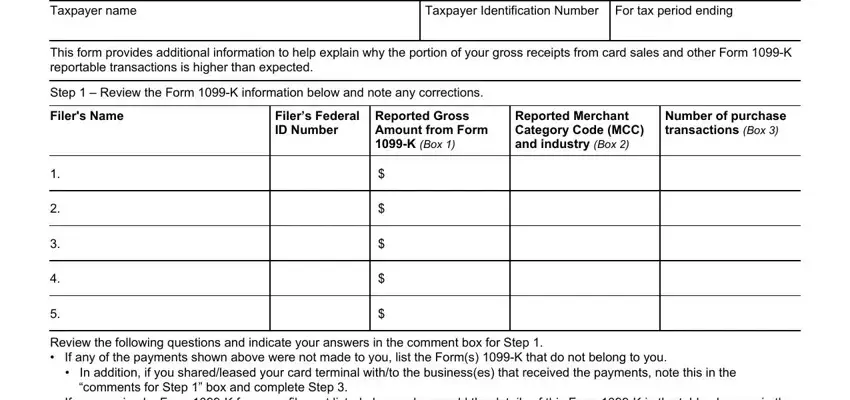

This PDF requires specific details to be typed in, therefore you should take the time to fill in what is required:

1. It's very important to complete the irs form 14420 accurately, hence pay close attention while filling out the areas including all of these blank fields:

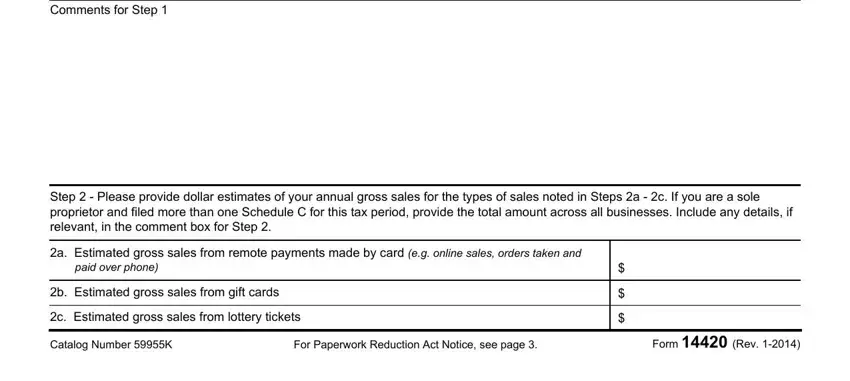

2. When the last segment is finished, it's time to include the necessary specifics in Comments for Step, Step Please provide dollar, a Estimated gross sales from, paid over phone, b Estimated gross sales from gift, c Estimated gross sales from, Catalog Number K, For Paperwork Reduction Act Notice, and Form Rev in order to move forward to the third step.

Be extremely mindful while filling out a Estimated gross sales from and paid over phone, since this is where many people make some mistakes.

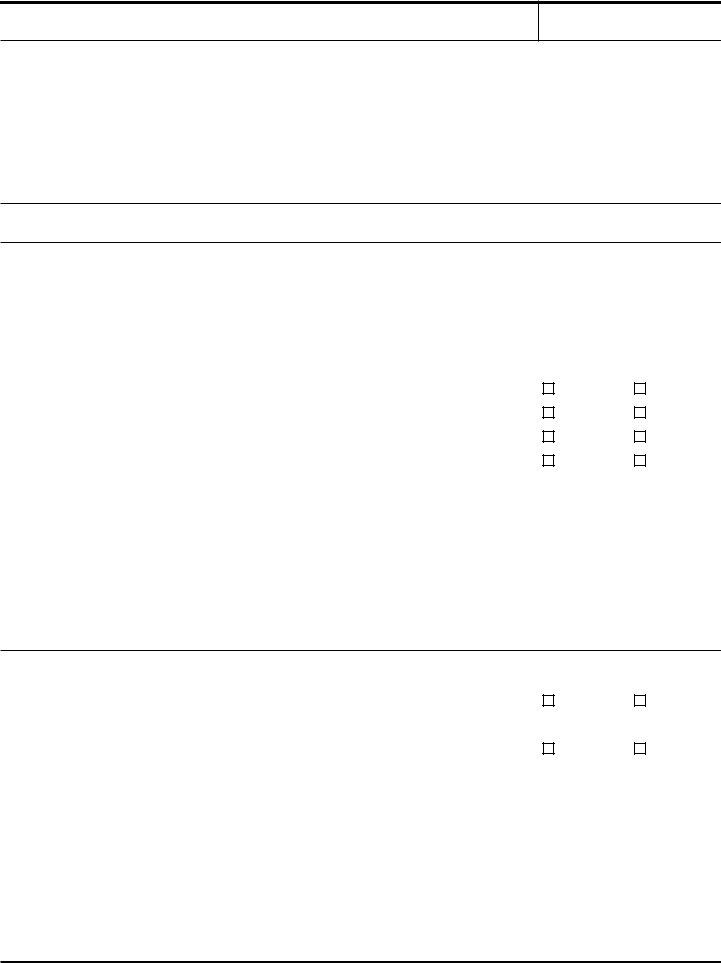

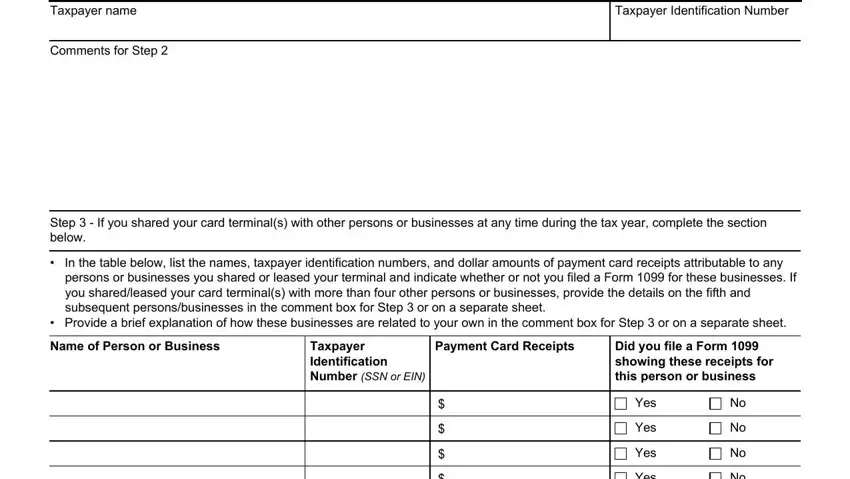

3. The following segment is all about Taxpayer name, Comments for Step, Taxpayer Identification Number, Step If you shared your card, In the table below list the names, persons or businesses you shared, Provide a brief explanation of, Name of Person or Business, Taxpayer Identification Number SSN, Payment Card Receipts, Did you file a Form showing these, Yes, Yes, Yes, and Yes - type in all these blank fields.

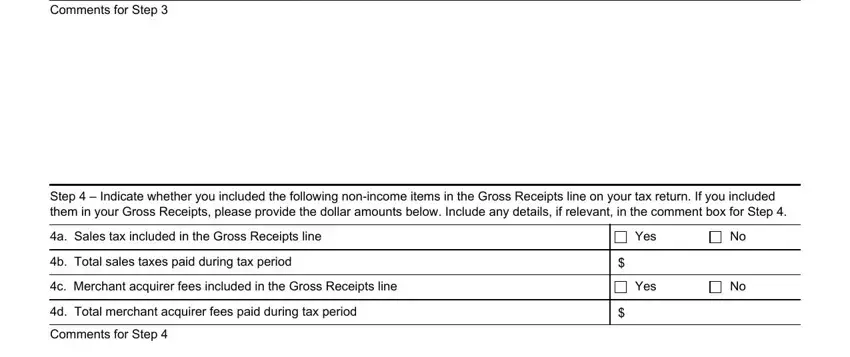

4. Filling out Comments for Step, Step Indicate whether you, a Sales tax included in the Gross, b Total sales taxes paid during, c Merchant acquirer fees included, d Total merchant acquirer fees, Comments for Step, Yes, and Yes is paramount in this next part - you'll want to don't hurry and take a close look at each field!

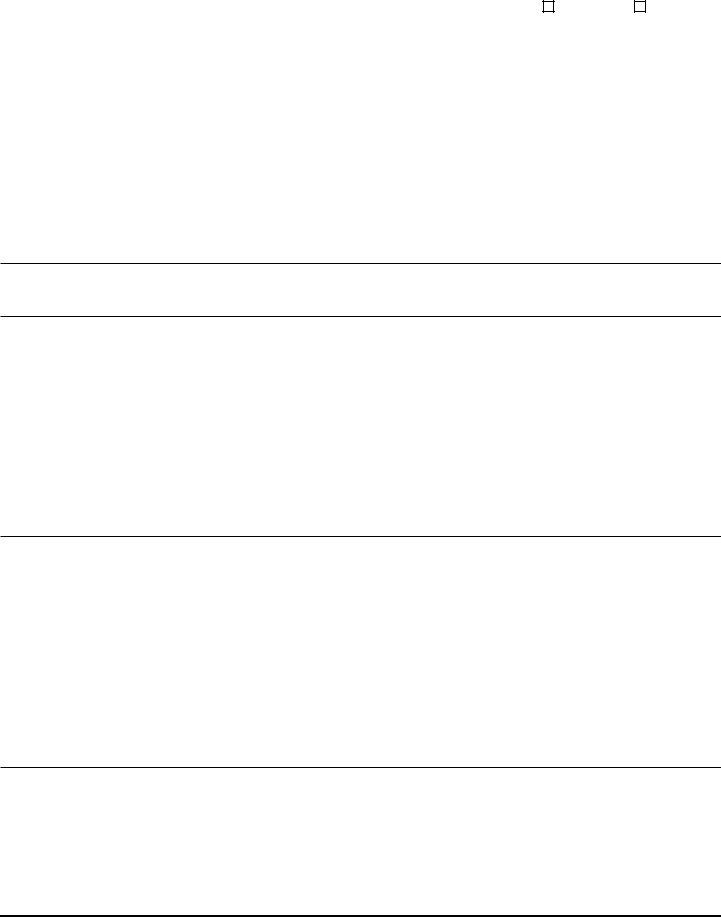

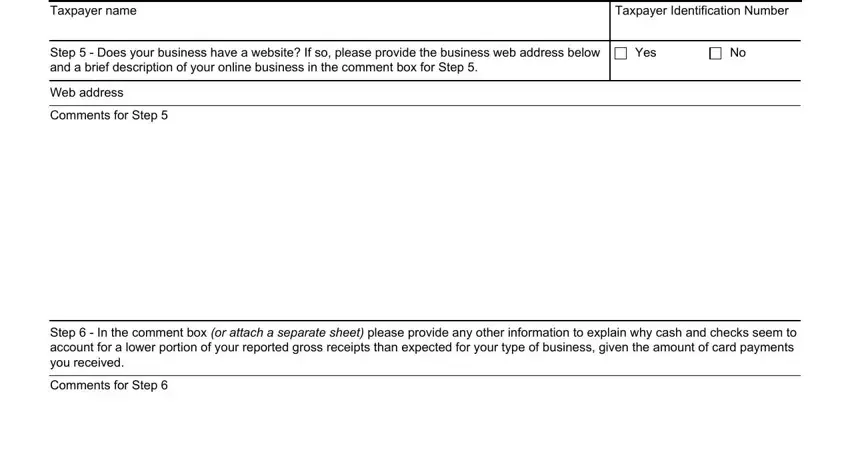

5. This final notch to finalize this form is pivotal. Ensure you fill out the required blank fields, particularly Taxpayer name, Taxpayer Identification Number, Step Does your business have a, Yes, Web address, Comments for Step, Step In the comment box or, and Comments for Step, before using the file. Neglecting to accomplish that can end up in an incomplete and potentially incorrect document!

Step 3: Confirm that the details are right and then click "Done" to proceed further. After creating a7-day free trial account here, you'll be able to download irs form 14420 or email it right off. The form will also be easily accessible in your personal account page with all your adjustments. When you use FormsPal, it is simple to fill out forms without the need to be concerned about database incidents or data entries being shared. Our protected platform makes sure that your private data is stored safely.