Navigating the complexities of international trade, businesses often find themselves handling the return of American goods to the United States. In such scenarios, the IRS 3311 Form, officially known as the American Goods Returned Declaration, becomes an invaluable asset. This form is a crucial document for companies seeking duty-free entry for products originally manufactured in the U.S. and later returned. Approved by the Bureau of Customs and Border Protection, a part of the U.S. Department of Homeland Security, this form encompasses several key details, including the port of entry, the date of entry, and a comprehensive description of the returned items. It requires declarations about whether the goods were previously claimed for drawback — a kind of refund on import duties, taxes, and fees for exported products. Additionally, the form mandates transparency about the items' value and their condition, ensuring that they have not been enhanced in value or improved in condition while overseas. The form also touches on the Harmonized Tariff Schedule of the U.S. (USTSA) to determine if a shipment can have duties repaid, should it have been previously imported then exported. This procedural necessity is backed by regulations under several codes, emphasizing its importance in the realm of international trade and customs enforcement. With a mandatory response stipulation under the Paperwork Reduction Act, the IRS 3311 form is designed to streamline the process for businesses to comply with customs laws, calculate correct dues, and facilitate the accurate collection of import and export statistics.

| Question | Answer |

|---|---|

| Form Name | Irs Form 3311 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | exporters, Colorado, 3311 irs pdf, form irs 3311 |

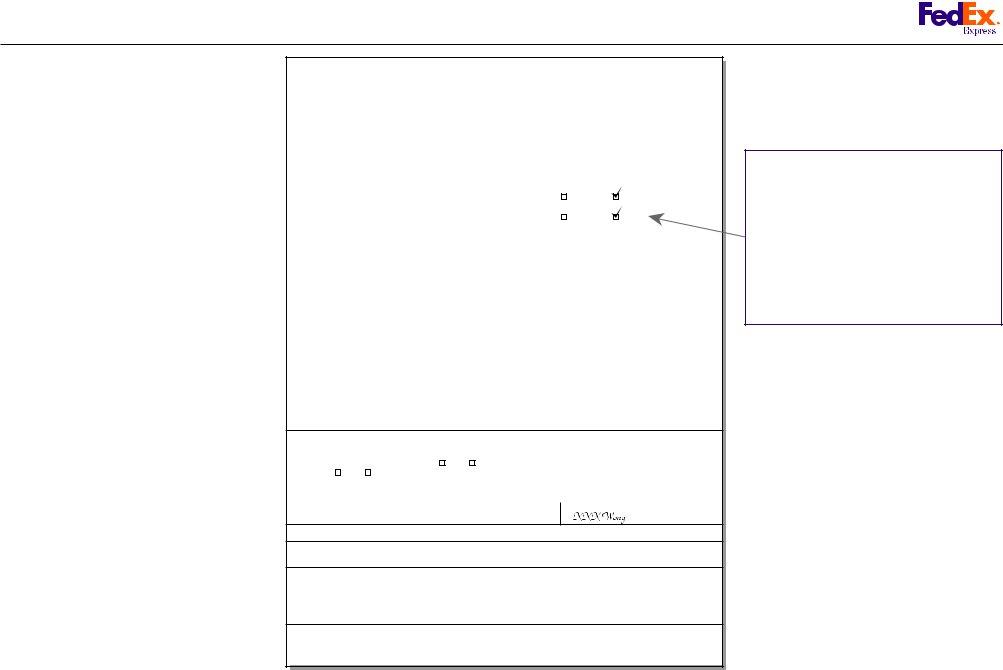

Sample Form 3311 American Goods Returned Declaration (AGR) for American Goods Return Shipment

U.S. DEPARTMENT OF HOMELAND SECURITY

|

Bureau of Customs and Border Protection |

Form Approved |

|||

|

OMB No. |

||||

|

DECLARATION FOR FREE ENTRY OF |

|

|||

|

RETURNED AMERICAN PRODUCTS |

|

|||

|

19 CFR 7.8, 10.1, 10.5, 10.66, 10.67, 12.41, 123.4, 143.23, 145.35 |

|

|||

|

|

|

|

|

|

1. PORT |

|

2. DATE |

3. ENTRY NO. & DATE |

|

|

|

|

|

|

|

|

4. NAME OF MANUFACTURER |

ABC Environmental Equipment Inc. |

5. CITY AND STATE OF MANUFACTURE |

|||

|

Denver, Colorado, USA |

||||

|

|

|

|||

6. REASON FOR RETURN |

|

|

7. U.S. DRAWBACK PREVIOUSLY |

||

|

|

|

CLAIMED |

UNCLAIMED |

|

|

Repair |

|

|

|

|

|

8. PREVIOUSLY IMPORTED UNDER HTSUS 864.05? |

||||

|

|

|

|||

|

|

|

YES |

NO |

|

|

|

|

|

||

9. MARKS, NUMBERS, AND DESCRIPTION OF ARTICLES RETURNED |

|

|

10. VALUE* |

||

Handles for Printing machine, made of stainless steel,. 23 pcs |

|

US$2,300 |

|||

|

|

|

|

|

|

*If the value of the article is $10,000 or more and the articles are not clearly marked with the name and address of U.S. manufacturer, please attach copies of any documentation or other evidence that you have that will support or substantiate your claim for duty free status as American Goods Returned.

11.I declare that the information given above is true and correct to the best of my knowledge and belief; that the articles described above are the growth, production, and manufacture of the United States and are returned without having been advanced in value or improved in condition by any process of

manufacture or other means; that no drawback bounty, or allowance have been paid or admitted thereon, or on any part thereof; and that if any notice(s)

of exportation of artivles with benefit of drawback |

was |

were |

filed upon exportation of the merchandise from the United States, such |

|||

notice(s) |

has |

have |

been abandoned. |

|

|

|

|

|

|

|

|||

12. NAME OF DECLARANT |

|

|

13. TITLE OF DECLARANT |

|||

XXX Wong |

|

|

|

Shipping Manager |

||

|

|

|

|

|||

14. NAME OF CORPORATION OR PARTNERSHIP (If any) |

|

15. SIGNATURE (See note) |

||||

ABC International Corporation

16. SIGNATURE OF AUTHORIZING CBP OFFICER

NOTE: If the owner or ultimate consignee is a corporation, this form must be signed by the president, vice president, secretary, or treasurer of the corporation, or by any employee or agent of the corporation who holds a power of attorney and a certificate by the corporation that such employee or agent has or will have knowledge of the pertinent facts.

PAPERWORK REDUCTION ACT NOTICE: This information is needed to ensure that importers/exporters are complying with Customs laws, to allow us to compute and collect the right amount of money, to enforce other agency requirements, and to collect accurate statistical information on imports. Your response is mandatory. The estimated average burden associated with this collection is 6 minutes per respondent or recordkeeper depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to Bureau of Customs and Border Protection, Information Services Branch, Washington DC 20229, and to the Office of Management and Budget, Paperwork Reduction Project

PREVIOUS EDITIONS ARE OBSOLETE |

CBP FORM 3311 (06/96) |

www.fedex.com/jp_english/services/tools/agr.html

USTSA stands for US Tariff Schedule (also known as Harmonized Tariff Schedule of the US). What this field is used for is to indicate if a shipment had been previously imported into the US and then exported. If yes in this field, the original importer can claim duty repayment. It is best that the shipper check NO if they do not know.