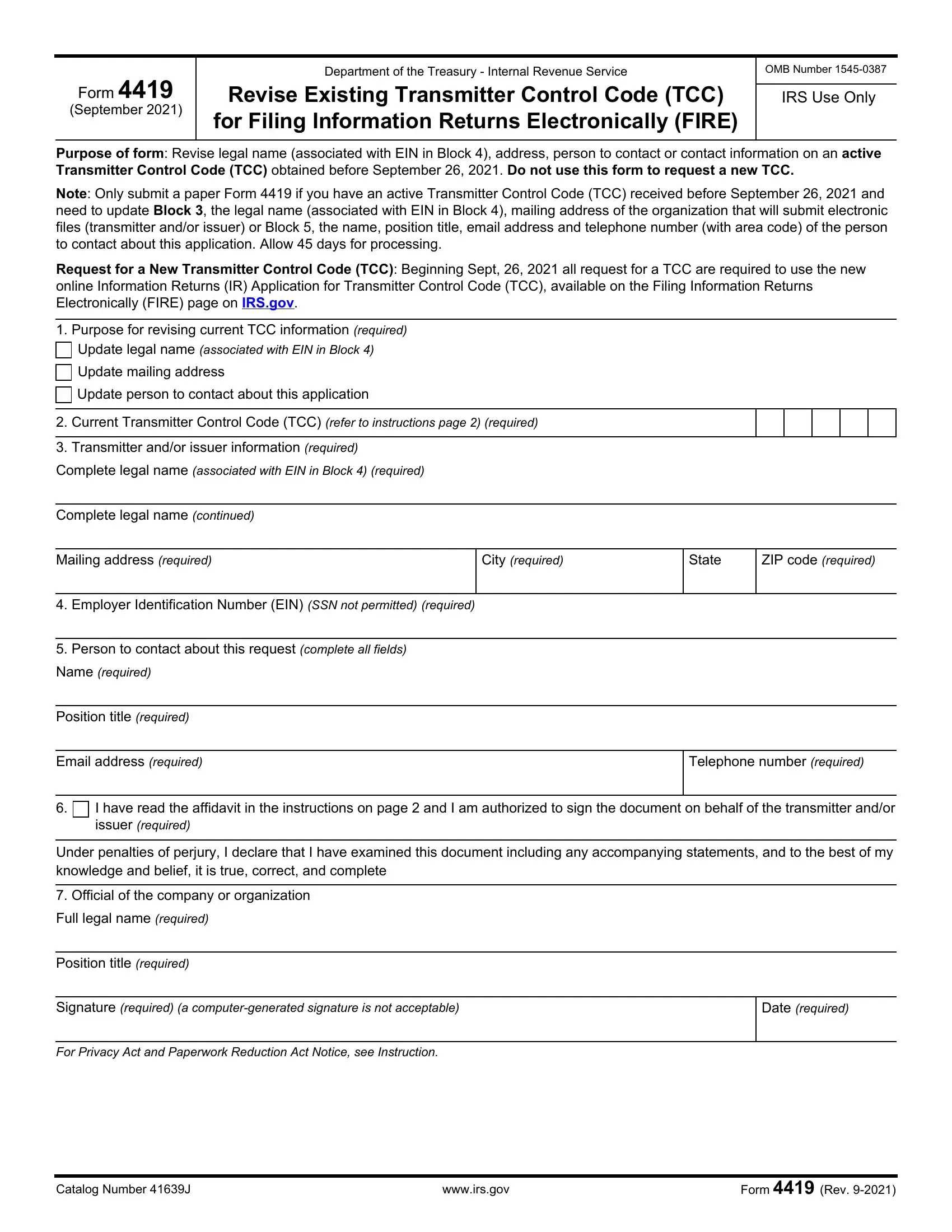

General Instructions

Purpose of Form: Submit a paper Form 4419 to revise an active Transmitter Control Code (TCC) received before September 26, 2021. If you do not have a TCC to transmit through the FIRE System, complete the Information Returns (IR) Application for Transmitter Control Code (TCC) at https://www.irs.gov/e-file-providers/filing-information-returns- electronically-fire.

A revised Form 4419 can only be submitted if you are updating information for a previously approved Form 4419 for the following:

•Block 3 - Legal name or Business mailing address

•Block 5 - Person to contact or contact information

Specific Instructions

When completing this form, please print or type clearly.

If you do not provide all the information, we may not be able to process your application

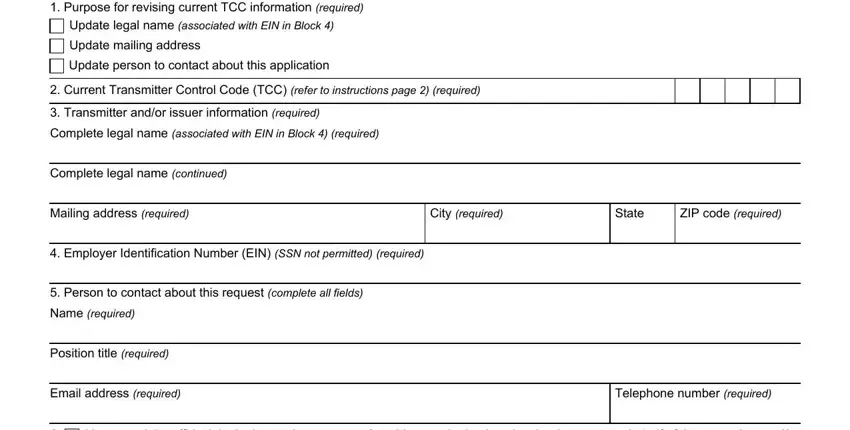

Block 1 - Indicate the purpose for revising the current TCC information.

Block 2 - Enter your current TCC.

Block 3 - Enter the legal name associated with the EIN in Block 4 and the complete address of the organization that will submit electronic files (transmitter and/or issuer).

Block 4 - Enter the employer identification number (EIN), Qualified Intermediary Number (QI-EIN), Withholding Partnership Number (WP- EIN), or Withholding Trust Number (WT-EIN) of the organization transmitting the electronic files. A social security number is not allowed.

Block 5 - Enter the name, position title, email address and telephone number (with area code) of the person to contact about this application. This should be a person who is knowledgeable about the electronic filing of your information returns.

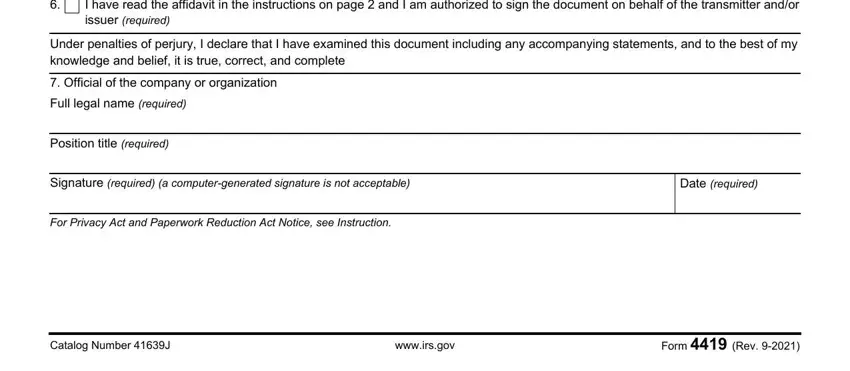

Block 6 - Affidavit. This application must be completed and submitted by: (a) the owner, if the applicant is a sole proprietorship, (b) the president, vice president, or other principal officer, if the applicant is a corporation, (c) a responsible and duly authorized member or officer having knowledge of its affairs, if the applicant is a partnership, government entity, or other unincorporated organization, or (d) the fiduciary, if the applicant is a trust or an estate.

Check the box to confirm you have read the affidavit and are authorized to sign on behalf of the transmitter and/or issuer.

Block 7 - The form must be signed and dated by an official of the company or organization requesting authorization to file electronically (a computer-generated signature is not acceptable).

How to submit Form 4419:

Mail or Fax Form 4419 to: Internal Revenue Service

230 Murall Drive, Mail Stop 4360 Kearneysville, WV 25430

Fax: (877) 477-0572 (within the U.S.)

(304) 579-4105 (International not toll-free)

Contact the IRS for information return and electronic filing assistance Monday through Friday 8:30 a.m. - 5:30 p.m. ET. Listen to all options before making your selection.

•(866) 455-7438 (Toll-free)

•(304) 263-8700 (International not toll-free)

•(304) 579-4827 for Telecommunications Device for the Deaf (TDD) (Not toll-free)

Request a New Transmitter Control Code (TCC): If you are a corporation, partnership, employer, estate and/or trust, required to file 250 or more information returns, Forms 1042-S, 1097, 1098, 1099, 3921, 3922, 5498, 8027, 8955-SSA, and W-2G, for any calendar year, the law requires you file electronically via the Filling Information Returns Electronically (FIRE) System using a Transmitter Control Code (TCC). The Internal Revenue Service (IRS) encourages filers who have less than 250 information returns to file electronically as well.

Beginning Sept, 26, 2021 all request for a new TCC are required to use the new Information Returns (IR) Application for Transmitter Control Code (TCC), available on the Filing Information Returns Electronically (FIRE) page on IRS.gov. This new application replaces both the Form 4419 and Fill-in Form 4419 on the FIRE System.

For further information concerning the electronic filing of information returns, visit IRS.gov. The following publications are available:

•Publication 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G

•Publication 1187, Specifications for Electronic Filing of Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding

•Publication 1239, Specifications for Electronic Filing of Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips

•Publication 4810, Specifications for Electronic Filing of Form 8955-SSA, Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

Forms W-2: Do not request authorization to electronically file Form W-2 using IR Application for TCC or Form 4419. Form W-2 information is sent to the Social Security Administration (SSA). Refer to Social Security Administration (SSA) website at https://www.ssa.gov.

Privacy Act and Paperwork Reduction Act Notice

The authority for requesting this information is Internal Revenue Code sections 7801, 6011(f) and 6109. The primary purpose for requesting the information is to identify you and to verify your fitness to transmit returns using the Filing Information Returns Electronically (FIRE) System. Your response is mandatory if you are required to file returns electronically. If you do not provide all or part of the information, we may not be able to process your application; providing false or fraudulent information may subject you to penalties. We may give this information to the Department of Justice for use in civil and/ or criminal litigation, to the public to help identify approved electronic filing practitioners, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, and to federal law enforcement and intelligence agencies to combat terrorism.

We ask for the information on these forms to carry out the Internal Revenue Laws of the United States. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form must be retained as long as their contents may become material in the administration of any Internal Revenue law. Tax returns and return information are confidential, as required by Code section 6103.

The time needed to provide this information would vary depending on individual circumstances. The estimated average time is:

Preparing Form 4419 . . . . . . . . . . . . . . . . . 20 minutes.

If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. Write to the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA 95743-0001. DO NOT SEND FORM 4419 TO THIS OFFICE. Refer to the instructions above on where to mail or fax.