It's straightforward to prepare the irs form 4549 instructions. Our tool was made to be easy-to-use and help you complete any PDF quickly. These are the four actions to take:

Step 1: To begin the process, click the orange button "Get Form Now".

Step 2: You'll notice all of the functions which you can take on the template once you've entered the irs form 4549 instructions editing page.

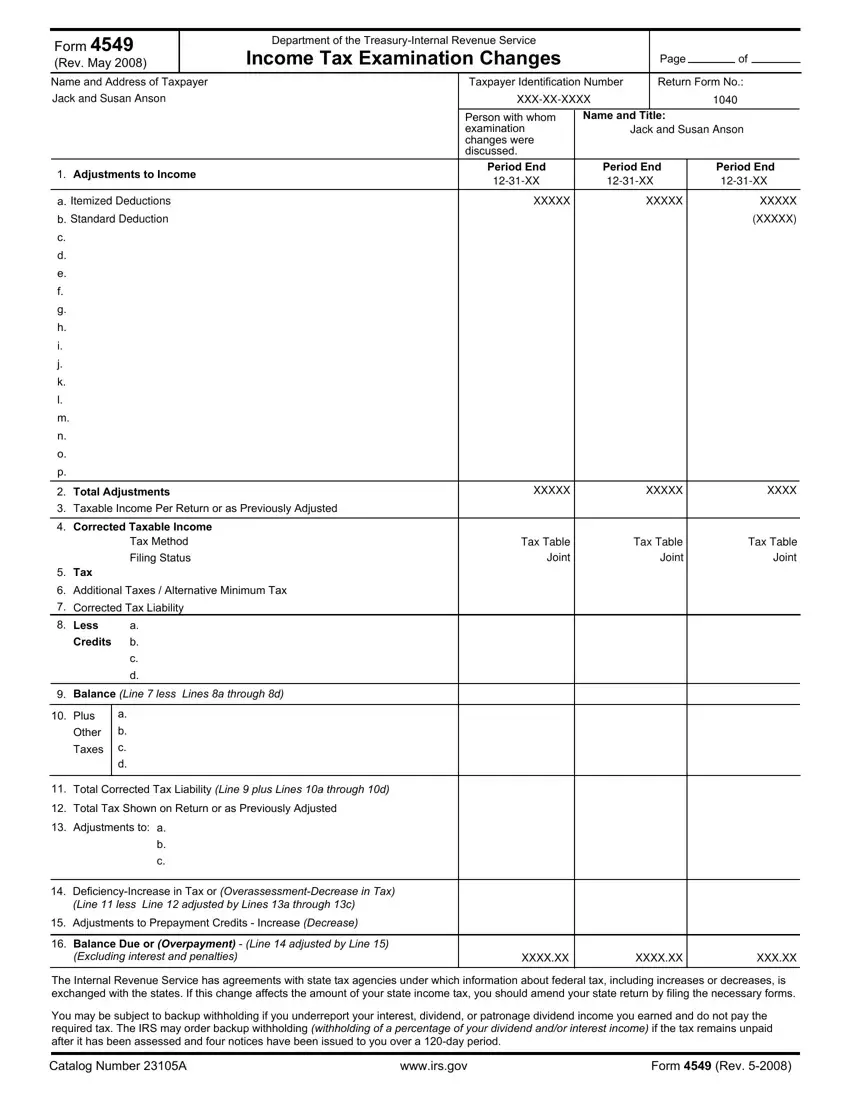

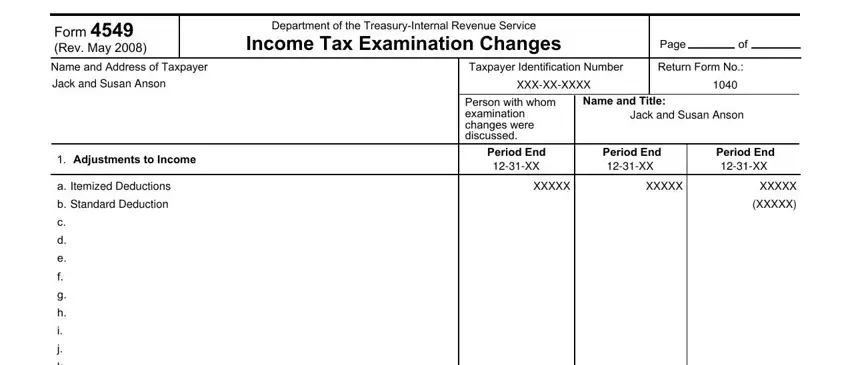

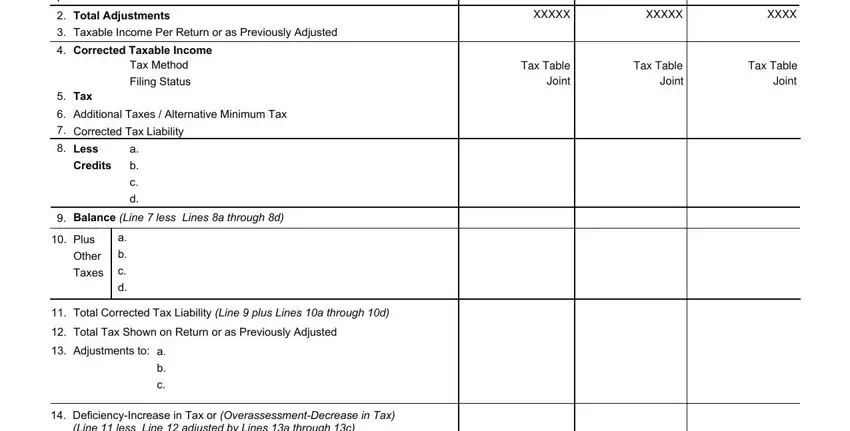

Fill out the particular segments to create the document:

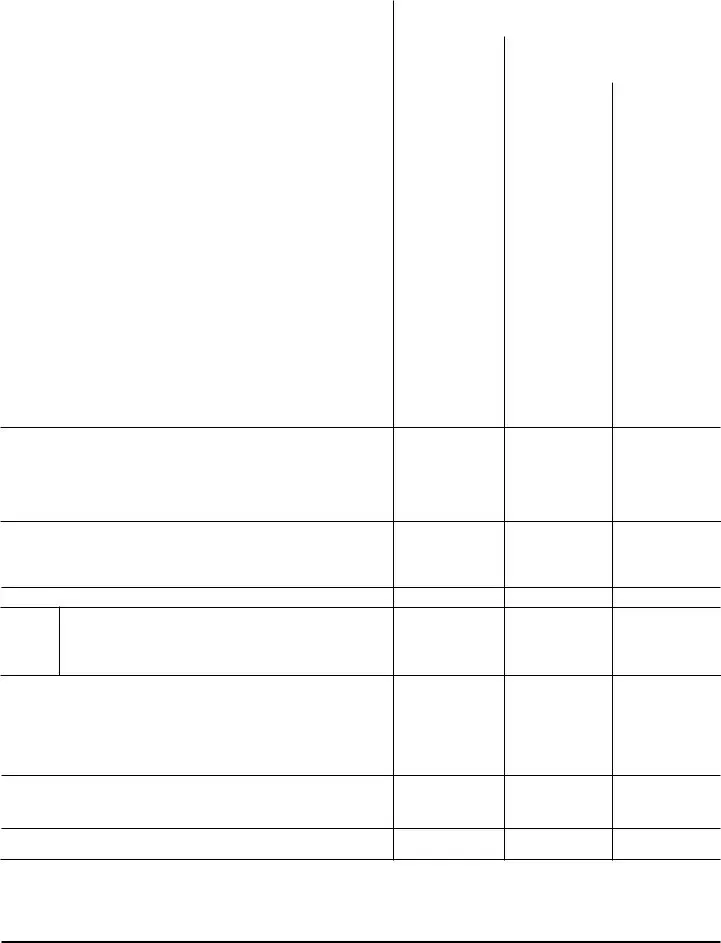

Write down the appropriate details in the area Total Adjustments, Taxable Income Per Return or as, Corrected Taxable Income, Tax Method, Filing Status, Tax, Additional Taxes Alternative, Credits, Balance Line less Lines a through, Plus, Other, Taxes, Total Corrected Tax Liability, Total Tax Shown on Return or as, and Adjustments to a b.

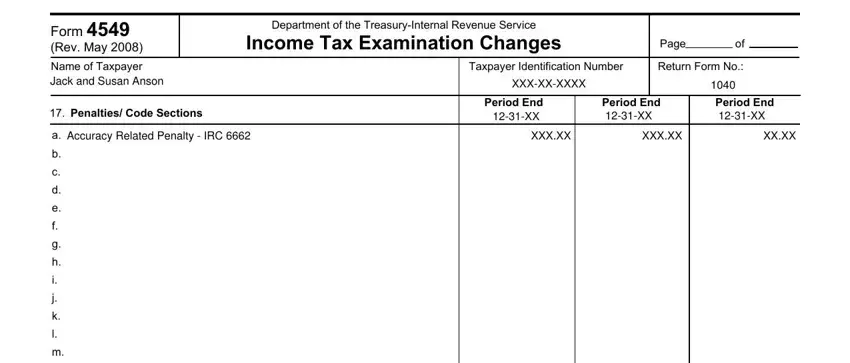

Write down the crucial particulars in Form Rev May, Name of Taxpayer Jack and Susan, Penalties Code Sections, Department of the TreasuryInternal, Page, Taxpayer Identification Number, Return Form No, XXXXXXXXX, Period End XX, Period End XX, Period End XX, Accuracy Related Penalty IRC, XXXXX, XXXXX, and XXXX section.

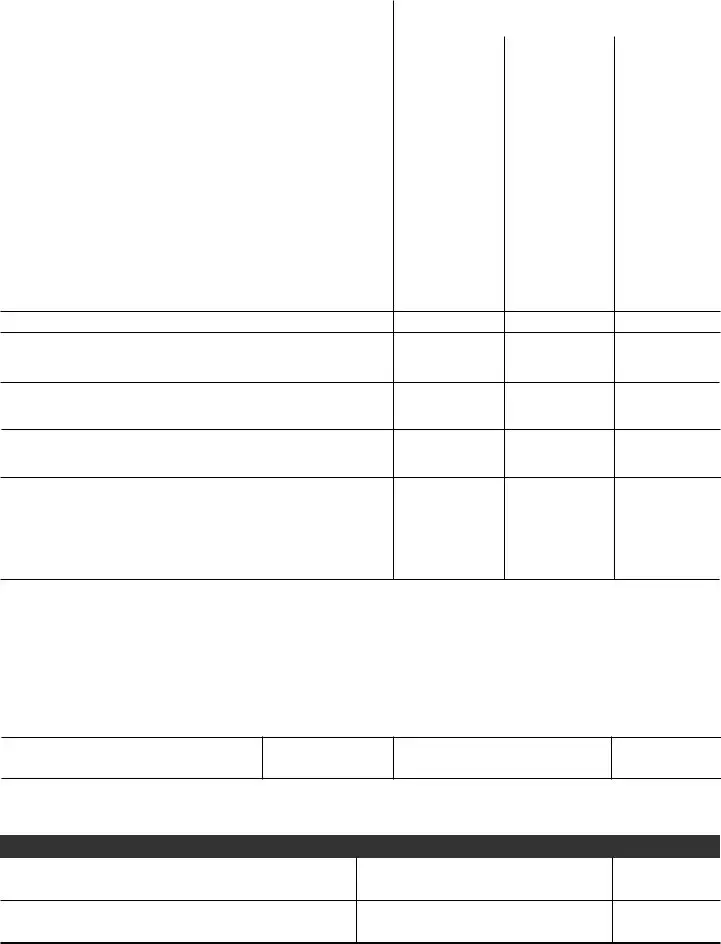

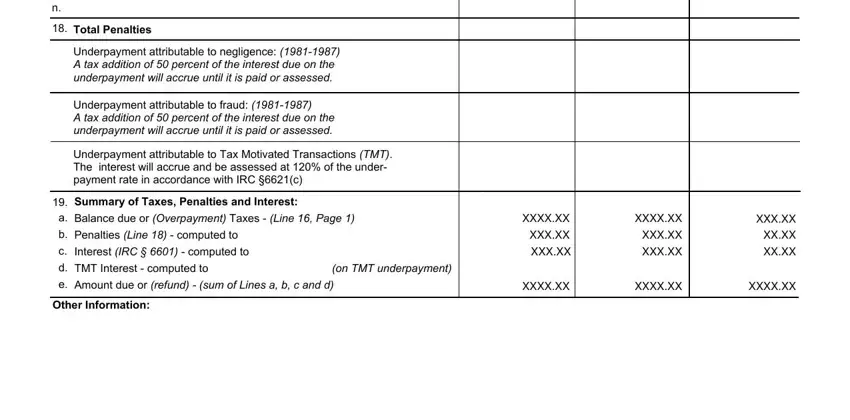

The Total Penalties, Underpayment attributable to, Underpayment attributable to fraud, Underpayment attributable to Tax, Summary of Taxes Penalties and, a Balance due or Overpayment Taxes, on TMT underpayment, Other Information, XXXXXX XXXXX XXXXX, XXXXXX XXXXX XXXXX, XXXXX XXXX XXXX, XXXXXX, XXXXXX, and XXXXXX section will be the place to insert the rights and obligations of each party.

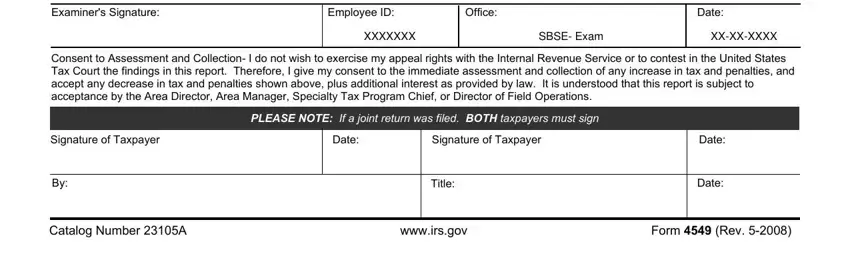

Complete the document by checking the following fields: Examiners Signature, Employee ID, Office, Date, Consent to Assessment and, XXXXXXX, SBSE Exam, XXXXXXXX, Signature of Taxpayer, Date, Signature of Taxpayer, PLEASE NOTE If a joint return was, Title, Date, and Date.

Step 3: Click "Done". Now you can transfer your PDF form.

Step 4: It could be better to have copies of the file. There is no doubt that we will not publish or read your data.