The notion behind our PDF editor was to make certain it is as simple to use as it can be. The whole procedure of filling in form 56 quick in case you stick to the next steps.

Step 1: To get going, hit the orange button "Get Form Now".

Step 2: So, you can begin modifying your form 56. The multifunctional toolbar is available to you - add, delete, change, highlight, and conduct many other commands with the words and phrases in the form.

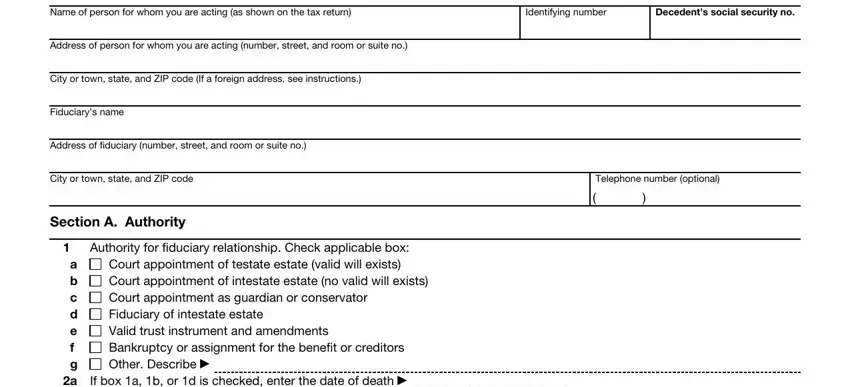

Prepare the form 56 PDF by typing in the content needed for each part.

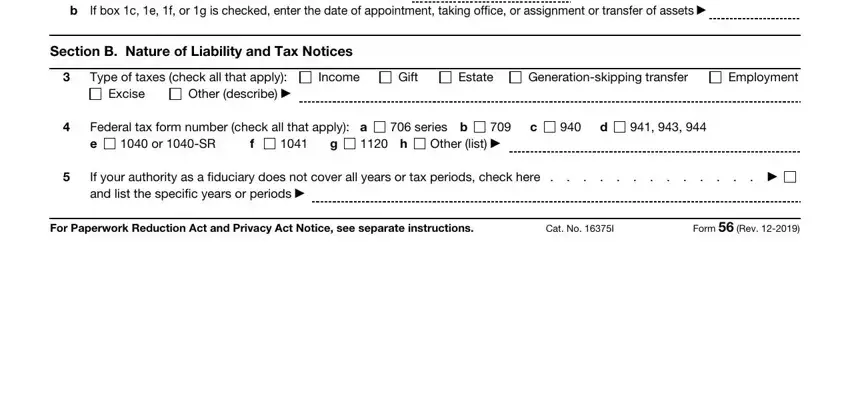

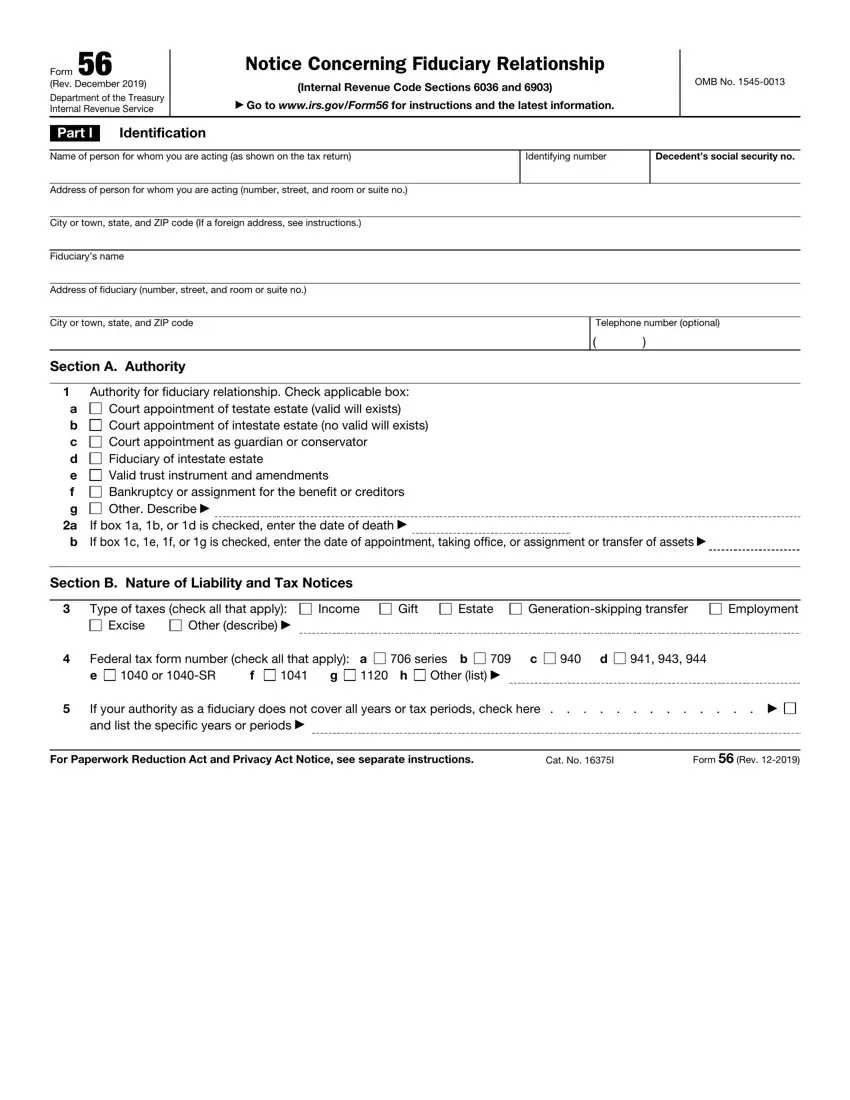

The system will need you to fill out the a b c d e f g a b, If box a b or d is checked enter, Section B Nature of Liability and, Type of taxes check all that apply, Excise, Income, Gift, Estate, Generationskipping transfer, Employment, Federal tax form number check all, or SR, Other list, series b, and If your authority as a fiduciary segment.

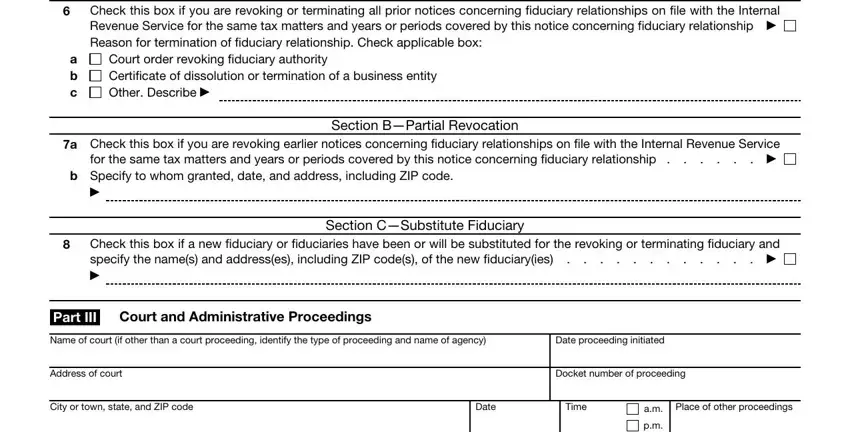

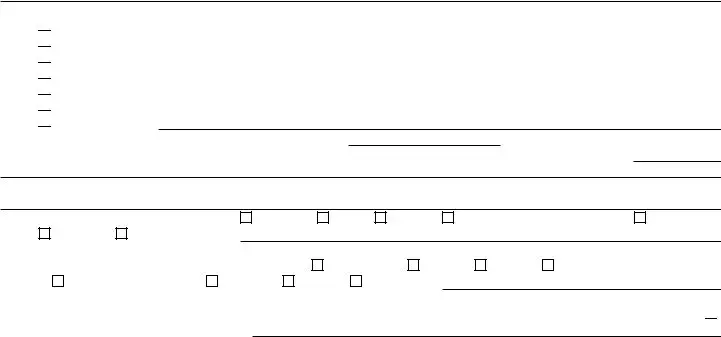

In the section referring to Section ATotal Revocation or, a b c, Court order revoking fiduciary, Section BPartial Revocation a, for the same tax matters and years, b Specify to whom granted date and, Section CSubstitute Fiduciary, specify the names and addresses, Part III Court and Administrative, Name of court if other than a, Date proceeding initiated, Address of court, Docket number of proceeding, City or town state and ZIP code, and Date, one should note some necessary data.

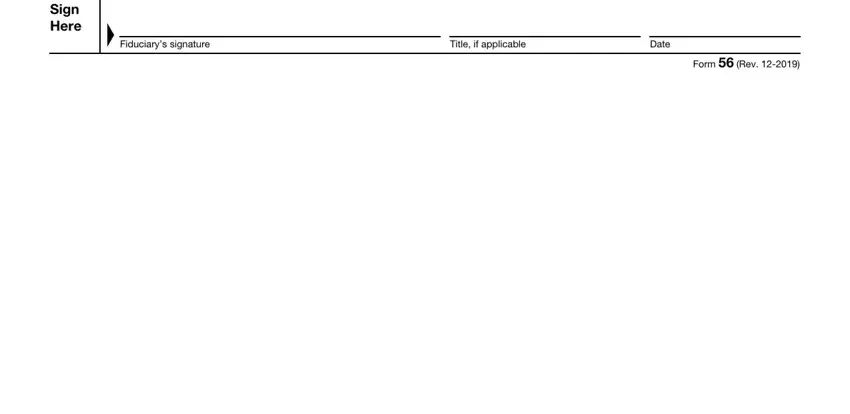

In the paragraph Please Sign Here, Fiduciarys signature, Title if applicable, Date, and Form Rev, specify the rights and obligations of the sides.

Step 3: Hit the Done button to save your form. At this point it is readily available for export to your electronic device.

Step 4: You may create copies of the file toavoid all possible future difficulties. You should not worry, we do not share or watch your details.

Court appointment of testate estate (valid will exists)

Court appointment of testate estate (valid will exists) Court appointment of intestate estate (no valid will exists)

Court appointment of intestate estate (no valid will exists) Court appointment as guardian or conservator

Court appointment as guardian or conservator Fiduciary of intestate estate

Fiduciary of intestate estate Valid trust instrument and amendments

Valid trust instrument and amendments Bankruptcy or assignment for the benefit or creditors

Bankruptcy or assignment for the benefit or creditors Other. Describe

Other. Describe

and list the specific years or periods

and list the specific years or periods

Court order revoking fiduciary authority

Court order revoking fiduciary authority