Our leading web developers have worked collectively to set-up the PDF editor that you may apply. The software allows you to prepare form 8850 pre screening notice documentation immediately and efficiently. This is everything you need to do.

Step 1: You can hit the orange "Get Form Now" button at the top of the following page.

Step 2: When you have entered the form 8850 pre screening notice editing page you can see all of the actions you'll be able to perform with regards to your document at the top menu.

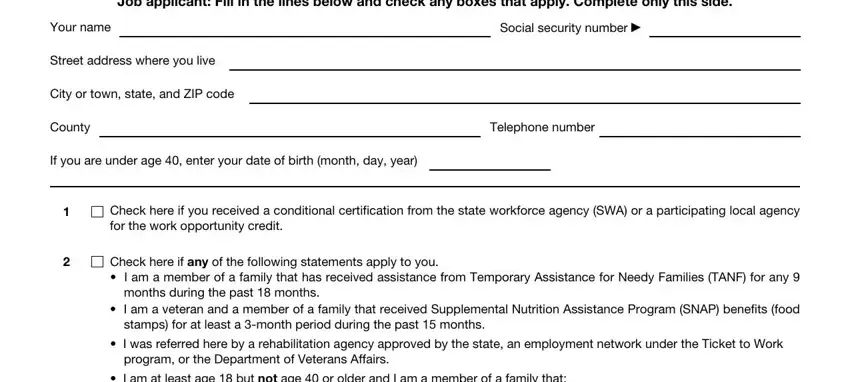

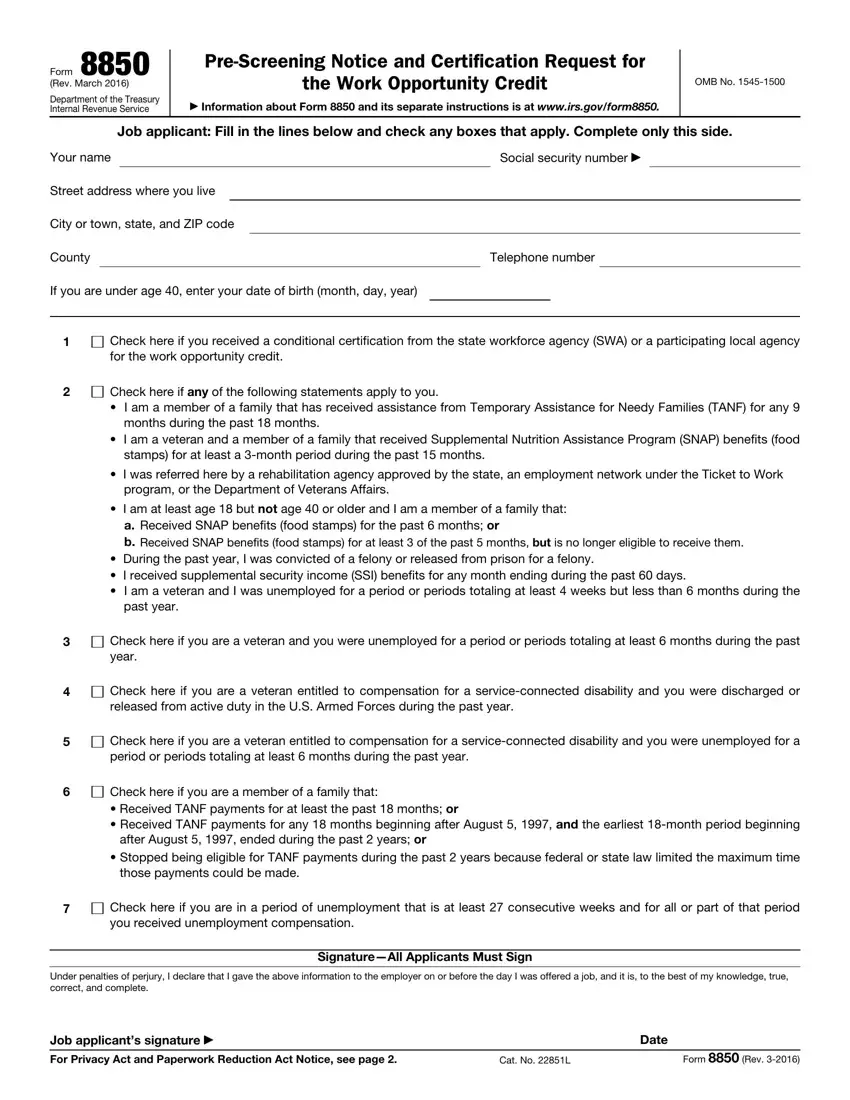

Type in the information required by the application to create the document.

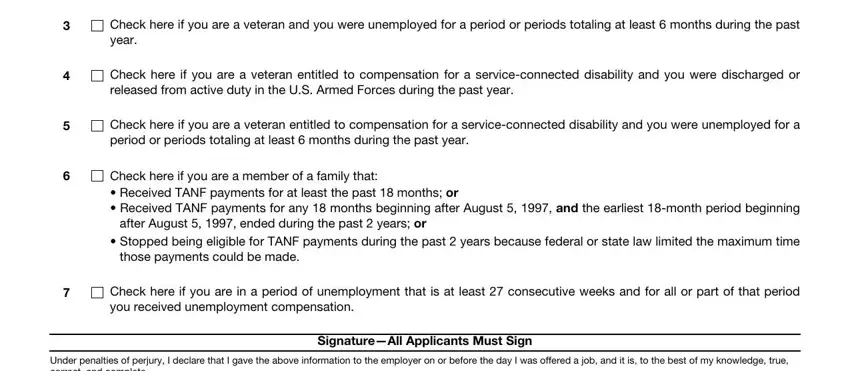

Fill in the Check here if you are a veteran, Check here if you are a veteran, Check here if you are a veteran, Check here if you are a member of, after August ended during the, Stopped being eligible for TANF, those payments could be made, Check here if you are in a period, Under penalties of perjury I, and SignatureAll Applicants Must Sign areas with any information that may be asked by the program.

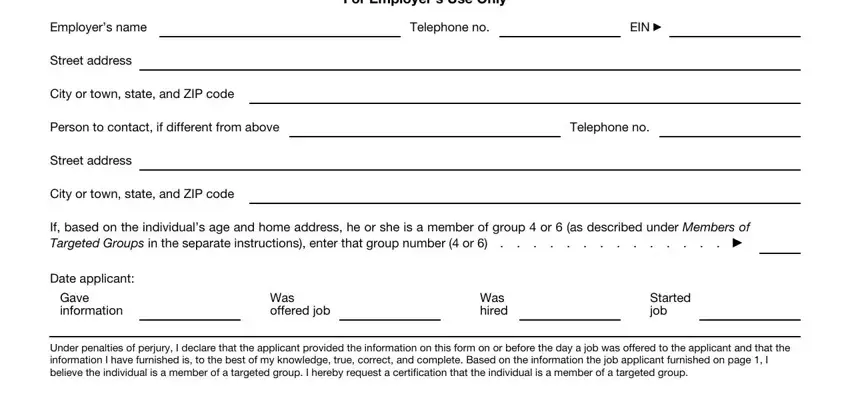

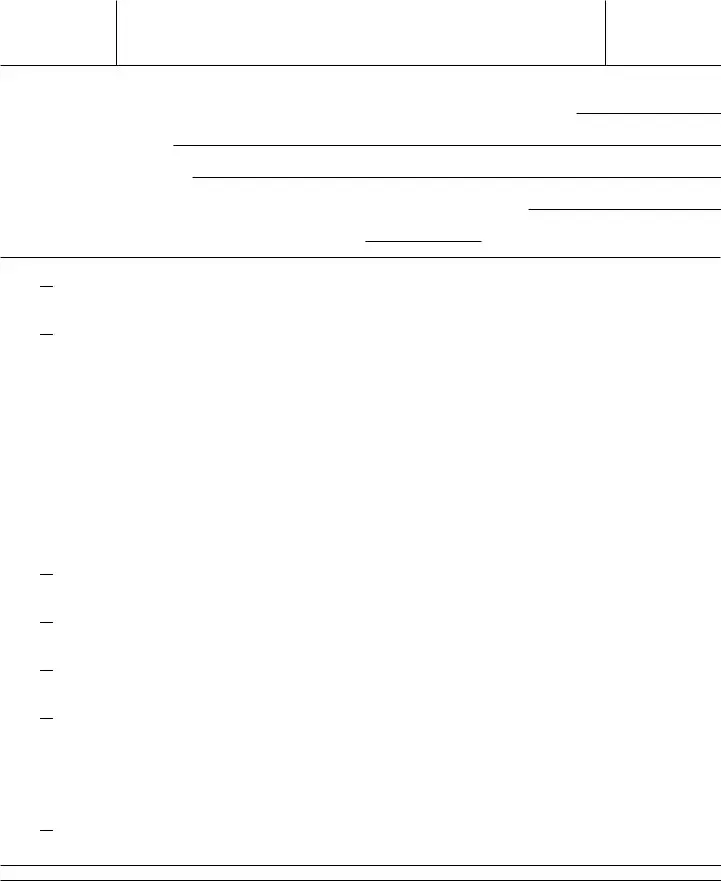

The software will ask you for information to effortlessly prepare the field Employers name, Street address, City or town state and ZIP code, For Employers Use Only, Telephone no, EIN, Person to contact if different, Telephone no, Street address, City or town state and ZIP code, If based on the individuals age, Date applicant, Gave information, Was offered job, and Was hired.

Step 3: When you have clicked the Done button, your file should be readily available export to any type of device or email address you identify.

Step 4: Make copies of the document - it can help you stay clear of upcoming complications. And fear not - we do not reveal or see your data.

Check here if you received a conditional certification from the state workforce agency (SWA) or a participating local agency for the work opportunity credit.

Check here if you received a conditional certification from the state workforce agency (SWA) or a participating local agency for the work opportunity credit.

Check here if

Check here if

Check here if you are a veteran and you were unemployed for a period or periods totaling at least 6 months during the past year.

Check here if you are a veteran and you were unemployed for a period or periods totaling at least 6 months during the past year.

Check here if you are a veteran entitled to compensation for a

Check here if you are a veteran entitled to compensation for a

Check here if you are a veteran entitled to compensation for a

Check here if you are a veteran entitled to compensation for a

Check here if you are a member of a family that:

Check here if you are a member of a family that: Check here if you are in a period of unemployment that is at least 27 consecutive weeks and for all or part of that period you received unemployment compensation.

Check here if you are in a period of unemployment that is at least 27 consecutive weeks and for all or part of that period you received unemployment compensation.