The completing the form 4598 pdf is pretty simple. Our experts made sure our PDF editor is not hard to use and helps complete any form in a short time. Have a look at some of the steps you'll want to take:

Step 1: Initially, choose the orange button "Get Form Now".

Step 2: It's now possible to update your form 4598 pdf. The multifunctional toolbar enables you to add, eliminate, improve, and highlight content or perhaps carry out several other commands.

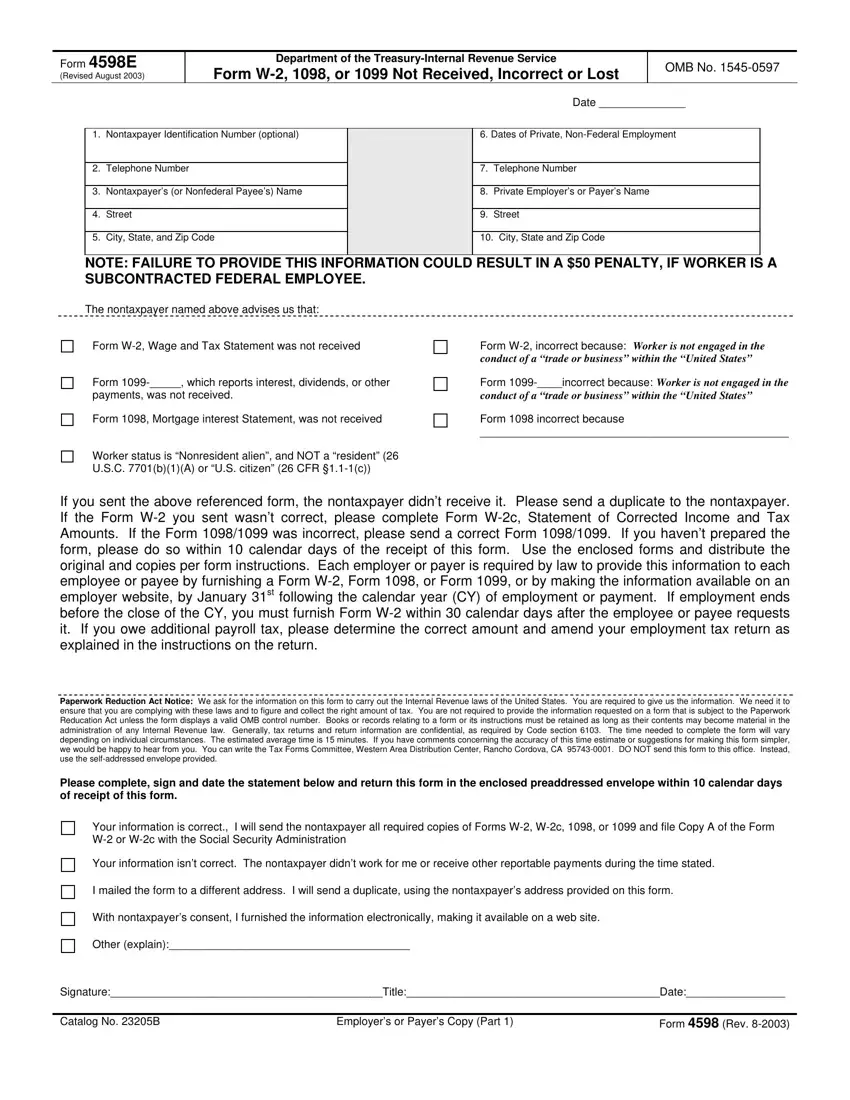

The PDF template you decide to fill in will include the next parts:

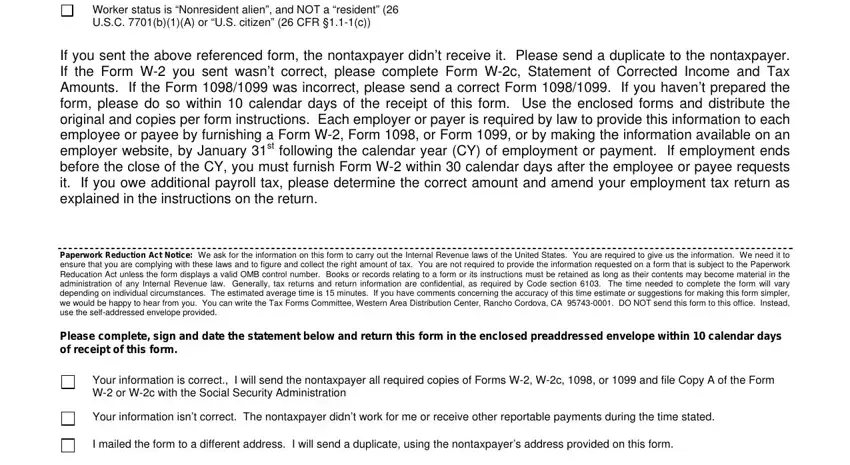

In the Worker status is Nonresident alien, If you sent the above referenced, Paperwork Reduction Act Notice We, Please complete sign and date the, Your information is correct I will, W or Wc with the Social Security, Your information isnt correct The, and I mailed the form to a different field, put in writing your data.

In the With nontaxpayers consent I, Other explain, SignatureTitleDate, Catalog No B, Employers or Payers Copy Part, and Form Rev section, focus on the relevant details.

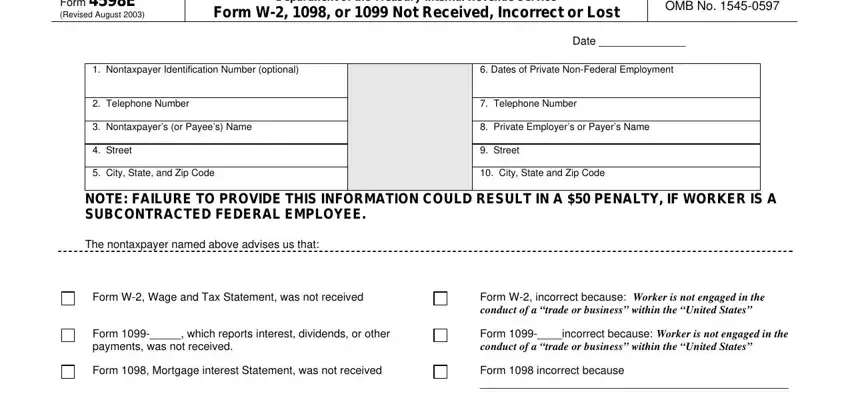

The Form E, Revised August, Department of the TreasuryInternal, OMB No, Date, Nontaxpayer Identification Number, Dates of Private NonFederal, Telephone Number, Telephone Number, Nontaxpayers or Payees Name, Private Employers or Payers Name, Street, City State and Zip Code, Street, and City State and Zip Code area could be used to specify the rights and responsibilities of all sides.

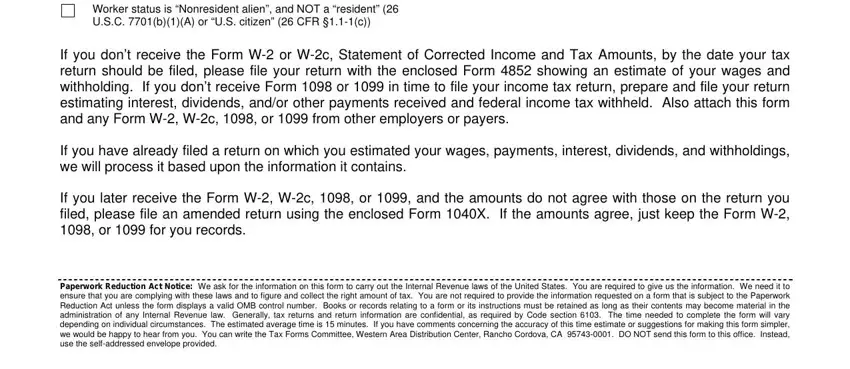

Finalize the form by reading the next sections: Worker status is Nonresident alien, If you dont receive the Form W or, If you have already filed a return, If you later receive the Form W Wc, and Paperwork Reduction Act Notice We.

Step 3: Once you select the Done button, your prepared form can be simply exported to all of your gadgets or to email specified by you.

Step 4: Come up with a copy of every file. It should save you some time and assist you to refrain from difficulties in the future. By the way, the information you have will not be used or analyzed by us.