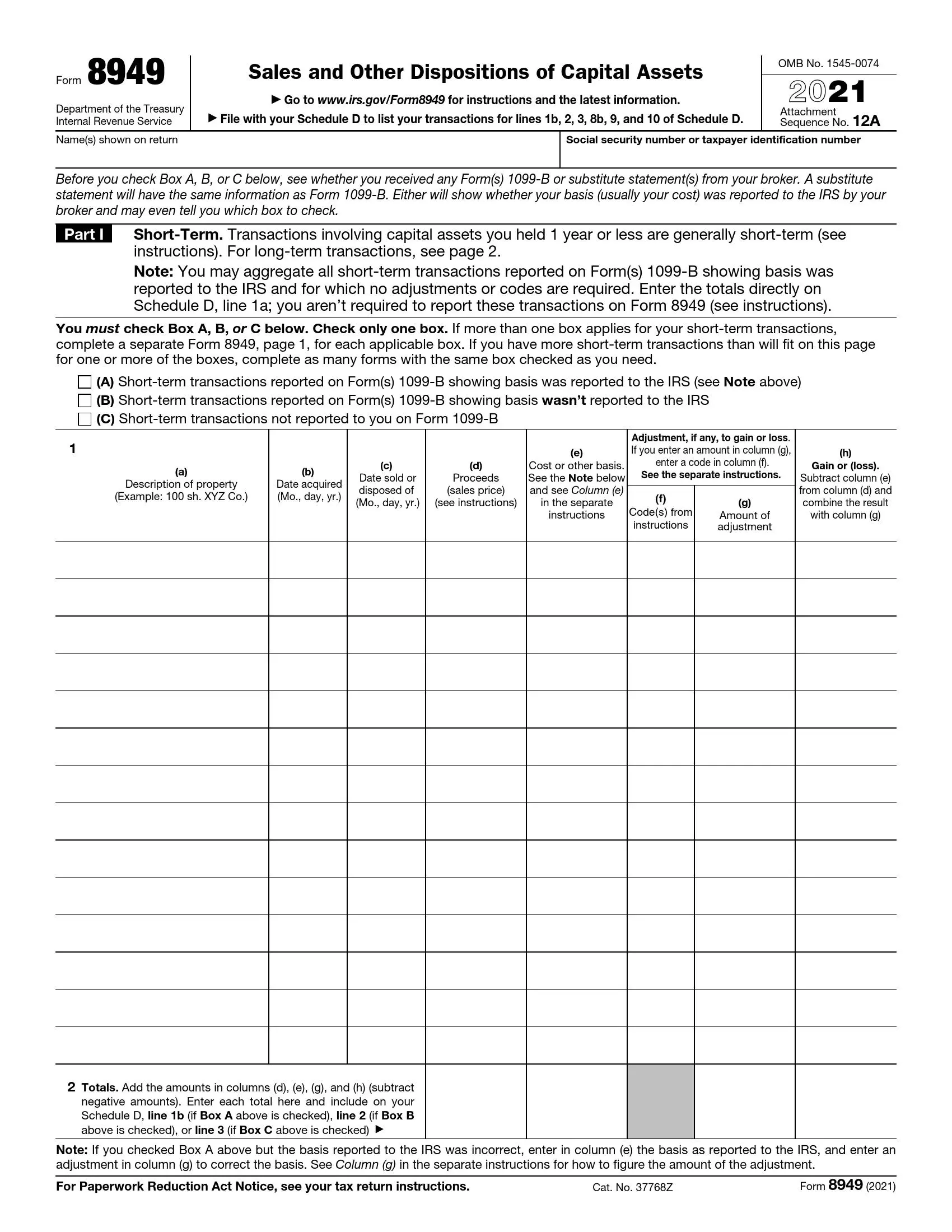

IRS Form 8949 is a tax form that taxpayers use to report the sale or exchange of capital assets that are not reported on other forms. Examples include stocks, bonds, real estate, and other investments. The form is essential for calculating capital gains or losses, which are then transferred to Schedule D (Form 1040) and used to determine the taxpayer’s tax liability. Information required on Form 8949 includes:

- Description of the property,

- Date acquired and sold,

- Proceeds from the sale,

- Cost or other basis,

- Adjustments to gain or loss.

Taxpayers use Form 8949, titled “Sales and Other Dispositions of Capital Assets,” to detail each transaction individually, allowing for adjustments such as market discounts, nondeductible losses, and wash sale losses. This detailed reporting ensures accurate calculation of the capital gains tax owed, reflecting the taxpayer’s investment activity throughout the year.

Other IRS Forms for Business

The IRS requires businesses to report information on financial transactions and actions they take through their operation. Find out more about similar IRS forms on our other pages.

How to Submit the Form

The paper is useful for a person who got Form 1099. The last is a state record that any company or individual, excluding your employer, gave you money for some object. Usually, the payers themselves submit Form 1099. Then it goes to the person who received the number of funds and at the same time to the IRS.

Who is the payer? It may be the bank that paid a client the benefit on their deposit or a client of a freelancer who paid him money. Form 1099 contains your SSN or taxpayer ID, so the IRS keeps records of such transactions and knows that you received the money.

Form 1099 does not mean that you are obliged to send the tax on this profit. If you have deductions that offset your income, then you do not have to pay tax. Even the gain from the sale of a private house is not always taxed, so often the Form 1099 is just an official statement of the transfer. The document does not exist to force a person to pay a tax but to keep records of profits and expenses annually.

There are many varieties of this document (they differ in the index after the form number), and we do not intend to consider them here. It is important to note that filling out Form 8949 often follows receiving you have owned for a period of less than one year), while the second one deals with long-term transactions (with assets that you held for more than a year). Form 1099 provides information about the type of transfer if it is unknown.

The form requires you to fill in a couple of lines, check the box, and complete the table. This can be done via our online form builder that is more convenient than the printed version of the document. Next, see our short guide for filling out the form.

Enter the basic data.

Enter the name listed on the return and identification information such as your taxpayer ID or social security number.

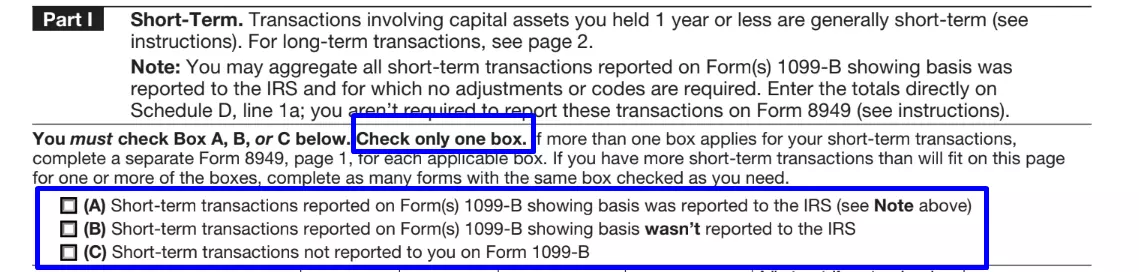

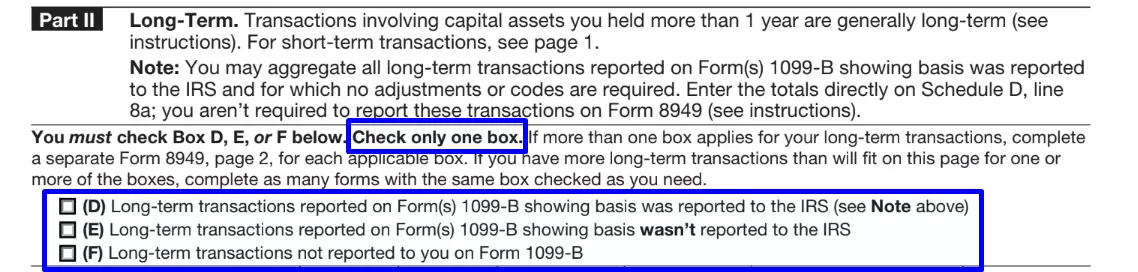

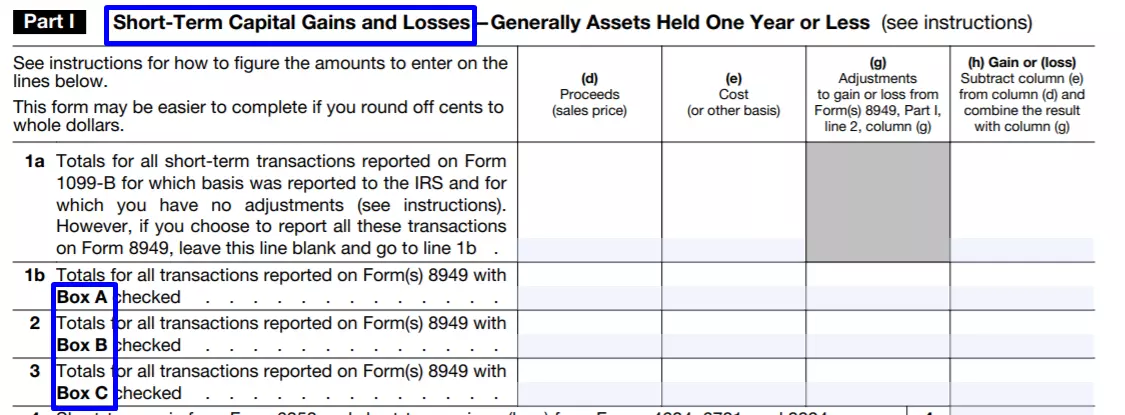

Specify the transaction type.

Sections A-C of the first part are intended for short-term transfers.

Items D-F of the second part concerns long-term ones.

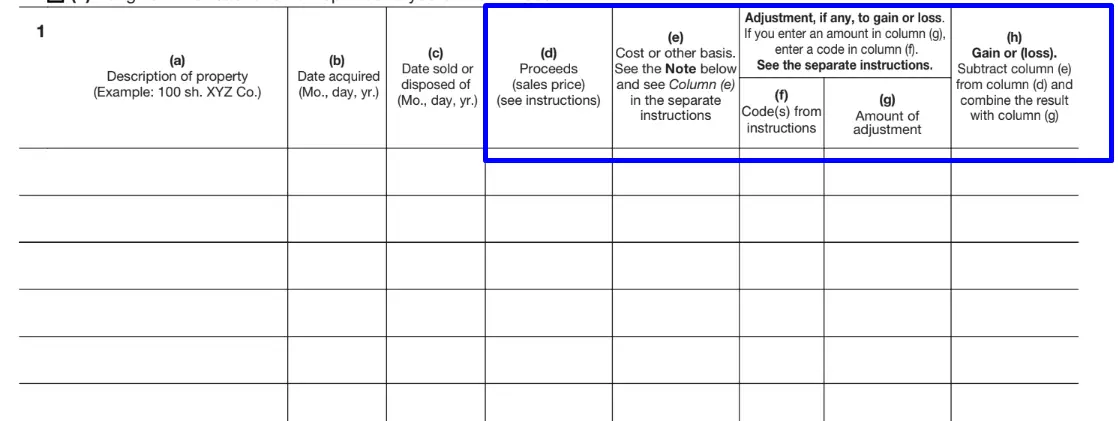

Fill in the primary data in the table.

Most likely, you will not have to adjust the data in columns (a) – (c). The description of the object is based on the information provided in Form 1099. The dates of selling and buying are indicated at the same place.

Complete the other columns.

Specify the price for which the object was sold in column (d). Enter the amount corresponding to the cost or other basis (e). In column (g), you can give the adjustments that you think are necessary. Finally, in column (h), specify profit or loss.

The IRS instruction that accompanies the document will help you better understand the calculations.

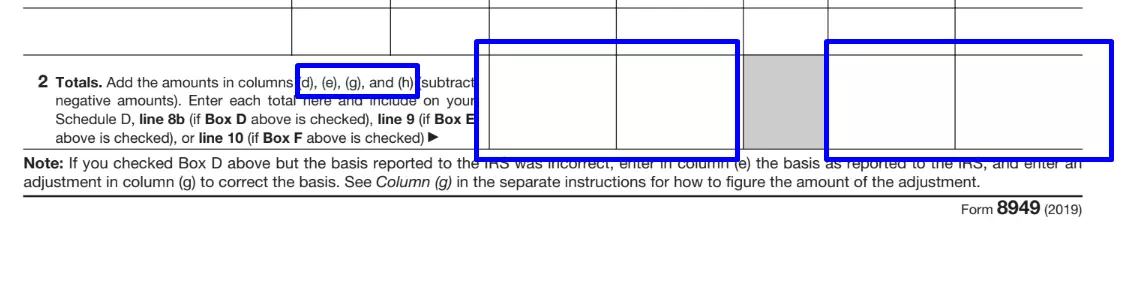

Calculate the total sum.

At the bottom, enter the total count for each column specified in the document.

Copy the data to Schedule D.

Enter the total amount from columns (d), (e), (g), and (h) on the first line of Form 1040 if you selected A, on the second line if you selected B, and on the third line if you selected C.

Here is the correspondence of the form lines for long-term operations (Part two Form 8949).