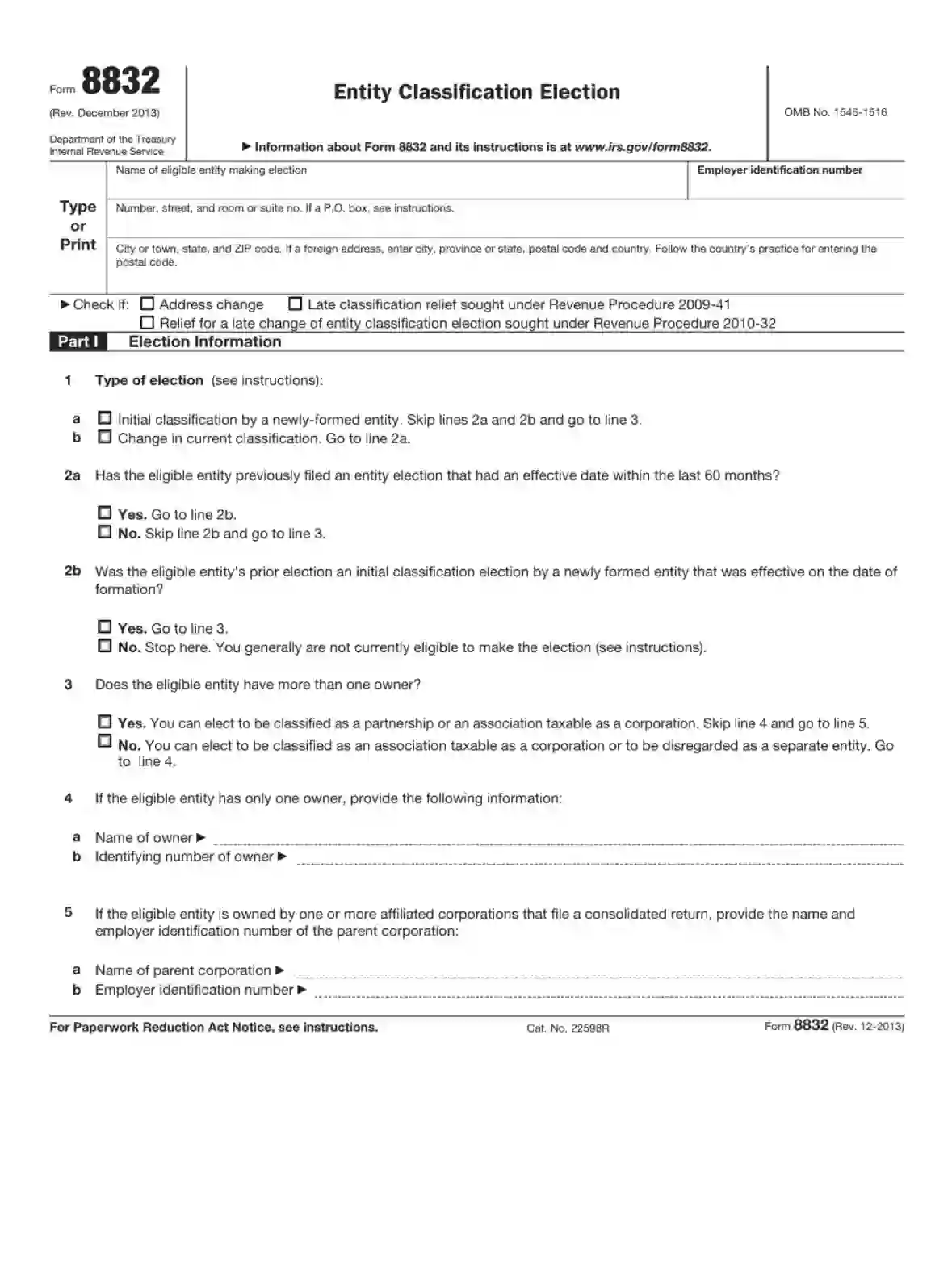

IRS Form 8832 is a document eligible entities use to elect how they want to be classified for federal tax purposes. An eligible entity, typically a business entity such as a corporation or partnership, can use this form to change its classification to either a corporation, a partnership, or a disregarded entity if it is a single-member limited liability company (LLC). This choice directly affects how the entity is taxed, including the tax rates applicable and the tax reporting requirements.

Form 8832 allows business entities flexibility in choosing a tax classification that best suits their operational and financial goals. Depending on the entity’s specific circumstances, making an election can lead to significant tax advantages. For example, a business might change its classification to be treated as a corporation to benefit from corporate tax rates or be disregarded as separate from its owner for a simpler tax reporting process.

Other IRS Forms for Business

The US Internal Revenue Service devised forms to report various types of information about businesses. Check whether your business has considered preparing some other necessary IRS forms.

How to Fill Out the Form

Usually, if the form is sent on behalf of an entity, its accountants deal with its content, completion, and submission. So, if you want to change your status using this form, you can delegate the task to those workers.

If for some reason, you do not have any accountants among your personnel, you can try completing the template individually or find a contractor who will provide you with the filled-out form. There are many agencies and individuals who are dealing with such forms professionally day by day. Hiring them is always a smart move that helps to avoid errors when making the document and problems in the future.

To make you feel more confident about this form, we have added guidelines that assist in the completion. Apart from them, you always should stick to the guide issued by the Service that also answers all questions you might have about the document (see the form’s pages from 4 to 7). We will mention this guide in our instructions, too.

Find the Template

It is crucial that you find the proper form before filling it out. All IRS forms are available on the Service’s site, but sometimes looking for them might be time-consuming. Instead, we suggest you try our easy-to-use form-building software to download the correct IRS Form 8832 right away.

Read the Notice

The first page you see in the form is an information sheet that tells you how to file the document. Read it before you begin adding data to the template.

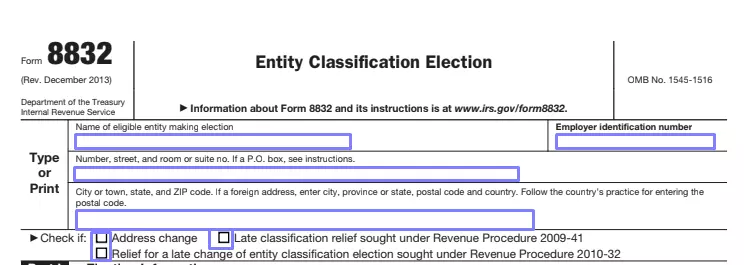

Provide Entity’s Info

To start, identify the entity that will send the form. Write its name, EIN (employer identification number), and full address (see the given instructions to insert all the needed details if the entity is foreign). Below, choose from three options describing your case. See the instructions from the Service if something is not clear here.

Outline Election Info

You have to answer various questions regarding your classification election. Firstly, indicate if you are selecting classification for a new or an existing entity. Then, reply to a set of “yes or no” questions. Near every answer, you will see what lines you should fill out next and what lines you can ignore.

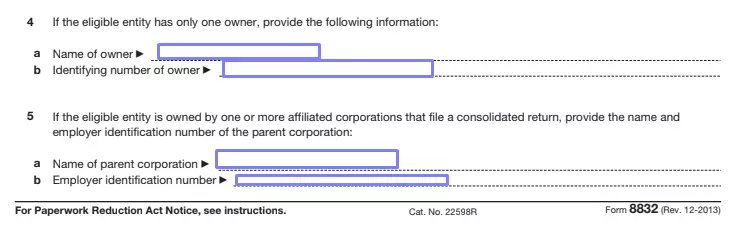

Your entity may have just one owner. If this is the case, indicate the owner’s name and ID number in line 4. If the entity is owned by an affiliated corporation (or corporations), insert the needed data in line 5 (parent corporation’s name and its EIN).

Select the relevant entity type in the following section and answer if the entity is established in a jurisdiction outside the United States (enter the country). Define the date when the election should start being effective.

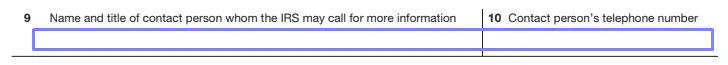

Below, you have to insert the details on the person who can be questioned by the Service. Add this person’s name, title, and valid phone number.

Ask Co-Members to Provide Their Consent

If this election is about an entity with multiple concerned parties (members, owners, officers, and so on), everyone should know about the potential changes and agree with them. So, the second part of the form is a chart where each relevant person should sign. Besides a signature, everybody should write the current date and their title.

Complete the Last Part (If Applicable)

Your entity might be late with submitting this form. To define what is “late” for this form, scroll down to the Service’s instructions. If this is your case, you can explain the reasons in the form’s last part. Describe all details in the designated lines. Under that lines, everyone concerned should sign again, leaving the current date and their title (as in the previous part).

After the last part, you can scroll down to check the IRS instructions we have mentioned above: they are added to the following pages. We recommend checking them all the time when you complete the form.