It is really simple to fill in the pa1000 schedule a empty blanks. Our software can make it virtually effortless to complete any specific PDF. Down below are the primary four steps you should take:

Step 1: Select the button "Get Form Here" on the website and select it.

Step 2: Now you can modify your pa1000 schedule a. Our multifunctional toolbar allows you to include, delete, modify, and highlight content as well as undertake several other commands.

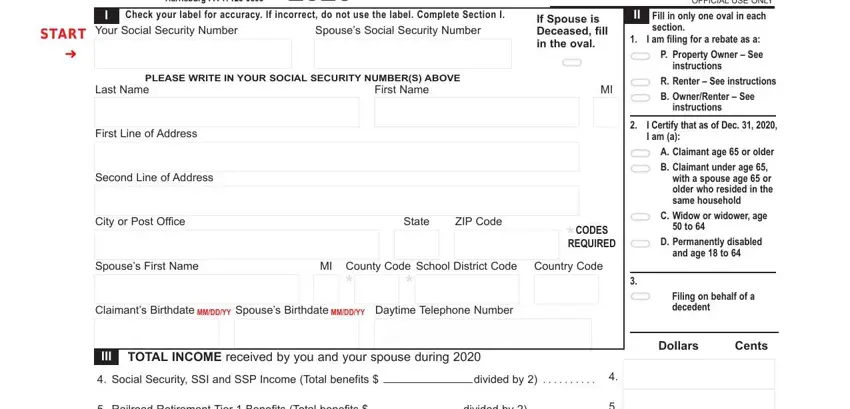

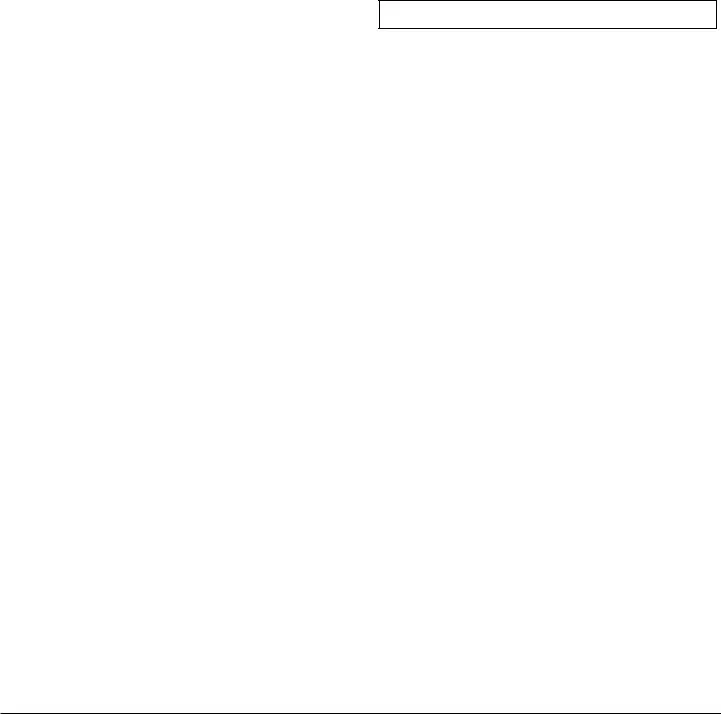

The next areas will make up the PDF form:

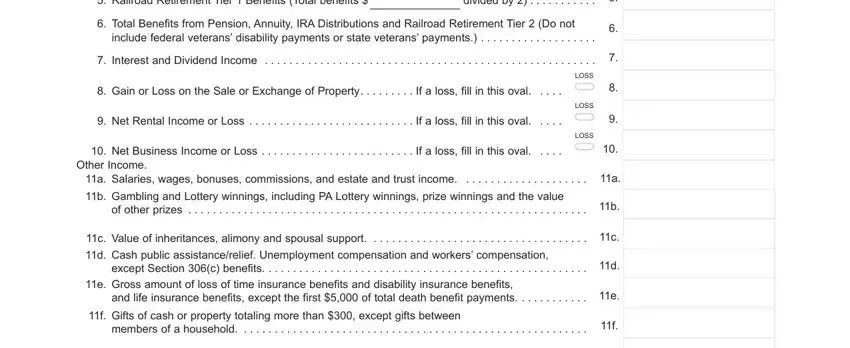

Type in the required particulars in Railroad Retirement Tier, Total Benefits from Pension, Interest and Dividend Income, Gain or Loss on the Sale or, Net Rental Income or Loss, Net Business Income or Loss, Other Income, LOSS, LOSS, LOSS, a Salaries wages bonuses, b Gambling and Lottery winnings, c Value of inheritances alimony, d Cash public assistancerelief, and f Gifts of cash or property box.

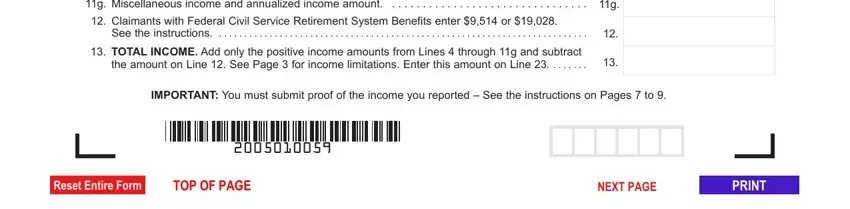

Write down any details you are required inside the field g Miscellaneous income and, Claimants with Federal Civil, TOTAL INCOME Add only the, and IMPORTANT You must submit proof of.

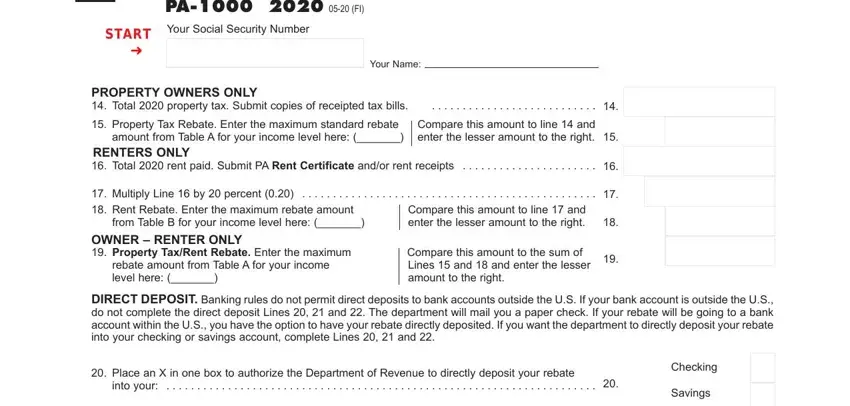

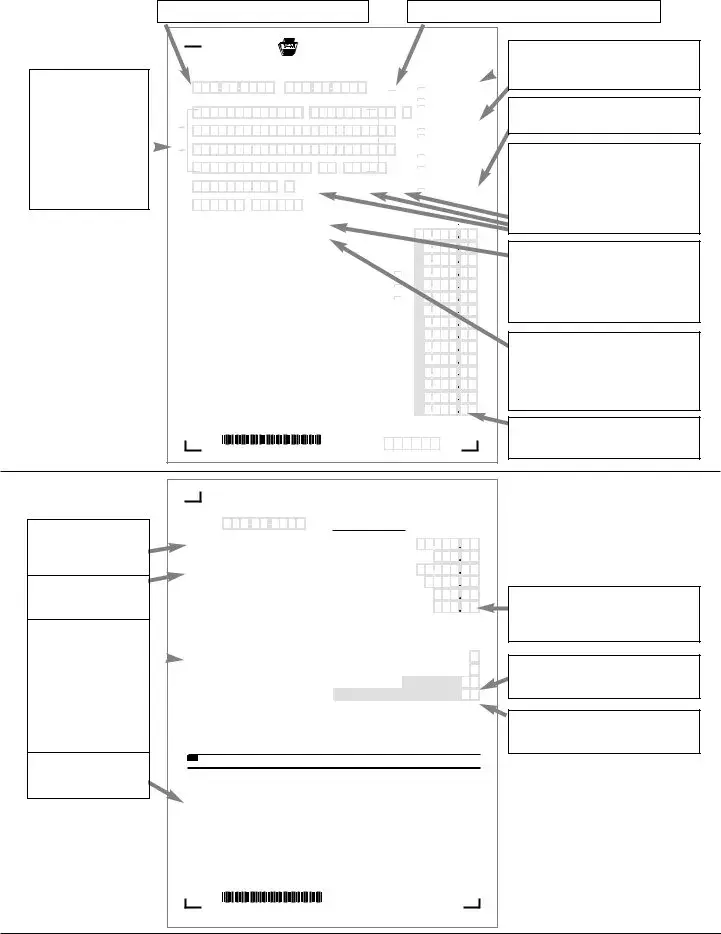

Explain the rights and responsibilities of the parties in the part PA FI, Your Social Security Number, Your Name, PROPERTY OWNERS ONLY Total, Property Tax Rebate Enter the, Compare this amount to line and, Multiply Line by percent, Compare this amount to the sum of, DIRECT DEPOSIT Banking rules do, Place an X in one box to, Checking, and Savings.

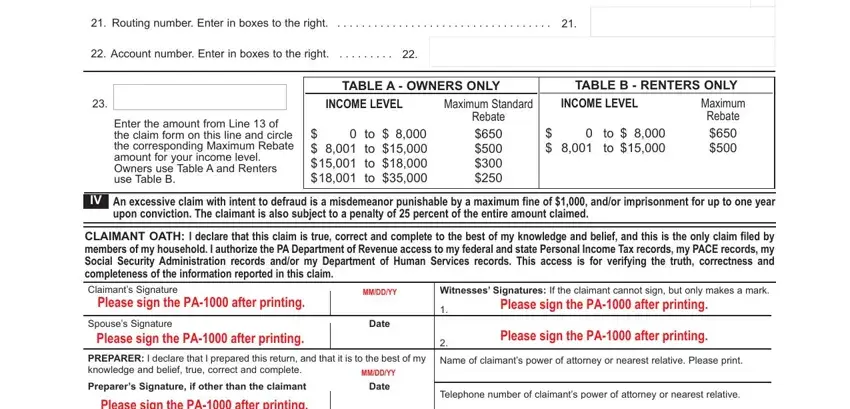

Terminate by reading these fields and filling them out correspondingly: Routing number Enter in boxes to, Account number Enter in boxes to, Enter the amount from Line of the, TABLE A OWNERS ONLY INCOME LEVEL, TABLE B RENTERS ONLY, INCOME LEVEL Maximum Rebate to, An excessive claim with intent to, CLAIMANT OATH I declare that this, Witnesses Signatures If the, Spouses Signature Date, PREPARER I declare that I prepared, Preparers Signature if other than, Name of claimants power of, Telephone number of claimants, and Home address of claimants power.

Step 3: When you are done, click the "Done" button to transfer the PDF document.

Step 4: Ensure that you stay clear of forthcoming complications by creating as much as a couple of duplicates of your form.

it is

it is  Fill in only one oval for Line 2.

Fill in only one oval for Line 2. s

s s

s s

s s

s s

s

s

s s

s rebate directly

rebate directly