Working with PDF forms online can be very simple with our PDF editor. You can fill in f5129 form here with no trouble. Our team is always working to expand the tool and enable it to be even better for people with its multiple features. Take full advantage of the latest innovative possibilities, and discover a trove of new experiences! All it takes is several easy steps:

Step 1: Hit the "Get Form" button in the top part of this page to access our PDF tool.

Step 2: This tool will give you the ability to work with almost all PDF files in a variety of ways. Modify it by writing any text, correct original content, and put in a signature - all readily available!

Be attentive when filling out this document. Ensure that all required blanks are filled in properly.

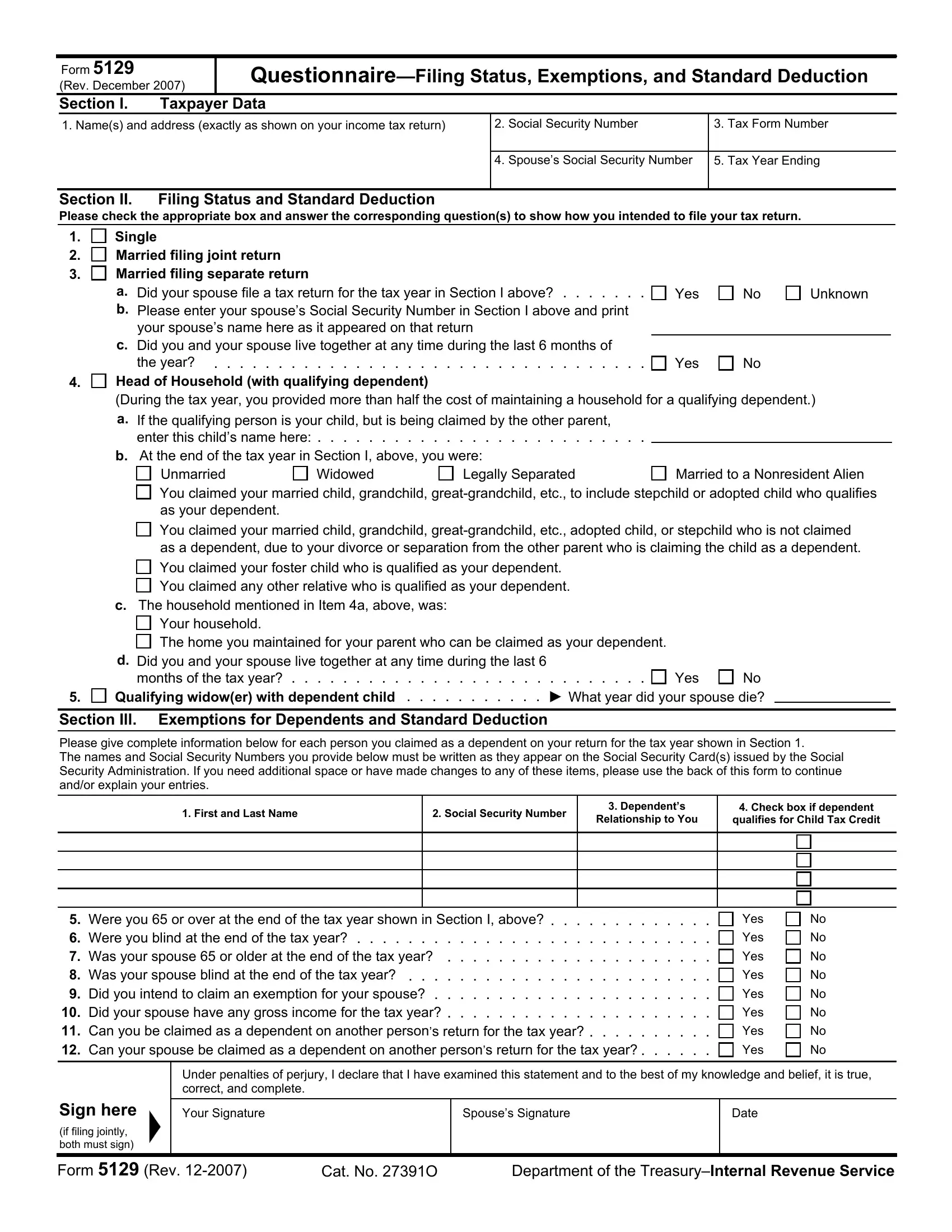

1. The f5129 form usually requires certain information to be typed in. Be sure the following blank fields are complete:

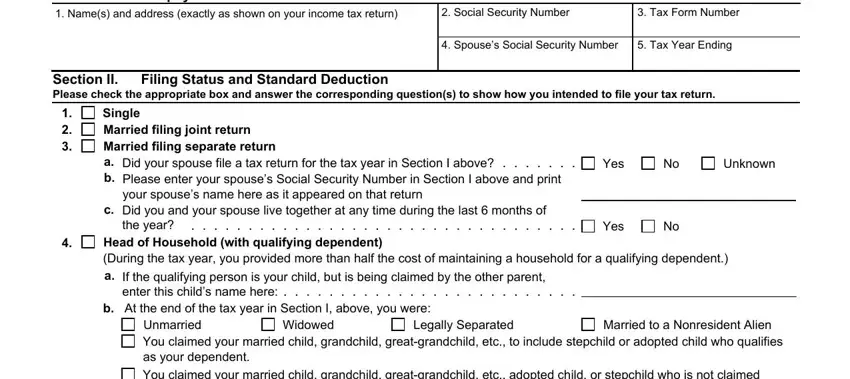

2. The next stage is usually to fill out the following blank fields: You claimed your married child, You claimed your foster child who, c The household mentioned in Item, Your household The home you, d Did you and your spouse live, months of the tax year, No Qualifying widower with, Yes, Section Ill Exemptions for, Please give complete information, First and Last Name, Social Security Number, Dependents, Relationship to You, and Check box if dependent.

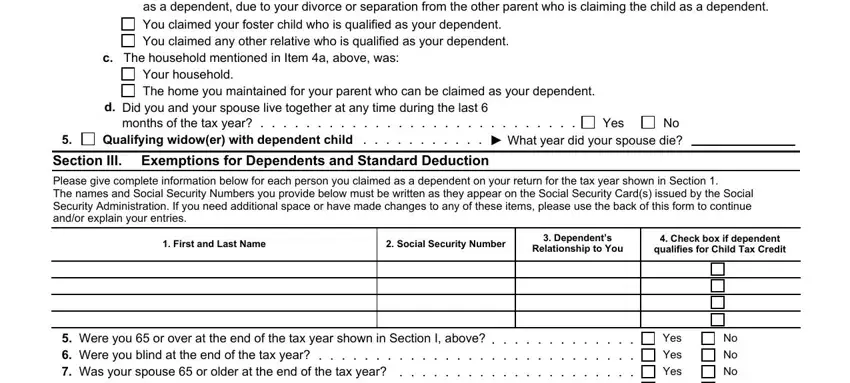

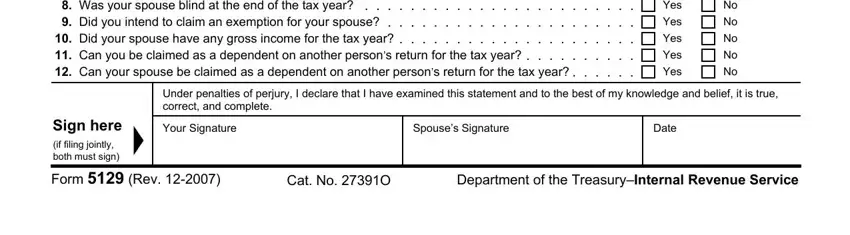

3. Through this part, look at Were you or over at the end of, Yes, Yes, Yes, Yes, Yes, Under penalties of perjury I, Your Signature, Spouses Signature, Date, Sign here, if filing jointly both must sign, Form Rev, Cat No O, and Department of the TreasuryInternal. These will have to be taken care of with utmost precision.

It's very easy to get it wrong when filling out your Form Rev, hence you'll want to go through it again before you'll submit it.

Step 3: Make certain the information is accurate and then click on "Done" to complete the task. Create a free trial plan at FormsPal and get instant access to f5129 form - download or edit inside your FormsPal account page. FormsPal ensures your information privacy with a secure system that never records or distributes any personal information used in the PDF. You can relax knowing your docs are kept protected whenever you use our services!