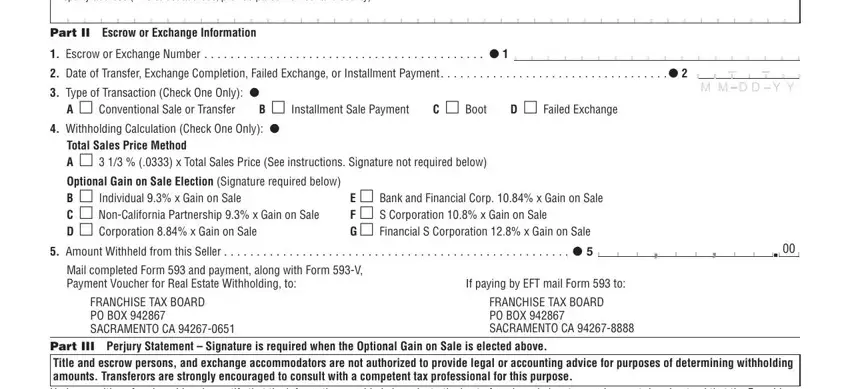

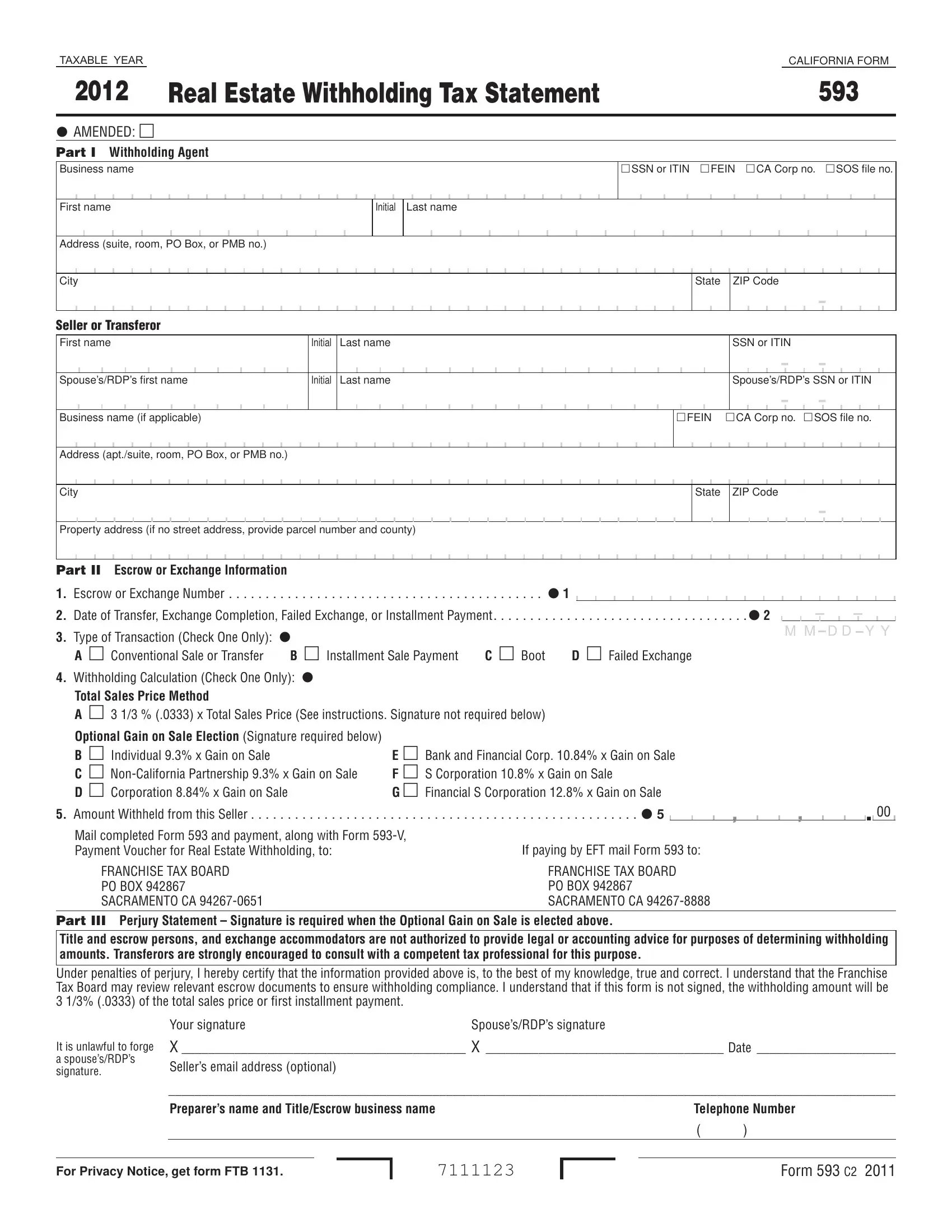

Conventional Sale or Transfer: Check this box if the conventional sale or transfer represents the close of escrow for the real estate transaction. This sale or transfer does not contain any conditions such as an installment sale, boot, or failed exchange.

Installment Sale Payment: Check this box if you are withholding on either the principal portion of the first installment payment during escrow or on the principal portion of a subsequent installment payment including the final payoff in escrow. Attach a copy of the promissory note with the first installment payment.

Boot: Check this box if the seller intends to complete a deferred exchange, but receives boot (cash or cash equivalent) out of escrow.

Failed Exchange: Check this box for any failed exchange, including if a failed deferred exchange had boot withheld upon in the original relinquished property.

Line 4 – Withholding Calculation

Check one box that represents the method to be used to calculate the withholding amount on line 5. Either the Total Sales Price Method (31/3% (.0333) of the sale price) or the Optional Gain on Sale Election based on the applicable tax rate as applied to the gain on sale. Check only one box, A-G.

Line 5 – Amount Withheld

Enter the amount withheld from this transaction or installment payment based upon the appropriate calculation for either the Total Sales Price or the Optional Gain on Sale Election, below.

Withholding Amount Using Total Sales Price

Conventional Sale or Transfer:

a.Total Sales Price . . . . . . . . . .$__________

b.Enter the seller’s

ownership percentage . . . . . . _ _ _ ._ _%

c.Amount Subject to Withholding. Multiply line a by line b and

enter the result . . . . . . . . . .$__________

d.Withholding Amount. Multiply line c by 31/3% (.0333) and enter the result here and on

Form 593, line 5 . . . . . . . . . .$__________

Installment Sales:

a.Amount Subject to Withholding. If you are withholding on the first installment payment in escrow, enter the required amount of the first installment payment. If you are withholding on subsequent installment payments or the final payoff in escrow, enter

the principal portion of the

payment . . . . . . . . . . . . . . . .$__________

b.Withholding Amount. Multiply line a by 31/3% (.0333) and enter the result here and on

Form 593, line 5 . . . . . . . . . .$__________

Exchanges:

a.Amount Subject to Withholding. For completed deferred exchanges, enter the amount of boot (cash or cash equivalent) received by

the seller. . . . . . . . . . . . . . . .$__________

b.Withholding Amount. Multiply line a by 31/3% (.0333) and enter the result here and on

Form 593, line 5 . . . . . . . . . .$__________

Failed Exchanges:

a.Total Sales Price. If a deferred exchange is not completed or does not meet the deferred requirements, enter the total

sales price . . . . . . . . . . . . . .$__________

b.Ownership Percentage. If multiple transferors attempted to exchange this property, enter this seller’s ownership percentage. Otherwise,

enter 100.00% . . . . . . . . . . . . _ _ _ ._ _%

c.Amount Subject to Withholding. Multiply

line a by line b . . . . . . . . . . .$__________

d.Withholding Amount. Multiply line c by 31/3% (.0333) and enter the result here and

on Form 593, line 5 . . . . . . .$__________

Withholding Amount Using Optional Gain on Sale Election

Conventional Sale or Transfer: Enter the amount from Form 593-E, Real Estate Withholding – Computation of Estimated Gain or Loss, line 17 on Form 593, line 5.

Installment Sales: The Installment Withholding Percent is applied to the principal portion of all installment payments, including the first installment payment received during escrow to determine the gain on sale. The gain on sale is then multiplied by the seller’s applicable tax rate to determine the withholding amount.

You must complete the calculation under Installment Withholding Percent first, in the next column, to determine the withholding percentage needed to complete the withholding amount in item c.

a.Installment Payment. . . . . . .$__________

b.Gain on Sale, multiply line a by the Installment Withholding Percent (calculated in the

next column) . . . . . . . . . . . .$__________

c.Withholding Amount. Multiply line b by the applicable tax rate* and enter the result here

and on Form 593, line 5 . . . .$__________

Installment Withholding Percent

Complete this calculation for the Installment Withholding Percent that will be applied to all installment payments, including the first installment payment received during escrow. If withholding on the principal portion of each

installment payment, the seller must provide the buyer with the Installment Withholding Percent to be included on Form 593-I, Real Estate Withholding Installment Sale Acknowledgement. If withholding on the first installment payment is received during escrow, then compute the percent as follows:

a.Gain on Sale from

Form 593-E, line 16 . . . . . . .$__________

b.Selling Price from

Form 593-E, line 1 . . . . . . . .$__________

c.Installment Withholding Percent, divide line a by

line b . . . . . . . . . . . . . . . . . . . _ _ _ ._ _%

With the principal portion of the first installment payment, attach a copy of the promissory note to the original Form 593 that will be sent to the FTB.

Exchanges:

a.Boot Amount. Not to

exceed recognized gain . . . .$__________

b.Withholding Amount. Multiply line a by the applicable tax rate* and enter the result here and on Form 593,

line 5 . . . . . . . . . . . . . . . . . .$__________

Failed Exchanges:

a.Gain on Sale from

Form 593-E, line 16 . . . . . . .$__________

b.Ownership Percentage. If multiple transferors attempted to exchange this property, enter this seller’s ownership percentage. Otherwise,

enter 100.00% . . . . . . . . . . . . _ _ _ ._ _%

c.Amount Subject to Withholding. Multiply

line a by line b . . . . . . . . . . .$__________

d.Withholding Amount. Multiply line c by the applicable tax rate* and enter the result here

and on Form 593, line 5 . . . .$__________

If a failed deferred exchange had boot withheld upon in the original relinquished property, reduce the withholding amount by the amount previously remitted to the FTB.

*Tax Rates Individual 9.3%

Non-California Partnership 9.3% Corporation 8.84%

Bank and Financial Corporation 10.84% S Corporation 10.8%

Financial S Corporation 12.8%

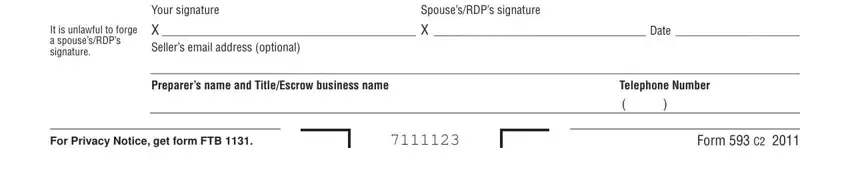

Part III – Perjury Statement

Complete the Seller’s and Preparer’s information. A signature is only required if the Optional Gain On Sale Election method is used.

Preparer’s Name and Title/Escrow Business Name

Provide the preparer’s name and title/escrow’s business name and phone number.