Navigating the complexities of tax documentation and compliance is a vital aspect of managing the interplay between local transportation initiatives and state aid. The IRS Form 7575, specific to June 2007, emerges as a focal point in this scenario, serving as a critical link for entities seeking to leverage state support for local transportation projects. Designed with precision requirements, this form not only demands attention to detail in its completion but also in its physical presentation. It cannot be overstated that this form is not your average document; it is a "machine-readable" form, meaning it requires special paper, specific inks, and adherence to exact specifications for it to be processed correctly. The implications of these requirements highlight the necessity for obtaining further information through IRS Publications 1167 and 1179, which delve into the substitute printed, computer-prepared, and computer-generated tax forms and schedules, along with specifications for paper document reporting. These publications, accessible through a straightforward request to the IRS, underscore the importance of meticulous compliance with the IRS’s stringent guidelines. The message is clear: accuracy and adherence to the detailed standards set forth are essential for those navigating the intersection of local transportation funding and state aid.

| Question | Answer |

|---|---|

| Form Name | Irs Form 7575 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | what is a form 9595, irs form 9595, 9595 irs, what is a 9595 form used for |

STATE AID FOR LOCAL TRANSPORTATION |

June 2007 |

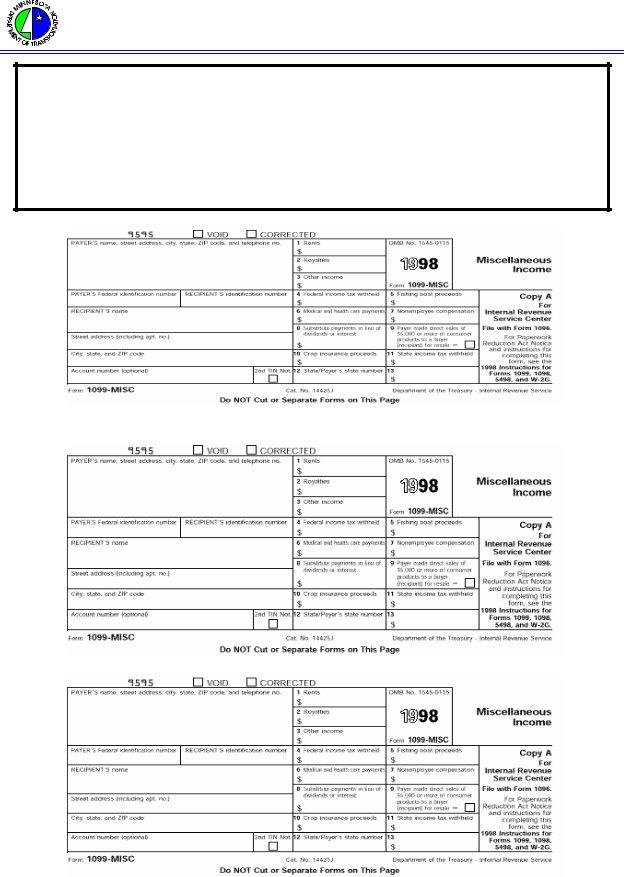

Example IRS form 7575 |

|

ATTENTION! This form is provided for informational purposes and should not be reproduced on personal computer printers by individual taxpayers for filing. The printed version of this form is a "machine readable"form. As such, it must be printed using special paper, special inks, and within precise specifications. Additional information about the printing of these specialized tax forms can be found in: Publication 1167, Substitute Printed,