Once you open the online editor for PDFs by FormsPal, you can easily fill out or modify Irs Form 940 B right here and now. The tool is consistently maintained by our staff, acquiring handy features and becoming more versatile. Starting is easy! Everything you should do is follow the next basic steps directly below:

Step 1: Just press the "Get Form Button" above on this webpage to launch our pdf file editing tool. This way, you will find all that is necessary to work with your file.

Step 2: This editor provides the capability to work with your PDF document in many different ways. Modify it by including your own text, adjust original content, and place in a signature - all when it's needed!

It is easy to finish the form using out helpful guide! Here is what you must do:

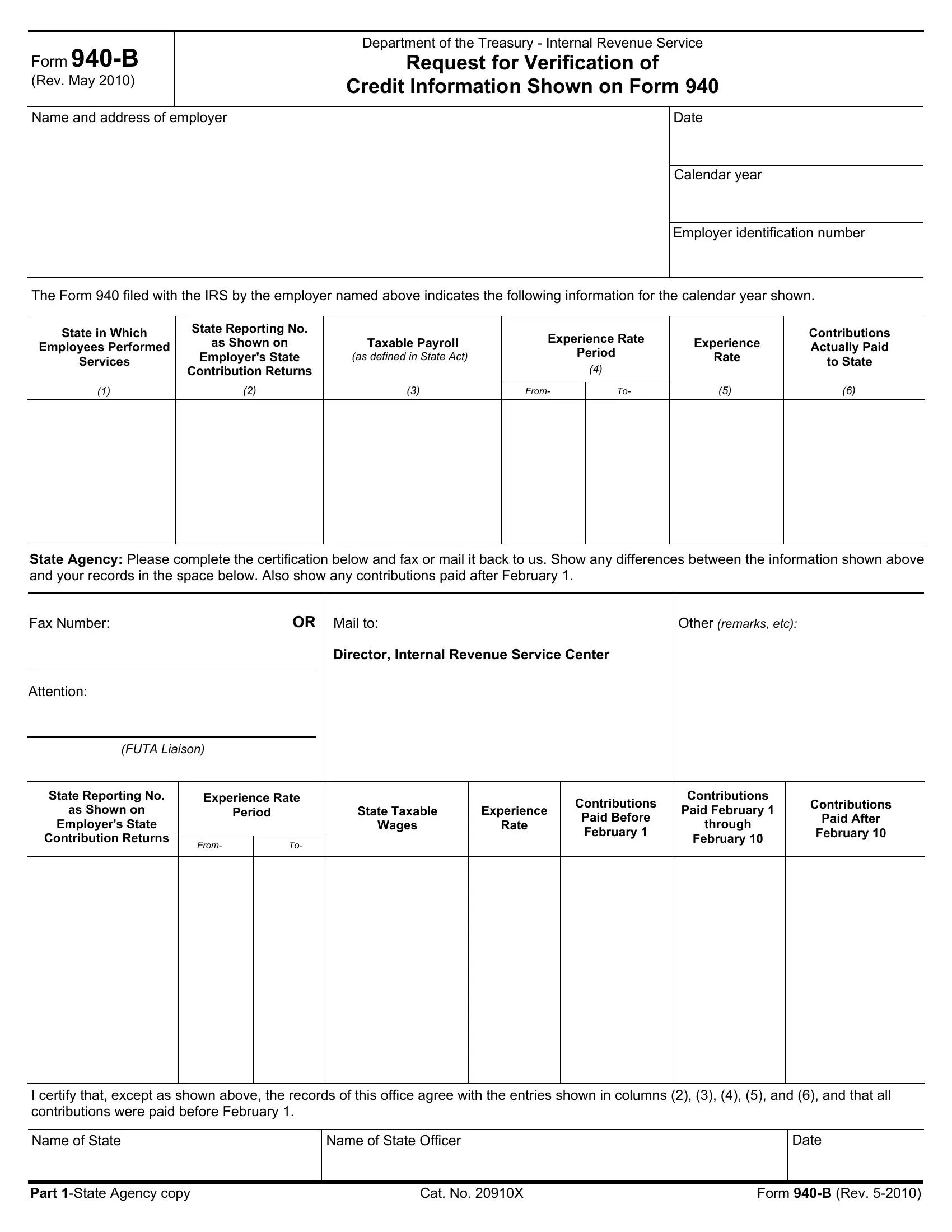

1. The Irs Form 940 B will require particular information to be inserted. Ensure that the next blank fields are finalized:

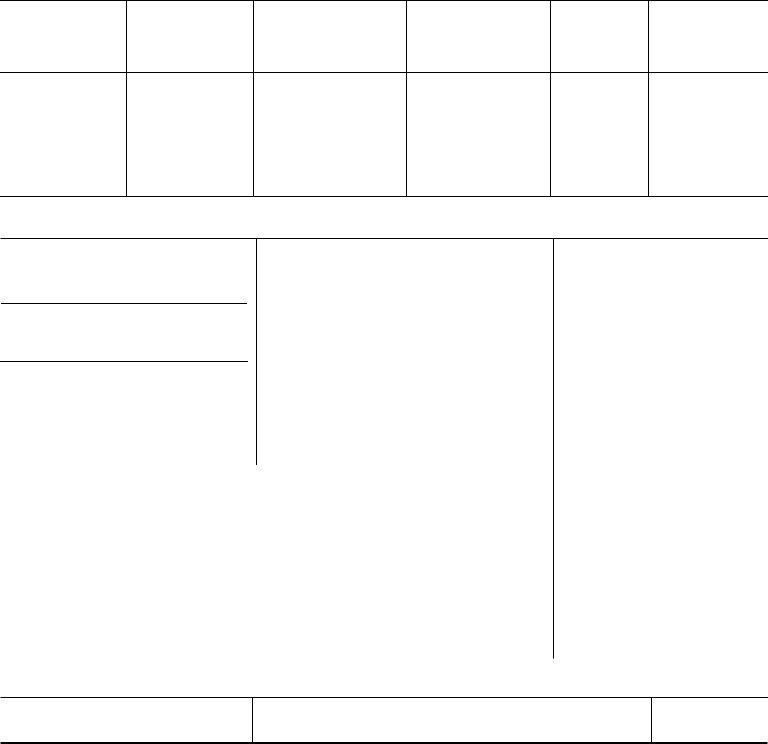

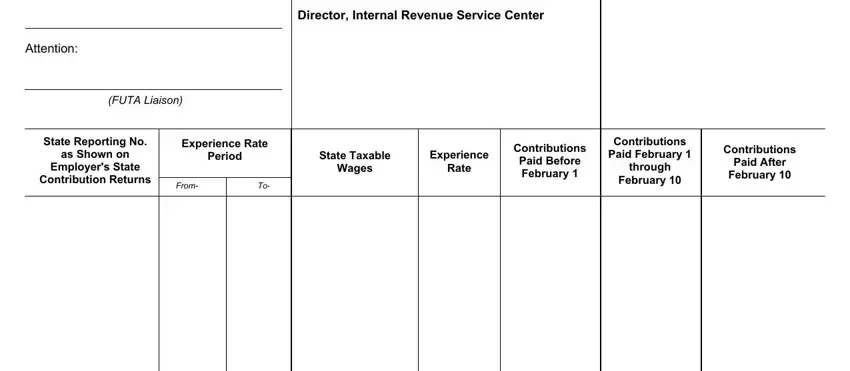

2. Once your current task is complete, take the next step – fill out all of these fields - Director Internal Revenue Service, Attention, FUTA Liaison, State Reporting No, as Shown on, Employers State, Contribution Returns, Experience Rate, Period, From, State Taxable, Experience, Wages, Rate, and Contributions with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

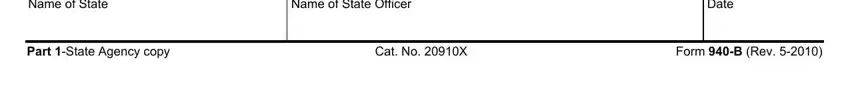

3. This next step is usually hassle-free - complete every one of the empty fields in Name of State, Name of State Officer, Date, Part State Agency copy, Cat No X, and Form B Rev to conclude this process.

Always be really careful while filling out Name of State Officer and Part State Agency copy, as this is the section where a lot of people make a few mistakes.

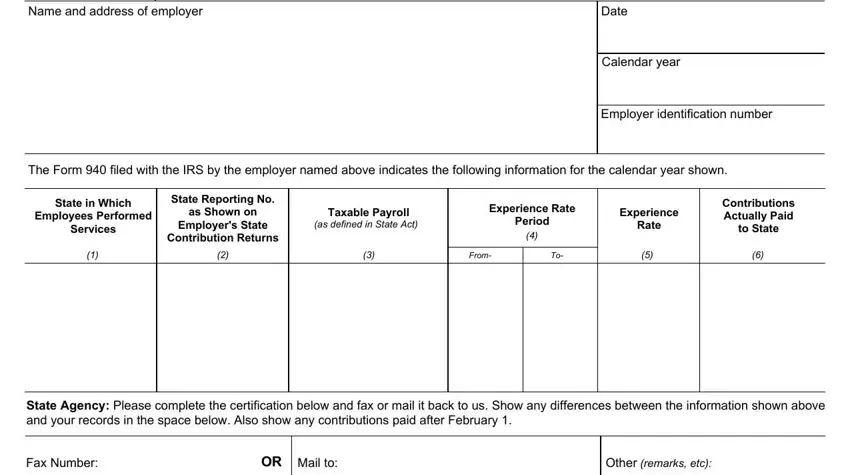

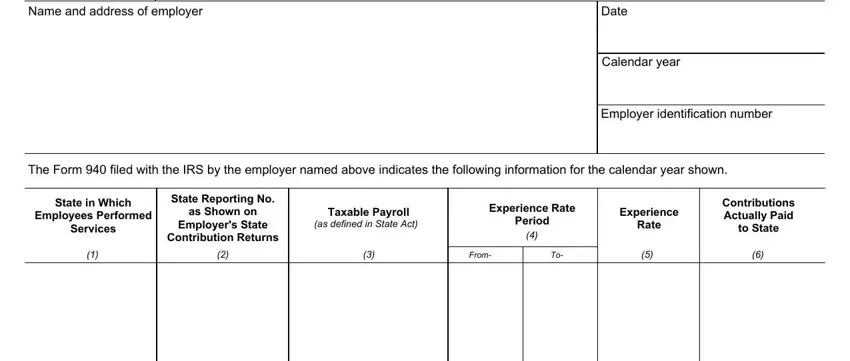

4. To move forward, this next section will require typing in several form blanks. Examples of these are Name and address of employer, Date, Calendar year, Employer identification number, The Form filed with the IRS by, State in Which, Employees Performed, Services, State Reporting No, as Shown on, Employers State, Contribution Returns, Taxable Payroll, as defined in State Act, and Experience Rate, which you'll find essential to carrying on with this document.

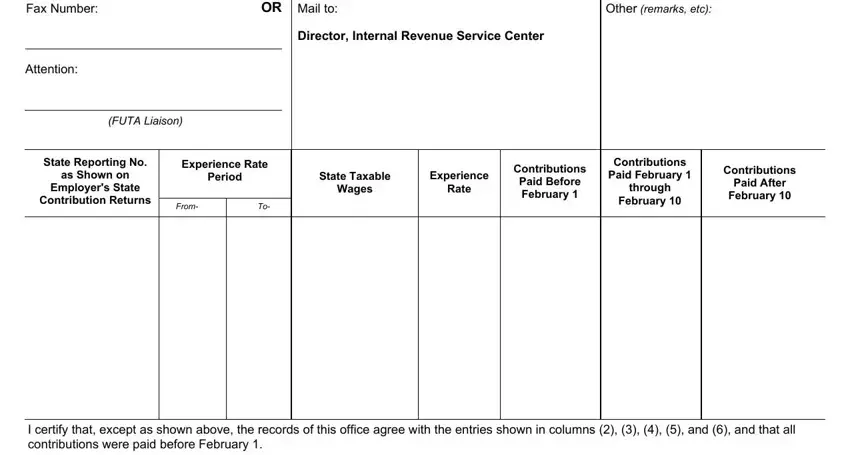

5. While you get close to the end of the file, you will find a few more things to undertake. Mainly, Fax Number, OR Mail to, Other remarks etc, Director Internal Revenue Service, Attention, FUTA Liaison, State Reporting No, as Shown on, Employers State, Contribution Returns, Experience Rate, Period, From, State Taxable, and Experience should all be filled out.

Step 3: Revise everything you have inserted in the blanks and click on the "Done" button. Acquire the Irs Form 940 B when you sign up at FormsPal for a 7-day free trial. Conveniently get access to the form inside your personal account, along with any modifications and adjustments conveniently synced! FormsPal guarantees your information privacy by having a protected system that never records or shares any sort of private data used. Feel safe knowing your files are kept confidential each time you work with our service!