You are able to prepare Irs Forms Schedule F Form effortlessly with our online PDF editor. Our expert team is ceaselessly working to expand the editor and ensure it is much better for clients with its extensive features. Take your experience to another level with constantly improving and great options available today! Starting is easy! All you need to do is adhere to these basic steps directly below:

Step 1: Firstly, access the pdf editor by clicking the "Get Form Button" above on this page.

Step 2: This editor will let you customize almost all PDF documents in various ways. Transform it with any text, adjust original content, and place in a signature - all at your convenience!

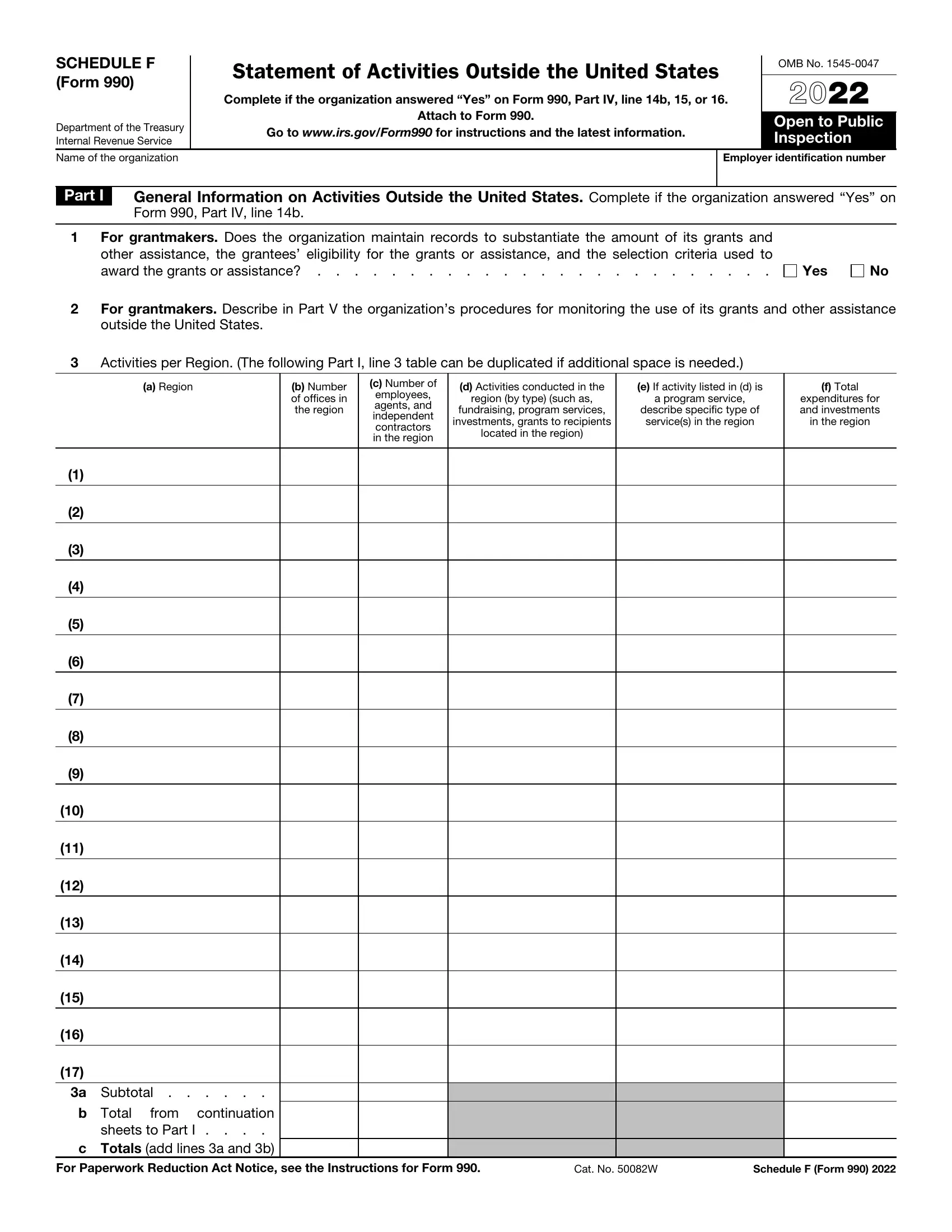

For you to fill out this PDF form, make sure you type in the right information in each blank field:

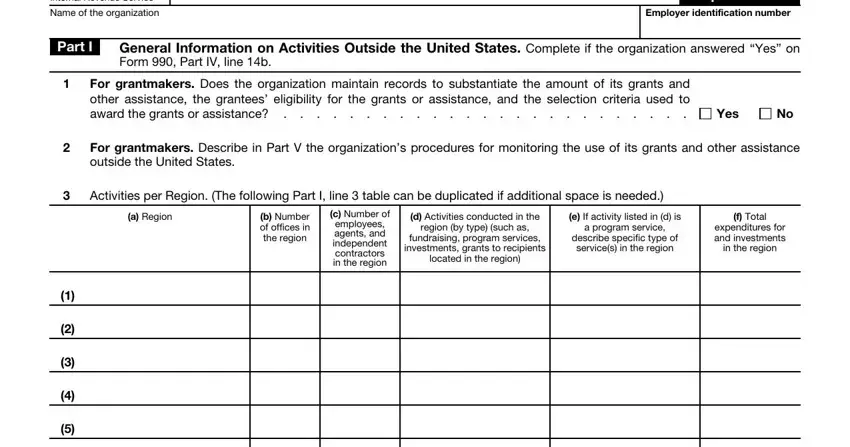

1. Begin completing the Irs Forms Schedule F Form with a number of necessary fields. Note all the necessary information and make certain there's nothing neglected!

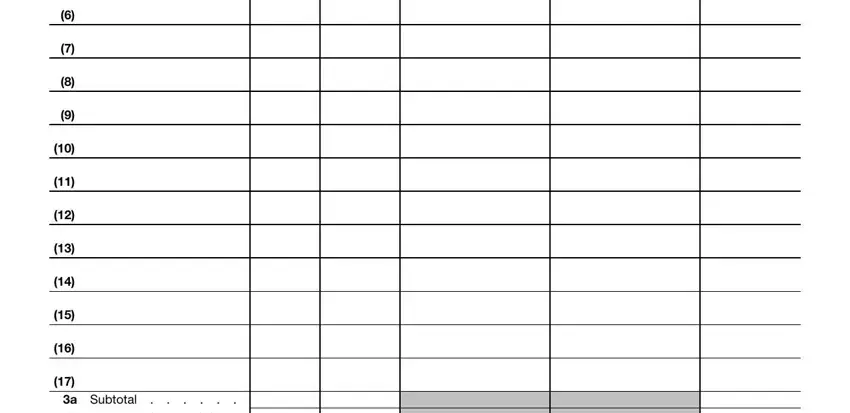

2. When this section is complete, you should include the essential particulars in a Subtotal in order to move on further.

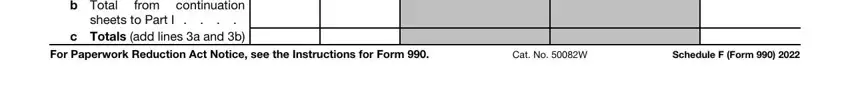

3. This next section should be relatively easy, b Total, from continuation, sheets to Part I, c Totals add lines a and b, For Paperwork Reduction Act Notice, Cat No W, and Schedule F Form - each one of these form fields must be filled out here.

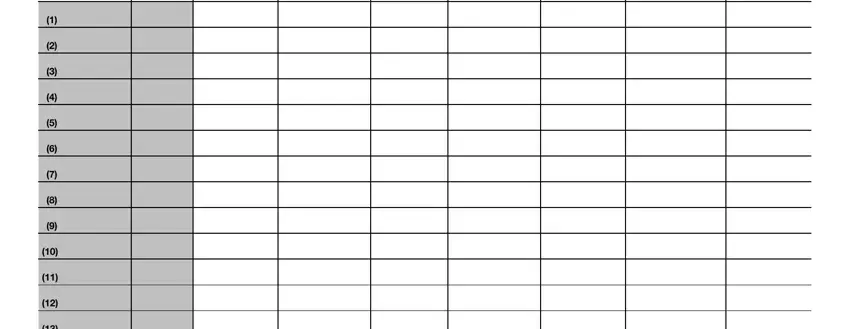

4. This next section requires some additional information. Ensure you complete all the necessary fields - - to proceed further in your process!

People generally make mistakes when completing this field in this section. You should definitely reread whatever you enter here.

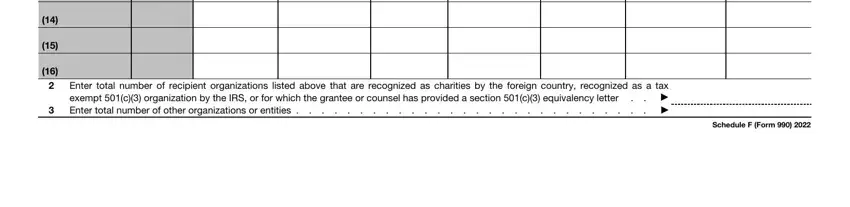

5. As you get close to the completion of this form, there are just a few extra requirements that should be fulfilled. Notably, Enter total number of recipient, and Schedule F Form must all be filled in.

Step 3: Right after taking one more look at your form fields, hit "Done" and you are done and dusted! Obtain your Irs Forms Schedule F Form after you join for a free trial. Readily use the document in your FormsPal account page, along with any modifications and changes being conveniently saved! FormsPal is dedicated to the personal privacy of all our users; we make sure all personal information going through our tool is kept confidential.